0/n #GryphsisAcademyWeeklyCryptoDigest When Regulatory Actions Shake Markets (2023.06.05–2023.06.11)

medium.com/@gryphsisacade…

medium.com/@gryphsisacade…

1/n Contents - 1

1) Macro Overview:US Stock V.S. Crypto

2) Big Story: @SECGov sues @binance and @coinbase ; June 9 Market Crash

3) Protocol Spotlight: @fraxfinance

4) Narrative Pick(Trading Tool): Unibot, the Telegram Uniswap Sniper Bot

5) VC Funding Highlight

1) Macro Overview:US Stock V.S. Crypto

2) Big Story: @SECGov sues @binance and @coinbase ; June 9 Market Crash

3) Protocol Spotlight: @fraxfinance

4) Narrative Pick(Trading Tool): Unibot, the Telegram Uniswap Sniper Bot

5) VC Funding Highlight

2/n Contents - 2

6) Alpha Threads: @ChadCaff’s analysis of $GMD;

@defi_mochi’s tutorial on whale hunting;

@louround’s research on Spin;

@rekwang’s insights on Radiant;

@VitalikButerin’s take on Ethereum’s technical transitions

7) Upcoming Events: Crypto; Macro

6) Alpha Threads: @ChadCaff’s analysis of $GMD;

@defi_mochi’s tutorial on whale hunting;

@louround’s research on Spin;

@rekwang’s insights on Radiant;

@VitalikButerin’s take on Ethereum’s technical transitions

7) Upcoming Events: Crypto; Macro

3/n Macro Overview

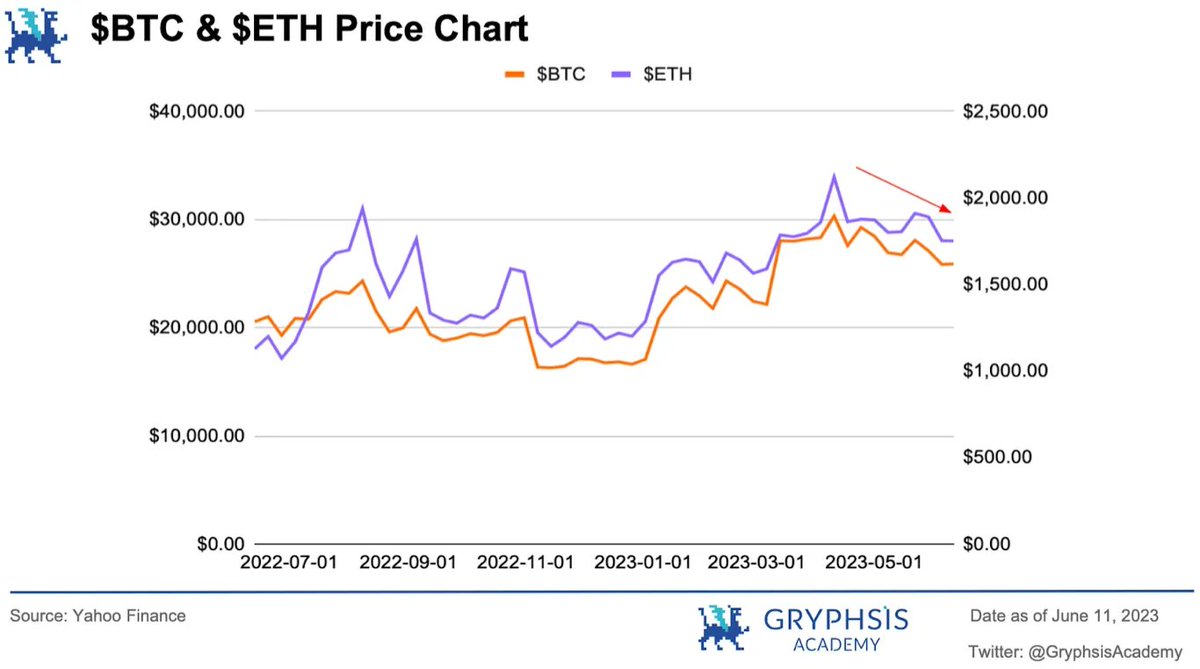

ISM shows service sector slowing (PMI at 50.3) & possible labor contraction (Index at 49.2). Equity markets still strong with NASDAQ surpassing Aug '22 highs, thanks to NVDA. Crypto, however, on a downward trend, impacted by SEC lawsuits. #MarketTrends

