🇺🇸 #Fed #Recession #Inflation | Lower tax refunds, uncertainty regarding the banking sector, upcoming tightening credit conditions and weather normalization should weigh on consumer spending from March ⚠ (1/8) ⬇

🇺🇸 According to latest IRS data, average refunds fell 11% YoY to $2,972 (after boosting spending earlier this year). This dynamic is expected to persist in the short term (2/8)

irs.gov/newsroom/filin…

irs.gov/newsroom/filin…

🇺🇸 Data released after turbulences in the banking sector also suggest consumers became cautious. Citi pointed out that its proprietary credit card data revealed a 10.3% ⬇ in spending in the week-ended 18-Mar., biggest ⬇ since the pandemic began (3/8)

https://twitter.com/carlquintanilla/status/1638538759552770048

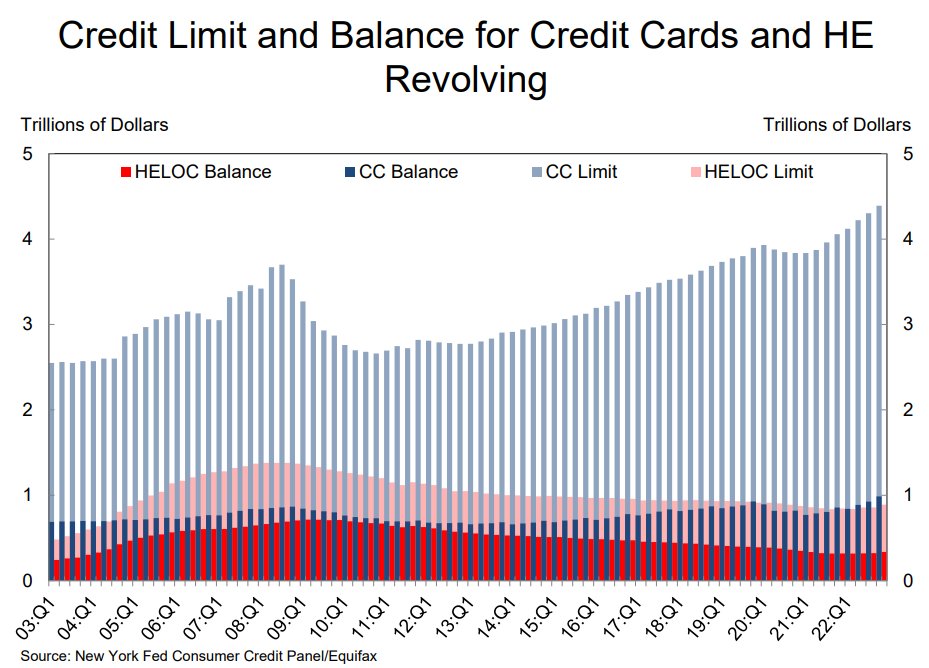

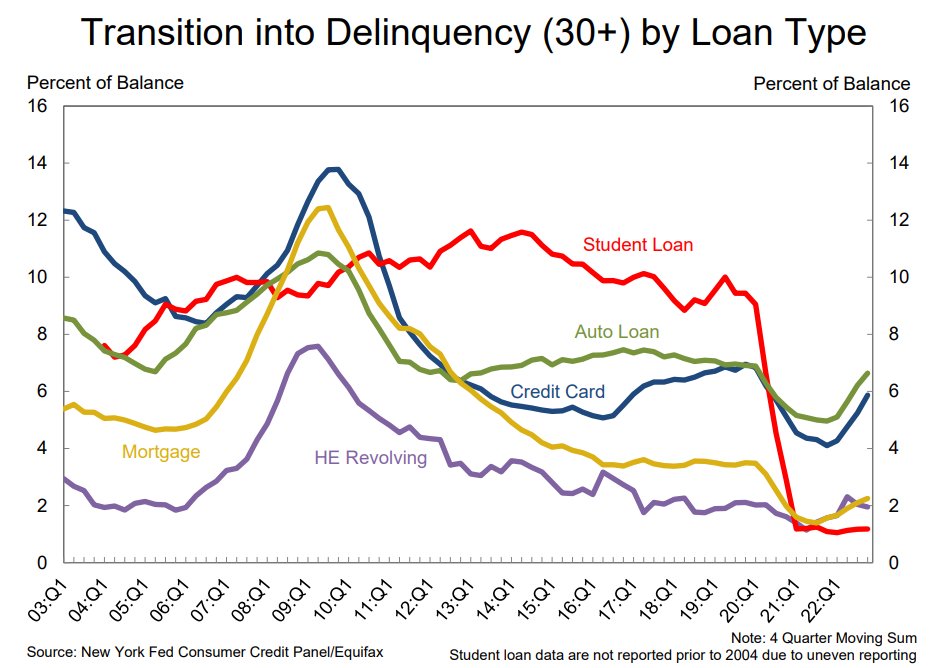

🇺🇸 Data also show consumers have ramped use of credit to maintain consumption. Credit card balances hit a record high in 4Q while the share of credit card users making payments that were at least 30 days late ⬆ to 5.9% from 5.2% prior. (4/8)

newyorkfed.org/medialibrary/i…

newyorkfed.org/medialibrary/i…

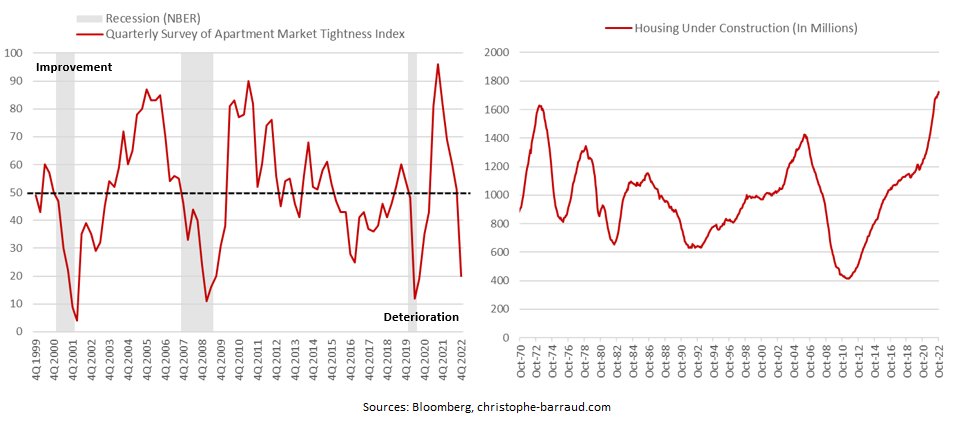

🇺🇸 Recent turbulences in the banking sector are likely to result in tighter credit conditions. They already deteriorated sharply over the past two quarters. (5/8)

https://twitter.com/MikeZaccardi/status/1638198471097298944

🇺🇸 This phenomenon should affect more small/medium banks, which account for a large part of consumer lending (6/8)

https://twitter.com/zerohedge/status/1637088001489551360

🇺🇸 Finally, as Powell noted yesterday, consumption was artificially boosted by favorable weather conditions earlier this year and could therefore normalize soon. (7/8)

https://twitter.com/C_Barraud/status/1638610083075735554

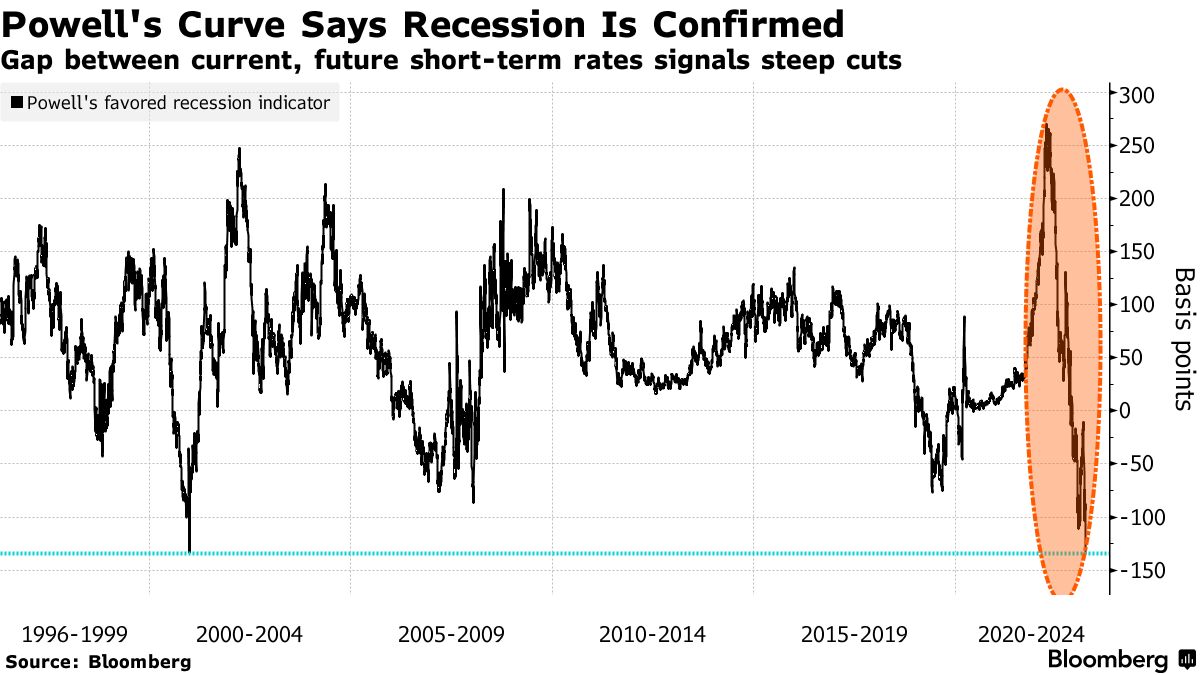

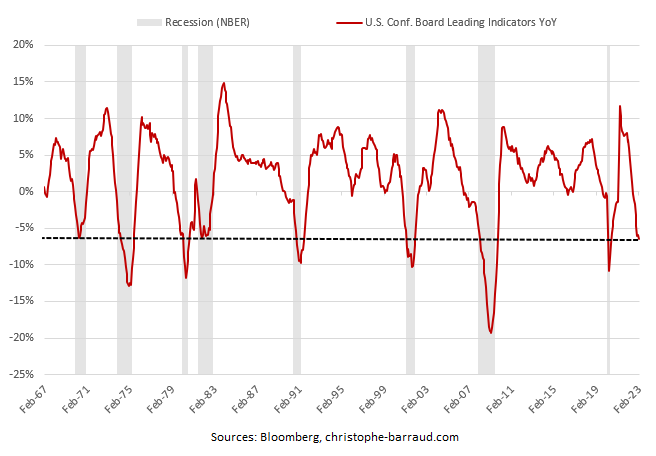

🇺🇸 Bottom line: Several factors suggest that consumer spending could soften from March. This trend should be monitored carefully as it could be the early sign of a #recession coming later this year (as suggested by leading indicators). (8/8)

• • •

Missing some Tweet in this thread? You can try to

force a refresh