1/ More #DeFi projects are adopting veTokenomics.

I researched 20+ veToken ecosystem projects to understand:

• Why?

• How it works?

• What makes it special?

Here's what you’ll need to know 🧵

I researched 20+ veToken ecosystem projects to understand:

• Why?

• How it works?

• What makes it special?

Here's what you’ll need to know 🧵

2/First things first. The price.

veTokenomics isn't a panacea to all #DeFi problems.

veTokens are highly inflationary and with the exception of $CRV all major veTokens underperformed $ETH in the past year.

veTokenomics isn't a panacea to all #DeFi problems.

veTokens are highly inflationary and with the exception of $CRV all major veTokens underperformed $ETH in the past year.

3/Then why are more projects adopting the model?

The success metric in #DeFi is Total Value Locked.

So projects give away their own tokens as rewards to attract liquidity.

Yet without proper token value proposition, these tokens get sold away.

Let's look at @compoundfinance

The success metric in #DeFi is Total Value Locked.

So projects give away their own tokens as rewards to attract liquidity.

Yet without proper token value proposition, these tokens get sold away.

Let's look at @compoundfinance

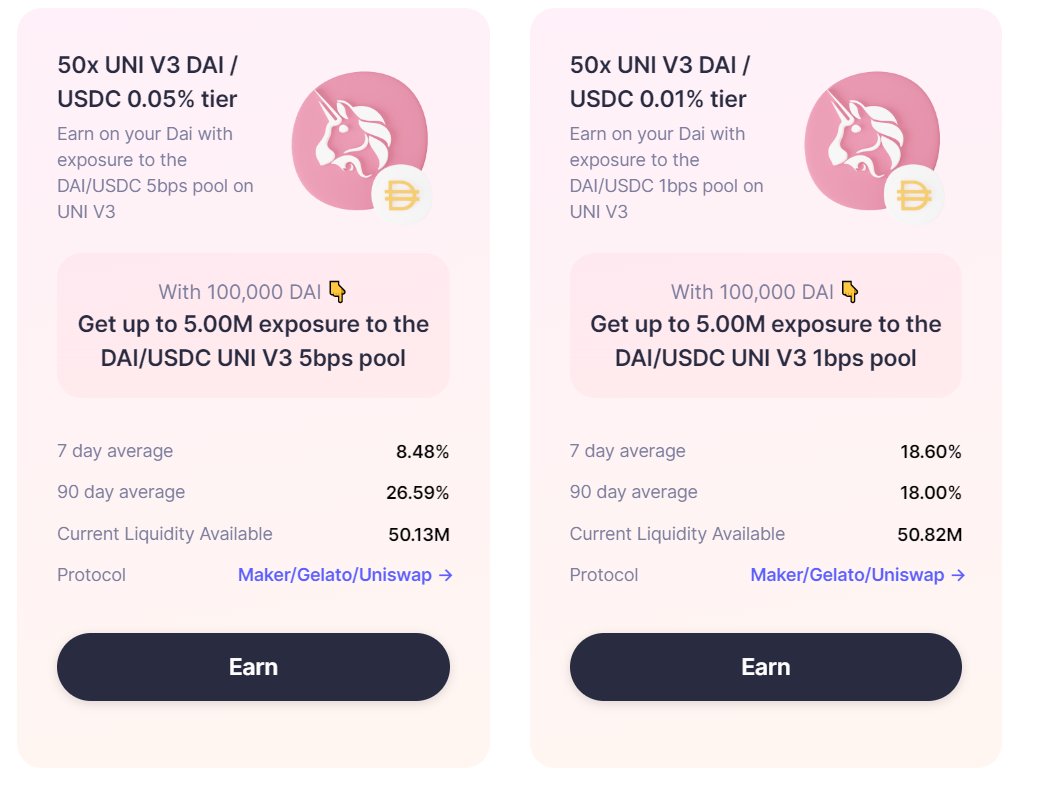

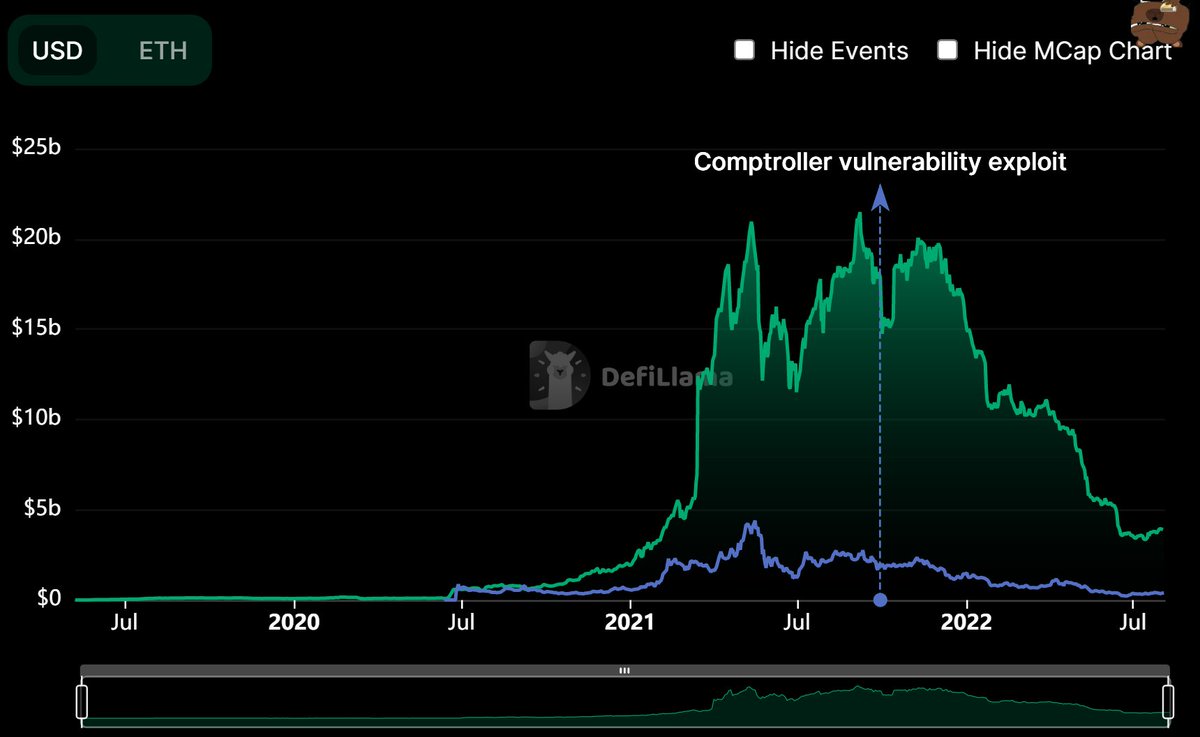

4/ In 2020 Compound launched liquidity mining giving away $COMP to liquidity providers. Compound's TVL explodes at first.

The goal here is to farm $COMP and then dump it for compounded returns.

The price plummets. Yield on deposits drops and LPs leave.

The goal here is to farm $COMP and then dump it for compounded returns.

The price plummets. Yield on deposits drops and LPs leave.

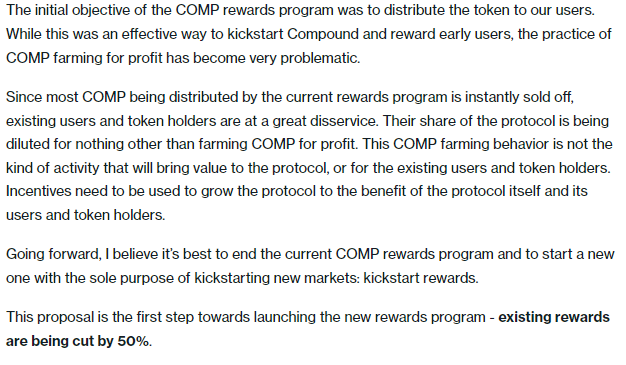

5/ 2 years later Compound finally cut rewards by 50%.

They admitted that distributed $COMP 'is instantly sold off' thus token holders are 'diluted for nothing other than farming $COMP for profit'.

They admitted that distributed $COMP 'is instantly sold off' thus token holders are 'diluted for nothing other than farming $COMP for profit'.

