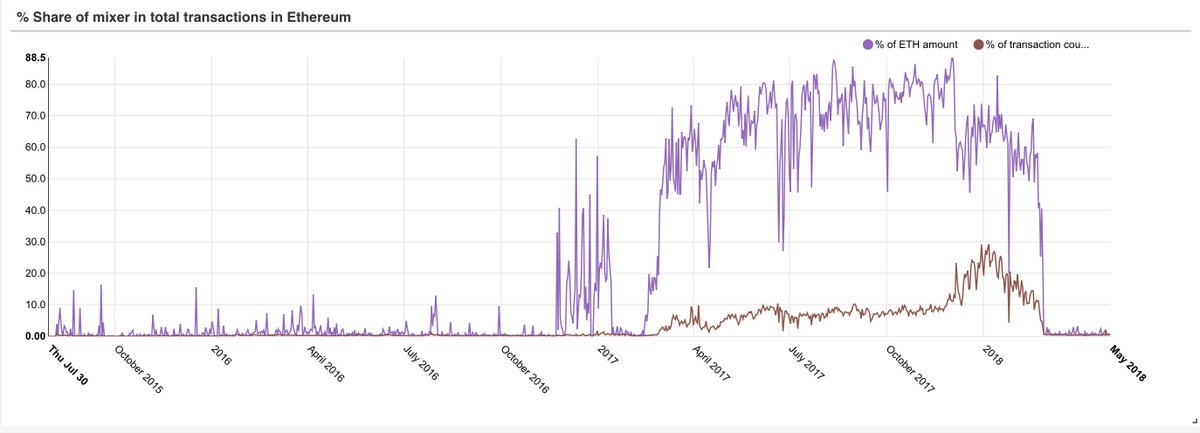

So only 8% of ETH's transactions are from what's supposed to be the purpose of the network. What are the rest? Like ICOs and payments.

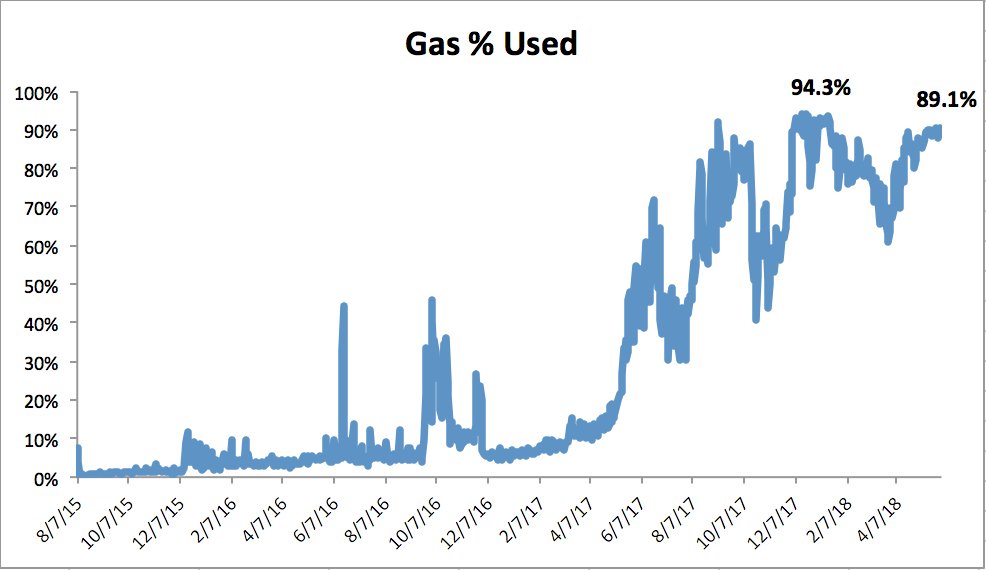

Blocks are full. And they are full with much lower volume transactions. The ETH public good--the blockspace--is being exploited by low value transactions

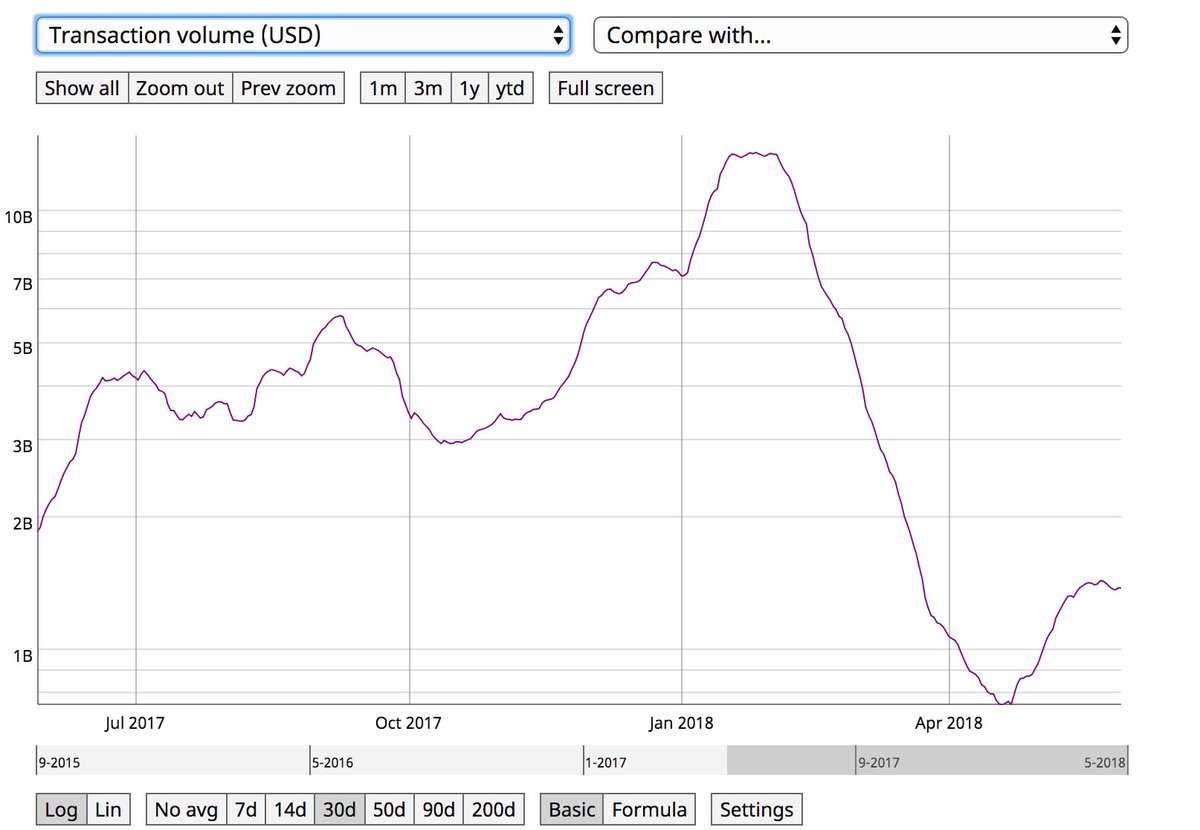

chart from @coinmetrics

Without Plasma and Sharding, I expect fees to go through the roof on ETH. And if fees are too high from low value "spam", real usage will be crowded out

These platforms *embrace* the centralization that's inherent to their model and thus all will have lower fees

Yet, that may be the only potential smart contract use case with any network effects

There won't be strong enough network effects to outweigh the high fees and bribes from platforms to ICOs

Gas h/t @KyleSamani

Data from @etherscan