In the meantime, will be sharing some (threaded) highlights here...

Final TCJA keeps the 7 tax bracket structure, but trims rates.

But impact is limited. $1M couple each earning $500k pays "just" $8k more in taxes.

This is the primary reason most individuals pay more by 2027. New brackets gone, but lower C-CPI-U bracket thresholds remain.

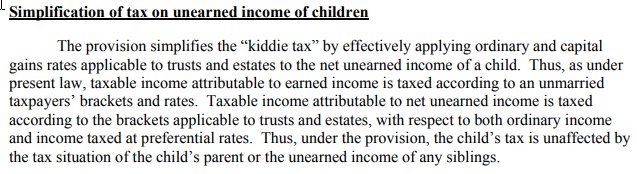

Under new rules, unearned income of children is taxed at Trust tax rates (top bracket at $12,500), NOT just stacked on parents' income brackets. #Ouch

Instead, top 20% cap gains will start in the middle of the 35% bracket.

However, in practice, the expanded Child Tax Credit makes up for this for most.

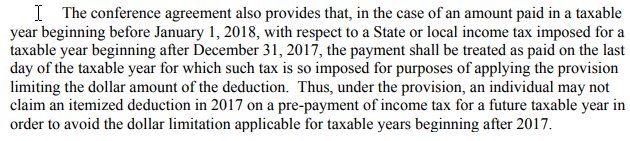

Can still deduct 2017 4th quarter estimated in 2017, though. And prepaid property taxes (if possible).

However, interest on home equity indebtedness is NOT grandfathered. Starting 2018, it's just not deductible anymore, period.

Was this really an area of abuse??

HOWEVER, 529 plans can now be used for elementary/secondary school (like Coverdells).

And 529 plans can now be used for homeschooling expenses!

$10k/student annual limit.

- $250 schoolteacher deduction

- Tax credit for plug-in electric vehicles

- Adoption Assistance tax credit

In the meantime, a few more provisions of note from my read-through of the full legislative text...

Full article with all the details coming first thing tomorrow (Monday) morning at kitces.com. Stay tuned! :)