#EPWConversations: Today, @AnupamSaraph and @sanjana_krishn will be talking about their work on PAN and Aadhaar linkage from epw_in’s handle. We invite you to join the conversation and ask questions. They will present their paper in this #thread.

Also, you can view their responses to questions and comments in this thread:

https://twitter.com/epw_in/status/1320703878355013634

Why is it curious that Ministry of Finances insists to link #Aadhaar with #PAN? The ministry has not made public any information leading to the decision to introduce #139AA that mandates quoting #Aadhaar to obtain a #PAN or to file return of income incometaxindia.gov.in/Acts/Finance%2…

Even more curious is MoF’s refusal to make public information under the Right to Information Act (RTI), by claiming exemption from disclosure under the most weird and inapplicable reasons of the RTI. | @AnupamSaraph @sanjana_krish

This information should have been public information as required under sec.4(1)(c) of the RTI Act as it constitutes facts relevant for formulating important policies and decisions affecting the public. | @AnupamSaraph @sanjana_krish

It should also have been public in accordance with Section 4(1)(d) of the RTI, to justify their administrative or quasi judicial decisions to affected persons. | @AnupamSaraph @sanjana_krishn

#139AA does away with the robustness of 139(2) that placed responsibility to identify and allot the #PAN on the Assessing Officer defined under Section 2 (7A) of the Income Tax Act by shifting the allotment away from the assessing officer to UIDAI @AnupamSaraph @sanjana_krishn

UIDAI does not take any responsibility to identification of anyone (See thread on #Aadhaar not identifying anyone, not being unique, not being certified, not being audited threadreaderapp.com/thread/1057513…) | @AnupamSaraph

@sanjana_krishn

@sanjana_krishn

#139AA thus hides the face of the taxpayer and raises questions about why it is enacted when the #PAN is already robust. | @AnupamSaraph

@sanjana_krishn

@sanjana_krishn

39% (18,38,06,056) #PANs are older than five years (issued before March 2015 ) and 99.94% of these have been allotted with IDs other than Aadhaar. | @AnupamSaraph

@sanjana_krishn

@sanjana_krishn

Focusing on the 39% #PANs older than 5 years, 99.94% of these having been allotted with IDs other than Aadhaar, have a clear tax history: of having paid tax, filed returns, having done both, or neither. | @AnupamSaraph

@sanjana_krishn

@sanjana_krishn

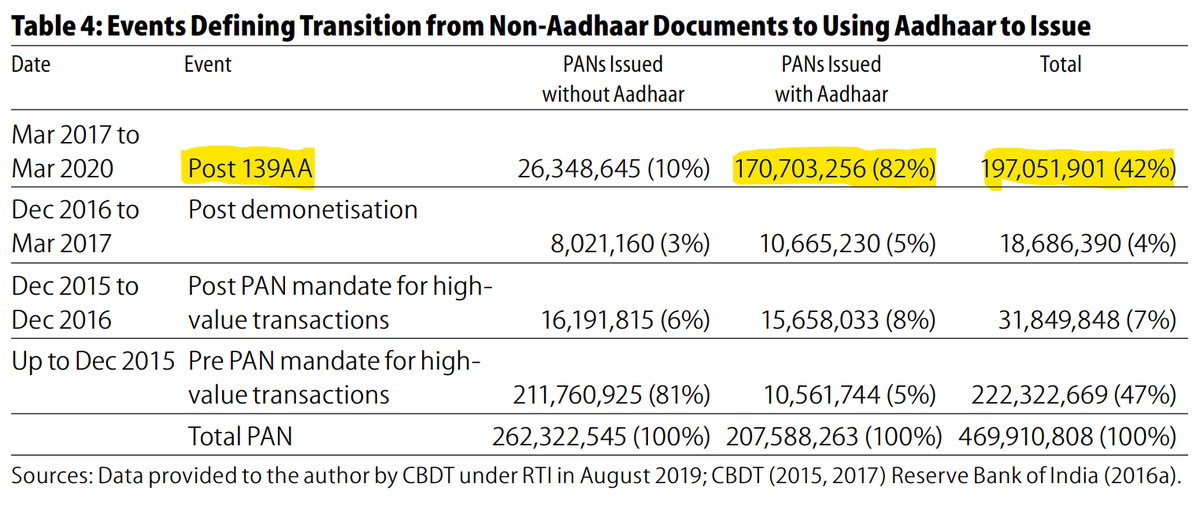

60.8% (28,61,04,752) #PANs have an age of less than five years (allotted in FY 2015–16 or later ). Of these, 72% (20,74,93,867) were allotted in the last five years using Aadhaar to establish identity. Most have no tax history. | @AnupamSaraph @sanjana_krishn

42% #PANs have been allotted post 2017, after #139AA was enacted, using #Aadhaar as a proof of identity. These have no tax history. Of the PANs allotted on the basis of documents other than Aadhaar, 81% were issued prior to December 2015. These have a long tax history.

By mandating to link PAN with Aadhaar, the CBDT and MoF are undermining PAN issued under 139A(2) by their own Assessing Officer in favor of Aadhaar numbers that were allotted to data submitted by private parties to UIDAI, that UIDAI neither verified, certified, or audited on par.

In doing so MoF and Central Board of Direct Taxes (CBDT) are also making indistinguishable 21,17,60,925 #PANs that have a tax history from 207,588,263 PANs allotted with #Aadhaar without a tax history. | @AnupamSaraph @sanjana_krishn

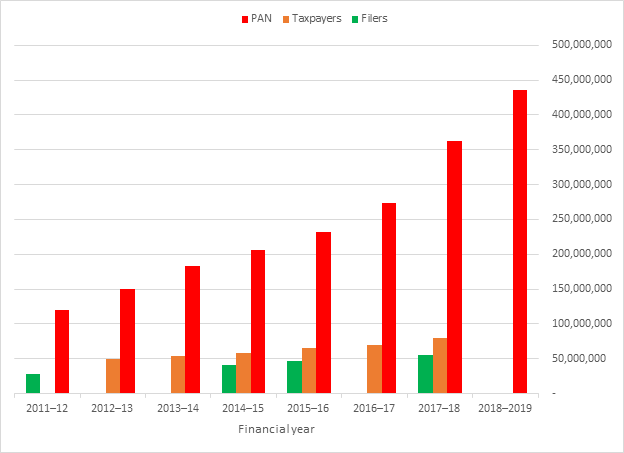

By increasing the inactive #PAN MoF and CBDT do not increase tax compliance. The percentage of PAN holders paying tax has dropped from 32.87% in 2012–2013 to 22.23% in 2017–2018. | @AnupamSaraph @sanjana_krishn

The percentage of #PAN holders filing tax returns has dropped from 24.01% in 2011–2012 to 15.27% in 2017–2018. #Aadhaar linkage to PAN has increased the number of PANs allotted but has not contributed to increased payments of tax or increased filing of tax returns.

Why, then, is MoF and CBDT wanting to invalidate #PANs that have a history of financial information and prevent them from reporting their tax returns? | @AnupamSaraph @sanjana_krishn

The only public information the government provided for its reasoning for Section #139AA is what it argued before the Supreme Court in the Binoy Viswam case (Binoy Viswam v Union of India and Ors) uidai.gov.in/images/Pan-Aad… | @AnupamSaraph @sanjana_krishn

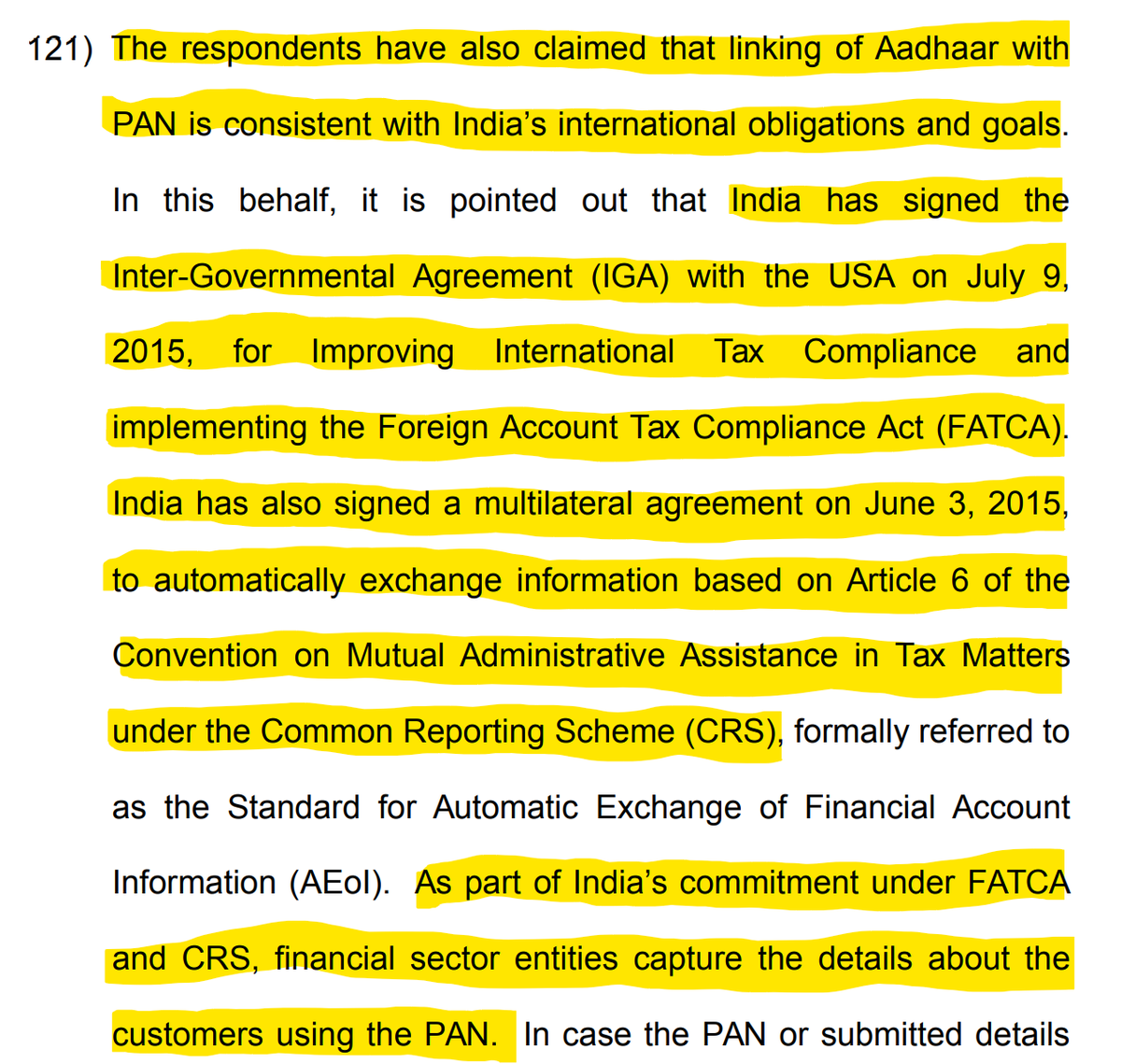

The government (Binoy Viswam v Union of India and Ors) claimed that linking of Aadhaar with #PAN is consistent with India’s international obligations (Binoy Viswam v UoI and Ors 2017: p 144, para 121). uidai.gov.in/images/Pan-Aad… | @AnupamSaraph @sanjana_krishn

The International agreements used by the government to justify the #Aadhaar-#PAN linkage under #FATCA (home.treasury.gov/policy-issues/…) and CRS (oecd.org/tax/automatic-…). | @AnupamSaraph @sanjana_krishn

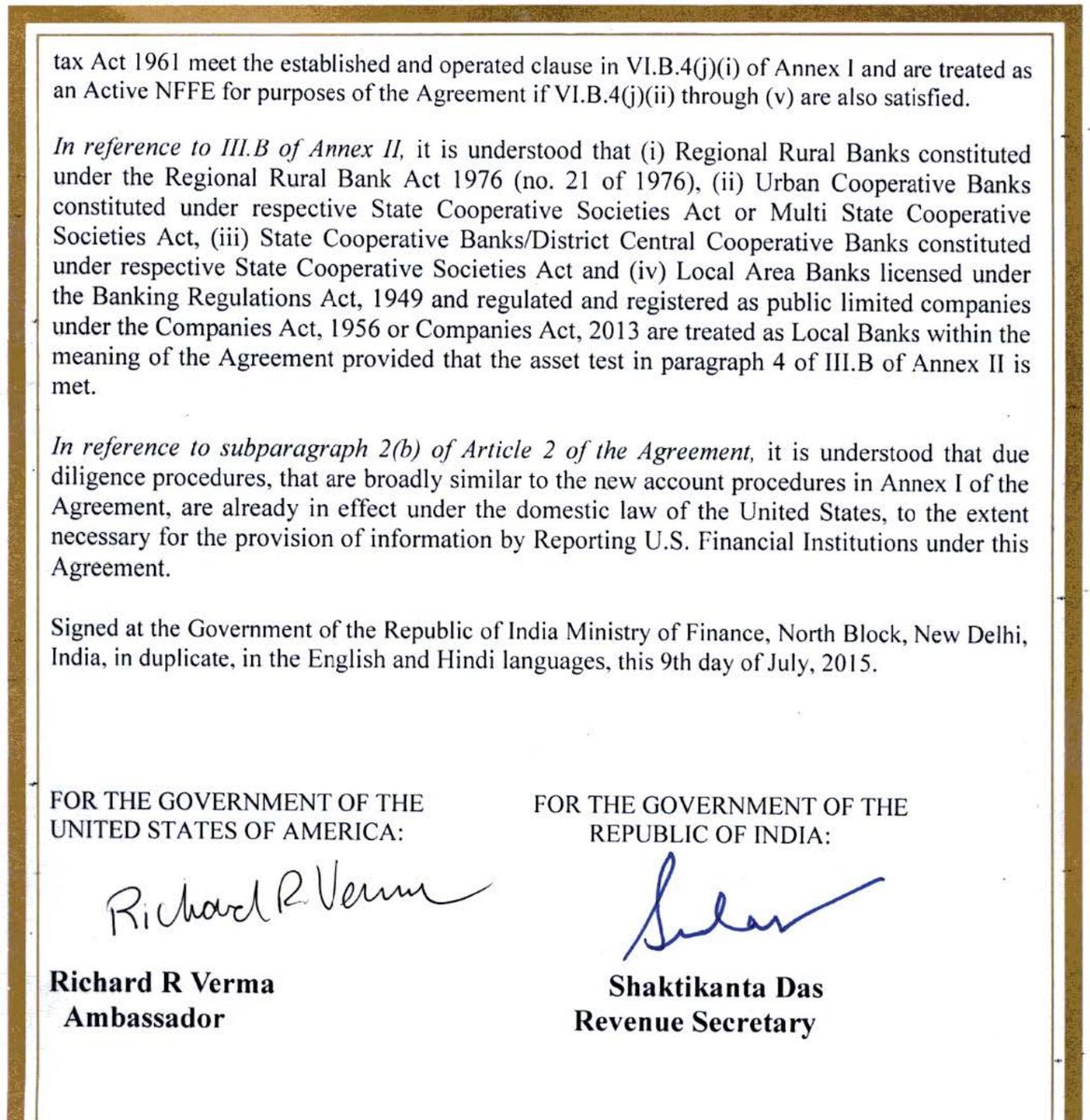

The agreement to improve international tax compliance and to implement the Foreign Account Tax Compliance Act (#FATCA) was signed by Shaktikanta Das (now Governor, RBI) and Richard Verma, the then US Ambassador to India treasury.gov/resource-cente… | @AnupamSaraph @sanjana_krishn

India is signatory to the OECD Tax CRS from September 2017 oecd.org/tax/automatic-…, after the Binoy Viswam judgement on June 9th 2017. | @AnupamSaraph @sanjana_krishn

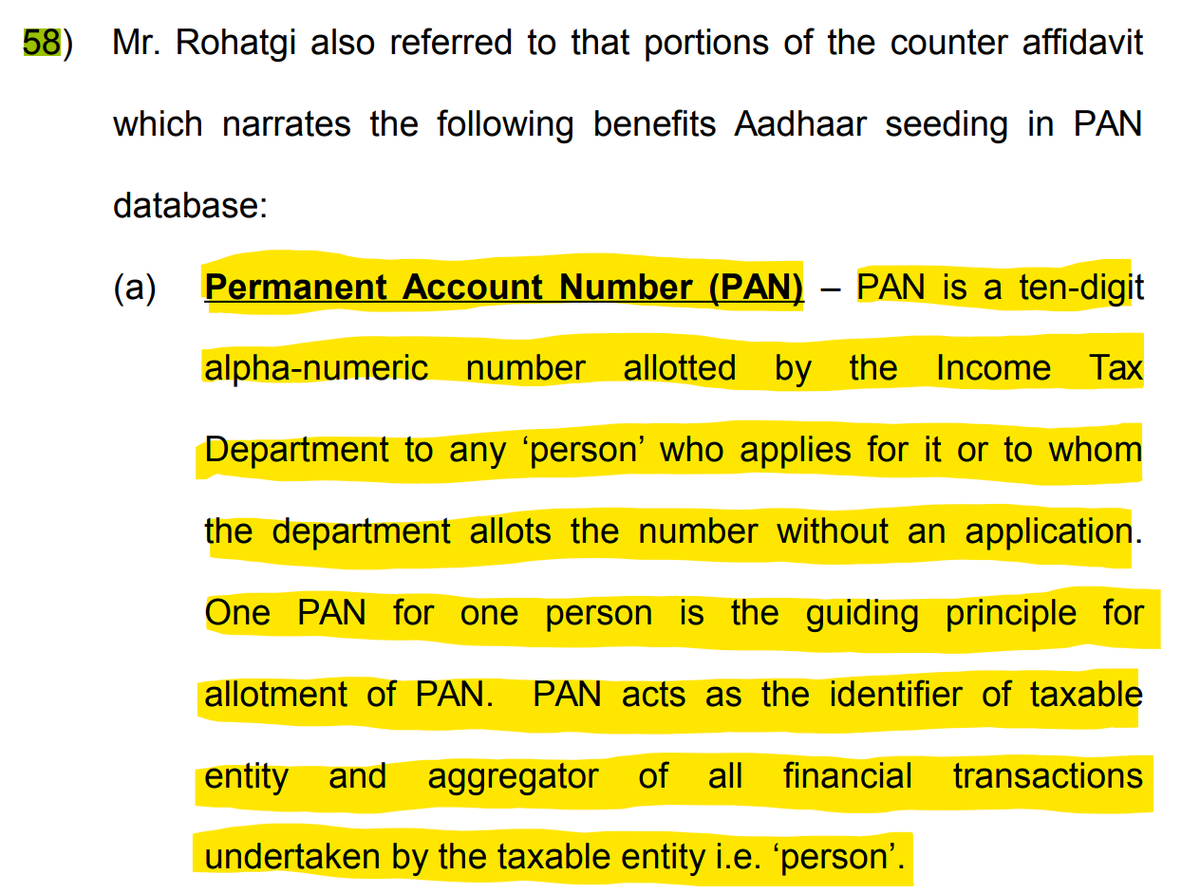

The #PAN identifies the transactions of individuals or organizations (Binoy Viswam v UoI and Ors 2017: p 75, para 58[a]) uidai.gov.in/images/Pan-Aad… | @AnupamSaraph @sanjana_krishn

Quoting of #PAN has been mandated for certain transactions above specified threshold value in Rule 114B of the Rules (Binoy Viswam v UoI and Ors 2017: p 75, para 58[b]) uidai.gov.in/images/Pan-Aad… | @AnupamSaraph @sanjana_krishn

The govt further argued that “for achieving the objective of one #PAN to one assessee, it is required to maintain the uniqueness for each PAN” (Binoy Viswam v UoI and Ors 2017: p 76, para 58[c]). The govt implicitly admits that PAN is a unique number. uidai.gov.in/images/Pan-Aad…

The government also assumed that because Aadhaar deduplication relied on biometric attributes of fingerprints and iris images, the Aadhaar database had no duplicates (Binoy Viswam v UoI and Ors 2017: p 77, para 58[d], [e]) uidai.gov.in/images/Pan-Aad… | @AnupamSaraph @sanjana_krishn

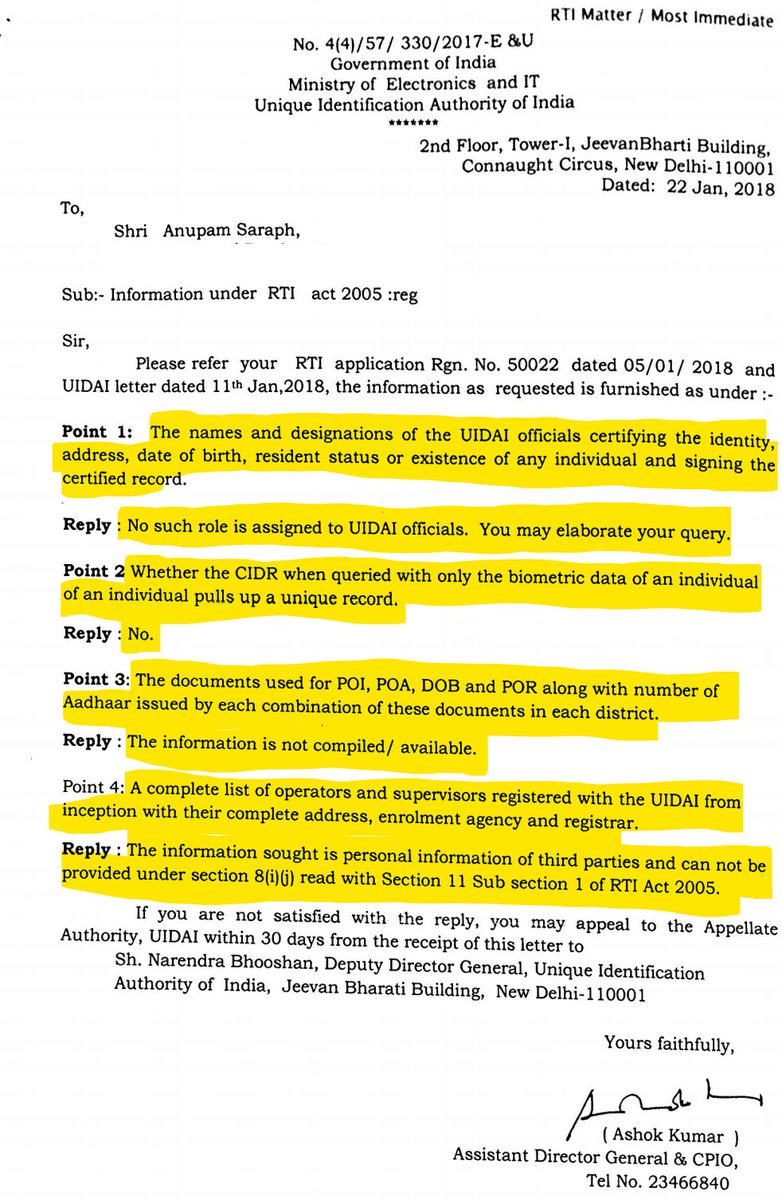

The argument in 58(d) is incorrect and flawed as #Aadhaar is not a certified document as UIDAI has confirmed that it does not certify the identity, address, dob, resident status or even existence of any individual, or know the documents on which the information is based.

The UIDAI has also confirmed that the #Aadhaar does not have unique biometrics in each record as it cannot retrieve a unique record with a biometric. | @AnupamSaraph @sanjana_krishn

It is, therefore, curious to propose the use of a non-unique, uncertified, #Aadhaar that cannot identify anyone ( arxiv.org/ftp/arxiv/pape…) in place of a unique #PAN. | @AnupamSaraph @sanjana_krishn

Furthermore #Aadhaar numbers were also allotted using #PAN as a proof of identity, so if a fake PAN was used to obtain Aadhaar, linking Aadhaar cannot distinguish fake PANs from genuine ones. | @AnupamSaraph @sanjana_krishn

Sec #139AA, therefore, also allows the same individual to hold multiple #PANs by holding multiple #Aadhaars and makes real the possibility of diverting personal income into several PANs, resulting in tax evasion. | @AnupamSaraph @sanjana_krishn

A #PAN created with #Aadhaar or linked to Aadhaar transfers the creation and updation of demographic and biometric data to private organisations and by processes that are not controlled, certified, verified or audited by the CBDT. | @AnupamSaraph @sanjana_krishn

Using an #Aadhaar to create or validate a #PAN, therefore, makes it impossible to establish the identity of the person holding a financial instrument or undertaking a financial transaction. | @AnupamSaraph @sanjana_krishn

Once Aadhaar is linked to financial instruments, it also enables money transfers using Aadhaar payment systems that make money transfers volatile, untraceable, facilitating money-laundering (thread on money laundering with Aadhaar: threadreaderapp.com/thread/8766857…)

The increase in #PAN numbers linked to Aadhaar, or the use of Aadhaar authentication, creates a false aura of identification, while facilitating and legitimizing money-laundering through millions of shell PANs. | @AnupamSaraph @sanjana_krishn

With the introduction of Sec #139AA, millions of shell #PANs can be used for parking black money and bribes, siphoning subsidies, making fake insurance claims, asset transactions, and fake borrowing, and yet remain untraceable. India will have replaced Panama as a tax haven.

If the ministry intended the Aadhaar–#PAN linkage to be a means to meet its #FATCA and #CRS obligations to the US Treasury and OECD as it stated to the Supreme Court (Binoy Viswam v Union of India and Ors 2017), it has created exactly the opposite effect. uidai.gov.in/images/Pan-Aad…

Contrary to the government’s claims, #Aadhaar linkage will generate incorrect or fictitious #PANs and cause incorrect reporting to US Treasury and OECD that it wanted to avoid to comply with FATCA and CRS (Binoy Viswam v UoI and Ors 2017). uidai.gov.in/images/Pan-Aad…

To protect the integrity of the financial system and ensure that it meets its reporting obligations to US Treasury under FATCA and OECD under CRS the government will need to end the use of #Aadhaar for financial transactions and issuing any identification documents.

To ensure that justice, dignity, and financial integrity of every person and the state are protected in India, there is no option but to delete Section #139AA and all acts and rules that have notified the use of #Aadhaar. | @AnupamSaraph @sanjana_krishn

The prima facie evidence presented is also enough to warrant an investigation into the generation of #PAN solely on the basis of #Aadhaar and the transactions undertaken with these PAN cards and the RBI directive regarding re-KYC. | @AnupamSaraph @sanjana_krishn

There are sufficient grounds to require a thorough investigation of how third parties, like UIDAI, have ended up diluting the role of financial bodies and removing any clarity of legal responsibility absolving them of legal liabilities without taking on any legal liability itself

MoF also needs to urgently create a mechanism whereby its basic role and responsibilities, and those of CBDT or RBI, will not be outsourced or taken over by third parties, like the UIDAI, that have no similar and symmetrical consequences for fraud. | @AnupamSaraph @sanjana_krishn

MoF cannot absolve its responsibility to be accountable, to protect the country’s financial databases, to protect the financial system, and the people of India. | @AnupamSaraph @sanjana_krishn

The curious case of the #Aadhaar–#PAN linkage has deep lessons of how trojan horses can take over and destroy the financial integrity of an entire nation. | @AnupamSaraph @sanjana_krishn

In case you missed it: you can ask questions and view their responses in this thread:

https://twitter.com/epw_in/status/1320703878355013634?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh