What you should know?

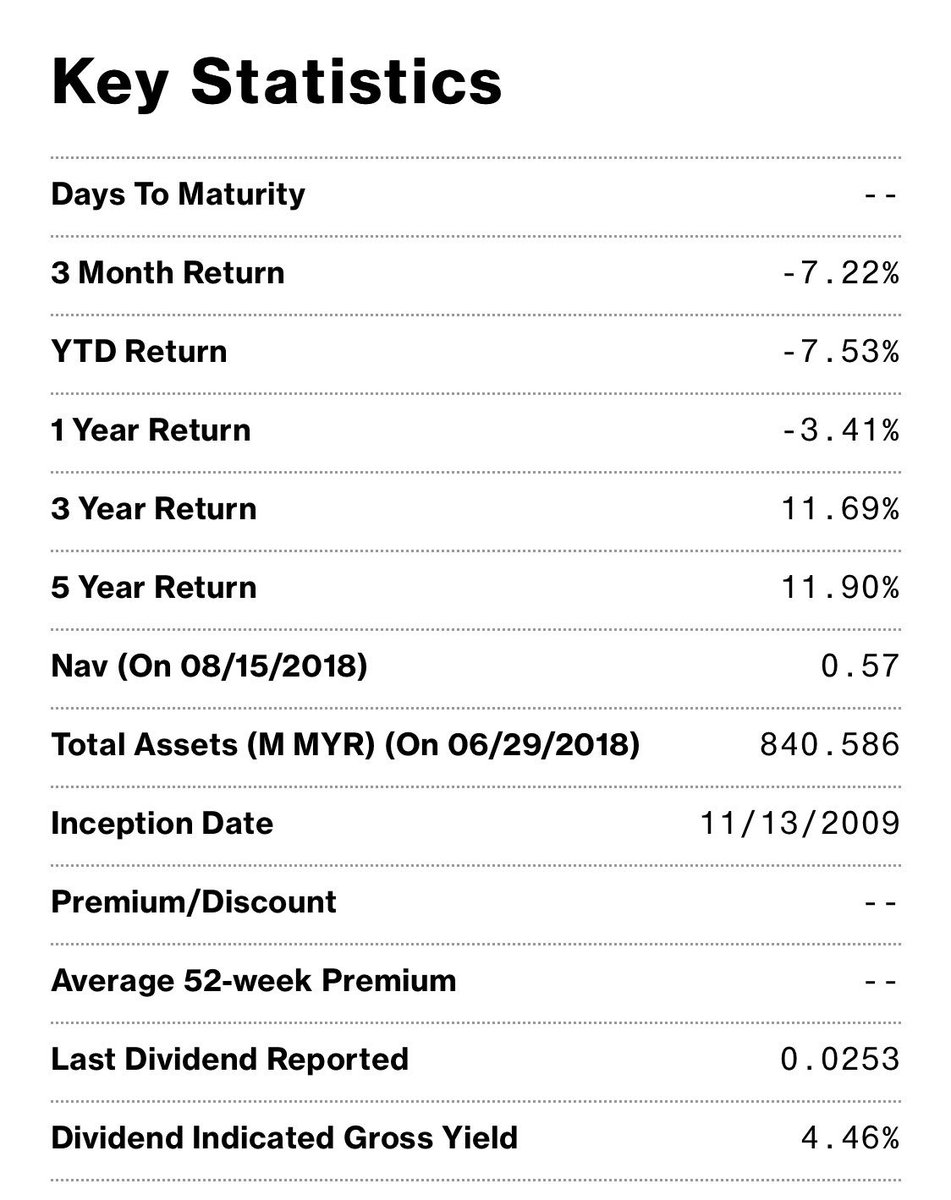

Btw, ni salah satu fund dalam portfolio my client. :)

#TheSophisticatedInvestor

#TSI

#BeAnInformedInvestor

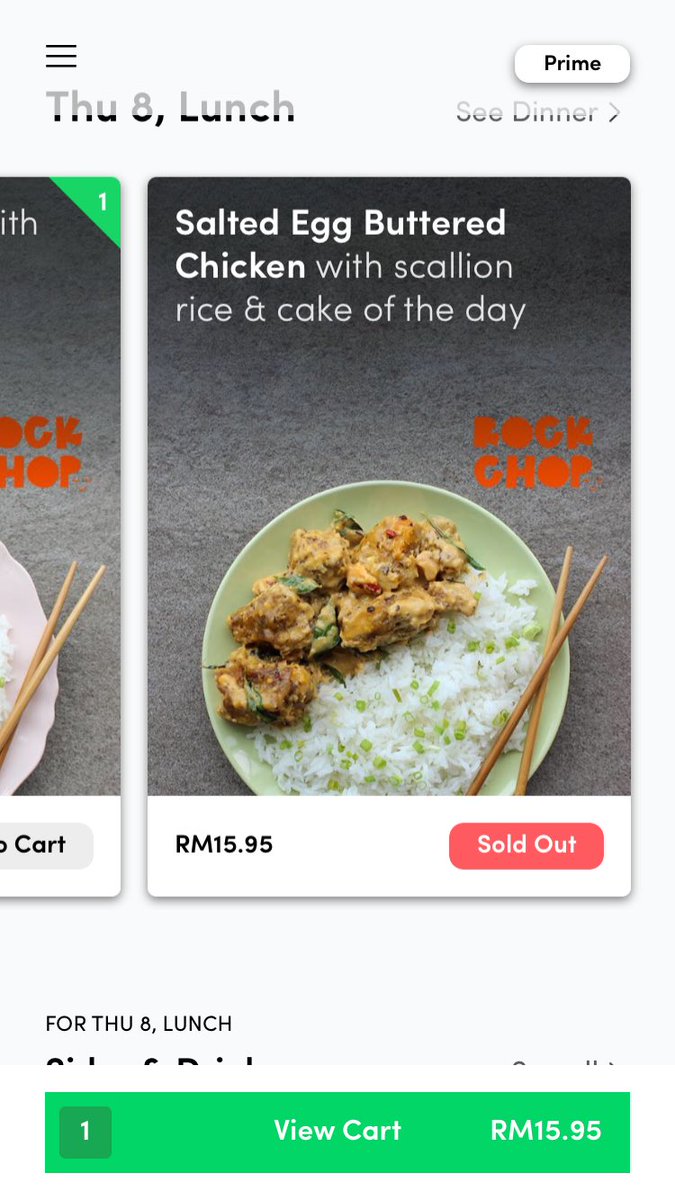

- 3 months

- YTD (Year-to-date), since 1st Jan this year.

- 1 Year Return

Unit trust in it’s nature is a medium to long term investment. So if short term is negative. Look around at the economics environment. What is happening around you.

- 3 Year Return

- 5 Year Return

- Some websites even show 10 Year Return

These are all annualised return. Sort of like average for 3,5,10 years. Sort of.

So if ada sesiapa claim they can give you up till 20-30%. Double check the fund annualised return as another indicator.