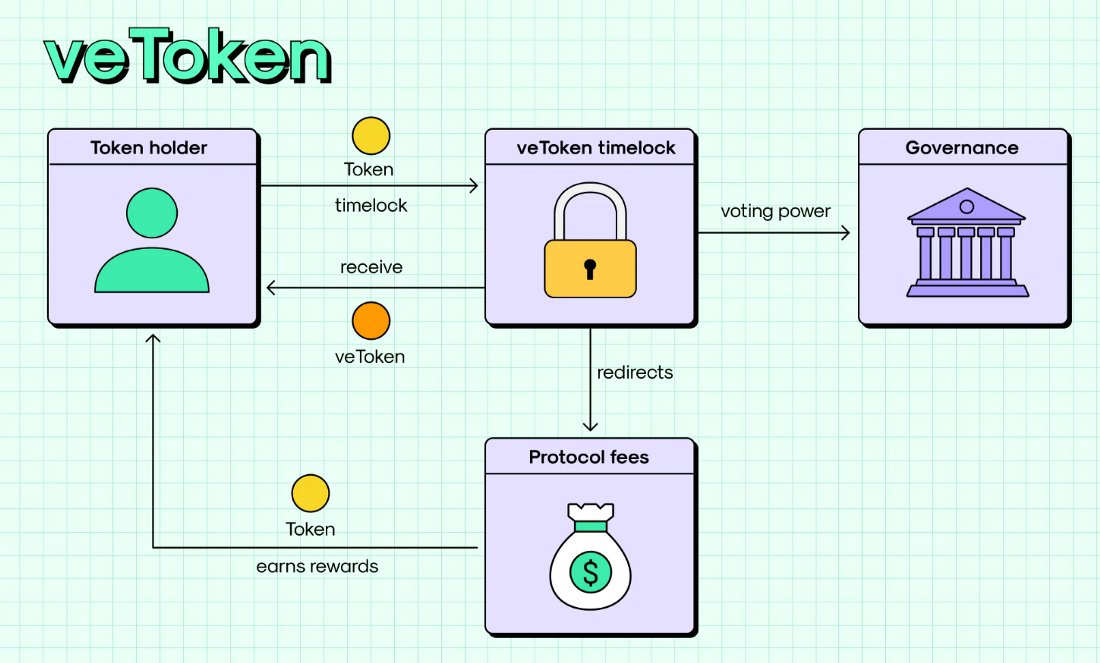

6/ @CurveFinance approaches LM differently:

1⃣LPs need to lock $CRV for up to 4 years to boosts rewards.

The longer you lock, the more vote-escrowed CRV (veCRV) you get.

2⃣Locking is irreversible and tokens aren't transferrable.

3⃣CRV lockers earn part of the protocol fees.

1⃣LPs need to lock $CRV for up to 4 years to boosts rewards.

The longer you lock, the more vote-escrowed CRV (veCRV) you get.

2⃣Locking is irreversible and tokens aren't transferrable.

3⃣CRV lockers earn part of the protocol fees.

7/ The goal?

Increase TVL without over inflating $CRV supply.

Curve's lock ups & vesting buys time to grow the protocol, adoption and revenue.

Succeeding means the value proposition for $CRV should be attractive enough not to sell $CRV at all.

Increase TVL without over inflating $CRV supply.

Curve's lock ups & vesting buys time to grow the protocol, adoption and revenue.

Succeeding means the value proposition for $CRV should be attractive enough not to sell $CRV at all.

8/ By the way, if you want a more detailed explanation, check my blog below or check the table with all projects analyzed (TVL, % of tokens locked, APR, unique features etc.)

1⃣ Table ignasdefi.notion.site

2⃣ Blog medium.com/@Ignas_defi_re…

1⃣ Table ignasdefi.notion.site

2⃣ Blog medium.com/@Ignas_defi_re…

9/ There's more.

veCRV holders vote on which pools get $CRV rewards.

If you're building a #DeFi protocol, you'll need liquidity for that. You can:

• Buy CRV and vote for yourself.

• Bribe veCRV holders

This should increase demand for CRV and yield of $veCRV

veCRV holders vote on which pools get $CRV rewards.

If you're building a #DeFi protocol, you'll need liquidity for that. You can:

• Buy CRV and vote for yourself.

• Bribe veCRV holders

This should increase demand for CRV and yield of $veCRV

10/ Curve changed the liquidity mining game theory.

Best strategy for $COMP mining was to farm & dump.

Then wait for an inflection point.

If the token price is low enough relative to the adoption, then consider buying back.

Best strategy for $COMP mining was to farm & dump.

Then wait for an inflection point.

If the token price is low enough relative to the adoption, then consider buying back.

11/ But with veTokes you have skin in the game.

In short it:

• Encourages long term holding

• LM is more efficient & transparent

• Holders incentivized to become LPs & vice versa

• Revenue incentivizes the team without selling tokens

• Bribe system attracts other protocols

In short it:

• Encourages long term holding

• LM is more efficient & transparent

• Holders incentivized to become LPs & vice versa

• Revenue incentivizes the team without selling tokens

• Bribe system attracts other protocols

12/The focus on long-term holding has attracted more protocols to adapt veTokenomics.

Quite many of them modified the original Curve model to fit their needs.

Here are the protocols & how they modified the veModel 👇

Quite many of them modified the original Curve model to fit their needs.

Here are the protocols & how they modified the veModel 👇

13/

1⃣Using LP tokens for vote-escrow.

@BalancerLabs locks 80% $BAL and 20% $ETH LP tokens to receive veBAL.

@finance_ref has a two token model: veLPT and LOVE, where veLPT consists of $REF and $NEAR.

Interestingly, the max lock period chosen by both protocols is 1 year.

1⃣Using LP tokens for vote-escrow.

@BalancerLabs locks 80% $BAL and 20% $ETH LP tokens to receive veBAL.

@finance_ref has a two token model: veLPT and LOVE, where veLPT consists of $REF and $NEAR.

Interestingly, the max lock period chosen by both protocols is 1 year.

14/

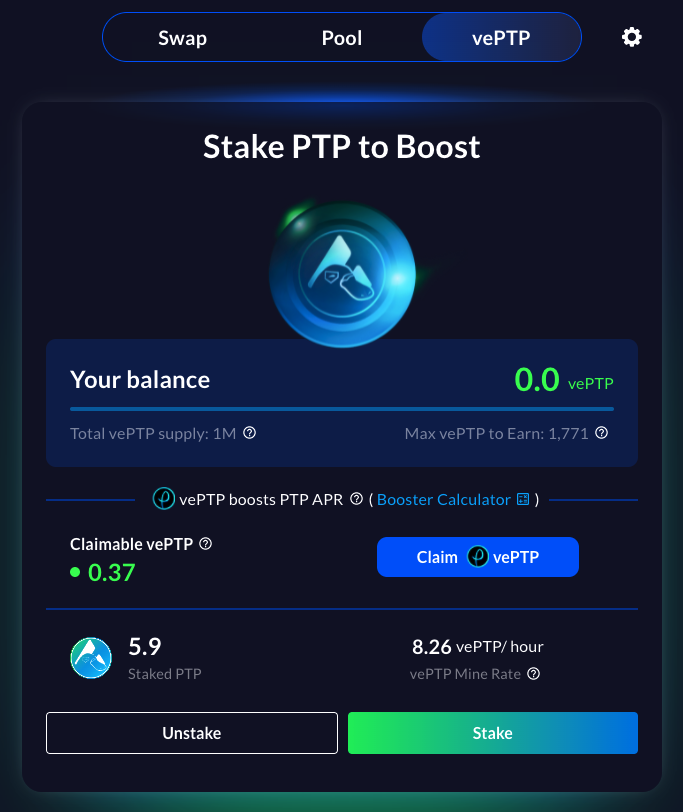

2⃣Platypus Finance model.

@traderjoe_xyz and @YetiFinance adopted Platypus model.

Tokens are staked and veTokens are accrued overtime.

The higher the veToken balance, the higher the yield.

There're no lock ups and users can withdraw anytime, but loses the yield boost.

2⃣Platypus Finance model.

@traderjoe_xyz and @YetiFinance adopted Platypus model.

Tokens are staked and veTokens are accrued overtime.

The higher the veToken balance, the higher the yield.

There're no lock ups and users can withdraw anytime, but loses the yield boost.

15/

3⃣Early unlocks

@ribbonfinance and @iearnfinance allows to unlock veTokens before lock up expires with a penalty.

i.e. locking for 2Y and unlocking when 1Y is left, incurs a 50% penalty.

$DODO's has a very different veModel, but can redeem DODO by paying an exit fee.

3⃣Early unlocks

@ribbonfinance and @iearnfinance allows to unlock veTokens before lock up expires with a penalty.

i.e. locking for 2Y and unlocking when 1Y is left, incurs a 50% penalty.

$DODO's has a very different veModel, but can redeem DODO by paying an exit fee.

