Thread🧵 on GMI's key macro charts by Raoul Pal. @RaoulGMI #GlobalMacro

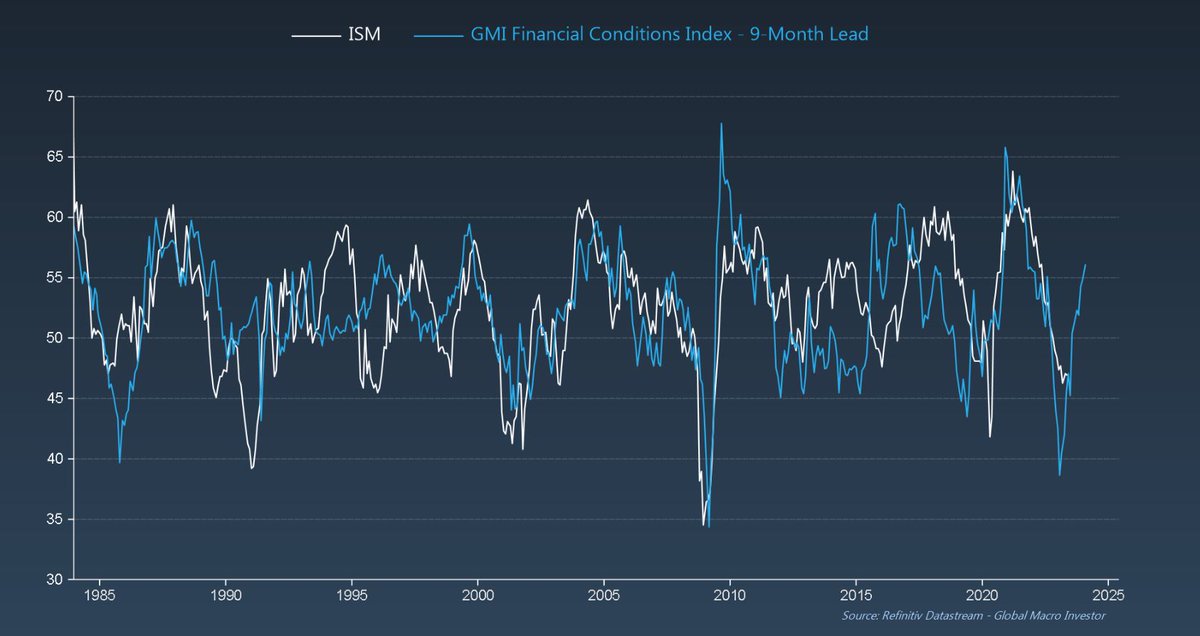

1/7 ISM is falling to 46.9, indicating short-term weakness. New orders point towards a drop closer to 45 in June. #GlobalEconomy

2/7 The GMI Financial Conditions Index suggests recovery, having already bottomed out and now rising. #FinancialConditions #EconomicTrends

3/7 Equities are rallying despite predicted ISM drop. Recession fears seem priced in, so markets are “climbing the wall of worry.” #StockMarket

4/7 Unemployment rose to 3.7%, could increase to 4.5%. Historically, a 0.5% increase prompts Fed intervention. #JoblessClaims #Unemployment

5/7 Manufacturing sector's weakness and falling inflation indicators hint at better growth environment later in 2023. #Manufacturing #EconomicGrowth

6/7 The GMI Financial Conditions Index suggests 20% YoY increase in global liquidity by Q4, despite looming recession. #Recession #GlobalLiquidity

7/7 Tesla's chart indicates a bullish trend. For the ACWI ETF, a potential rise to 109 is predicted. #Tesla #BullishTrends

If you found this post interesting and want to keep up to date with the latest happenings in the financial world, don't forget to follow me on Twitter! More insights await. 💪

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter