"Don Valentine used to say: 'I'm looking to invest in businesses that can screw everything up and still succeed because customers will pull the product out of their hands.'" tim.blog/2019/11/25/sta…

"One of the best things about teaching is how much you get to learn."

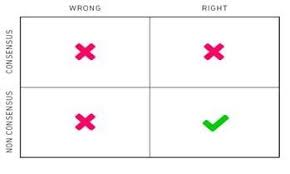

Product market fit precedes growth hypothesis.