16/ I'd like to add, that @ribbonfinance is interesting with its Bribes Boosting Delegation (receiving extra rewards without being and LP)

Also, @iearnfinance's YFI is not inflationary so rewards will come from buybacks with 800 $YFI already prepared🤑

Also, @iearnfinance's YFI is not inflationary so rewards will come from buybacks with 800 $YFI already prepared🤑

17/

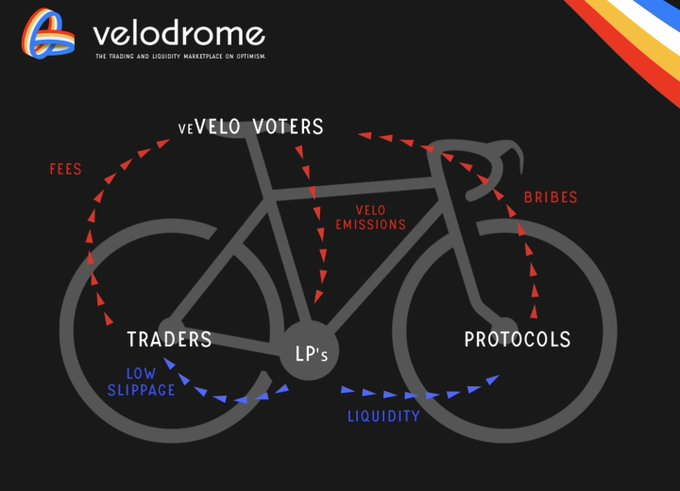

4⃣@VelodromeFi

Velodrome is an improved version of Andre Cronje's failed Solidly project.

By staking $VELO for up to 4 years, users get veVELO: an ERC-721 governance token in the form of an NFT, which uses ve(3,3) rebase mechanism.

4⃣@VelodromeFi

Velodrome is an improved version of Andre Cronje's failed Solidly project.

By staking $VELO for up to 4 years, users get veVELO: an ERC-721 governance token in the form of an NFT, which uses ve(3,3) rebase mechanism.

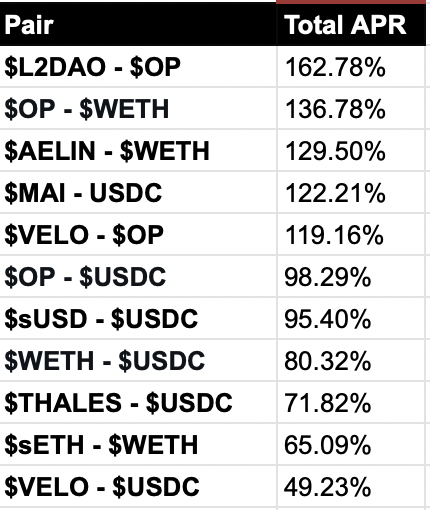

18/veVELO voting power diminishes with time, so every rebase you should claim and restake $VELO to restore it.

The veVELO weigh voting encourages bribes to distribute $VELO rewards.

For example, just last week L2DAO bribes in $OP token yielded 162% APY to veVELO holders.

The veVELO weigh voting encourages bribes to distribute $VELO rewards.

For example, just last week L2DAO bribes in $OP token yielded 162% APY to veVELO holders.

19/ veTokenomics requires significant efforts to maximize returns.

You need to consider:

• How much & how long to stake?

• Claim and sell rewards or restake?

• How often to compound returns?

• Which weight gauges to vote?

• Find out who's offering the best bribes

....

You need to consider:

• How much & how long to stake?

• Claim and sell rewards or restake?

• How often to compound returns?

• Which weight gauges to vote?

• Find out who's offering the best bribes

....

20/ Enter Yield/Governance Aggregators

The mission is to minimize investment strategy efforts and maximize returns.

Here I cover 4 veAggregators:

• @ConvexFinance for CRV & FXS.

• @AuraFinance for BAL

• @vector_fi for PTP and JOE

• @StakeDAOHQ for CRV, FXS, ANGLE and BAL

The mission is to minimize investment strategy efforts and maximize returns.

Here I cover 4 veAggregators:

• @ConvexFinance for CRV & FXS.

• @AuraFinance for BAL

• @vector_fi for PTP and JOE

• @StakeDAOHQ for CRV, FXS, ANGLE and BAL

21/ @ConvexFinance is by far the biggest with $4.42b in TVL and controls 77% of all circulating $CRV.

Even Yearn Finance uses some of Convex vaults now.

In comparison, Aura controls around 27% share of veBAL despite launching not long time ago.

