1/14

* HOW TO BECOME RICH THIS DIWALI 🤑 *

With Diwali around the corner along with our economy rebounding , only fair that we be bombarded with "PATAKA STOCKS" by EXPERTS from Indore to the enthusiastic newbie who made 30% returns on his portfolio ( of ₹10,000) in 1 week 🙄

* HOW TO BECOME RICH THIS DIWALI 🤑 *

With Diwali around the corner along with our economy rebounding , only fair that we be bombarded with "PATAKA STOCKS" by EXPERTS from Indore to the enthusiastic newbie who made 30% returns on his portfolio ( of ₹10,000) in 1 week 🙄

2/14

So here are my 2 cents gently reminding how much of WEALTH has ACTUALLY been created for the enthusiastic retailers by PATAKA / PENNY / MULTI BAGGER stocks recommended in the past few years .

DISCLAIMER : Being a learner, I am mostly wrong 😇🙏

To each his own .

So here are my 2 cents gently reminding how much of WEALTH has ACTUALLY been created for the enthusiastic retailers by PATAKA / PENNY / MULTI BAGGER stocks recommended in the past few years .

DISCLAIMER : Being a learner, I am mostly wrong 😇🙏

To each his own .

3/14

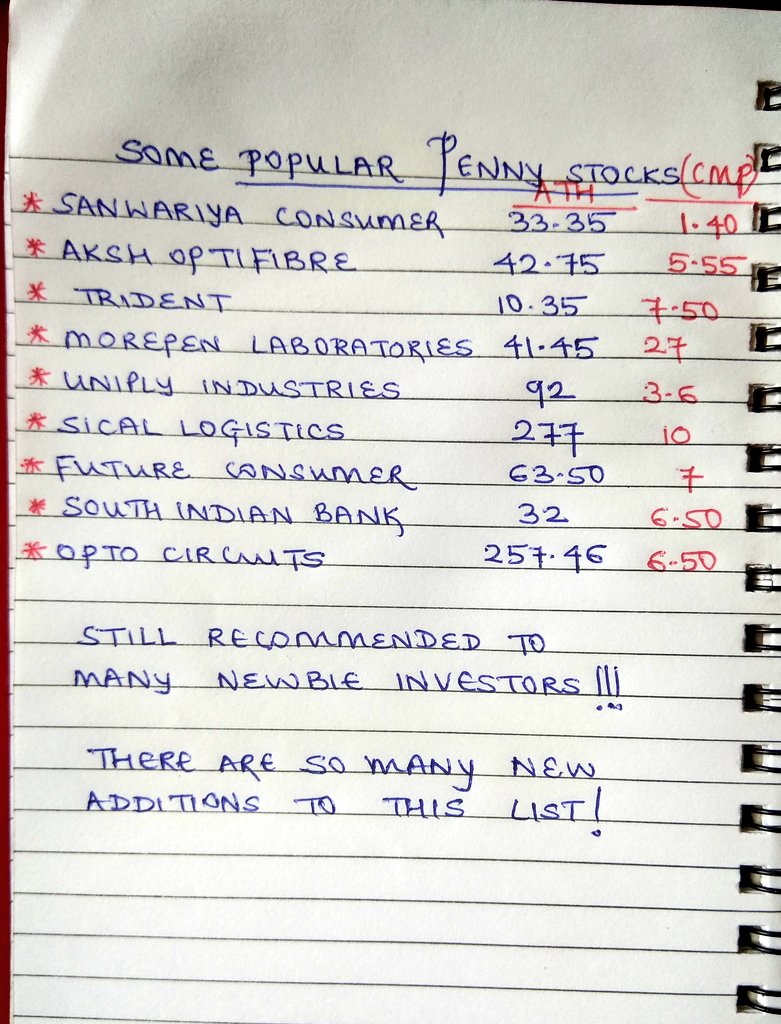

A small snapshot of a few Penny stocks ( using this word a little liberally here ) that were recommended LEFT , RIGHT AND CENTRE on Social Media & how they are doing currently :))

P.S - These are still recommended to newbies with the recount of their glorious past ! 🤦

A small snapshot of a few Penny stocks ( using this word a little liberally here ) that were recommended LEFT , RIGHT AND CENTRE on Social Media & how they are doing currently :))

P.S - These are still recommended to newbies with the recount of their glorious past ! 🤦

4/14

The lure of earning huge money by purchasing PENNY stocks attracts many as they believe they are buying equity CHEAPLY.

