Passionate Educator | Sharing insights on Trading & Financial Markets | Former Dean & Professor | SEBI Reg RA

#Building - Markup & The Noiseless Trader

5 subscribers

How to get URL link on X (Twitter) App

This thread includes a study of Welles Wilder from his book ‘New Concepts in Technical Trading System’ on the Average Directional Index (ADX). This book also includes details on Average True Range (ATR), the Parabolic SAR system, and RSI.

This thread includes a study of Welles Wilder from his book ‘New Concepts in Technical Trading System’ on the Average Directional Index (ADX). This book also includes details on Average True Range (ATR), the Parabolic SAR system, and RSI.

In this thread, we are going to discuss which tools to use to analyze OI, how to interpret the data and some case studies.

In this thread, we are going to discuss which tools to use to analyze OI, how to interpret the data and some case studies.

#Quote

#Quote

If you have missed reading Basic Patterns of PnF, I will encourage you to read that first to take the best out of this thread

If you have missed reading Basic Patterns of PnF, I will encourage you to read that first to take the best out of this threadhttps://twitter.com/kaushikaki/status/1568192548392280065

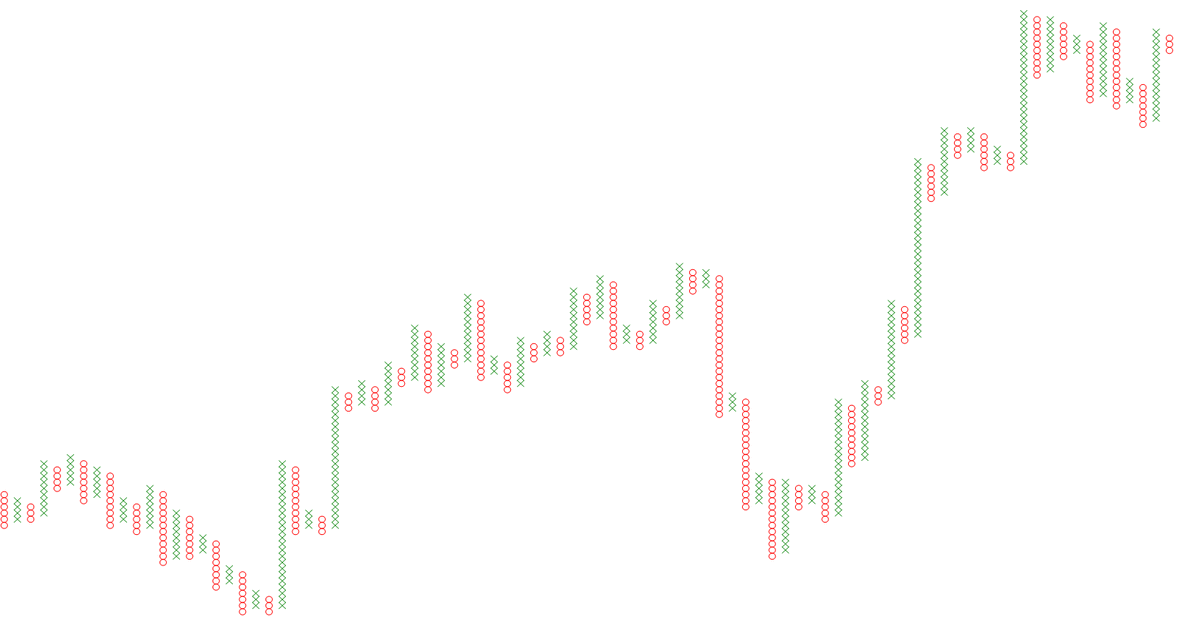

Whenever we decide to plot P&F Charts, determining box values is important. Log box values have simplified the subject and made the patterns and other P&F formations more relevant.

Whenever we decide to plot P&F Charts, determining box values is important. Log box values have simplified the subject and made the patterns and other P&F formations more relevant.

Column Reversal

Column Reversal

What is a P&F?

What is a P&F?

1. Price trading above TMA is bullish

1. Price trading above TMA is bullish

1. The marked zone in 'Green' is Demand Zone for Nifty

1. The marked zone in 'Green' is Demand Zone for Nifty

Breadth helps to evaluate the market sentiments by measuring the number of stocks above and below particular criteria.

Breadth helps to evaluate the market sentiments by measuring the number of stocks above and below particular criteria.

#Nifty on charts

#Nifty on charts

#Nifty on charts

#Nifty on charts

https://twitter.com/kaushikaki/status/1459466104795893763?s=20

https://twitter.com/kaushikaki/status/1467134735117922309?s=20