(Bad) Argument #1:

(Bad) Argument #2:

1/

medium.com/ussbriefs/unde…

uss.co.uk/how-uss-is-run…

medium.com/@mikeotsuka/ho…

medium.com/@mikeotsuka/th…

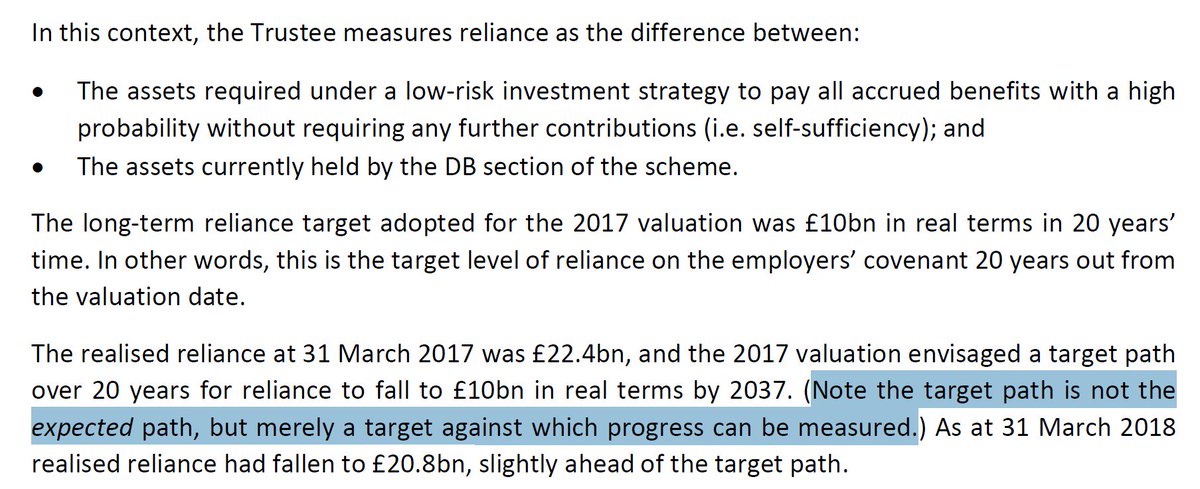

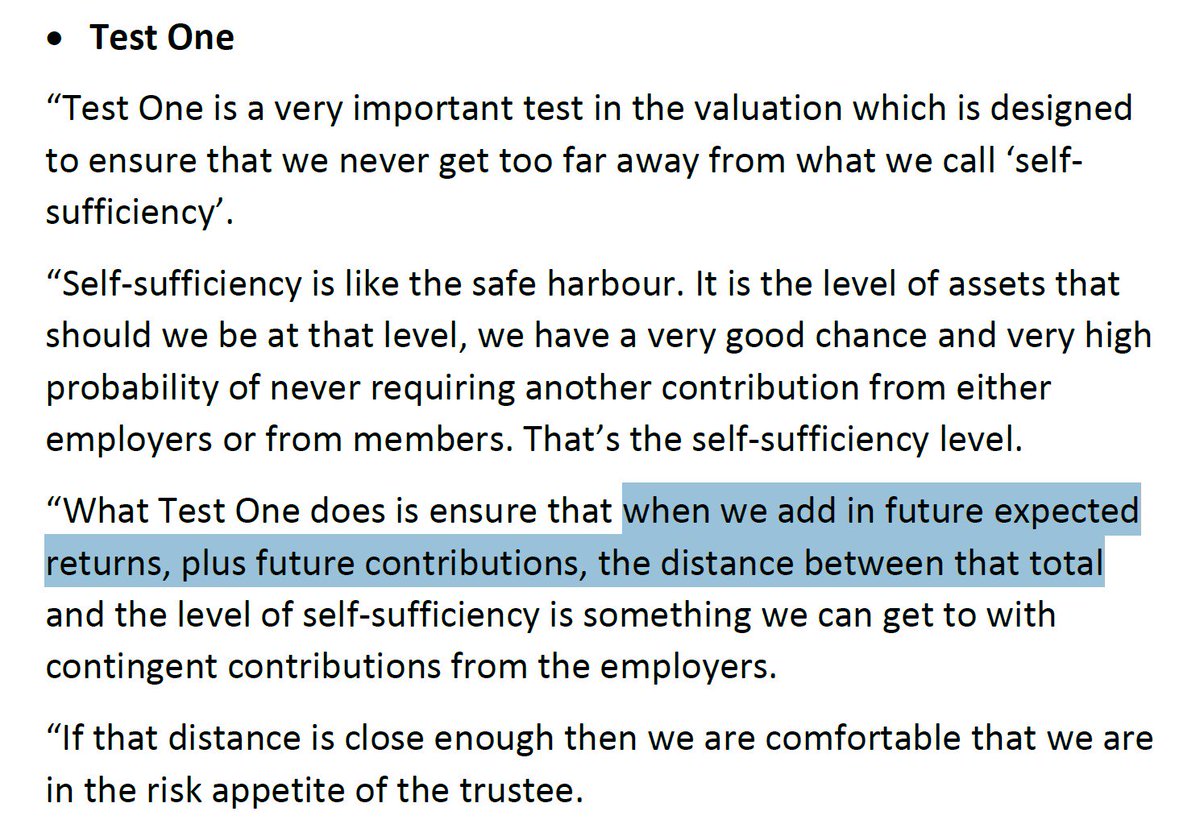

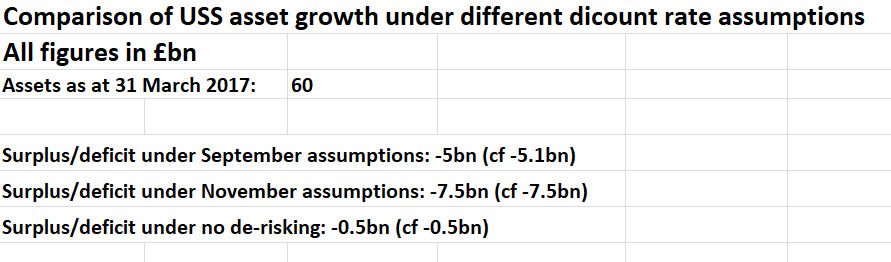

First, so long as the scheme remains cash flow positive because open to future DB accrual at a sufficiently high level (i.e., CRB 1/75 up to at least £30k), the risk of remaining continually invested in growth assets is low. 11/

medium.com/@mikeotsuka/th…

wonkhe.com/blogs/pensions…

medium.com/@mikeotsuka/an…