In reality , THEY ARE ACTUALLY BUYING "CHEAP EQUITY" !

Huge difference between the two ! 🙄🤷

The lure of earning huge money by purchasing PENNY stocks attracts many as they believe they are buying equity CHEAPLY.

In reality , THEY ARE ACTUALLY BUYING "CHEAP EQUITY" !

Huge difference between the two ! 🙄🤷

5/14

Risks being :

*Low market cap making it super risky

* Low liquidity making it easy for manipulation

*Skewed Risk Reward ratio

*Inconsistent performance, mostly never recovers from lows

*We get stuck in lower after lower circuits when selling begins

Risks being :

*Low market cap making it super risky

* Low liquidity making it easy for manipulation

*Skewed Risk Reward ratio

*Inconsistent performance, mostly never recovers from lows

*We get stuck in lower after lower circuits when selling begins

6/14

Look for QUALITY , NOT QUANTITY.

Penny stocks are not a treasure trove . They won't compound wealth .

Infact they are RIGHTLY called PATAKA stocks.

Afterall they are a MINEFIELD all set to blow up your capital ! 🔥💥😬🤷

Look for QUALITY , NOT QUANTITY.

Penny stocks are not a treasure trove . They won't compound wealth .

Infact they are RIGHTLY called PATAKA stocks.

Afterall they are a MINEFIELD all set to blow up your capital ! 🔥💥😬🤷

7/14

If you really wish to buy during Diwali, instead of purchasing 1000 shares of 10₹ , use the entire capital to buy only 10 shares of a QUALITY company (T&C applicable)

The return ( Cap appreciation + Dividend ) would anyday be more !

*Even Index funds is good option !

If you really wish to buy during Diwali, instead of purchasing 1000 shares of 10₹ , use the entire capital to buy only 10 shares of a QUALITY company (T&C applicable)

The return ( Cap appreciation + Dividend ) would anyday be more !

*Even Index funds is good option !

