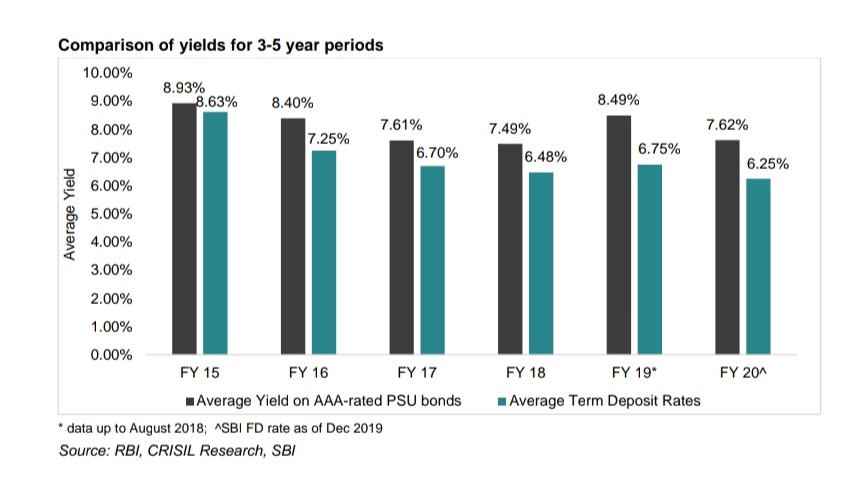

A frequent question in minds of many investors. When it comes to investing in debt, yields matter. It is always ideal to lock investments at higher yields.

Moot question is, at what level can we say it is high.

1/n

Let's see them one by one in context of current Nifty #BharatBond index yields.

Currently the index yield in 10yr is ~7.75% and in 3 yr ~6.83%

1/n

These levels are well above last 5 year average spreads.

Usually it is very difficult to predict RBI policy stance and time it.

Given that RBI is focused on transmission, FD rates may fall further.

Having said that, we can't predict which way interest rates move in future. Our past track record in predicting rates is bad. 🙂

The beauty about #BharatBond is, if you invest today and yields go up, you can average out your entry yield by investing more later. If yields fall you win.

Instead, you can board the current train and still have a chance to catch the fast train on next station. If it comes, you won't miss it.

Happy Investing!

#BharatBond