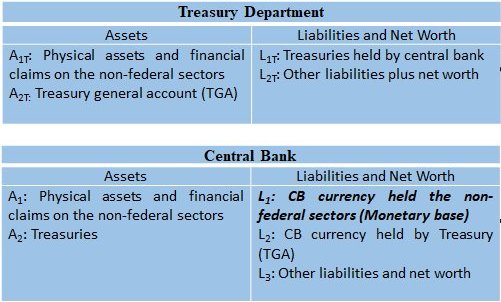

Again each in turn starting with 1a and then 1b

- On central bank balance sheet: ΔL1 < 0, ΔL2 > 0: Destruction of monetary base

- On Treasury balance sheet: ΔA2T > 0, ΔL2T > 0 (or ΔA1T < 0 if taxes liabilities are on-balance sheet claims)

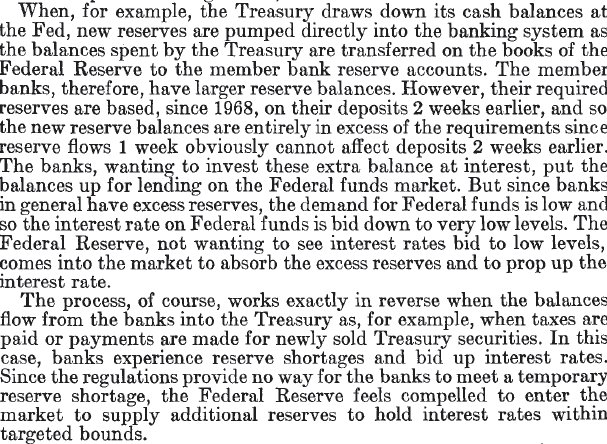

- Treasury has requested advances from Fed even when it had plenty of funds for spending

- Fed has provided reserves to banks to settle taxes.

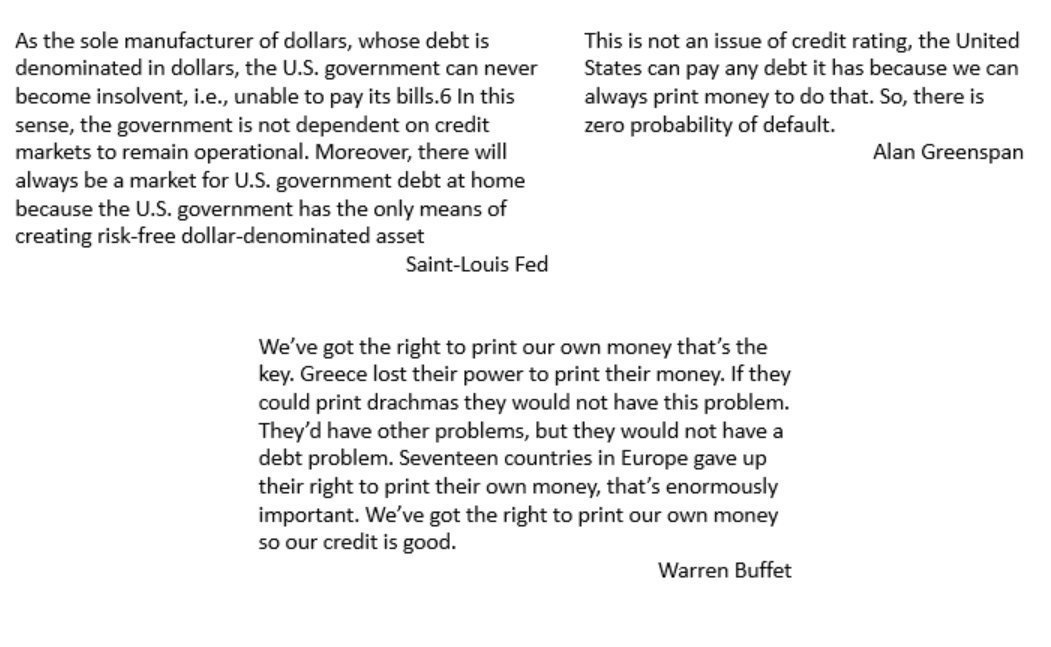

Yes we do because taxes have some purposes but "Tax for Revenues are Obsolete" are former NYFed direct noted.

Basically, it is about stabilizing the business cycle, prevent the formation of dynasties, changing "bad" behaviors, assess costs of some programs. One at a time.

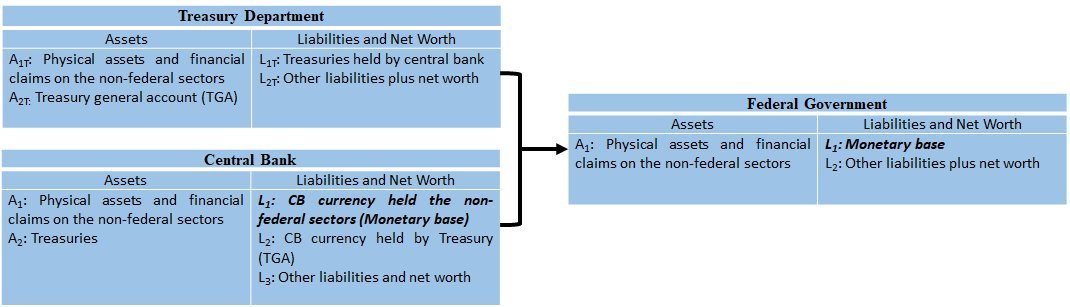

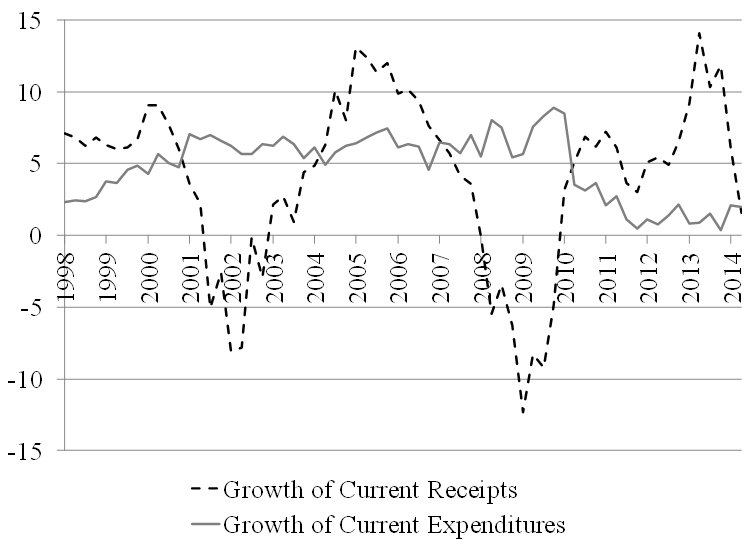

Financial side:Taxes don't finance the gov, taxes comes after G. US gov can always finance spending (consolidated view).Fed&Treas coordinate to ensure that fiscal and monetary policies run smoothly (unconsolidated view).Probs come from political gridlock not finances