Independent, unfiltered macro insights from the guys who inform leading global financial institutions I Free weekly investment newsletter: https://t.co/32MXCs8lPh

How to get URL link on X (Twitter) App

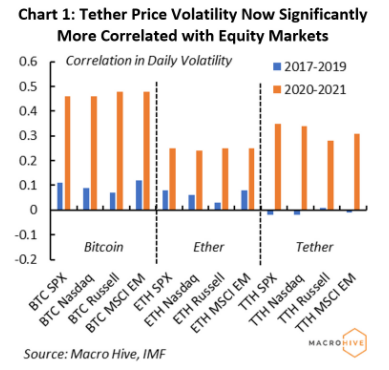

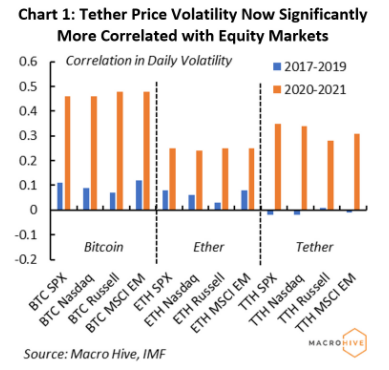

Risk aversion is likely to be the dominant theme for markets, and with the correlation between #ethereum and NASDAQ picking up again, broader risk sentiment will likely be the dominant driver of ethereum.

Risk aversion is likely to be the dominant theme for markets, and with the correlation between #ethereum and NASDAQ picking up again, broader risk sentiment will likely be the dominant driver of ethereum.