securities holdings

by not buying new ones

when they matured,

effectively taking money out

of the financial system.

So, there's that.

New York Fed

moved 2 inject $53B

N2 banking system

thru trannys known as

repurchase agreements, or repos.

wsj.com/articles/fed-t…

inject up 2 $75B more📌

on Wed a.m.,

but many in mrkt

looking beyond that decision.

Eww👇

“Market will b waiting 2 see

if Fed makes this

more permanent part of playbook,”

says fuqq-face Beth Hammack,

Goldman Sachs Group Inc. treasurer.

wsj.com/articles/fed-t…

this likely affects

only market participants

who borrow in

overnight markets,

but if strains last long enough

it can affect

rates other businesses

+ consumers pay.

wsj.com/articles/fed-t…

also undercut

Fed’s ability 2 keep

economic expansion on track

thru monetary policy,

such as

by lowering rates

2 provide boost +

raising them 2 prevent economy

from overheating.

wsj.com/articles/fed-t…

in overnight lending markets

“are clearly not desirable

because they impede the transmission

of monetary policy decisions

2 the rest of the economy,”📌

said Roberto Perli,

analyst at Cornerstone Macro.

wsj.com/articles/fed-t…

provide funding

2 ensure smooth operation

of repo market 4 some time,

altho it isn’t clear how long

that might be,

analysts said.

📌“This is in every way, shape + form

an emergency measure,”

said Gennadiy Goldberg,

fixed-income strategist at TD Securities.

hasn’t had 2 intervene

in money mrkts since 2008

bc during + after finan crisis,

Fed flooded finan sys

w reserve;

$ banks hold at Fed.

It did this

by buying 100s of billions of $$s

of Treasurys + mrtg-backed securities

2 spur growth

after cutting int rates 2 nearly zero.

"Reserves over last 5 yrs

have been declining,

after Fed stopped increasing

its securities holdings

+ later, in 2017,📌

after Fed began shrinking holdings.

Reserves have fallen 2 less than

$1.5 trillion last wk

from peak of $2.8 trillion."

wsj.com/articles/fed-t…

its asset holdings last mo,

but bc other Fed liabilities

such as currency in circulation

+ Treasury’s general financing account

r rising,

reserves r likely 2 grind lower

in wks + mos ahead.

[i.e. not good.]

Steve Mnuchin

is mobbed.

wsj.com/articles/fed-t…

brokers who buy + sell Treasurys

have more securities

on their balance sheets

due 2 increased govt-bond sales

2 finance rising govt deficits. 📌

[truth is,

our economy,

not performing well.

tRUmp + Team Failure

suqq at everythin

cept suqqin]

wsj.com/articles/fed-t…

corporate tax payments

were due 2 Treasury,

+ Treasury debt auctions settled,

leading 2 lrg transfers of cash

from banking system.

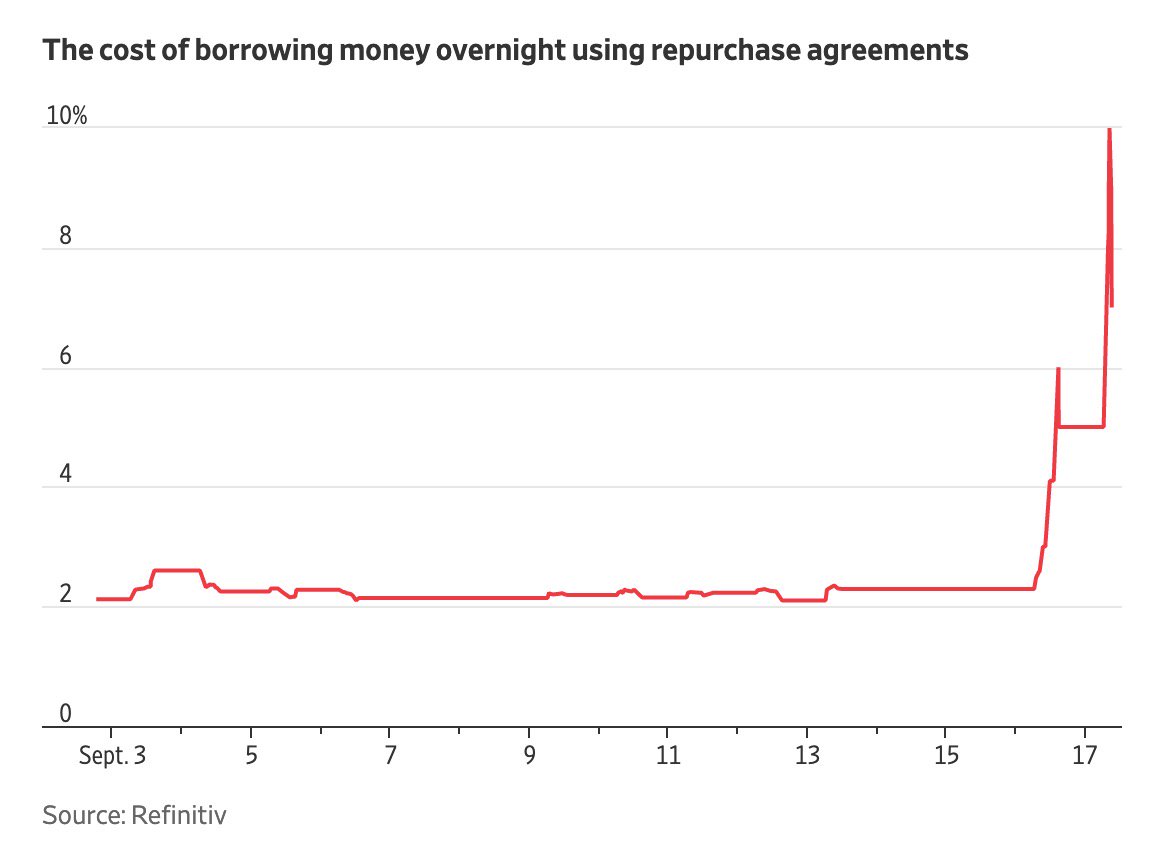

Surge in repo rates began

Mon afternoon, well after

vast majority of trading in mrkt

4 overnight loans

typically takes place,

demand 4 cash was unclear,📌

as traders seeking cash

could have been acting

on their own behalf

or as intermediaries

4 other parties.

Unexpected bids

seeking cash entered market

at time traders said

was uncomfortably close

2 3 p.m. deadline

4 settling trades.

repo trader at

Curvature Securities LLC

had seen cash trade in repo rate

as high as 9.25% Tuesday.

“It’s just crazy

that rates could go

so high, so easily,” he said.

wsj.com/articles/fed-t…

have warned regulatory changes,

such as a rule

requiring banks 2 hold enough

high-quality liquid assets

2 fund cash outflows 4 30 days,

*could lead 2 funding strains.

wsj.com/articles/fed-t…

Pardon

Murdoch expression

2 alert folks of

*MarketWatch.

👁️🔥👁️

Has Repo-Man arriveth?

@RussellSieg

@ninaandtito

@wokyleeks

@YDanasmithdutra

@ericgarland

@HatesHorseshoes

Seems a bit *odd.

"Does Mnuchin know wat he doing?"

😏