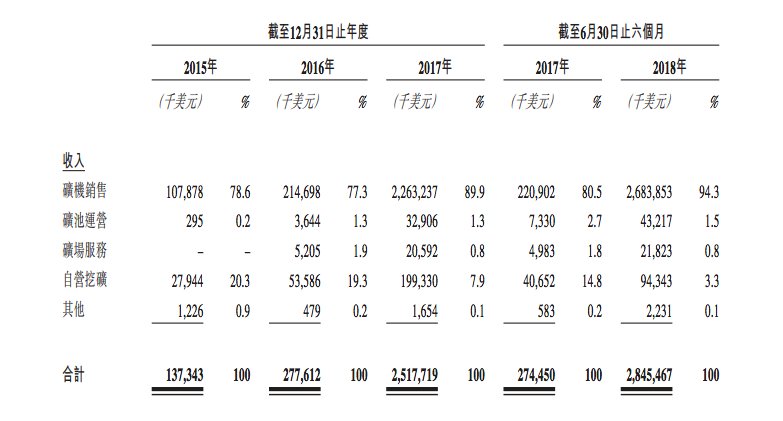

+ 3.3% of their revenue in 2018 thus far comes from self-mining.

+ Bitcoin currently has 11 mining farms in China, including Sichuan, Inner Mongolia, etc. Each mining farm can hold ~20,000 mining rigs.

+ The Bitmain IPO plans to be listed on the Hong Kong Stock exchange via a weighted voting right structure.

+ Two largest shareholders: Micree Zhan & Jihan Wu. Also: The CEO of Sogou (Chinese search engine) is among the largest shareholders.

+ Bitmain addresses U.S. regulations (loosely translated): “We do not know of any U.S. federal laws that forbid the import of mining rigs from any natural persons or entity, nor the selling or manufacturing of the mining rigs within its borders...

+ As of June of 2018, Bitmain has a team of 840 (!!) full-time engineers. That is ~30% of its entire team. The focus: chip design, algo dev, platform design, software, and hardware development.

+ Continue to invest in the research & development of chips— specifically, in ASIC chip design for crypto mining in order to increase computation efficiency while decreasing power watt usage. As such, Bitmain plans to hire aggressively towards that direction.

+ ASIC chips for crypto mining and AI applications; the hardware that accompanies those, mining farms and operations, and other related crypto services.

+ There are three mining farms currently underway in the U.S.: Washington, Texas, and Tennessee. Expected operational date is 2019 Q1, and a maintenance/repair center will also be set up in Washington state.

+ As of June 2018, Bitmain has 7 garages located in Shenzhen, China. Those garages can store up to 1.5 million (!!) mining rigs. Inventory includes mostly conductor components.

(FYI accountants: inventory is accounted using FIFO.)

+ From 6,000 customers in 2015 to 80,000 customers in just the first six months of 2018.

+ 48.2% domestic sales, 51.8% international sales.

Read (+ subscribe) here: messari.substack.com/p/bitmain-sani…