I started trading 4 years ago by buying options.

Had I known this intraday sell strategy by Vishal Mehta, I would have avoided the loss that I faced in my 1st year.

Don't do the same mistake that I did!

#OptionsTrading #tradingstrategy

#nifty #banknifty #finnifty

Let's go 👇

Had I known this intraday sell strategy by Vishal Mehta, I would have avoided the loss that I faced in my 1st year.

Don't do the same mistake that I did!

#OptionsTrading #tradingstrategy

#nifty #banknifty #finnifty

Let's go 👇

1.

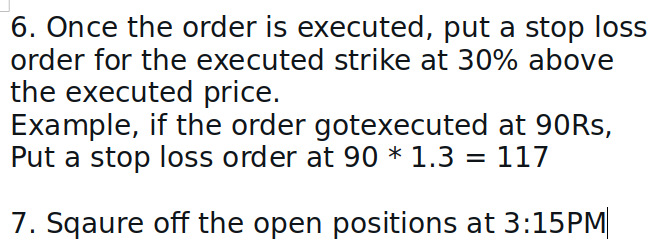

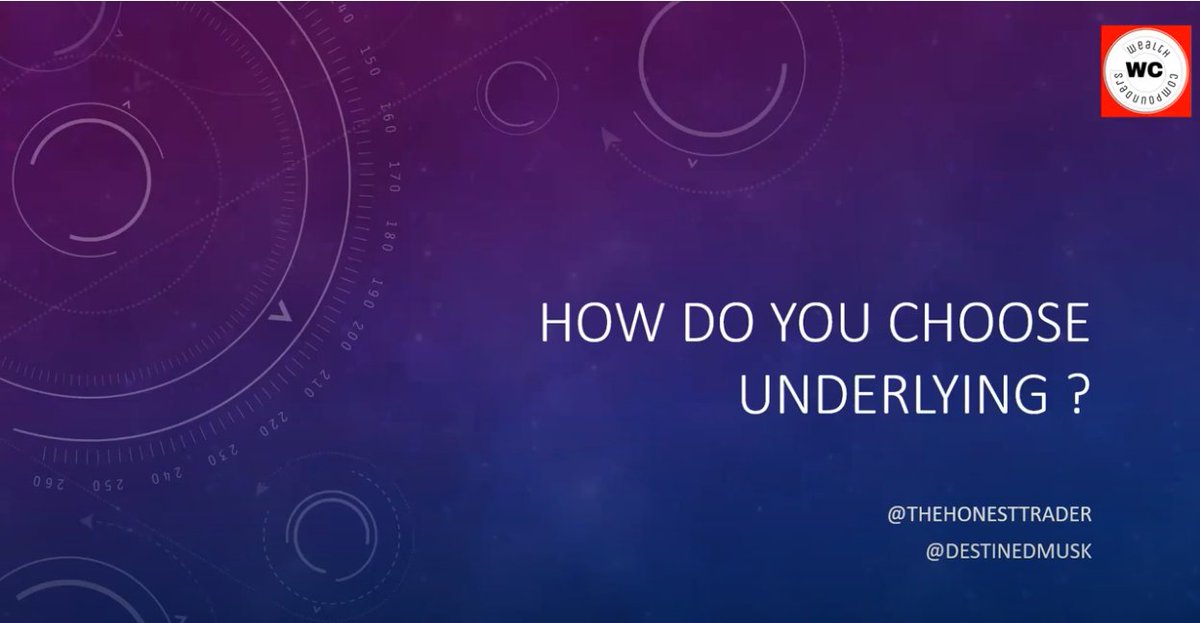

The logic behind this strategy is to wait and sell that leg of straddle/strangle first that is decaying fast.

Basically follow the trend.

The logic behind this strategy is to wait and sell that leg of straddle/strangle first that is decaying fast.

Basically follow the trend.

2. If the market is going down, the CE leg will get executed.

3. If the market is going up, the PE leg will be executed.

4. If the market reverses the other leg is also executed.

3. If the market is going up, the PE leg will be executed.

4. If the market reverses the other leg is also executed.

Thanks for reading!!

It would mean the world to me if you follow me(@THEH0NESTTRADER)

Like + RT the tweet above to spread the trading knowledge with others👆

I take personal time out of my day to make these for you for FREE when others are charging for the same info...

It would mean the world to me if you follow me(@THEH0NESTTRADER)

Like + RT the tweet above to spread the trading knowledge with others👆

I take personal time out of my day to make these for you for FREE when others are charging for the same info...

• • •

Missing some Tweet in this thread? You can try to

force a refresh