They will all be in this thread

PE= Private equity

IRR= Internal rate of return

More in depth vocab and acronyms to come :) this was just a taste of some real basics

We are starting the vocab off basic. It will become more advanced in time.

NOI=Net Operating Income

Gross income-Vacancy and Operating Expenses=NOI

This shows you the base profitability of your investment.

Detailed Thread below:

Tonight is just some light acronyms. Cap rate comes tomorrow

ARV: After-Repaired Value

COO: Certificate of Occupancy

P and S: Purchase and sales agreement

JV: Joint Venture

LTV: Loan to value

Real Estate has a lot of acronyms. Its best to learn them

This thread is on Cap Cate. It is a companion to our NOI thread a couple nights ago.

Enjoy :D

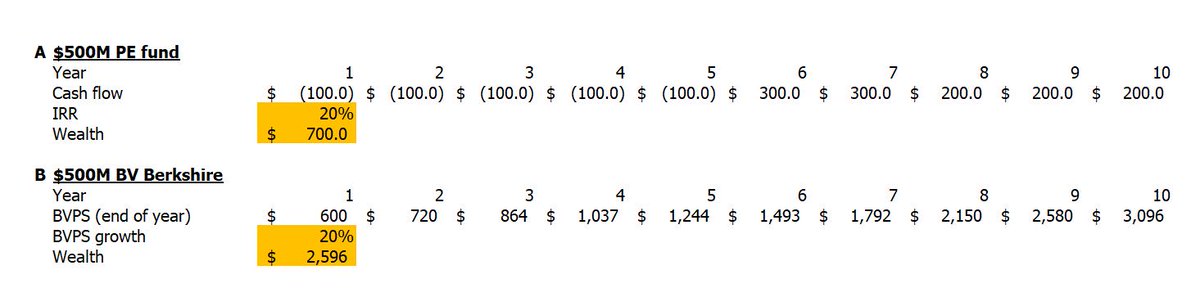

NPV: Net Present Value

IRR: Internal Rate of return.

I will be doing threads on these guys in the coming days.

They are both the basis for simple real estate modeling.

Tax Certiorari

It is essentially the legal process of arguing what your building is actually worth vs what the tax collectors say its worth.

This will save you $$$ on your taxes.

I will write a thread on this later in more depth.

1031 Exchange

This is a very important piece of tax code

In short, it allows you to defer your capital gains when you sell a property. But you must buy another similar property within a certain time frame

This is important look it up on Investopedia

NNN or triple net tenant.

This is a tenant who pays for their CAM (common area maintenance) insurance and taxes.

I structure all my leases like this regardless of the tenant. Costs always rise faster than rent increase

Gross Lease: This is a lease where the tenant pays just the rent.

You as the landlord pay all other expenses.

Try to avoid lease like this.

With a little break on Twitter for a building, I just closed on I am back

Vesting: We usually use this when talking about equity. For example, we say my equity will "vest" in this year.

This essentially means when we will receive the equity in our deal.

Closing costs: These are the costs to actually close the deal

Make sure you include this into your estimates when purchasing a building as it is usually .05% to 1% of the purchase price

It is not an insignificant amount.

Dual Agency: This is when one agent represents both the seller and the buyer.

Escrow: An account where a third party holds the money while the transaction takes place. Usually done for the down payment when purchasing a building.

Title: This is somewhat of a bundle of rights for the person who owns the building. In your due diligence process, you will pull the title to make sure it is clear of any lawsuits.

CAM means common area maintenance. (Incase anyone forgot)

Depreciation: The process of estimating the lifespan of your investment

In real estate depreciation is a deduction off your taxes

Depreciation Schedule:

CRE: 39 years

Rental: 27.5

(If you need to know more google. This is a topic too long for twitter)

Fixed-Rate Loan: The rate is fixed for the period of the loan

Variable Rate Loan: The rate will change at a certain point

Basic concepts yet they are important.

If you want to get into Real Estate it means knowing every nook and cranny of how it works

TI Bill

Stands for tenant improvement

It's an amount the landlord allots to the tenant to make improvements. Usually done through the lease

Always ask to see the full TI bill when buying a property.

It can skew the lease payments so they are higher

Always get multiples of everything.

Get multiple bids for your construction projects.

Multiple term sheets from banks.

Then play them off each other.

Term Sheet: Is the loan terms.

A quick term because I am tired haha.

HOA: Means homeowners association.

The only time you have to deal with this is if you buy a retail condo.

But rethink twice if you are looking to buy because HOA is a pain in the ass and restrictive.

DSCR: Debt Service Coverage Ratio

Get used to knowing what this is when talking to lenders.

It is the NOI/Debt Service.

It essentially shows the ability of the investment's cashflows to pay off the debt payment.

Quick and easy one.

Pro Rata Share: Simply your share of the building. divide your sq ft by the total sq ft of the building and now you have your pro rata share.

Used commonly for splitting up cam expenses.

Building Class:

This refers to the desirability of the location, building type, age, and more.

There is Class A, B, C.

It is usually scaling with price and risk. A is more expensive and least risky. C is vice versa

Air Rights:

Notably used in New York. Depends on the city but usually refers to the amount of square footage you can build on a property

It depends on the type of zoning as to how much you may build

Air rights can also be sold to adjacent properties

FAR: Floor Area Ratio

This is the relationship between the SQ ft of the building and the SQ feet of the parcel of land its on.

It is typically calculated by dividing sq ft of building by sq ft of the parcel

1031 Exchange

This is a section of the tax codes which allows real estate investors to defer their capital gains taxes on the sale of a property.

Essentially you are allowed to sell the property and buy another without paying capital gains.

Anchor Tenant:

A major or prime tenant within a multi tenant building.

This usually refers to a tenant that brings in the majority of the revenue or has a strong and stable long term lease.

Essentially a tenant you can count on.

Mixed Use Building: A building that quite simply is mixed use.

Could be a building with ground floor retail and top floor office.

Or a building with ground floor retail and top floor residential.

I think you get the jist it is pretty simple

Bad Boy Carve Outs: Used in CRE nonrecourse loans.

Borrower is only liable if he does something illegal or something written in their signing document.

Read the terms carefully banks add in all sorts of shit these days.

Origination Points:

One point is equal to 1% of the mortgage amount

They are the costs that a lender charges for creating the loan. Usually one or two points

They are also tax-deductible. The deduction is spread out evenly for the life of the loan.

Discount Points: They lower your mortgage by a certain percentage.

When you buy these discount points you are essentially paying the interest of your loan in exchange for a lower rate.

SubLease: When your original tenant decides to rent out the space that he rents from you.

Usually forbidden in a lease without the express approval of landlord