1/15: I was recently called a “China Macro Tourist”, so I decided to do the following and give a chance to everyone to find out about China’s Macro reality for themselves.

Since the best way of learning is by doing, I will set a few questions so that everyone who doubts to find… twitter.com/i/web/status/1…

Since the best way of learning is by doing, I will set a few questions so that everyone who doubts to find… twitter.com/i/web/status/1…

2/15 a: We start from the GDP: China’s GDP is an input number and not an output figure like in Western economies. National accounts are based on data collected by local governments, which are rewarded for meeting growth targets; hence, local governments are incentivised to skew… twitter.com/i/web/status/1…

2/15 b: The Brookings Institution, in a research paper published in March 2019, estimated that China's GDP growth from 2008-2016 could be 1.7% (annually) lower than publicly acknowledged. I am confident China did not stop there. What happens if China’s GDP is 20% lower than most… twitter.com/i/web/status/1…

3/15: China appears to have a positive Capital Account. Please break it down and see what % of this net “positive” capital coming into China is repatriating capital and/or divestments from abroad.

Hence what % is real FDI coming into China?

#China #PBOC #HongKong #Yuan #RMB… twitter.com/i/web/status/1…

Hence what % is real FDI coming into China?

#China #PBOC #HongKong #Yuan #RMB… twitter.com/i/web/status/1…

4/15: Starting in July 2017, banks and financial institutions in China have to report all domestic and overseas cash transactions of RMB 50,000 (US$7,600) or more; the previous threshold was RMB 200,000 (US$30,350). Any overseas transfers by individuals of US$10,000 or more need… twitter.com/i/web/status/1…

5/15: China also appears to have a positive Current Account. i) Please check the PBOC for imports-exports from Hong Kong and then do the same on the HKMA – The numbers should be the same, but they are not. You will be amazed by the discrepancy. ii) Also, go and check the imports… twitter.com/i/web/status/1…

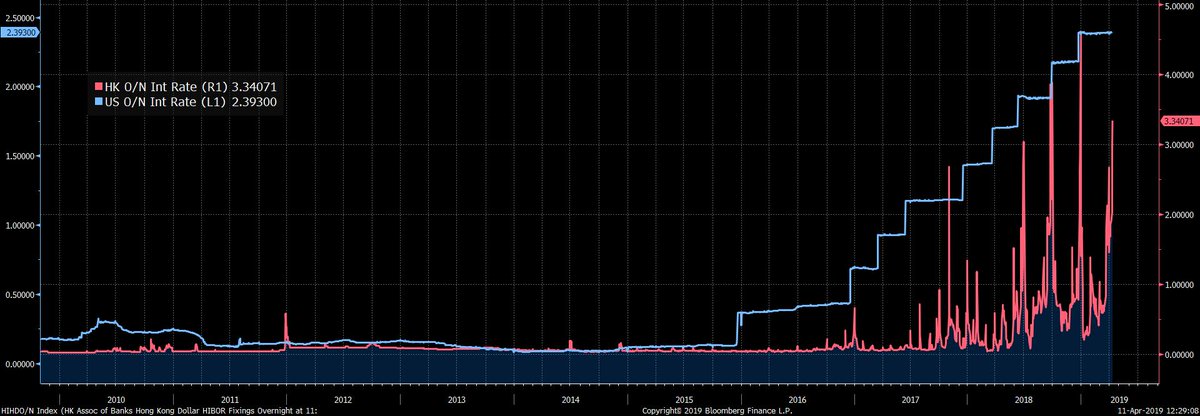

6/15 Many Chinese have been using Hong Kong as an escape valve (check the PBOC and HKMA data). Money has been leaving Hong Kong as well. The spread on overnight rates between Libor and Hibor is as high as it has ever been. The HKMA needs to raise rates ASAP to stop money from… twitter.com/i/web/status/1…

7/15: Regarding the Impossible Trinity

The “Impossible Trinity” is a concept in economics that states that it is impossible to have simultaneously for a PROLONGED period:

- Free capital movement

- A fixed foreign exchange rate

- An independent monetary policy

You can only have… twitter.com/i/web/status/1…

The “Impossible Trinity” is a concept in economics that states that it is impossible to have simultaneously for a PROLONGED period:

- Free capital movement

- A fixed foreign exchange rate

- An independent monetary policy

You can only have… twitter.com/i/web/status/1…

8/15: Asian Tigers (1997) broke their pegs when the ratio fell below 25%. China has been increasing the money supply (M2) while blocking capital from leaving the country, thus fueling the domestic bubble.

#China #PBOC #HongKong #Yuan #RMB #CNH #CNY #DXY #USD #Treasuries #US #HKD… twitter.com/i/web/status/1…

#China #PBOC #HongKong #Yuan #RMB #CNH #CNY #DXY #USD #Treasuries #US #HKD… twitter.com/i/web/status/1…

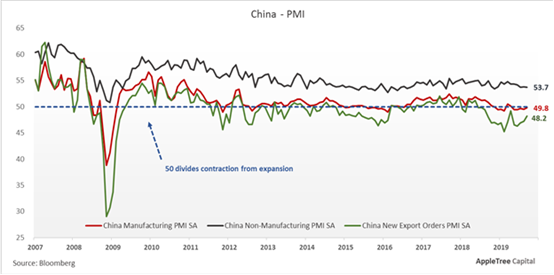

9/15: Blue: US 3-month Libor - China 3-month Shibor rate. (Spread 278bps)

Red: CNY (Yuan) @ 6.87 vs the USD

With a deteriorating current_ account and a capital account manipulated to stay positive when, in reality, there is no actual FDI (in size), how will the currency hold… twitter.com/i/web/status/1…

