---+++---+++---+++---+++

THREAD::::THREAD::::

---+++---+++---+++---+++

@JoshuaOigara @Saagite @hawklead1 @MigunaMiguna @citizentvkenya @TheStarKenya @Ihrm_Kenya @IFCAfrica @RobertSyundu

cnyakundi.com/rot-at-nationa…

centralbank.go.ke/policy-procedu…

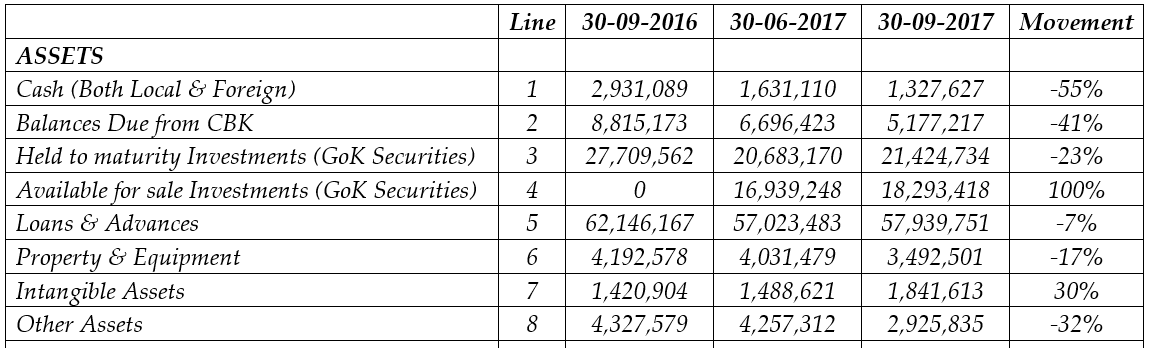

....The term “STATUTORY RESERVES” as captured on line 16 of the image above is only applicable to Grades 1 and 2. Grade 1 accounts are deemed to be operating normally and attracts Loan Loss provision of 1% while Grade 2 are classified as Watch accounts and attracts...

....additional 2% on provisions. In total, Statutory Loan Loss Reserves is a one-off 3% of the loan portfolio. It is one-off because it’s only levied once in the life of a loan....

...Now here is the KITCHEN-WORK. For such reserves to increase by KSH 1 Billion as seen in line 16, Loan Portfolio ought to have grown by at least KSH 33 Billion.

According to Line 5 of the above image, Loans and advances ought to have been at least KSH 95 Billion...

....However what we are seeing is a reduction of the loan portfolio from KSH 62 Billion to KSH 57 Billion. A reduction in the portfolio by KSH 5 Billion should invoke a write-back of about KSH 150 Million back to the P&L.....

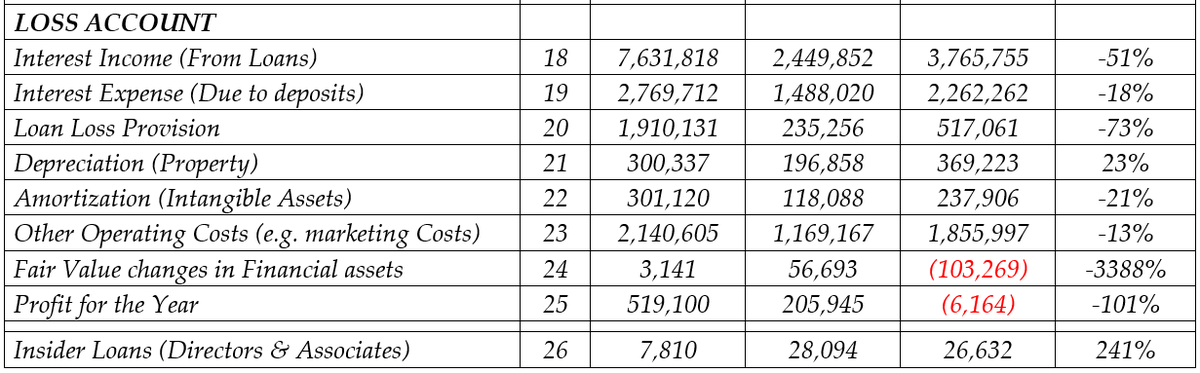

.....Because there was no growth of portfolio, The KSH 1 Billion hidden under Statutory reserves is an actual loan loss which ought to have been captured on the Profit and loss account. If you adjust this hidden loss amount to NBK.....

......September accounts, you will increase the comprehensive loss position from KSH 6.164 Million to a staggering loss of KSH 935 Million......

...Now tell me, why is Wilfred Musau misleading Investors? Why is CBK Gov. allowing this to happen? Patrick Njoroge boasts of having worked with @IMFNews, .....

....what was he doing there if he cannot even comprehend simple accounting treatments? Was he a sweeper or a Chaplain at the IMF Offices?

businessdailyafrica.com/corporate/NSSF…

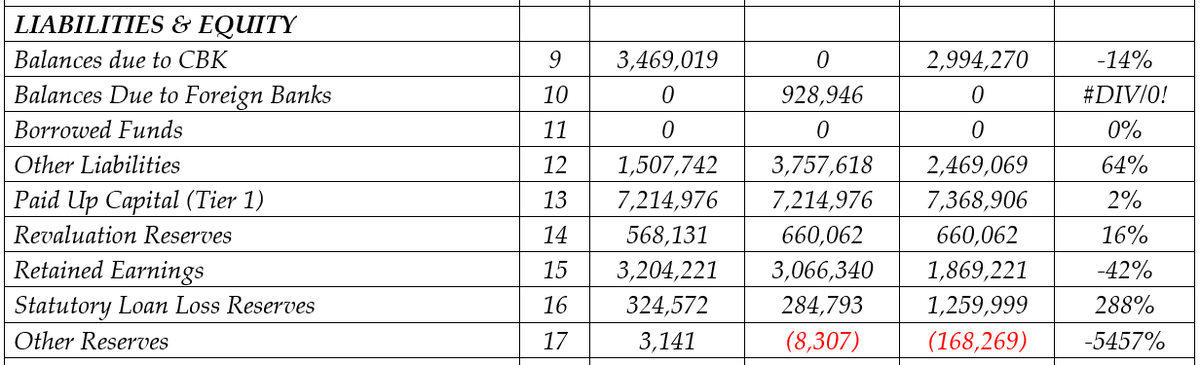

....However, out of their own wisdom or lack of it, Wilfred Musau & Hassan Mohamed decided not to capture this anywhere. Shockingly, there is an entry for borrowed funds captured as NIL on line 12 of the image.....

..The Impact of these funds on the loan portfolio is also not evident as the portfolio shrunk. Therefore any argument suggesting that the funds were offloaded to customers must be resisted.....

.....In short, Wilfred Musau & Hassan Mohammed (the protected criminals) may have once again spirited away with NHIF contributions.....

....This time around, they have a new Chief-chef in town called Peter Kioko as the Chief Risk Officer.

Peter Kioko, a longtime friend of Wilfred Musau was frog-matched from the Fast Moving Consumer Goods (FMCG) Industry to come and implement creative accounting in NBK....

....He has over 20 years of experience in creative accounting in the FMCG. He goes around Nairobi CBD boasting how no company can make a loss as long as he is the CFO. .....

...On the other hand when losses as are encountered, the figure goes down and eats up on the core capital (Tier 1 capital) of the institution....

From Line 15 of the above image, you will notice that as of 30th September 2016, Retained Earnings were KSH. 3.2 Billion...

...followed by a KSH 3.06 Billion in June 2017.

We are all aware National Bank has not declared a loss which leaves all intelligent people wondering how the figure suddenly shrank to KSH 1.8 Billion. Could there be a hidden loss somewhere? ....

..Why are these two criminals (Wilfred Musau & Hassan Mohamed) testing the investor intelligence? Where is @CBKKenya and @CMAKenya who must give a go-ahead before accounts are published? .....

...At least we know Audit firms sends inexperienced associates to deal with hardcore criminals like Hassan Mohamed & Wilfred Musau who in turn outmaneuvers them in Banking matters......

....But a regulator like CBK must have qualified IDEOTS to do the job rather than having Opus Dei like Patrick Njoroge who continuously apply make-up and rushes to his one bedroom apartment every evening.

...Some of the Ratios are: Capital Adequacy Ratios, Earnings Ratios, Bad Loan ratios, employee productivity ratios best captured on overheads and liquidity ratios among others. ...

...Rogue Banks like National Bank Will MASSAGE the SOURCE NUMBERS that affect these ratios because according to them, FINANCIAL SOUNDNESS MUST BE FORCED ON INVESTORS....

... If Wilfred Musau together with his CREATIVE ACCOUNTANT (Peter Kioko) correctly declared the 1 Billion loss, they would have been RED on all the Financial Soundness Ratios......

..Looking at Line 13 of the above image, you will realize core capital increased from KSH 7.21 Billion to KSH 7.37 Billion without disclosure on activities that led to this. We already know how the RIGHTS ISSUE was squandered by MUSAU & HASSAN....

...and as a result never took place.

So where is the additional paid up capital coming from? Could it be a BALANCING FIGURE for accounts that have refused to balance? Or was it meant to reduce the SEVERITY OF NON-COMPLIANCE with some CBK ratios? .....

...Already we can see Core Capital as a ratio of Risk Weighted Assets is UNDER WATER by 0.7% while the Total Capital (Tier 2 capital) ratio is SUBMERGED by 3.2%.....

...The misreporting of this figure was engineered by the Chief crooks (Wilfred Musau & Hassan Mohammed) with direct supervision from CELIBACY EXPERT PATRICK NJOROGE, THE GITHERI MEDIA SENSATION.

National bank has a website & ...

nationalbank.co.ke/investor-relat…

...being a publicly listed company, they are obliged to make public there accounts whether cooked or not. There only hope is that the consumers of such information is not sophisticated enough to digest the fine-print.

From the financial accounts in there website, .....

..you will notice that the events leading to losses on these financial instruments have been consistent for a few years. This begs the question: “Why continue holding financial instruments whose value depreciates every year?”......

...It is almost guaranteed the same instruments will depreciate next year. Now if you did not know, this is the DEFINITION OF INCOMPETENCE......

...a company approaching foreclosure and certainly an investment cheat-sheet.

Then a surprise figure (Line 4) designed to balance runaway unexplained liabilities shows up as Government instruments available for sale at KSH 18 Billion from ZERO in 2016......

.....It must be a PLEASANT COINCIDENCE that INVESTMENT INSTRUMENTS WERE DESIGNED TO SUDDENLY MATURE WITHOUT NOTICE.

Could it be that NBK does not have a TREASURY DEPARTMENT TO MONITOR MATURITY OF INVESTMENT INSTRUMENTS WITH PLANS OF QUICK REINVESTMENTS?........

....We Refuse to believe this argument. The Creative CFO (Peter Kioko) found it easy to introduce a balancing figure against treasury instruments because Audit Firms lack the experience to understand treasury instruments and rightfully so because they lay emphasis.......

...on theories while banking criminals concentrate on understanding Operationalization.

..We are informed the Trio pushed the sale of these assets to there proxies at the book values rather than the fair values. For instance, a branch which was valued at KSH 50M 10 years ago was sold at that price with total disregard to the actual market value for KSH 180M..

....The Ignorant shareholders then continue wondering why the much hyped sale of assets failed to achieve its purpose of shoring up core capital. Off course the Githeri Media sensation (CBK’s Beauty Pageant Patrick Njoroge) as a partner in shoddy transactions with.....

....most banks (including KCB’s Oigara) is not a dependable watch-dog for shareholders. Shareholders must however be informed that Foolishness can never be forgiven even by God....

...Having sold most of its assets, NBK was left with more permanent assets whose Expected life (Leases) are longer with minimal depreciation.

It is therefore shocking that National bank properties experiences accelerated depreciation within 1 year.....

....You will notice on Line 6 of the image that properties’ book value condensed by KSH 700 Million which is weird for assets having long life (Leases).....

...On the other hand on line 21, the cumulative depreciation for the year quoted as KSH 369 Million did not match the movement in book values.

MUSAU must have noted that correct entry of the depreciation figure could plunge his books of accounts to a further loss......

....You know he must demonstrate Financial soundness to unsuspecting shareholders. By the way, all Pension contributors (NSSF) are shareholders of NBK. One of these fine days there will be violent demonstrations across the country against NBK Looters....

....We stated with certainty how an upgrade from the same platform did not require Accelerated amortization. Yet as you can see on Line 7 of the above image, A KSH 400 Million amortization has been recorded.....

...While Wilfred Musau decided to hide Actual Loan Loss provisions disguising them as statutory reserves, he found it necessary to pass a systems amortization of KSH 400 Million because according to him, Looting comes first before the Pensioners (shareholders)......

...capping was 18% per annum which reduced to 14% after rate capping.

This means that if you had a performing loan portfolio of KSH 42 Billion you would earn KSH 7.56 Billion per annum of interest income as compared to KSH 5.88 Billion after rate capping......

....The reduction as a result of rate capping would be 22% and anything else like 51% is pure incompetence. Blaming rate capping is simply a convenient way for looters with no institutional growth strategy.....

....You will notice that reduction of rates was meant to be good for the banks who were complaining about high default rates. Lower rates means lesser repayment amount by borrowers and hence lesser default rates......

....As a result, Efficient banks would use that as an opportunity to plough back suspended interest (in the suspense account) back to profit and loss account.

...In exchange for a good salary, the boys MUST PERSEVERE a harsh environment of cartilages) has over KSH 1.5 B of marketing budget annually.

She has a target from HASSAN & MUSAU to come up with all sorts of marketing tricks just to make sure the KSH 1.5B is exhausted.

BOOM!!!!!!!!