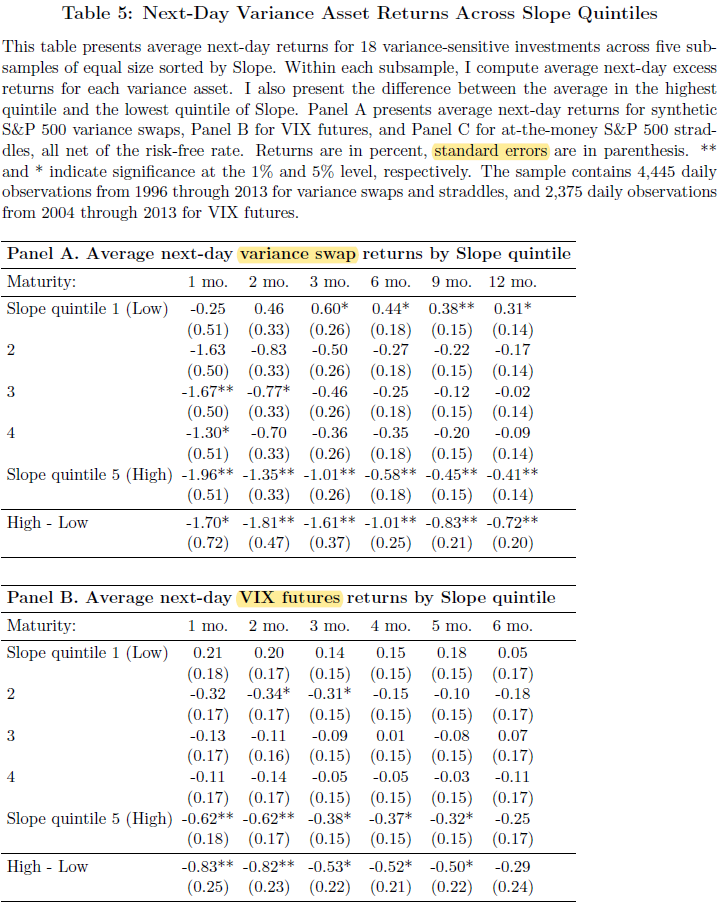

"A single principal component, Slope, predicts the excess returns of S&P 500 variance swaps, VIX futures, and S&P 500 straddles for all maturities to the exclusion of the rest of the term structure."

papers.ssrn.com/sol3/papers.cf…

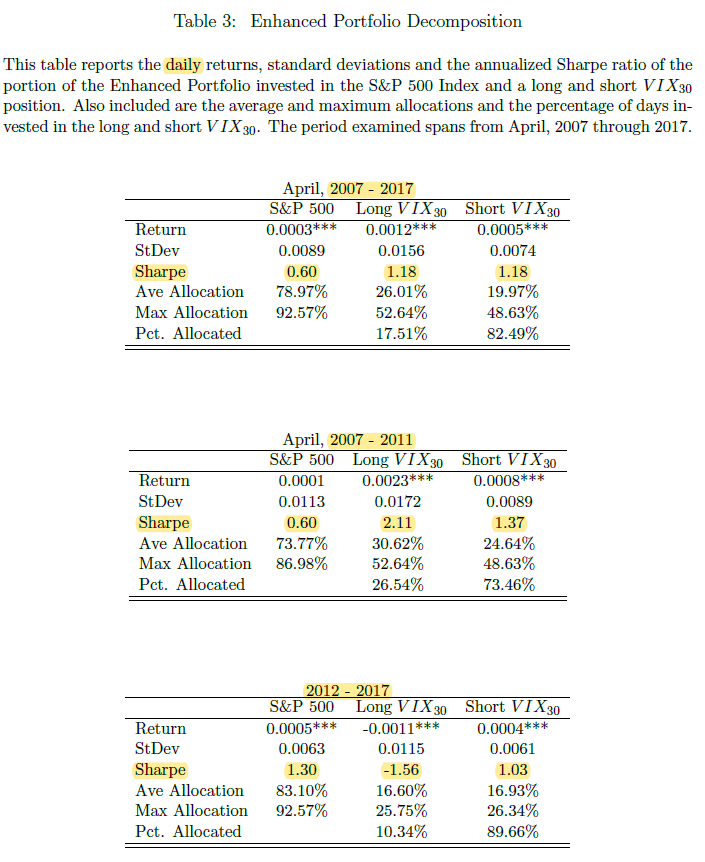

Jim Campasano outlines a simple strategy for trading the VIX term structure here: