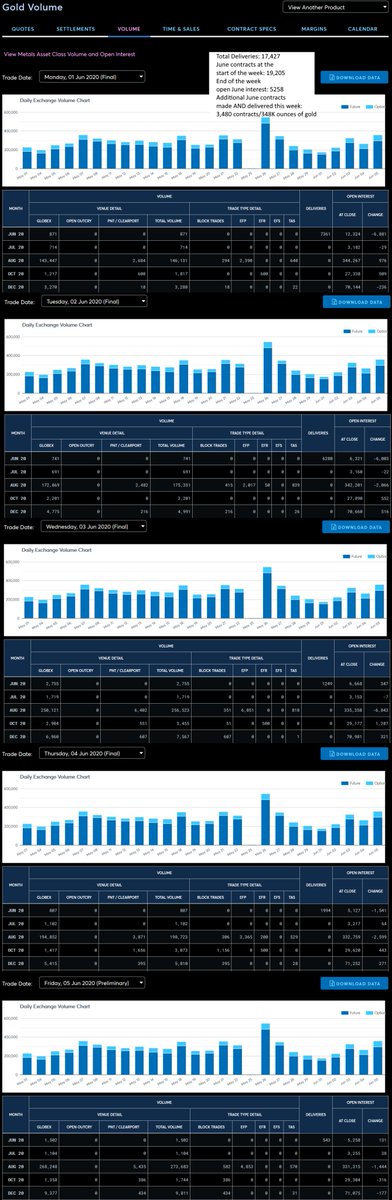

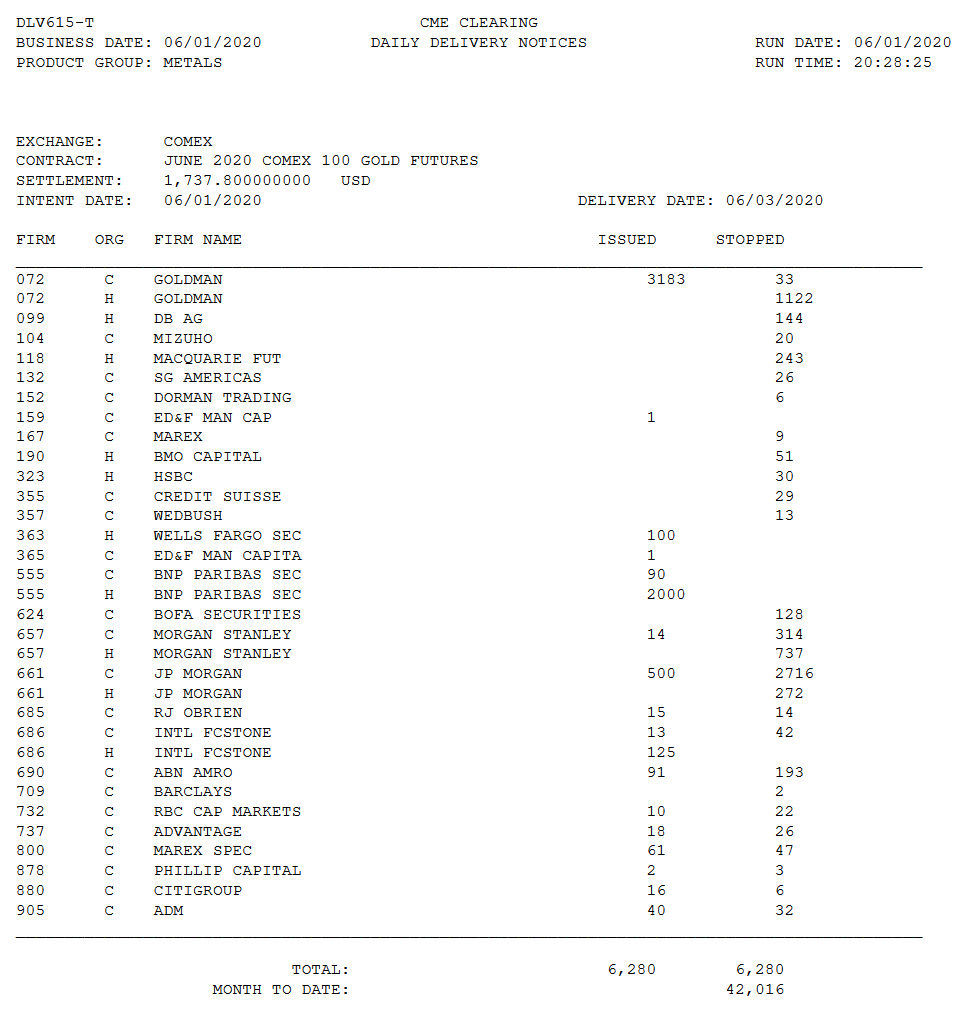

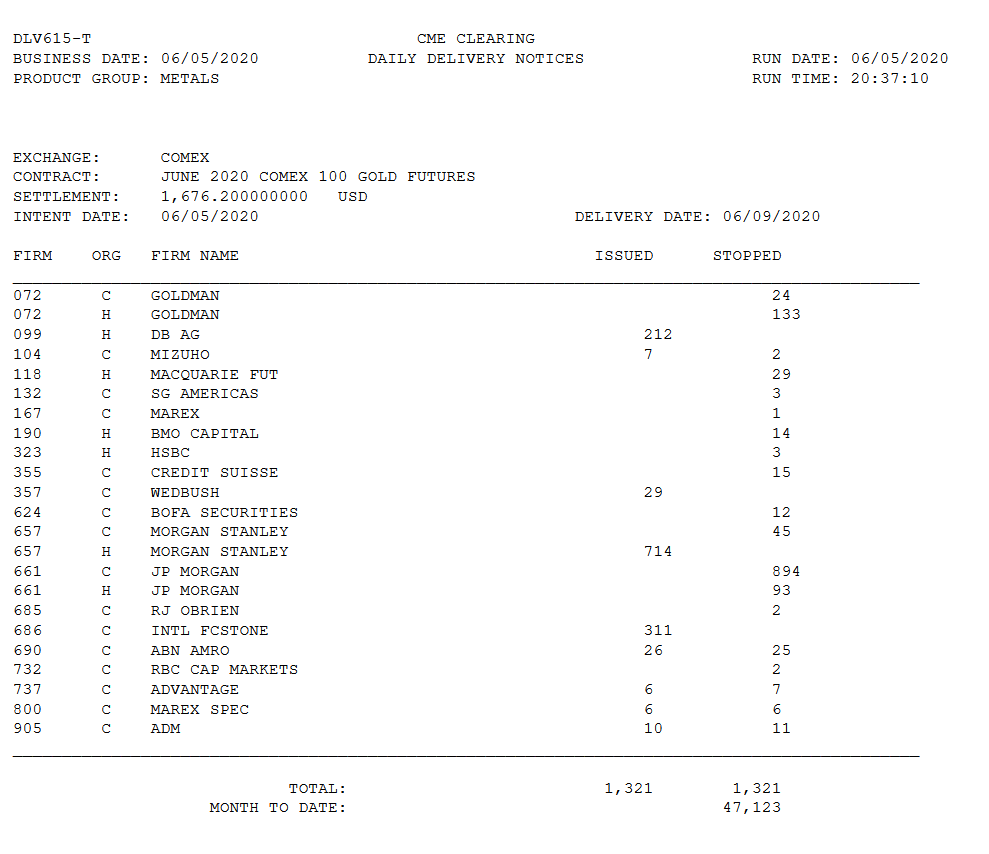

Picture first, explanation below. It's cobbled together from daily screenshots from their site cmegroup.com/trading/metals… where you can check daily futures volume. 1/x

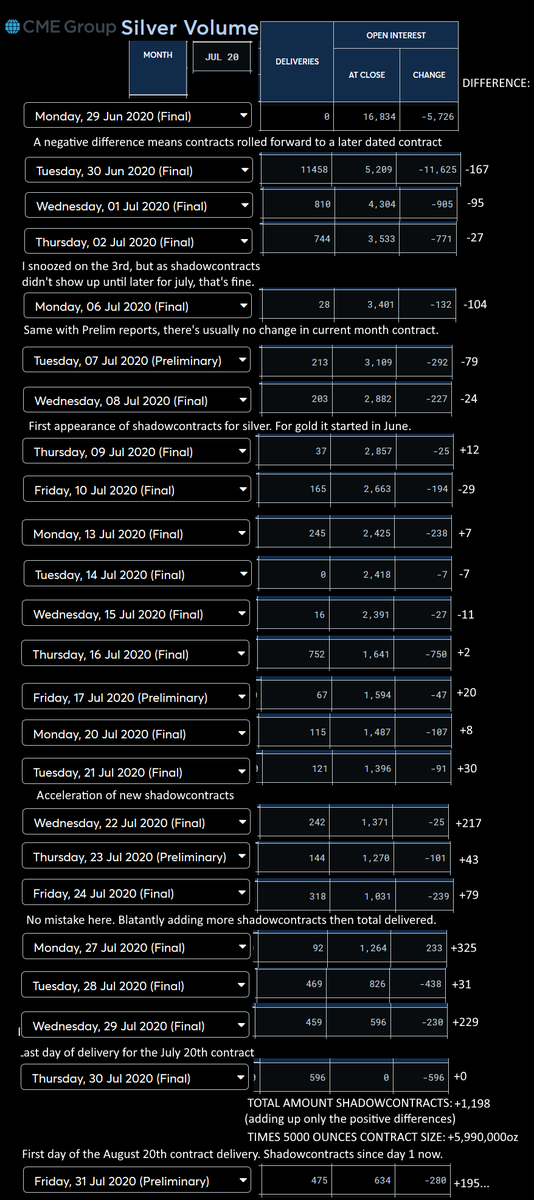

Let's start with the basic question: What do i mean by #silver or #gold #shadowcontracts? 2/x

I want to stress i don't know this, it's just the only logical explanation left. 3/x

These numbers aren't being typed in manually all those systems where automated long ago.

This must be how the system was designed to work, so it does. 7/x

(Especially if your name is Jamie Dimon and you're absolutely ruthless).

Let's think through what happens when the system fails. 9/x

So what other bars do they not have then? 10/x

They definitely don't add up. But what i do know is that whatever they have in reality is much less then what they say they have.

Meaning i'm being generous here. 12/x

Nobody wants that. So it hasn't failed. Vested Interests it's called. Nobody wants to pull the plug. 13/x

Don't be fooled. The economic collapse we're in was very much planned and expected. Same reasoning, if you know it *will* fail, position yourself early.

#Covid19 was not. Good lord was it ever not. Worst possible trigger. 14/x

You can't print people into restaurants!

The smart money knows this. I mean the REAL smart money, the elite families.

Why nobody else seems to understand this is a mystery to me actually. 16/x

If the moment has come where everybody actually stands for delivery;

Does it really matter the #COMEX can only deliver 1 out of 2 bars or 1 out of 2000? Isn't Force Majeure just Force Majeure?

It's going to be a shitshow in every situation regardless. 18/x

If you don't have it, you don't own it. That'll be the mantra of the next decade.

The people taking delivery right now understand this. 21/x

You sell paper at the front door.

You move metal out the back as long as you can.

When people try to convert their paper you confess isn't any metal.

Everybody becomes poor.

Except your backdoor friends who bail only you out 23/x

It won't be the people responsible, but yknow, still exciting.

Meanwhile the people who recieved the metal saw their relative wealth explode and are now the rich who set policy. 24/x

Yall don't get it do you? This is an Every Man For Himself situation. Lying comes with the basics. 25/x

These #shadowcontracts are only the latest thing. 26/x

Then in April, deliveries started happening before the last date.

Then, massive amounts of deliveries. 27/x

You'll see these #shadowcontracts appear for months and months, people will think it's all fine, until the December contract wall hits and it turns out there aren't ANY bars left. 33/x

EVERYTHING is pointing towards the system just trying to make it to those elections.

Both the political interests as the elite interests (COMEX still has inflows that could be drained for months) 37/x

Well i've got physical in a vault. But it's only 305oz of silver and 2oz of gold cause i'm still poor. System breaks i escape poverty. 38/x

I'm much more worried about whoever's reading this as crazy as that sounds. 39/x

But A LOT of people are gonna lose everything. And i mean alot of middle class people who are far far richer currently then my 15k yearly income poor ass. 40/x

That we also got in because of wealth concentration so, the more that listen the better. 41/x

Buy Physical silver and gold and put it in a private vault with a private vault company that guarantees at all times that the contents of the safe are yours. EVEN at these prices, cause this is still peanuts. 42/x

If i'm wrong sorry for the inconvenience. But i'll be happier wrong then right. End/x