ISM shows service sector slowing (PMI at 50.3) & possible labor contraction (Index at 49.2). Equity markets still strong with NASDAQ surpassing Aug '22 highs, thanks to NVDA. Crypto, however, on a downward trend, impacted by SEC lawsuits. #MarketTrends

4/n Binance & Coinbase face distinct SEC charges: Coinbase is mainly accused of operating as an unregistered exchange, while Binance faces allegations of fraud and manipulation, with CEO CZ specifically named. Both firms strongly deny these claims. #CryptoNews

5/n #GryphsisInsights

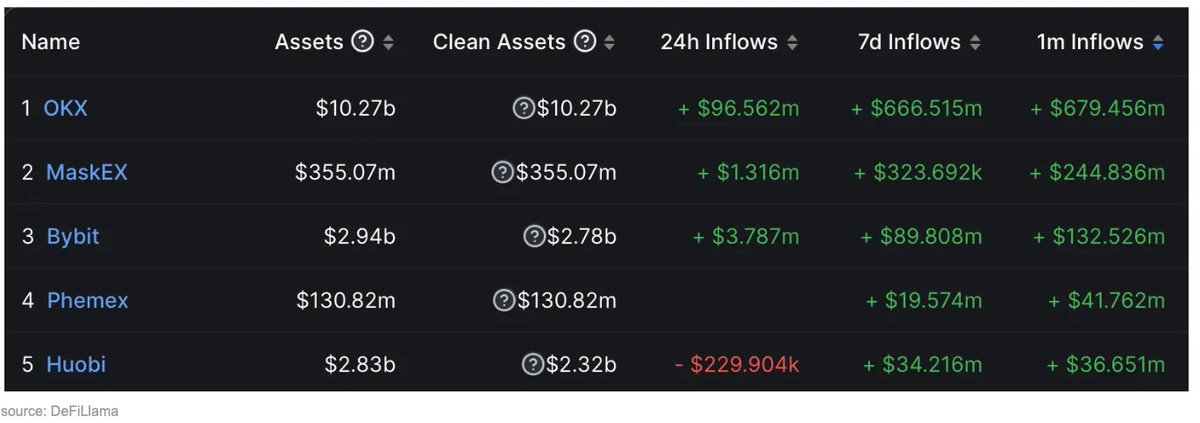

Interesting development: #Binance inflows have redirected to #OKX @okx, possibly driven by their new Web3 wallet feature.📈

Interesting development: #Binance inflows have redirected to #OKX @okx, possibly driven by their new Web3 wallet feature.📈

6/n #GryphsisInsights

Investors, take note! Native tokens #BNB and #OKB reflect positive alignment with exchange operations. Watch out for OKB as OKX is set to launch an AA wallet.👀 #CryptoInvestment

Investors, take note! Native tokens #BNB and #OKB reflect positive alignment with exchange operations. Watch out for OKB as OKX is set to launch an AA wallet.👀 #CryptoInvestment

7/n #GryphsisInsights

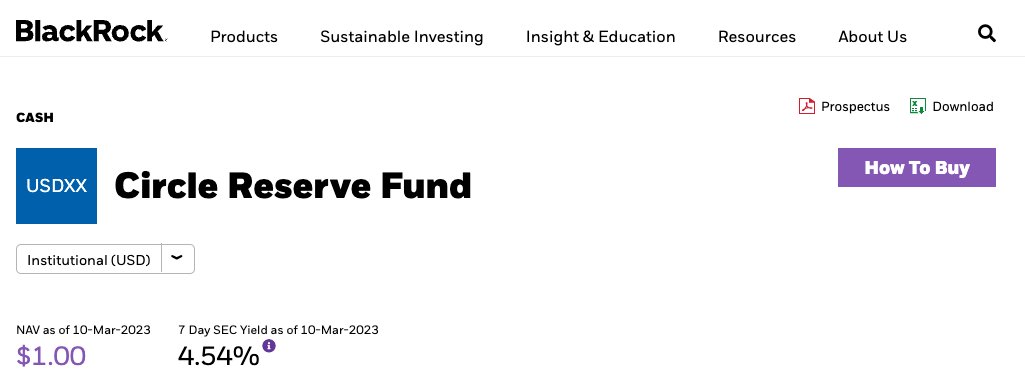

Amidst uncertainty, stablecoins like #USDT and #USDC could be next in line. Consider hedging against depegging risk through Y2K Finance's product, Earthquake.⚠️ #CryptoRisk

Amidst uncertainty, stablecoins like #USDT and #USDC could be next in line. Consider hedging against depegging risk through Y2K Finance's product, Earthquake.⚠️ #CryptoRisk

8/n June 9 Market Crash

💥A harsh sell-off hit the #crypto market on June 9. Many altcoins, especially those listed as securities by the SEC, witnessed a 10%-30% decline. However, #BTC and #ETH seemed relatively unaffected. What's behind this?🤔 #CryptoSellOff

💥A harsh sell-off hit the #crypto market on June 9. Many altcoins, especially those listed as securities by the SEC, witnessed a 10%-30% decline. However, #BTC and #ETH seemed relatively unaffected. What's behind this?🤔 #CryptoSellOff

9/n June 9 Market Crash

Recently, #Robinhood decided to delist tokens ($ADA, $MATIC, $SOL) deemed securities by the SEC. This move could be influencing market makers' outlook on altcoins, adding complexity to the recent sell-off.📉 #CryptoDelisting

Recently, #Robinhood decided to delist tokens ($ADA, $MATIC, $SOL) deemed securities by the SEC. This move could be influencing market makers' outlook on altcoins, adding complexity to the recent sell-off.📉 #CryptoDelisting

10/n #GryphsisInsights

This massive sell-off could be driven by market makers, given their substantial influence on the market. Firms like Jane Street and Jump Trading have already retreated from U.S. crypto trading due to regulatory scrutiny.🔍 #CryptoRegulations

This massive sell-off could be driven by market makers, given their substantial influence on the market. Firms like Jane Street and Jump Trading have already retreated from U.S. crypto trading due to regulatory scrutiny.🔍 #CryptoRegulations

11/n #GryphsisInsights

A tip for retail investors in these turbulent times: observe the market movements rather than making hasty decisions. It's best to wait for prices to find solid support before considering an entry. Stay safe!💡 #CryptoInvestmentTips

A tip for retail investors in these turbulent times: observe the market movements rather than making hasty decisions. It's best to wait for prices to find solid support before considering an entry. Stay safe!💡 #CryptoInvestmentTips

12/n Weekly Protocol Pick

Meet @fraxfinance, an algo-stablecoin and LSD protocol. With the launch of frxETH and sfrxETH tokens, they've claimed a 2.34% market share thanks to higher yields and smart governance.🚀 #FraxFinance #DeFi

Meet @fraxfinance, an algo-stablecoin and LSD protocol. With the launch of frxETH and sfrxETH tokens, they've claimed a 2.34% market share thanks to higher yields and smart governance.🚀 #FraxFinance #DeFi

13/n. User complaints about centralization in frxETH V1 have led to the upcoming launch of frxETH V2. This aims to decentralize the mechanism while maintaining or even increasing yield for users.🔄 #Decentralization

14/n #GryphsisInsights

The frxETH V2 design includes a utilization-based interest rate and a decentralized lending market, fostering a lending and borrowing marketplace for LSD users. Get ready for a more inclusive, transparent, and efficient system.💡

The frxETH V2 design includes a utilization-based interest rate and a decentralized lending market, fostering a lending and borrowing marketplace for LSD users. Get ready for a more inclusive, transparent, and efficient system.💡

15/n #GryphsisInsights

With frxETH V2, we predict Frax's market share will rise as it introduces a more decentralized validator onboarding mechanism and offers higher yields than competitors. The recent SEC issues with Coinbase might also drive more investors towards Frax.👀

With frxETH V2, we predict Frax's market share will rise as it introduces a more decentralized validator onboarding mechanism and offers higher yields than competitors. The recent SEC issues with Coinbase might also drive more investors towards Frax.👀

16/n #GryphsisInsights

The push towards decentralization isn't limited to Frax. Other LSD protocols like Lido's V2 and Rocket's Atlas upgrade aim for a more decentralized ETH staking process. Keep an eye on unshETH, which is emerging as a potential liquidity hub for LSD.🔮

The push towards decentralization isn't limited to Frax. Other LSD protocols like Lido's V2 and Rocket's Atlas upgrade aim for a more decentralized ETH staking process. Keep an eye on unshETH, which is emerging as a potential liquidity hub for LSD.🔮

17/n Trending Narrative: Trading Tool

@TeamUnibot, an innovative tool, addresses complexities of DeFi platforms like Uniswap V2. It's accessible via Telegram and offers features such as Multi-Wallet Swap and Private Transactions.

@TeamUnibot, an innovative tool, addresses complexities of DeFi platforms like Uniswap V2. It's accessible via Telegram and offers features such as Multi-Wallet Swap and Private Transactions.

18/n #GryphsisInsights

Unibot has performed remarkably well since its launch in May, with a massive 31676% gain! With market sell-off on June 9, data suggests Unibot saw the largest influx of smart money, making it a token to watch. Stay tuned for Unibot V2 coming mid-June.

Unibot has performed remarkably well since its launch in May, with a massive 31676% gain! With market sell-off on June 9, data suggests Unibot saw the largest influx of smart money, making it a token to watch. Stay tuned for Unibot V2 coming mid-June.

19/n #GryphsisInsights

As the Trading Tool narrative grows, we anticipate more such tools surfacing. Key factors for sustainable growth in this evolving sector are innovation and security. Keep an eye on this space for updates on the trending sector! #CryptoTrends #DeFiTrends

As the Trading Tool narrative grows, we anticipate more such tools surfacing. Key factors for sustainable growth in this evolving sector are innovation and security. Keep an eye on this space for updates on the trending sector! #CryptoTrends #DeFiTrends

20/n Top Funded Crypto Protocols This Week

Meanwhile, a Bitcoin life insurance company, raised $19 million, making it the protocol that raised the most this week;

@LensProtocol, a decentralized social media platform ensuring user data ownership, secured $15 million on June 8.

Meanwhile, a Bitcoin life insurance company, raised $19 million, making it the protocol that raised the most this week;

@LensProtocol, a decentralized social media platform ensuring user data ownership, secured $15 million on June 8.

21/n Alpha Threads

Originally a pseudo-GLP vault protocol, GMD has recently seen its token price and TVL skyrocket. You might be wondering how a vault protocol can achieve such a growth. For a deeper understanding, check out @ChadCaff’s thread.

Originally a pseudo-GLP vault protocol, GMD has recently seen its token price and TVL skyrocket. You might be wondering how a vault protocol can achieve such a growth. For a deeper understanding, check out @ChadCaff’s thread.

https://twitter.com/ChadCaff/status/1664175481804181505

21/n Alpha Threads

Mastering whale hunting is pivotal when navigating the tumultuous seas of the crypto world. @defi_mochi’s thread offers valuable technique into using a Dune dashboard to locate the whales for any altcoin.

Mastering whale hunting is pivotal when navigating the tumultuous seas of the crypto world. @defi_mochi’s thread offers valuable technique into using a Dune dashboard to locate the whales for any altcoin.

https://twitter.com/defi_mochi/status/1663559597926526978

22/n Alpha Threads

With the buzz around Arbitrum, ZK L2s are now in the market spotlight. @louround’s thread shares insightful research on an orderbook-based DEX demonstrating huge potential.

With the buzz around Arbitrum, ZK L2s are now in the market spotlight. @louround’s thread shares insightful research on an orderbook-based DEX demonstrating huge potential.

https://twitter.com/Louround_/status/1664559980312240129

23/n Alpha Threads

Since launching on Arbitrum, @RDNTCapital has made a significant splash as the first omnichain DEX in the DeFi space. For a deeper analysis and insights, don’t miss @Rewkang’s illuminating Twitter thread

Since launching on Arbitrum, @RDNTCapital has made a significant splash as the first omnichain DEX in the DeFi space. For a deeper analysis and insights, don’t miss @Rewkang’s illuminating Twitter thread

https://twitter.com/Rewkang/status/1666495970748825603

24/n Alpha Threads

Make sure to check out @VitalikButerin latest article exploring the three key technical transitions that Ethereum must undertake as it evolves.

vitalik.eth.limo/general/2023/0…

Make sure to check out @VitalikButerin latest article exploring the three key technical transitions that Ethereum must undertake as it evolves.

vitalik.eth.limo/general/2023/0…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter