In it, we document several interesting empirical facts about housing + RE agents, and use them to discuss aggregate liquidity of housing.

paulgp.github.io/papers/Heterog…

Thread👇🏼

We focus on a central feature of this market:

real estate agents.

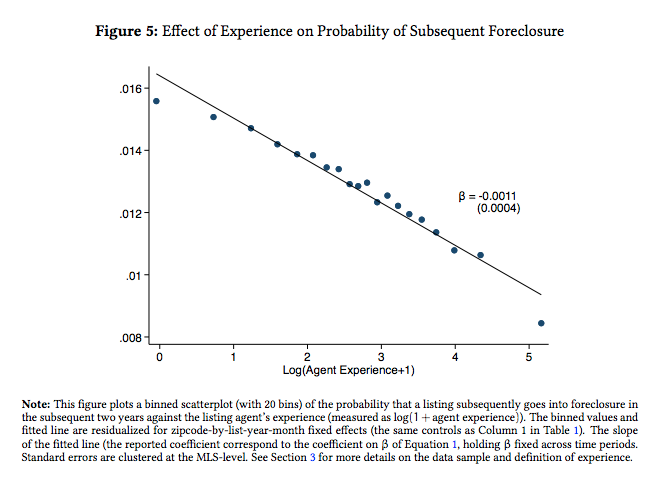

Moreover, due to the structure of commissions in the U.S., brand-new, inexperienced agents end up charging the same commission (2.5-3%) as veterans of the industry.

paulgp.github.io/papers/Heterog…