The loans seem sexy and cheap, but they're definitely not. They're borderline predatory.

Let's take a look at why 👇

(1/16)

"No interest!"

"No paperwork!"

"Easy funding!"

Unfortunately, that's where the fun ends.

(3/16)

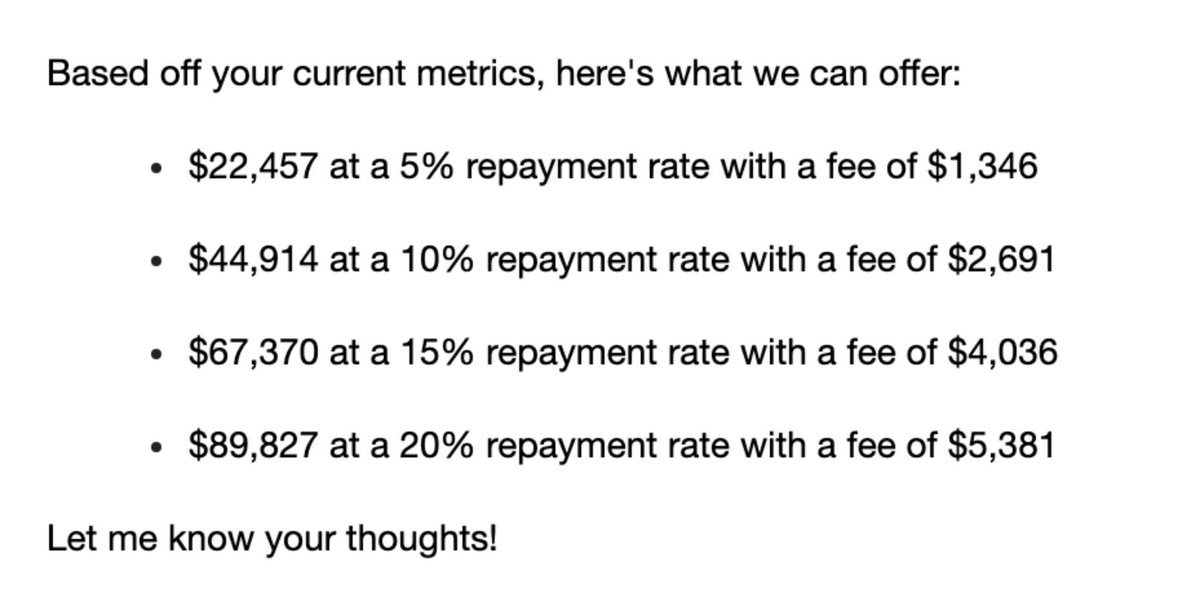

These offers actually carry anywhere from a 30%-50% APR, depending on your assumptions for revenue over the coming months.

Read that again.

FIFTY percent APR.

(6/16)

(7/16)

When we received that offer from Clearbanc, we were doing roughly $3500 in daily sales, and growing roughly 15% monthly.

They knew this because they used my sales history to calculate the offer they made me.

(8/16)

American Express offered me 170K at 14% APR

Wells Fargo offered me a 90K line of credit at 8% APR

(Guess which loans I took?)

(10/16)

There's a reason Clearbanc has raised ONE BILLION dollars. They're getting very rich on very high interest loans.

(11/16)

(12/16)

Come to your own conclusions.

(13/16)

I made a spreadsheet you can find at the link below. Make a copy and plug your Clearbanc, Shopify, or Stripe loan offers into the orange cells to calculate your APR.

(14/16)

docs.google.com/spreadsheets/d…

(15/16)

modernretail.co/startups/a-ban…

(16/16)

“Having an option like Clearbanc is better than no option at all.”

(1/4)

Paying 40% APR is better than giving away another 30% of your company.

(2/4)

There’s a reason that federal law requires APR and nominal interest rate to be listed for all consumer loans.

All I want is some Truth in Lending.

(3/4)

There’s a reason they don’t.

(4/4)