The biggest mistake beginners do in #stockmarket is to directly start FnO trading.

I did the same mistake but you can avoid it!

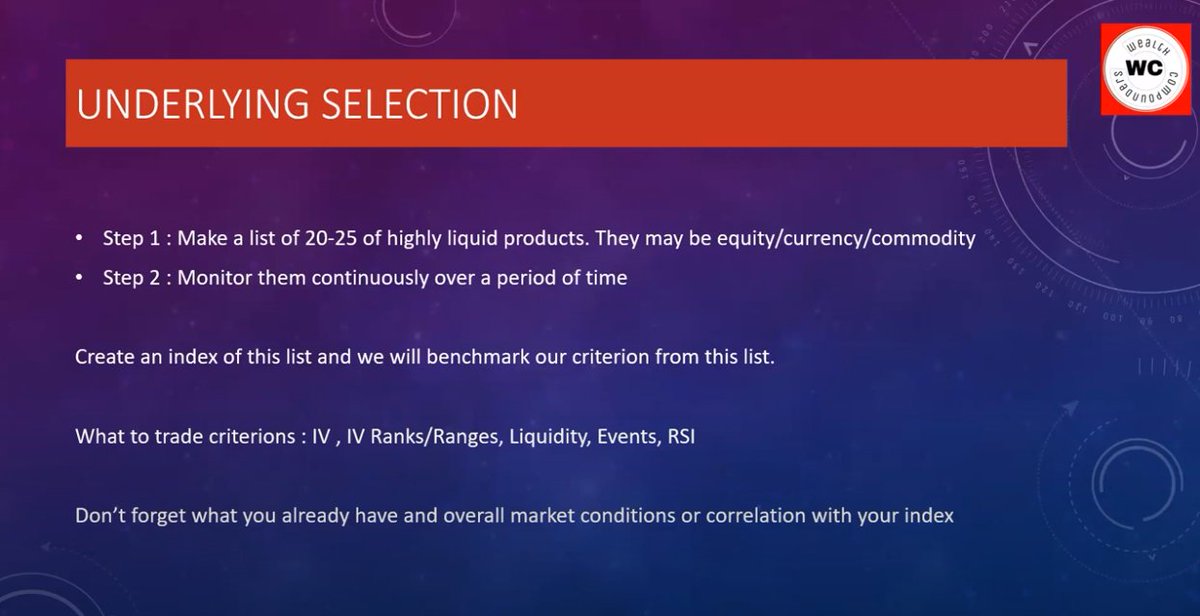

Here is a profitable mean-reverting intraday stocks strategy from @vishalmehta29 that you can begin with.

#StocksToTrade #Nifty #stocks

Read on👇

I did the same mistake but you can avoid it!

Here is a profitable mean-reverting intraday stocks strategy from @vishalmehta29 that you can begin with.

#StocksToTrade #Nifty #stocks

Read on👇

Thanks for reading!!

It would mean the world to me if you follow me(@THEH0NESTTRADER)

Like + RT the tweet above to spread the trading knowledge with others👆

I take personal time out of my day to make these for you for FREE when others are charging for the same info...

It would mean the world to me if you follow me(@THEH0NESTTRADER)

Like + RT the tweet above to spread the trading knowledge with others👆

I take personal time out of my day to make these for you for FREE when others are charging for the same info...

Source : youtube.com/live/oG1UOsTTU…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter