@OpenUPP2018 @USSbriefs @ForPension

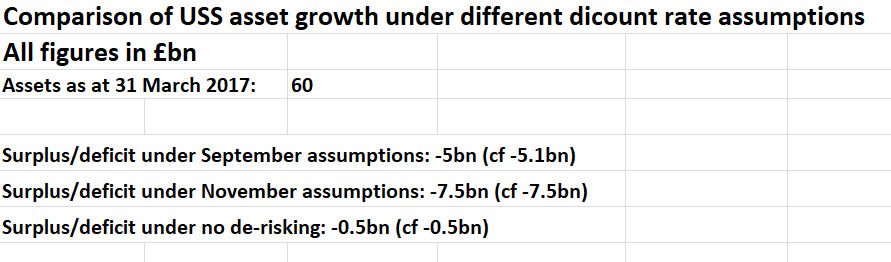

USS say 5.1bn deficit, my spreadsheet says 5.0bn

November valuation?

USS say 7.5bn deficit, my spreadsheet agrees

Cancel the de-risking (allowing for prudence)?

My spreadsheet says 0.5bn deficit, same figure I was told last year by @alanhigham100 of USS. 3/

medium.com/ussbriefs/unde…

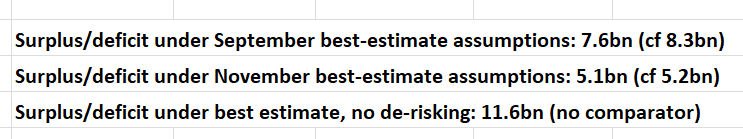

Suppose you cancel the de-risking. What is the expected value of the assets at Year 20, taking into account the expected asset growth, benefit payments and contributions under current rates?

More than the 112.5bn figure above would be VERY GOOD NEWS. 13/

medium.com/@mikeotsuka/ho…

Suppose you de-risk as planned by #USS. What is the expected value of the assets at Year 20, taking into account the expected asset growth, benefit payments and contributions under current rates?

The answer to this was very surprising! 16/