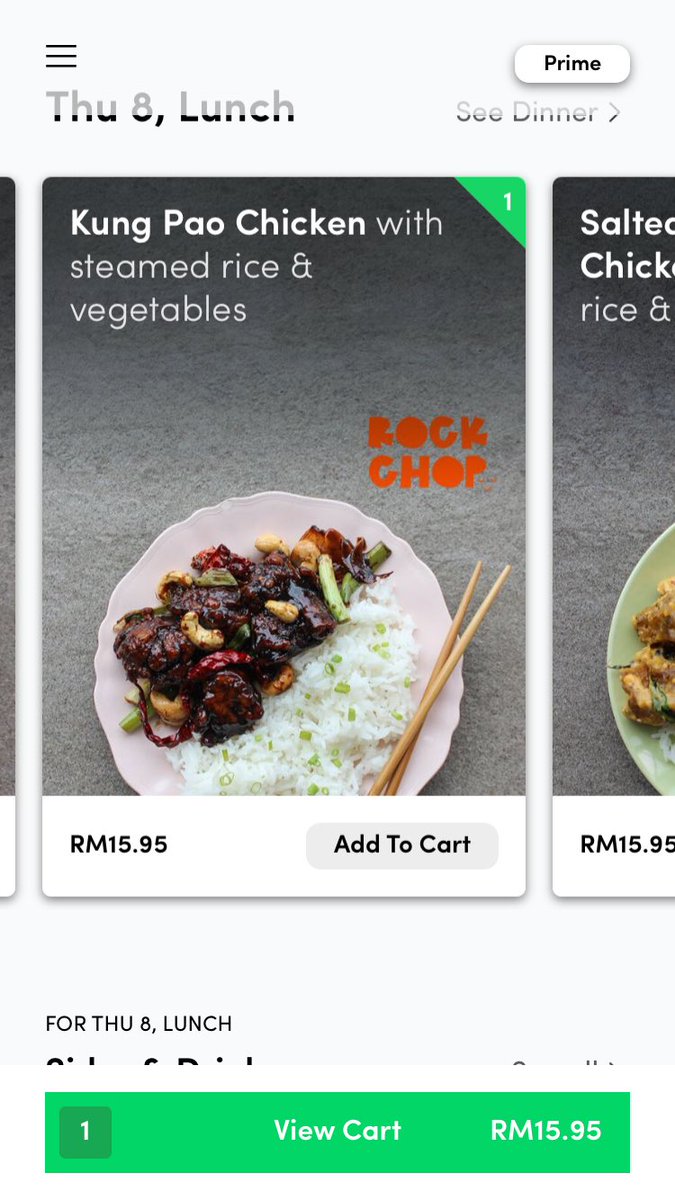

Ataupun Net Asset Value. Dikira berdasarkan jumlah asset fund pada hari tersebut over total units yang ada dalam fund.

So in this case NAV is 0.57. Jika anda beli fund tersebut pada harga 0.55, anda dah untung 0.02.

That is what we called Capital Appreciation.

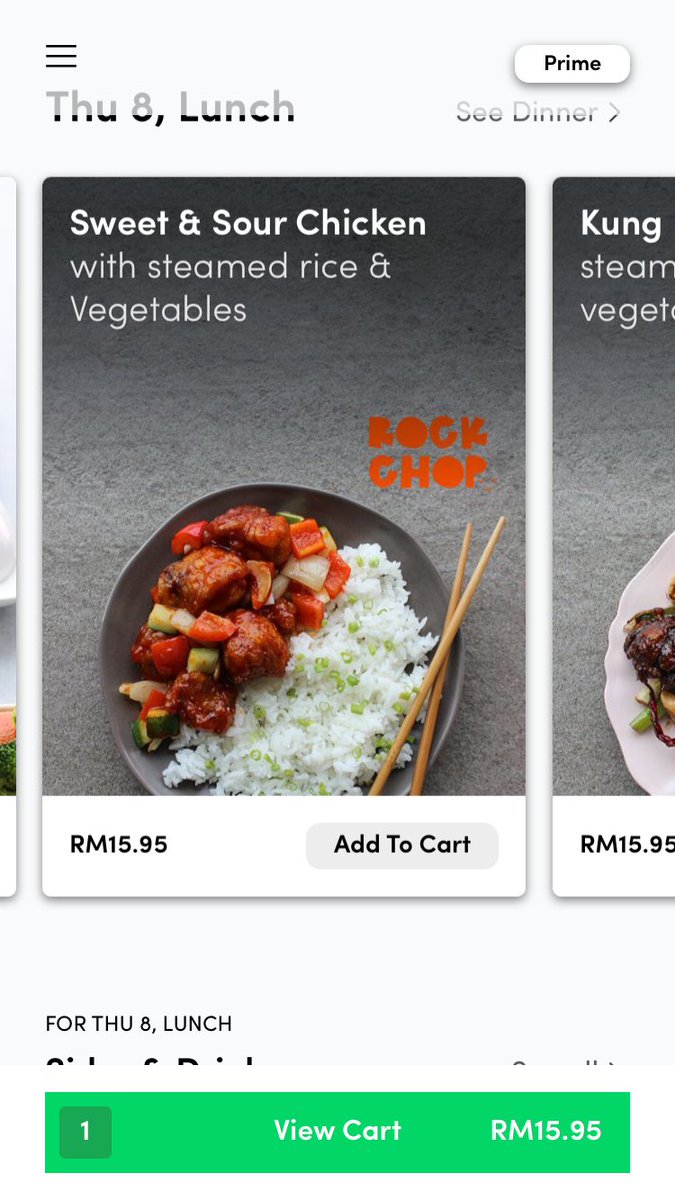

Tarikh Fund tersebut mula dibuka untuk jualan/belian unit. So kalau tengok takde annualised 3, 5 year return. Tengok semula bila tarikh inception fund tu

Some fund bagi annual income distribution. Dan selalunya kita boleh tengok in term of gross yield in this case 4.46%

Eh sikitnya dividen. Sabar huhu

Combination of Capital Appreciation and Income Distribution tu yang buat Unit Trust ada potensi untuk dapat keuntungan pelaburan lagi tinggi. :)

mind reading this and if informative mind RT juga? 😁