Red: CNY (Yuan) @ 6.87 vs the USD

With a deteriorating current_ account and a capital account manipulated to stay positive when, in reality, there is no actual FDI (in size), how will the currency hold… twitter.com/i/web/status/1…

10/15 a: We talk about a real estate bubble in the West. China’s heavily indebted property is estimated at $62 trillion. The residential property market equals 20% of China’s GDP, and including construction activity, property-related services accounts for ~29% of China's GDP.… twitter.com/i/web/status/1…

10/15 b: Real Estate in China represents 62% of Chinese household wealth compared to 36% in the US. China’s Household debt has climbed from $2trn in 2010 to over $10trn in 2021. Given today’s macro landscape, the debt situation should be even worse now. The obligation to… twitter.com/i/web/status/1…

11/15 a: Adding to the above real estate bubble, China’s Cities Are Buried in Debt. According to official data, China’s 31 provincial governments owed around $5.1 trillion at the end of 2022, an increase of 66% from 3 years earlier.

#China #PBOC #HongKong #Yuan #RMB #CNH #CNY… twitter.com/i/web/status/1…

#China #PBOC #HongKong #Yuan #RMB #CNH #CNY… twitter.com/i/web/status/1…

11/15 b: An @imf report puts the provincial government’s debts at $9 trillion (i.e. 50% of the country’s “official” GDP. Now do the exercise if China’s GDP is inflated by 20%, according to the Brookings Institution.

Is this sustainable?

#China #PBOC #HongKong #Yuan #RMB #CNH… twitter.com/i/web/status/1…

Is this sustainable?

#China #PBOC #HongKong #Yuan #RMB #CNH… twitter.com/i/web/status/1…

12/15: China's provincial governments' debt is increasing, and the real estate bubble is growing. Yet, at the same time, the economy has slowed (not to mention their GDP numbers have been overinflated), and Real Estate prices have fallen. Yet, looking at the @imf table, you will… twitter.com/i/web/status/1…

13/15: According to China’s Banking and Insurance Regulatory Commission, as of 2022, Chinese financial institutions’ local and foreign currency assets totalled 379.4 trillion yuan ($55.03 trillion), up 10% YoY. As a result, Chinese banking assets are now ~55% of Global GDP. At… twitter.com/i/web/status/1…

14/15 They have tried to mitigate this by increasing their M2, which they have been doing at a 9% rate yearly. M2 is now $40 trillion, more than double China's GDP.

Compared to other countries, what does this look like?

What happens if the GDP numbers are indeed inflated (as… twitter.com/i/web/status/1…

Compared to other countries, what does this look like?

What happens if the GDP numbers are indeed inflated (as… twitter.com/i/web/status/1…

15/15 As per @worldranking_

World Foreign Exchange Reserves with Central Banks:

USD: 59.8%

EUR: 19.7%

JPY: 5.3%

GBP: 4.6%

RMB: 2.8%

CAD: 2.5%

AUD: 1.9%

CHF: 0.2%

Other: 3.2%

Let’s assume for a minute that any country accepted to trade in Yuan (in size) and that they had… twitter.com/i/web/status/1…

World Foreign Exchange Reserves with Central Banks:

USD: 59.8%

EUR: 19.7%

JPY: 5.3%

GBP: 4.6%

RMB: 2.8%

CAD: 2.5%

AUD: 1.9%

CHF: 0.2%

Other: 3.2%

Let’s assume for a minute that any country accepted to trade in Yuan (in size) and that they had… twitter.com/i/web/status/1…

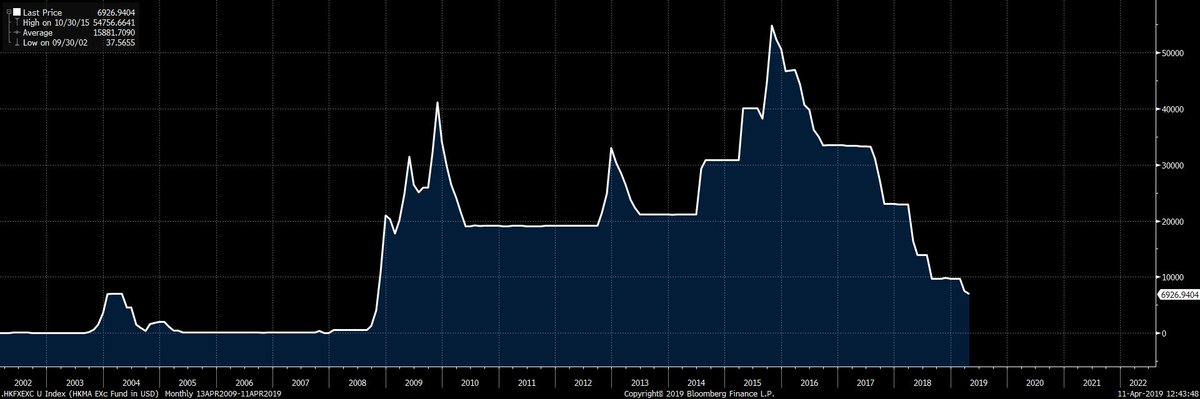

Bonus: What happened this morning to the HKD-USD peg?

The cracks seem to be appearing in Hong Kong, where Chinese entities have been over-invoicing affiliate entities to take their money out of China and now out of Hong Kong.

Hong Kong’s banking system is even worse than… twitter.com/i/web/status/1…

The cracks seem to be appearing in Hong Kong, where Chinese entities have been over-invoicing affiliate entities to take their money out of China and now out of Hong Kong.

Hong Kong’s banking system is even worse than… twitter.com/i/web/status/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh