Data driven insights before the consensus

We serve the world's top institutional investors.

Check out:

https://t.co/WcLvjdLaHc

https://t.co/RWQ9sYIeag (substack)

3 subscribers

How to get URL link on X (Twitter) App

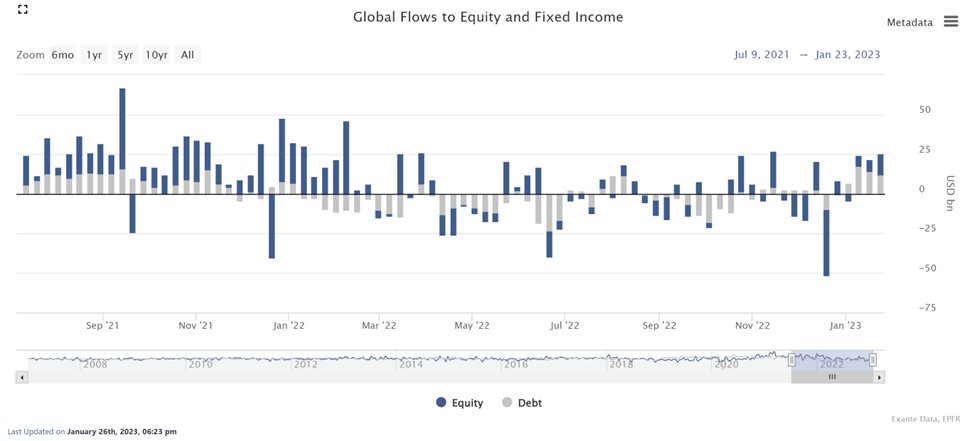

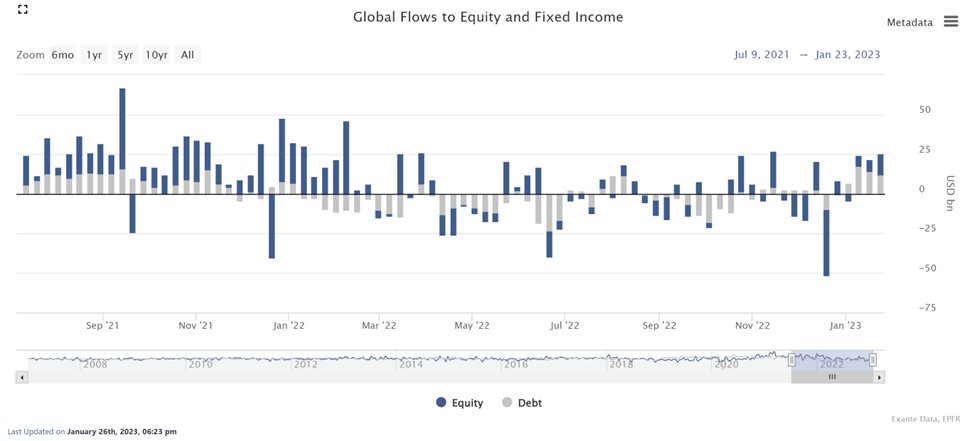

Inflows to global fixed income were explained by purchases of EM debt by foreign investors ($2.6bn), the highest record since February 2019, but also for purchases of US fixed income by domestic investors ($3.1bn).

Inflows to global fixed income were explained by purchases of EM debt by foreign investors ($2.6bn), the highest record since February 2019, but also for purchases of US fixed income by domestic investors ($3.1bn).

https://twitter.com/Brad_Setser/status/1588952644004954112The latest Japanese data show sales of US LT debt of about $17bn in September. That brings such sales to $113bn YTD.

Outbound travel from Shanghai is similarly weak.

Outbound travel from Shanghai is similarly weak.

https://twitter.com/jamestareddy/status/1379088670985228288China's digital currency is a game changer (Part 1).

On flows, it is important to keep both the cyclical and structural stories in mind. Flows to EM ex-China (especially equity flows) have been weakening for years. And increasingly China accounts for debt inflows equal to the rest of EM combined. @michaelxpettis @M_C_Klein 2/5

On flows, it is important to keep both the cyclical and structural stories in mind. Flows to EM ex-China (especially equity flows) have been weakening for years. And increasingly China accounts for debt inflows equal to the rest of EM combined. @michaelxpettis @M_C_Klein 2/5

https://twitter.com/ExanteData/status/1313130088062496768(2/4) This still represents a softening in the pace of net asset purchases from EUR29.5BN the previous week and the lowest for 4 weeks, but redemptions of EUR8BN across all programs during the week also weighed on the flow. Updated chart below:

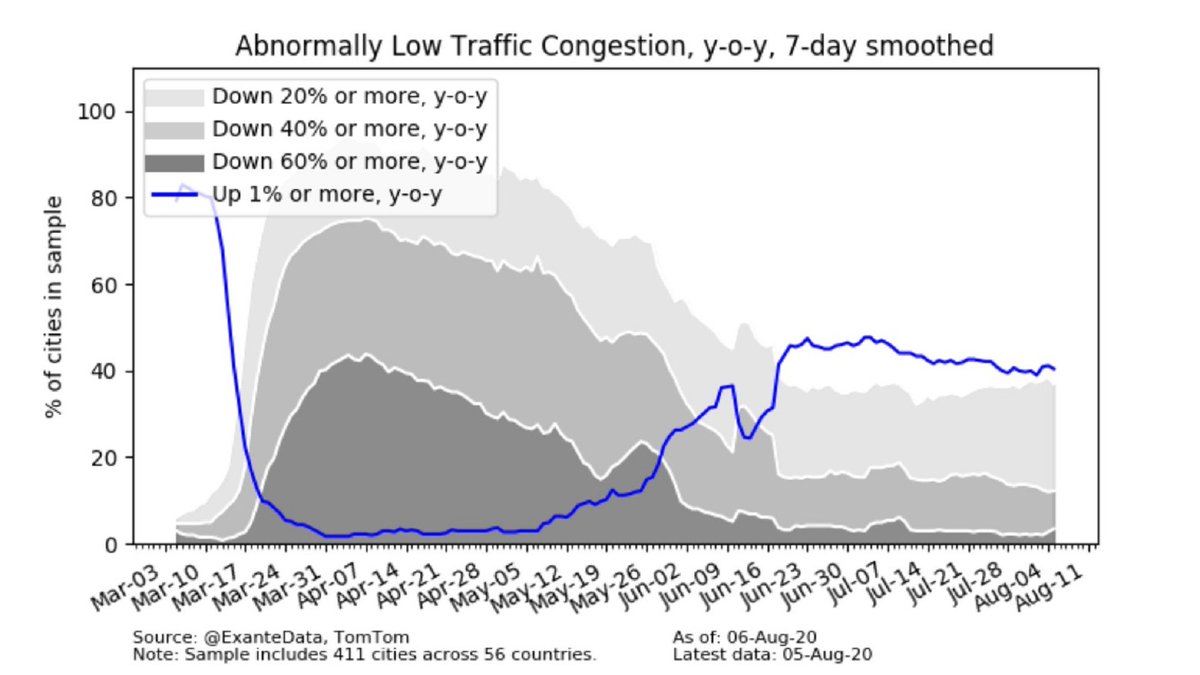

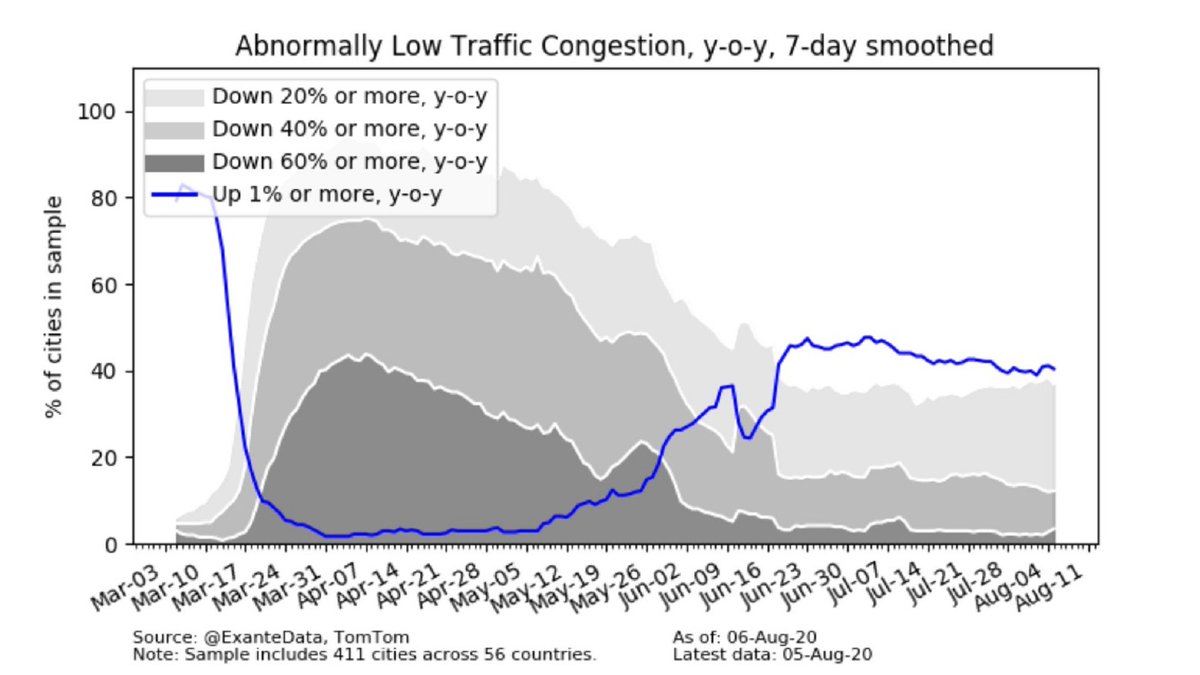

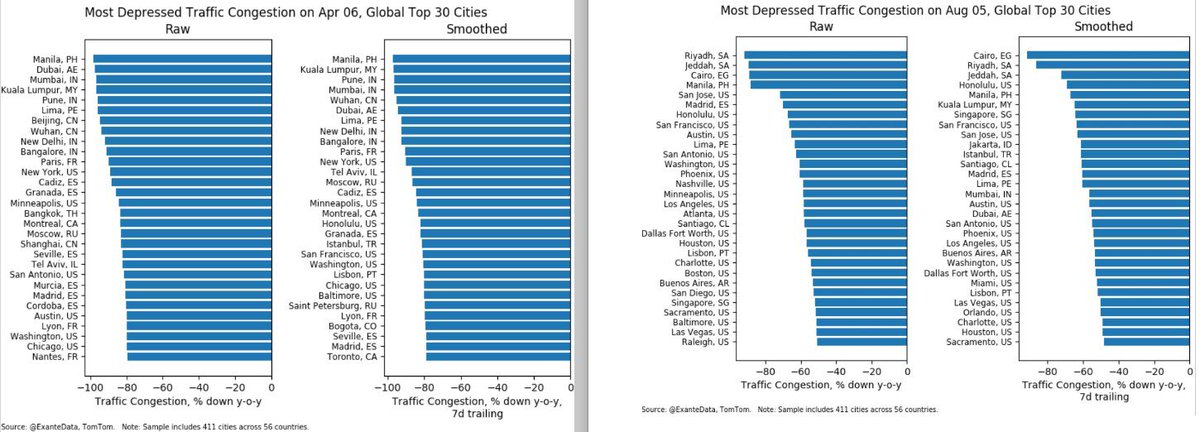

Charts: Side-by-Side Comparison - Top 30 Global Cities Most Depressed #Traffic Congestion. April 6 (Max lockdown) % Oct 6. Apr 6 (left): smoothed shows cities Manila & Kuala Lumpur top 2. The US had 7 cities in top 30. #India had 4. Other cities included: #Wuhan #Paris #Istanbul

Charts: Side-by-Side Comparison - Top 30 Global Cities Most Depressed #Traffic Congestion. April 6 (Max lockdown) % Oct 6. Apr 6 (left): smoothed shows cities Manila & Kuala Lumpur top 2. The US had 7 cities in top 30. #India had 4. Other cities included: #Wuhan #Paris #Istanbul

*Side-by-Side Comparison*: Top 30 Global Cities w/ Most Depressed #Traffic Congestion. April 6 (Max lockdown) & today’s release. Apr 6th (left) Smoothed data showed #Philippines & #Malaysia cities top 2. US - 7 cities. #India - 4. #Wuhan #Paris #Istanbul #Moscow included. #OOTT

*Side-by-Side Comparison*: Top 30 Global Cities w/ Most Depressed #Traffic Congestion. April 6 (Max lockdown) & today’s release. Apr 6th (left) Smoothed data showed #Philippines & #Malaysia cities top 2. US - 7 cities. #India - 4. #Wuhan #Paris #Istanbul #Moscow included. #OOTT

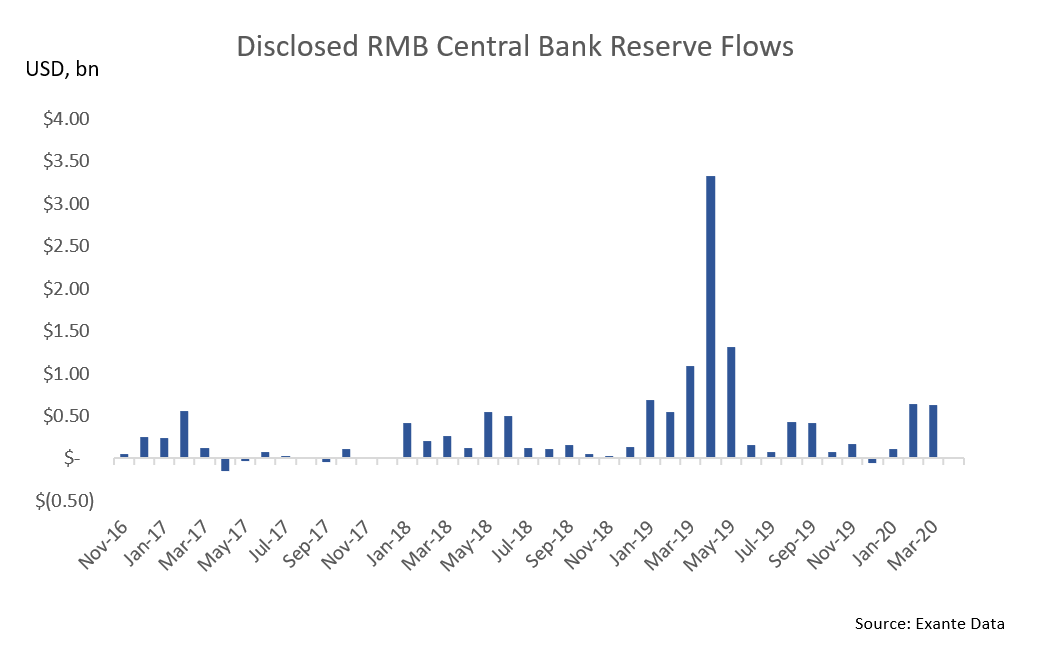

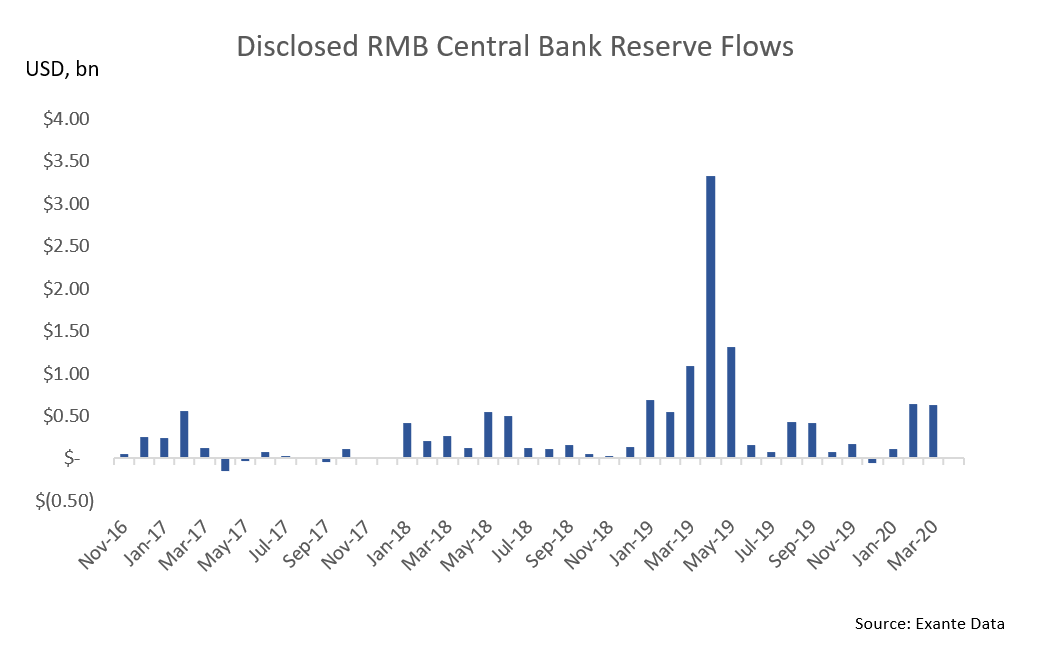

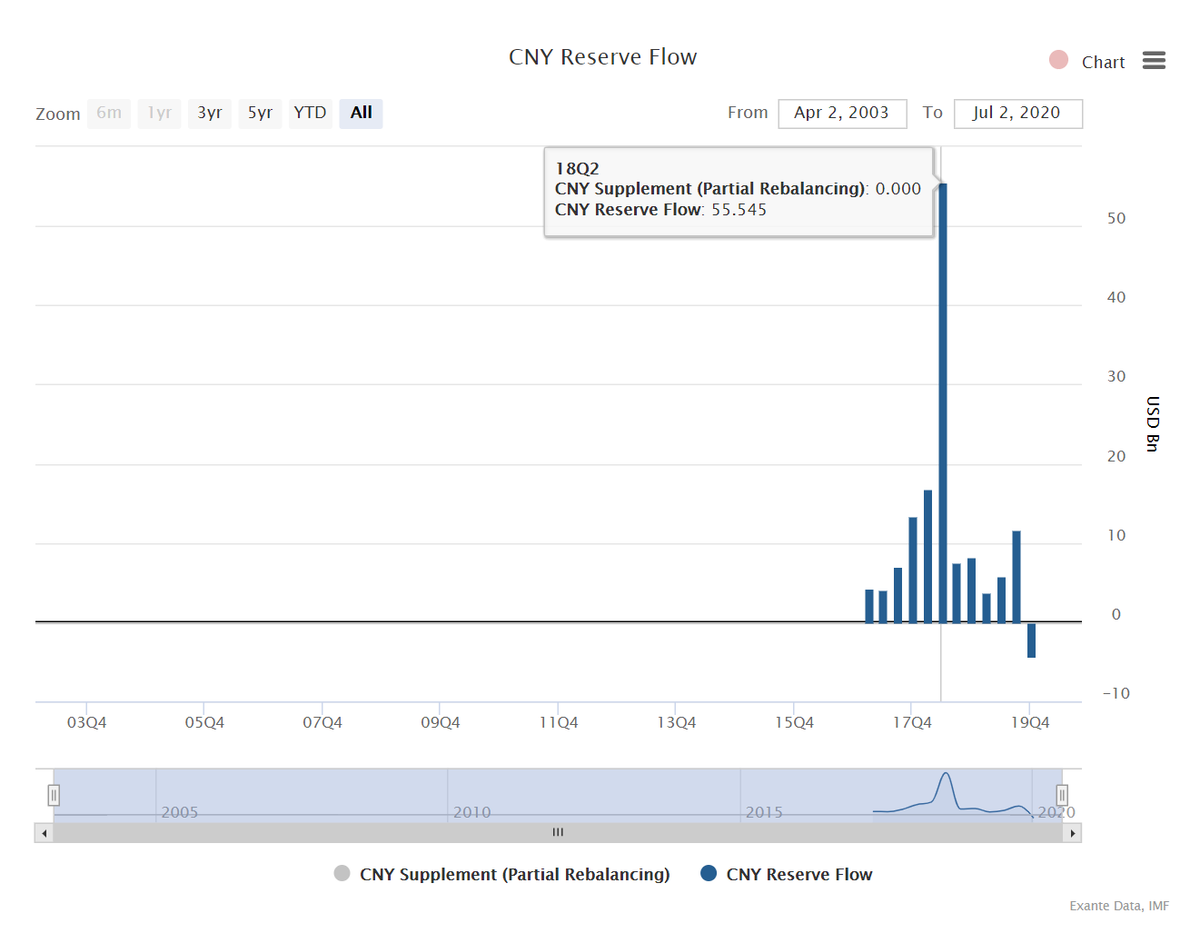

...but COFER data, which is a much broader sample than the reserve managers tracked above, shows net RMB sales by reserve managers in Q4. The first quarter of sales since joining the SDR... 2/5

...but COFER data, which is a much broader sample than the reserve managers tracked above, shows net RMB sales by reserve managers in Q4. The first quarter of sales since joining the SDR... 2/5

https://twitter.com/jnordvig/status/1221784791567273990A key point: There is no single source of data that is the best. The data is collected in a decentralized way. Hence, you have to think about which data is best for each jurisdiction (though it is nearly impossible to track them all individually).