"Identify structural edges and commit to seeing them through inevitable periods of underperformance. As each of our superstars shows, “merely good” edges over time compound to great long-term performance."

aqr.com/Insights/Resea…

* Impressively, "factors" were used before they were factors

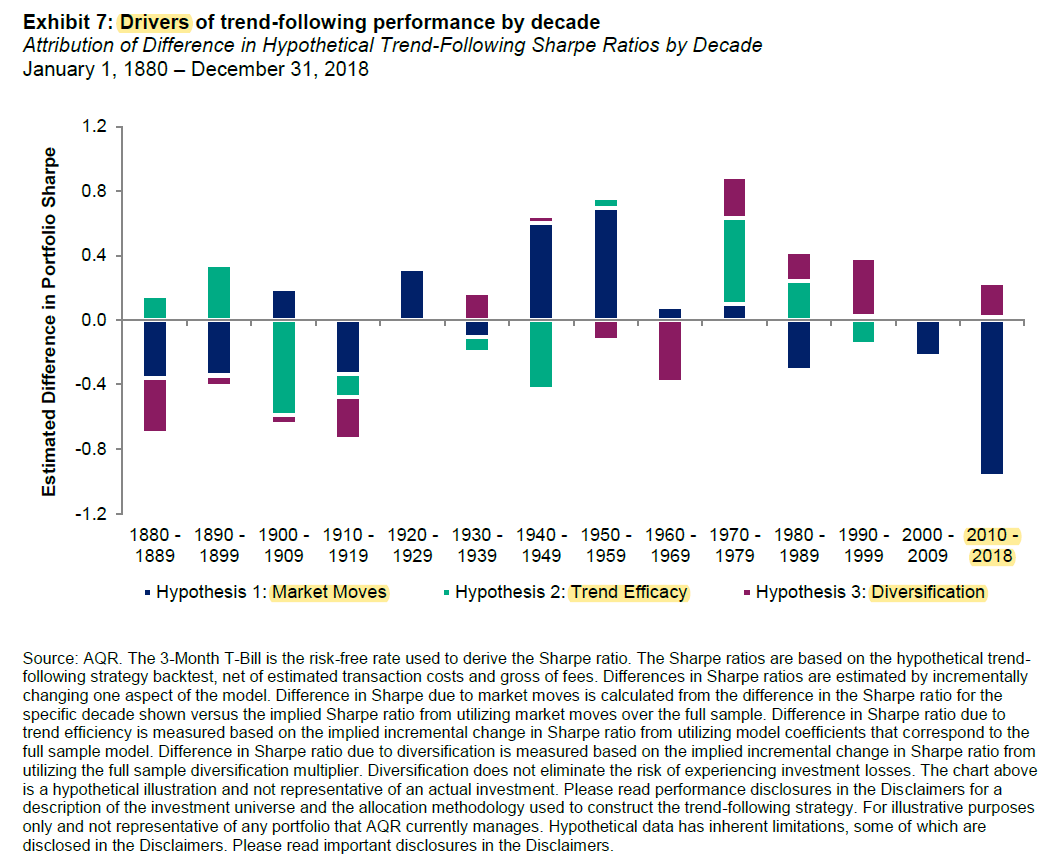

* There are *lots* of ways to invest, suggesting that almost no one is fully diversified

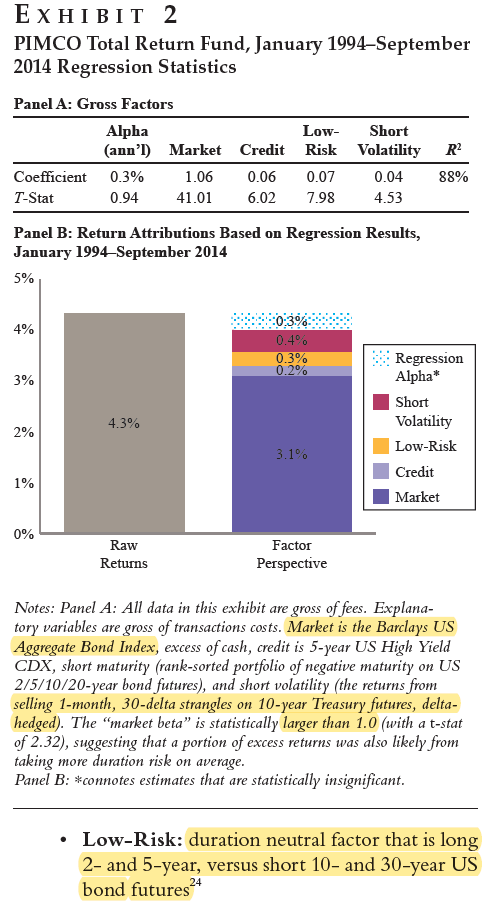

* Even super-star managers have a lot of market beta