Even Yearn Finance uses some of Convex vaults now.

In comparison, Aura controls around 27% share of veBAL despite launching not long time ago.

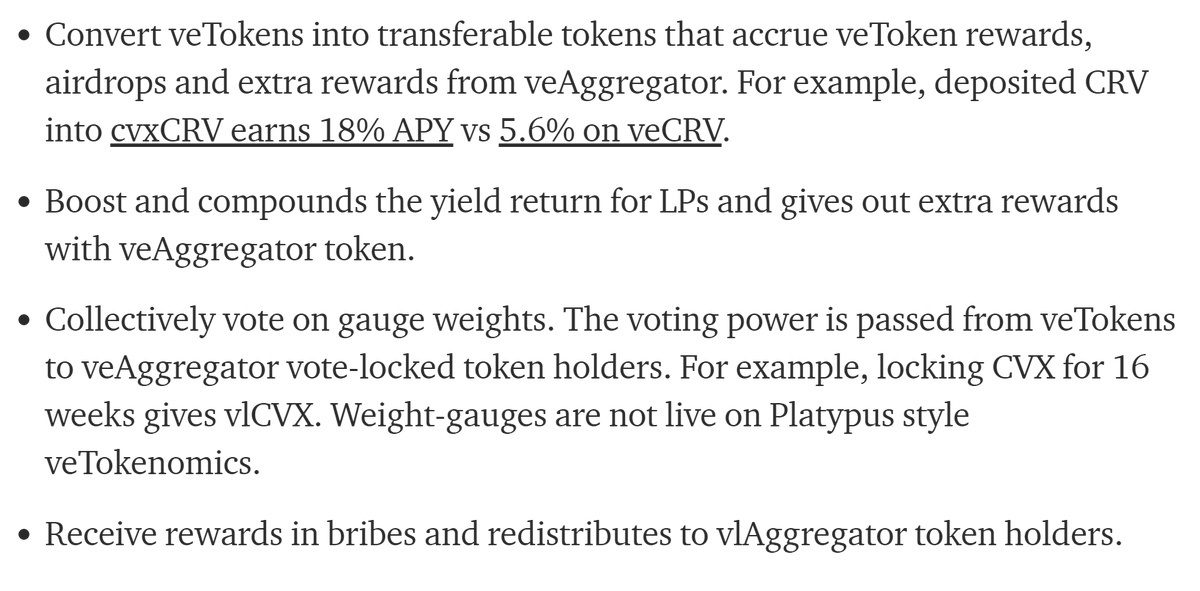

22/ Although with some differences, they do the following tasks:

• Automate & maximize veToken rewards

• Boost and compounds the yield return to LPs

• Vote on gauge weights.

• Receive rewards in bribes and redistributes to vlAggregator token holders.

• Automate & maximize veToken rewards

• Boost and compounds the yield return to LPs

• Vote on gauge weights.

• Receive rewards in bribes and redistributes to vlAggregator token holders.

23/ Once again, for max returns from bribes investors need to participate actively.

Solution: delegate vlAggregator tokens to another platform 'so you can sit back and enjoy the rewards without doing any work.'

For $vlCVX holders, @VotiumProtocol does the heavy lifting.

Solution: delegate vlAggregator tokens to another platform 'so you can sit back and enjoy the rewards without doing any work.'

For $vlCVX holders, @VotiumProtocol does the heavy lifting.

24/ As you can see the complexity grows at every stage!

To sum up, veTokenomics aligns incentives to the long term holders and LPs, but also creates space for other protocols & communities to build on top.

It's a marriage of convenience 👰♂️🤵

To sum up, veTokenomics aligns incentives to the long term holders and LPs, but also creates space for other protocols & communities to build on top.

It's a marriage of convenience 👰♂️🤵

25/Hope this thread helped you to understand the power of veTokenomics.

Would love your feedback or if I missed something important let me know @thedefiedge @DeFi_Dad @DeFi_Brian @newmichwill @milesdeutscher @Dynamo_Patrick and @xangle_intern

Would love your feedback or if I missed something important let me know @thedefiedge @DeFi_Dad @DeFi_Brian @newmichwill @milesdeutscher @Dynamo_Patrick and @xangle_intern

If you liked the thread, please like and share ♥️

https://twitter.com/DefiIgnas/status/1555115991180673024

• • •

Missing some Tweet in this thread? You can try to

force a refresh