Tackling the #crypto trilemma, #PartisiaBlockchain aims to address scalability, privacy, and interoperability with a dual-layer approach.

Ambitious? Definitely.

Let's take a closer look at the project and its distinctive #tokenomics. @partisiampc

🧵 by @FlorentPorrot

1/15

Ambitious? Definitely.

Let's take a closer look at the project and its distinctive #tokenomics. @partisiampc

🧵 by @FlorentPorrot

1/15

Offering a dual-layer solution, Partisia features consensus, governance & interoperable Zero-Knowledge & Oracle services.

The 2nd layer is essentially a platform for ZK computations - on-chain, off-chain, inter-chain, bolstering blockchain privacy in a decentralized way.

2/15

The 2nd layer is essentially a platform for ZK computations - on-chain, off-chain, inter-chain, bolstering blockchain privacy in a decentralized way.

2/15

Decentralized nodes ensure security and integrity. As #web3 leans towards transparency, control over information is paramount.

By harnessing a global network of ZK computation nodes, Partisia enhances privacy and security, opening doors to secret voting, secure aid, etc.

3/15

By harnessing a global network of ZK computation nodes, Partisia enhances privacy and security, opening doors to secret voting, secure aid, etc.

3/15

#Scalability is addressed through a fast consensus mechanism that involves #sharding at both the consensus/#governance layer and ZK/oracle services layer.

This approach allows transactions to occur in parallel, improving the overall efficiency of the system.

4/15

This approach allows transactions to occur in parallel, improving the overall efficiency of the system.

4/15

ZK computations address #privacy, allowing private data sharing on the blockchain among numerous parties.

It integrates ZK computations through global collaboration among accredited nodes and modules for cross-chain functionality, balancing #transparency and privacy.

5/15

It integrates ZK computations through global collaboration among accredited nodes and modules for cross-chain functionality, balancing #transparency and privacy.

5/15

To enhance #interoperability, the project uses a privacy-preserving oracle for cross-chain transactions.

Unlike existing solutions on exchanges, this approach uses decentralized nodes for smart contracts and transactions, eliminating a single point of failure.

6/15

Unlike existing solutions on exchanges, this approach uses decentralized nodes for smart contracts and transactions, eliminating a single point of failure.

6/15

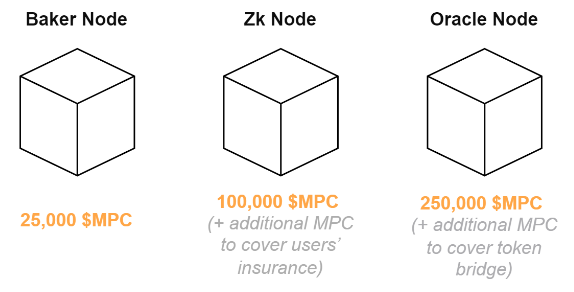

There is somewhat of a double currency system:

- The native $MPC which is only used by node operators to stake and have the possibility to become a node operator

- External tokens, via the Bring Your Own Coin BYOC solution, used for payment of the services on the platform

7/15

- The native $MPC which is only used by node operators to stake and have the possibility to become a node operator

- External tokens, via the Bring Your Own Coin BYOC solution, used for payment of the services on the platform

7/15

The BYOC solution enhances chain interoperability. Users can access #ZK computations & oracle services without converting coins to the native currency.

It simplifies cross-chain interactions with smart contracts & a collateralized burn-mint bridge.

8/15

It simplifies cross-chain interactions with smart contracts & a collateralized burn-mint bridge.

8/15

$MPC token demand primarily arises from staking, which secures the network and enables fee collection. This staking creates a "skin in the game" scenario.

Indirectly, user service usage impacts $MPC demand via the BYOC bridge, requiring collateralization and staking.

9/15

Indirectly, user service usage impacts $MPC demand via the BYOC bridge, requiring collateralization and staking.

9/15

Decoupling service payment (via BYOC) from the native $MPC token used for staking improves accessibility, as users can pay with any token covered by the bridges.

It also enhances system security by reducing volatility risks associated with the token backing system stakes.

10/15

It also enhances system security by reducing volatility risks associated with the token backing system stakes.

10/15

Despite its innovation, the project faces visibility issues. The main challenge appears to be marketing. Through blockchain event appearances like #PBW2023 and ZK technology voting demos, the team is making strides to enhance awareness and demand.

11/15

11/15

Distribution of $MPC tokens is as follows with a notable 4 years for the full vesting of the team and private sale #investors.

The seed to IDO phase price saw an 8x increase, curbing excessive advantages for early investors to prevent potential token dumps post-vesting.

12/15

The seed to IDO phase price saw an 8x increase, curbing excessive advantages for early investors to prevent potential token dumps post-vesting.

12/15

Partisia Blockchain, tackling hot topics like sharding, ZK, and interoperability, promises sustainable demand. The team's expertise hints at reliable solutions.

Their separating of payment means from store value using BYOC and native tokens, showcases thoughtful design.

13/15

Their separating of payment means from store value using BYOC and native tokens, showcases thoughtful design.

13/15

Challenges lie ahead, especially with cross-chain bridges. Proactive measures like double bookkeeping and collateral strategy ensure transparency and security.

Success hinges on overcoming challenges and effective marketing.

14/15

Success hinges on overcoming challenges and effective marketing.

14/15

The project's solutions are undoubtedly compelling and cutting-edge, and if successful, their impact could be profound on the ecosystem.

For a detailed breakdown of the tokenomics, please read the full article here: tokenomicsdao.substack.com/p/tokenomics-1…

15/15

For a detailed breakdown of the tokenomics, please read the full article here: tokenomicsdao.substack.com/p/tokenomics-1…

15/15

Thanks for making it this far!

Follow and join the Tokenomics DAO:

🌐 Website: tokenomicshub.xyz

👾 Discord: discord.gg/2nv88A3S7q

Follow and join the Tokenomics DAO:

🌐 Website: tokenomicshub.xyz

👾 Discord: discord.gg/2nv88A3S7q

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter