Head of Asia Pacific, Grant Wilson on RISK PARITY: It has been presented as an alternative to the classic 60/40 allocation b/w equities & bonds. (Thread 1/8). Originally featured as an opinion piece in @FinancialReview

2/8: Risk Parity equalizes contributions to risk from different asset classes in portfolio. Typically targets #volatility for portfolio as whole, in range of 10-15%. Equity, bonds, & other sector allocations derived based on measures of expected return/risk/correlation.

3/8: Risk parity has become synonymous with an ‘all weather’ portfolio. In March, #COVID19 roiled financial markets & we saw the short-comings of this slogan.

4/8: Early on, risk parity functioned, w/ sharp decline in equity prices, counterbalanced by lower bond yields. 10yr US yield reached historic intraday low of 0.32%. From there things went wrong. $SPX fell a further 13% through Mar 18, yet bond yields reversed higher, to 1.19%.

5/8: This was worst-case for risk parity - involved drawdowns on both sides of book. Fed came to the rescue w/ unlimited #QE Mar 23, restoring market functioning & liquidity - effectively bailing out the risk parity sector.

6/8: There has been some recovery in risk parity performance (owing to rally in equities/credit), but **our view is that risk parity is beyond being retooled. It is fundamentally broken now**.

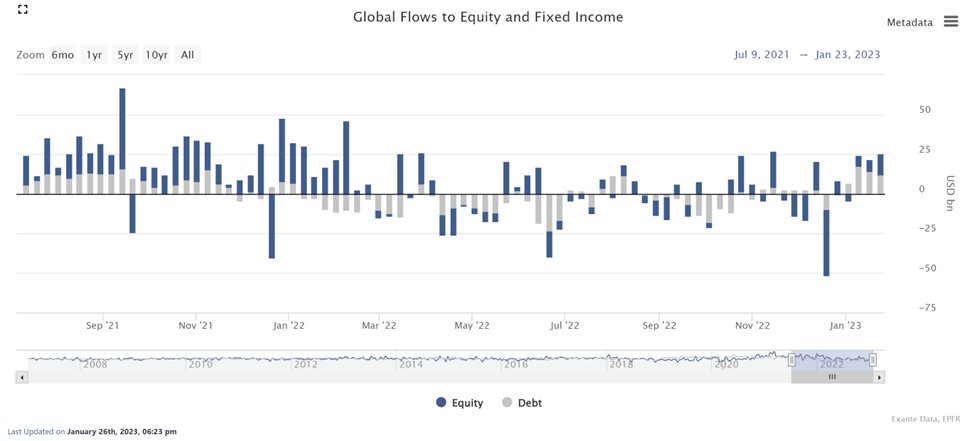

7/8: 1). levered bond component. w/ nominal yields so low, portfolio protection limited. 2). Real yields now deeply neg - capital may be preserved nominal terms but inflated away in real terms. 3). Structural decline in FI vol & breakdown in realised correlation b/w equity/debt.

8/8: Time to Exit: Sheer weight of money & influence that underpins risk parity ensures that it will not go away gently. We expect more rejigging/rebranding & are wary. *We think it is time to exit risk parity in full, & return when its basic precepts are restored by the market*

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh