If anyone wants a question about Real Estate answered just @ me or comment on my threads.

I hope you enjoy!

"What could be a shortest and suggested roadmap for a non-RE newbie, in his mid 30s, to break in big boys club"

The big boys all have large portfolios. (Usually coupled with Insurance and PE but thats another topic)

What you need to do is build your portfolio

Building your portfolio is about not taking money out of your buildings and using leverage

Basic formula: Buy building at 60 to 70% LTV. 5 years later refinance, Buy new building. Rinse repeat

This will go up exponentially. But the more you take out the slower it is

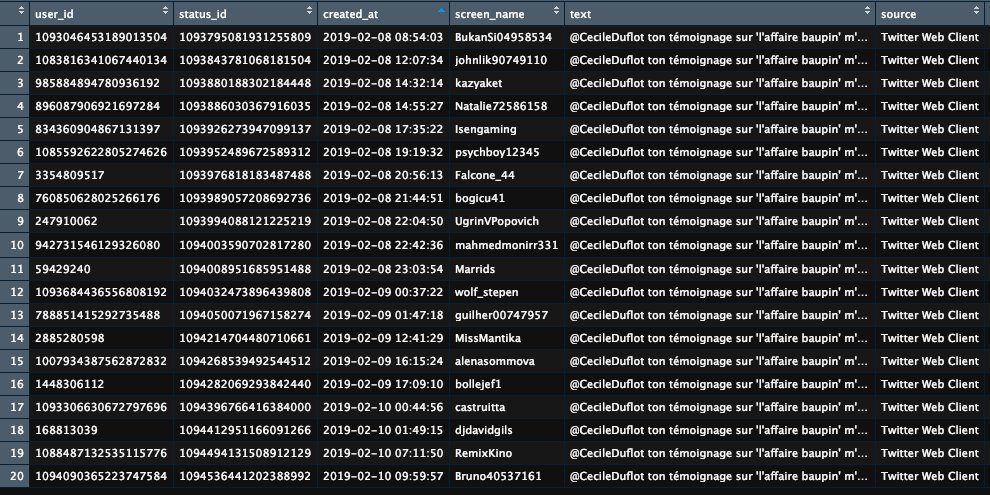

"Do you utilize credit lines? And if through a business, is there any way to dodge the personal guarantees"

I try to keep my portfolio at around 50% leveraged. I have quite a few business cards. In my early stages, my investor gave me a credit line

When starting out it is hard to get away from personal guarantees. It's usually just the cost of doing business.

It depends on the risk of your buildings. Almost every loan will have a bad boy carveout.

I still personal guaranty my high-risk buildings.

"How to analyze ROI"

On all my buildings I model cash flows for 10 to 20 years.

I use Argus can be done in Excel just a little tougher.

Always use IRR as a rate of return measure as it takes into account reinvestment and Time Value of Money.

"When viewing a property, what are the first things you inspect? Roof? Location? Or is it dependent on the type of building?"

Pretty much all of that.

Older buildings I look a lot into physical aspects. Roof, environmental, basements, etc...

A newer building I am less concerned and don't look into physical aspects as much.

(With experience you will be able to know the extent of physical damages. If newbie bring a GV with you)

Location is very important. But that is investor specific.

"Ever buy distressed notes or liens?"

No, I do not. I actually don't really know anyone else who does either.

Personally, I wonder how the market is for that seeing how well Real Estate is doing right now.

"What would be your advice to a novice Realtor?"

(If you are a commercial broker)

Focus on relationships not sales. Provide value to your client, be honest, be on top of shit.

Focus on creating relationships with clients and sales will follow

"Legal aspect of property management. Fair housing act, etc. how not to get sued as a landlord"

I don't touch residential so I can't help there.

For my CRE buildings:

Deice sidewalk

Fix sidewalk cracks

Get video cameras

Do things by the books

"How to negotiate or the step by step process of how a deal actually gets inked. Eg title, escrow, etc etc"

I will make a thread on how to negotiate.

In terms of the transaction side peep a thread I made.

"Best types of re for cash flow and longevity.. also how does the debt work with like the down payment and stuff.. one last thing where did you go to learn about it"

I only invest in CRE.

There is no best type of RE. It is whatever works for you.

For debt on CRE read this investopedia.com/articles/perso…

From @Investopedia

I learned about through experience working at a firm as well as reading on @investopedia everything I didn't understand.

"Ideal balance between paid price and investment needed in order to get the property to max potential. 1. buy low and increase refourbishement cost or 2. better buy at higher price and reduce time/investment needed after purchase."

This is deal-specific. I own some buildings that I didn't do anything to and my return is pretty low.

I have also bought buildings where my value add was high and my return was as well

Its all about what you are trying to do with your portfolio. Investor specific

"Starting in RE with little to no money, basically how to get your foot through the door"

A college degree really helps for the analyst side. Look for small companies that manage their portfolio.

Without a degree you will have trouble with a big firm

If no degree and can't find a job with a smaller firm then look to CRE broker.

Take your state exam and apply to everywhere.

Make $. Use that to buy Real Estate down the road.

Lastly just know your shit and learn everything about RE.

"Buying property with good credit but no cash (if its possible and/or advisable), and getting into wholesaling as a novice"

Don't know anything about wholesaling and never done it. I believe @willnyguifarro1 is the Twitter guy for it.

You need cash for RE. Start saving.

You can set up investor deals and take money from other people. expect to raise 40% of the purchase price.

But honestly just start banking money.

"What type of investment properties should beginners look to get into? (Sorry if you went over this already)"

Stay away from casinos, hotels etc...

I would say the easiest would be a small residential house or condo.

My first deal was a CRE retail strip.

"Is it possible to get a RE job without a degree but working on building experience by working on your business (wholesaling/working with friends that are doing RE, and general RE information)?"

At a large firm probably not possible.

Look for family firms. Small with assets under 300M.

You are on the right track. Your goal is to be a master at all things Real Estate and that your lack of a degree doesn't matter.

So keep studying and continue to be involved in the industry and you will get there

"Enjoy the threads with specific details. Lot of insight when you share your rundown of property evaluations."

Thanks for the encouraging words I will try to do more of those.

"Any interest in coming up with a thread discussing quick back of the envelope calcs may do before diving deeper on a property?"

Here are my Fav:

DSCR

Price per Sq Ft

Cap Rate

Avg. PSF for tenants pay