I thought y'all might find the pitch interesting so I'm going to share it

Note If you're pitching your market/asset class you've already lost. I just refuse to surrender so 🤷♂️

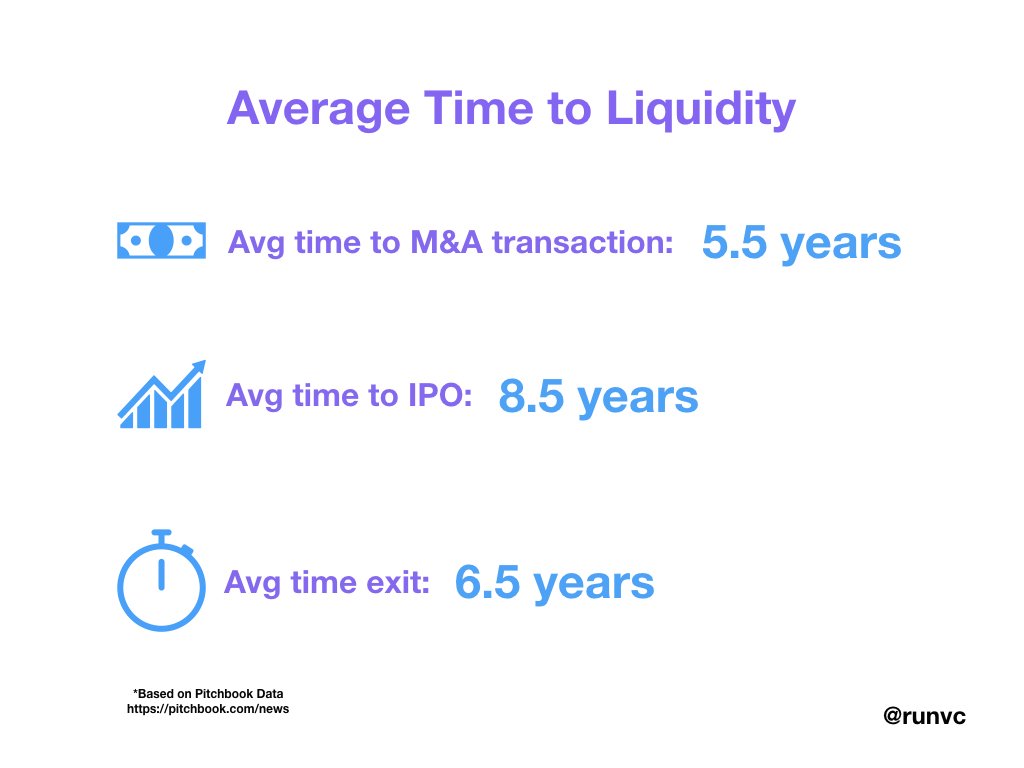

These numbers from @PitchBook start counting from the date of investment in a portfolio company. Funds deploy over 18-36 months so we need to add those months on.