@drawandstrike @ThomasWictor @HNIJohnMiller @jihadaeon1 @rising_serpent @_ImperatorRex_ @Debradelai @LarrySchweikart

whitehouse.gov/articles/econo…

Thus far in 2018, real GDP is on track for growth of 3.1 percent over the calendar year, which would be the first calendar year of growth over 3 percent since 2005.

As a result, over the first 6 full quarters of the Trump Administration, growth has averaged 2.7 percent.

Since September 2017, growth of equipment investment was a robust 7.4 percent at an annual rate,

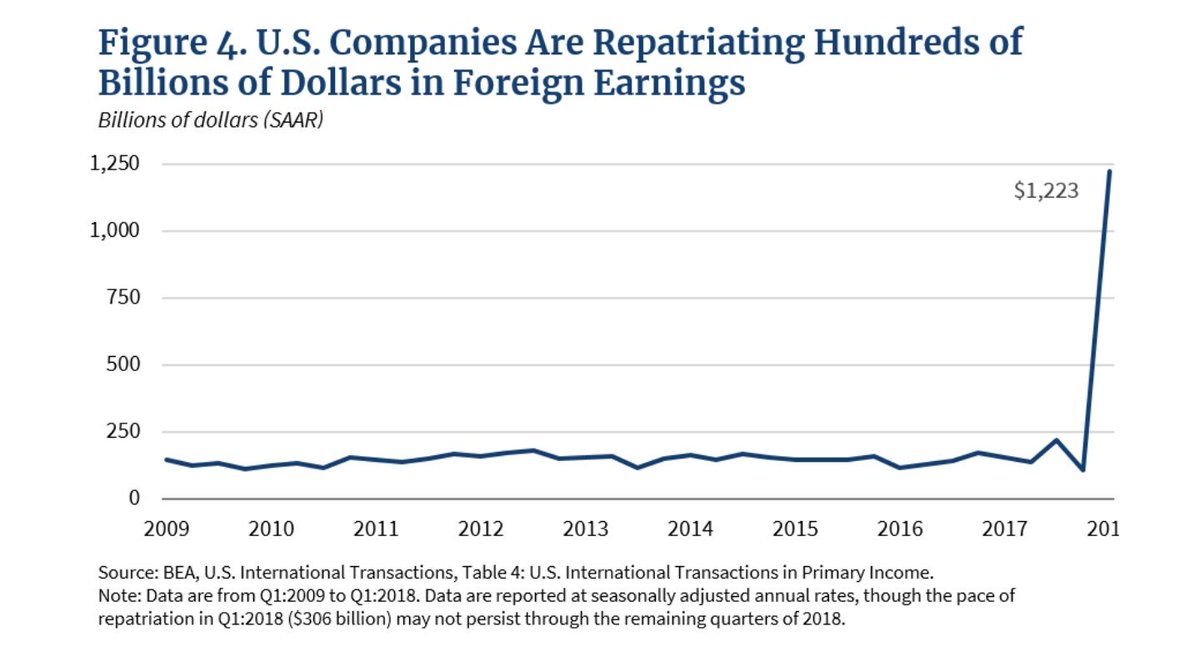

In the first quarter of 2018, U.S. companies brought home (repatriated) a record $306 billion, or $1.2 trillion at a seasonally adjusted annual rate.