8/14

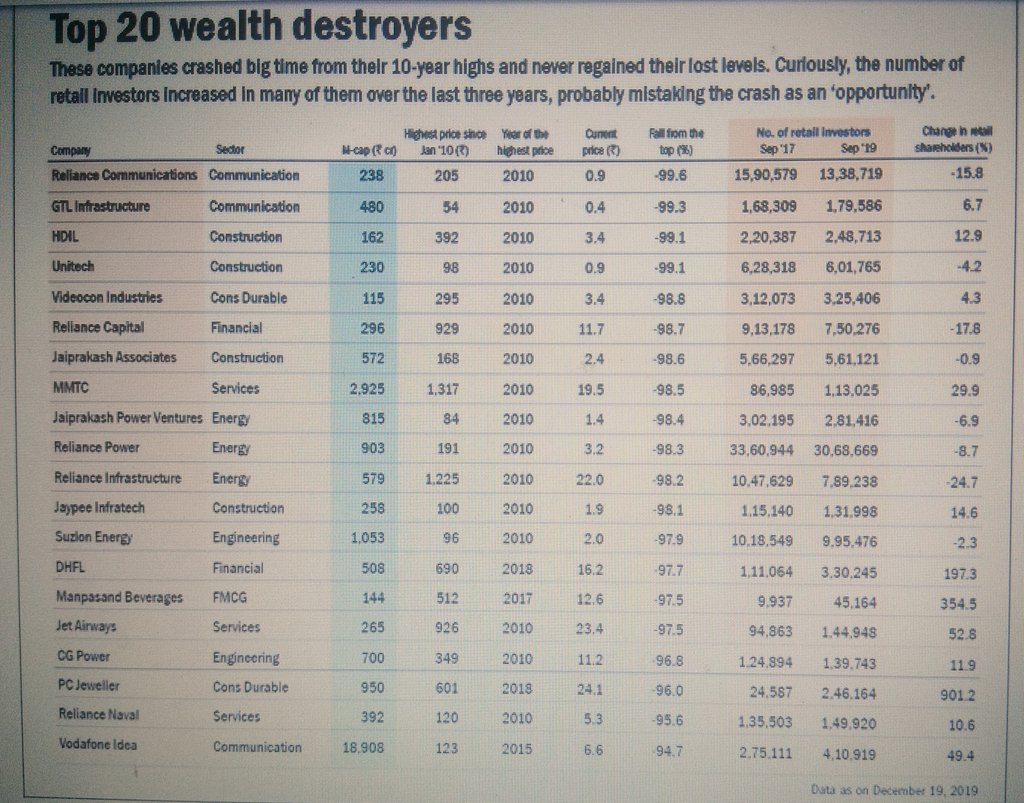

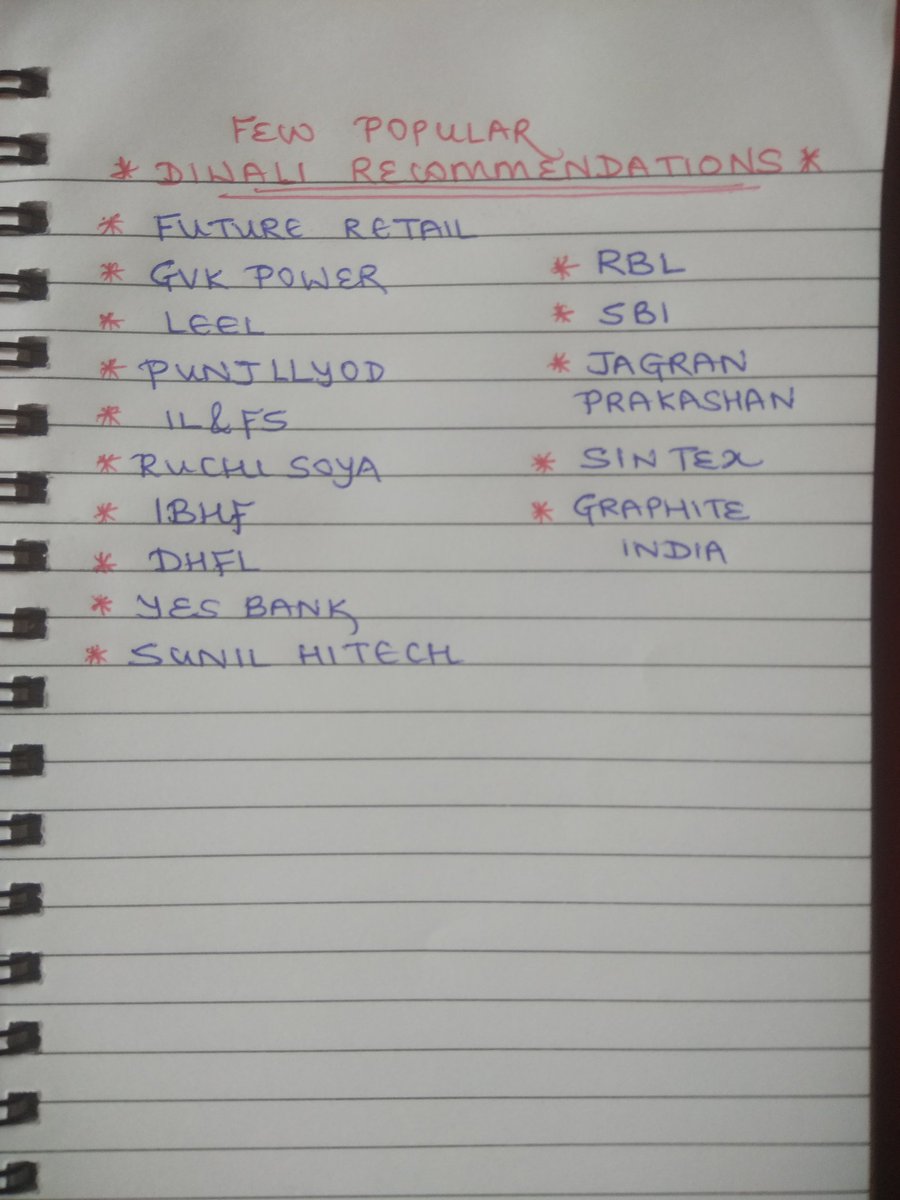

Moving on to the other non penny scrips that were also recommended way too much on SM despite negatives being identified early on. (Questionable actions by management , Corporate Governance issues,cyclical ,huge debt etcetc ) becoming major wealth destroyers.

Moving on to the other non penny scrips that were also recommended way too much on SM despite negatives being identified early on. (Questionable actions by management , Corporate Governance issues,cyclical ,huge debt etcetc ) becoming major wealth destroyers.

9/14

Businesses are prone to risks . Sometimes headwinds & underlying debt cause havoc even to a good business temporarily. This is where holding Quality helps.

As we all would have experienced it now , how quality falls LAST but rebounds FIRST :)

Businesses are prone to risks . Sometimes headwinds & underlying debt cause havoc even to a good business temporarily. This is where holding Quality helps.

As we all would have experienced it now , how quality falls LAST but rebounds FIRST :)

10/14

But it's an open secret that this technique of recommendation is indirectly used for Pump & Dump by operators ( especially cyclicals & bad Corporate Governance stocks)

Retail investors are the LAST to know the real happenings although we are made to think otherwise.

But it's an open secret that this technique of recommendation is indirectly used for Pump & Dump by operators ( especially cyclicals & bad Corporate Governance stocks)

Retail investors are the LAST to know the real happenings although we are made to think otherwise.

11/14

So this Diwali let's not

follow ANY recommendations BLINDLY from telegram ,watsapp , money control or any SM for that matter !

People are all here TO SELL .

WE are their " prospective clients " .

* MOST recommendations are sponsored.

Yeah ! 🙄UGLY TRUTH.

So this Diwali let's not

follow ANY recommendations BLINDLY from telegram ,watsapp , money control or any SM for that matter !

People are all here TO SELL .

WE are their " prospective clients " .

* MOST recommendations are sponsored.

Yeah ! 🙄UGLY TRUTH.

12/14

* Most analysts on TV don't even beat index benchmark ! So don't keep buying based on recommendations.

* If you are still looking for recommendations then you ARE NOT READY for direct equity investing.

* SIP in Index funds/good MF

* Use time wisely & self learn.

* Most analysts on TV don't even beat index benchmark ! So don't keep buying based on recommendations.

* If you are still looking for recommendations then you ARE NOT READY for direct equity investing.

* SIP in Index funds/good MF

* Use time wisely & self learn.

13/14

Ultimately , money not lost is also money earned which is how we shall become rich this Diwali !😇

* TO SUM IT UP *

"People are trying to be smart, all I am trying to do is not to be idiotic, but it's harder than most people think" ~ Charlie Munger.

Ultimately , money not lost is also money earned which is how we shall become rich this Diwali !😇

* TO SUM IT UP *

"People are trying to be smart, all I am trying to do is not to be idiotic, but it's harder than most people think" ~ Charlie Munger.

14/14

Wishing everyone a Happy Diwali :))

*THE END*

@dmuthuk

@Vivek_Investor

@RichifyMeClub

@FI_InvestIndia

@position_trader

Wishing everyone a Happy Diwali :))

*THE END*

@dmuthuk

@Vivek_Investor

@RichifyMeClub

@FI_InvestIndia

@position_trader

• • •

Missing some Tweet in this thread? You can try to

force a refresh