January Investment Portfolio Review (as of close on 1/30)

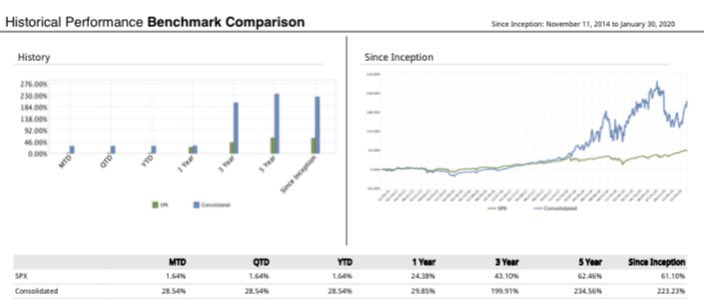

5Y +235% // S&P500 +62%

3Y +200%

1Y +30%

YTD +29%

Largest Drawdown -39% (2019)

others who share: @ZimVC @David_Kretzmann @TMFStoffel @BrianFeroldi @FoolMCochrane @TMFInnovator @TMFSymington

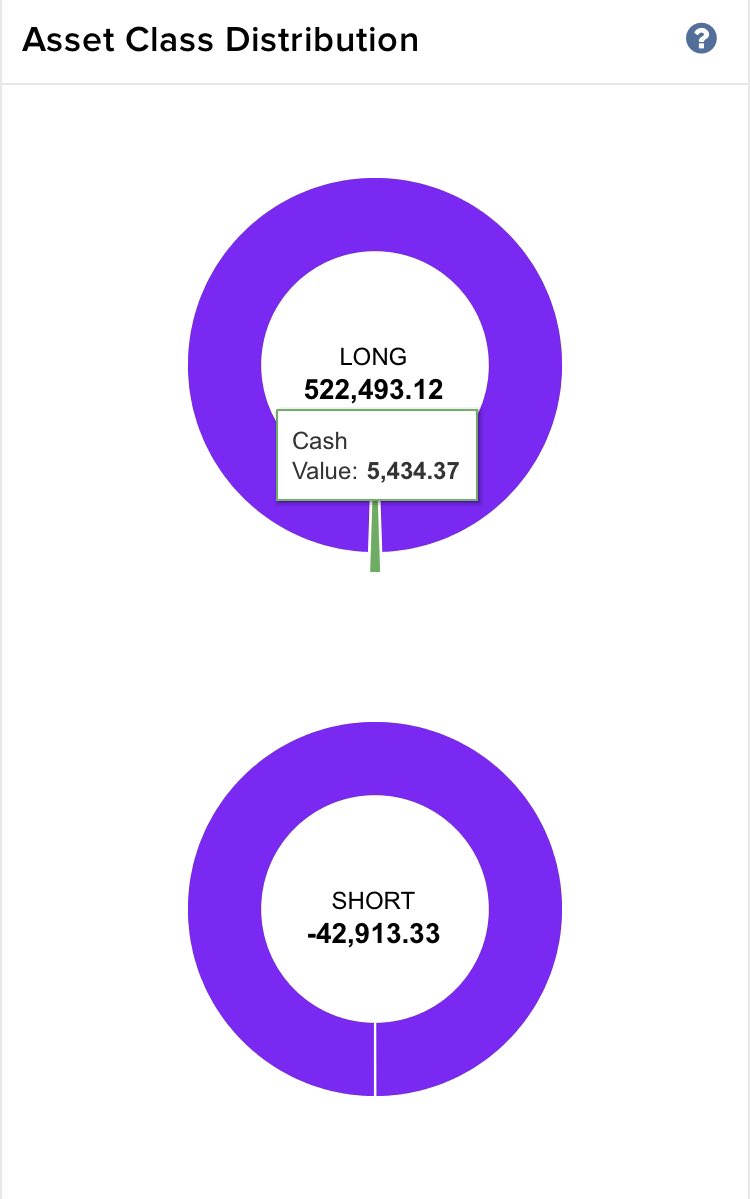

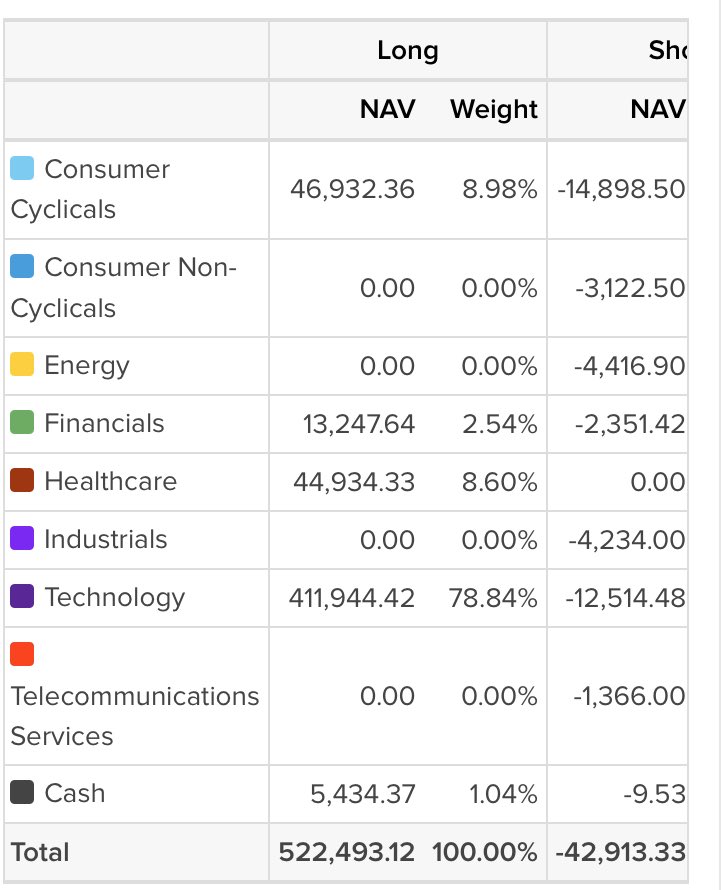

$522k long

$43k short

$5k cash

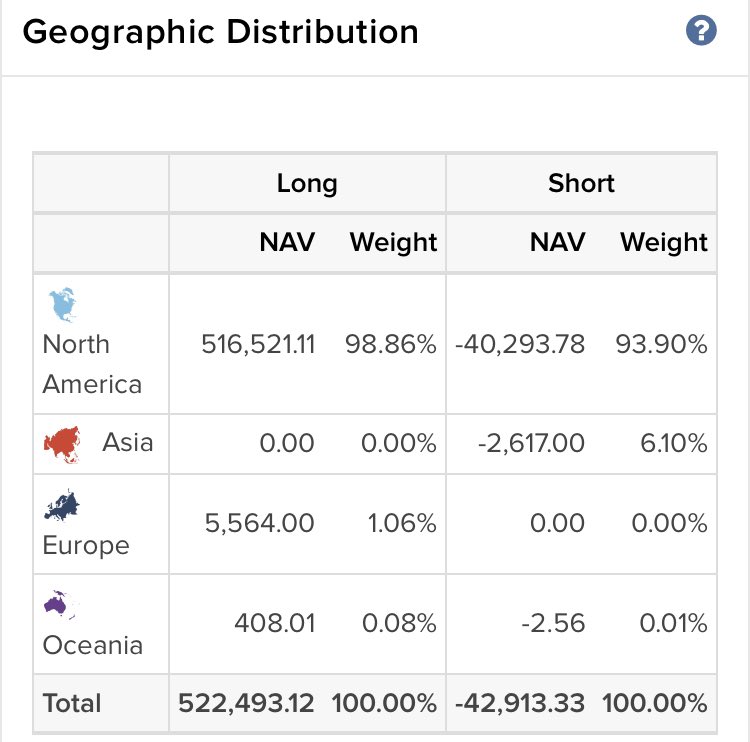

Mostly long Tech and consumer cyclicals. Mostly short consumer cyclicals and Tech.

These shorts are biz I believe will be impacted by the #coronavirus (travel/food/China dependent)

-Using small bit of margin

1. Keeping it simple and investing in great companies is all we need to do.

2. I know the above is true but I still mess around with shorts/short term trades with a small %.

3. I know #2 is foolish

4. I do think Coronavirus will have a short term impact

Tiers of how much of my money I will invest.

High confidence: 10%

Medium: 5%

Low: 2.5%

I will then let winners run (how $AYX is 20%+ and trim down to 20% if they get around 25%.

Low tier could change quickly as I learn more

/fin

My wife and I both work middle income jobs, keep expenses low and save 30% of income (started at 5%)

Starting with an index fund in a 401k with whatever % possible is great. As you get promotions save 50% of those and spend the rest.

This is the path to $1M+ over 20+yr based of historical data