1/31

My takeaways from the best seller

#ThePsychologyOfMoney by @morganhousel

It beautifully encapsulates , via chapters , the most under rated factor in investing - The Psychological aspect of it .

Do read the book :)

#BookRecommendations

#booklovers

My takeaways from the best seller

#ThePsychologyOfMoney by @morganhousel

It beautifully encapsulates , via chapters , the most under rated factor in investing - The Psychological aspect of it .

Do read the book :)

#BookRecommendations

#booklovers

2/31

CHAPTER 1

What we experience early on (in our adult life) is more compelling than what we learn second hand, which is why each person thinks about #Risk & #Reward DIFFERENTLY.

In theory we SHOULD make our investments based on OUR goals & options available.

CHAPTER 1

What we experience early on (in our adult life) is more compelling than what we learn second hand, which is why each person thinks about #Risk & #Reward DIFFERENTLY.

In theory we SHOULD make our investments based on OUR goals & options available.

3/31

However we tend to include our unique experiences of how the world works (albeit with incomplete information) which might seem crazy to others .

* Spreadsheets cannot replicate human emotions which is why no amount of studying can make one truly UNDERSTAND the underlying.

However we tend to include our unique experiences of how the world works (albeit with incomplete information) which might seem crazy to others .

* Spreadsheets cannot replicate human emotions which is why no amount of studying can make one truly UNDERSTAND the underlying.

4/31

CHAPTER 2

#LUCK & #RISK both play a role for EVERY outcome along with individual effort. At times making a greater impact than the consequential actions taken .

This we ought to remember when judging others' financial success.

Not ALL SUCCESS is due to hard work.

CHAPTER 2

#LUCK & #RISK both play a role for EVERY outcome along with individual effort. At times making a greater impact than the consequential actions taken .

This we ought to remember when judging others' financial success.

Not ALL SUCCESS is due to hard work.

5/31

Likewise, NOT ALL POVERTY is due to laziness.

To learn from successful people, we must focus on BROAD PATTERNS & not on specific individuals ( for we often tend to just study extreme cases at both ends of the spectrum. )

It's never AS GOOD or AS BAD as it seems !!

Likewise, NOT ALL POVERTY is due to laziness.

To learn from successful people, we must focus on BROAD PATTERNS & not on specific individuals ( for we often tend to just study extreme cases at both ends of the spectrum. )

It's never AS GOOD or AS BAD as it seems !!

6/31

CHAPTER 3

An important chapter IMHO

Having the sense of HOW MUCH is enough & learning WHEN to stop is of paramount importance because there is NO END to wanting more.

"There is no reason to risk what you have and need , for what you don't have and don't need".

~ Buffet

CHAPTER 3

An important chapter IMHO

Having the sense of HOW MUCH is enough & learning WHEN to stop is of paramount importance because there is NO END to wanting more.

"There is no reason to risk what you have and need , for what you don't have and don't need".

~ Buffet

7/31

*The hardest financial skill is getting the goalpost to stop moving.

Perpetual increase of wants shall only result in recklessness ahead .

* Avoid Comparison.

* Certain things SHOULD NOT be risked in the quest for a gain .

Be it reputation , values, friends or happiness.

*The hardest financial skill is getting the goalpost to stop moving.

Perpetual increase of wants shall only result in recklessness ahead .

* Avoid Comparison.

* Certain things SHOULD NOT be risked in the quest for a gain .

Be it reputation , values, friends or happiness.

8/31

CHAPTER 4

Good investing isn't necessarily about earning the highest returns (mostly one off).

It's about earning GOOD returns CONSISTENTLY over LONG periods of time .

The secret ingredient in Investing for compounding to work its magic is #TIME .

CHAPTER 4

Good investing isn't necessarily about earning the highest returns (mostly one off).

It's about earning GOOD returns CONSISTENTLY over LONG periods of time .

The secret ingredient in Investing for compounding to work its magic is #TIME .

9/31

CHAPTER 5

Staying wealthy is a COMBINATION of frugality , fear of losing money earned & acceptance of the fact that luck has played its role somewhere ,somehow ...

SURVIVAL MINDSET being the key over growth,brains or insight .

What we DON'T DO HERE matters equally.

CHAPTER 5

Staying wealthy is a COMBINATION of frugality , fear of losing money earned & acceptance of the fact that luck has played its role somewhere ,somehow ...

SURVIVAL MINDSET being the key over growth,brains or insight .

What we DON'T DO HERE matters equally.

10/31

* Inorder to let compounding do its job one needs to ensure that the process is UNINTERRUPTED.

For this one must provide such, that during ill times liquidity is ensured.

*Plan taking into account UNCERTAINTY. Make room for error (MOS) & plan REALISTICALLY.

* Inorder to let compounding do its job one needs to ensure that the process is UNINTERRUPTED.

For this one must provide such, that during ill times liquidity is ensured.

*Plan taking into account UNCERTAINTY. Make room for error (MOS) & plan REALISTICALLY.

11/31

* SHORT TERM paranoia is needed to keep one alive long enough to exploit long term optimism.

Being sensibly optimistic about the Long Term whilst accepting a bumpy road now & then is much needed.

* SHORT TERM paranoia is needed to keep one alive long enough to exploit long term optimism.

Being sensibly optimistic about the Long Term whilst accepting a bumpy road now & then is much needed.

12/31

CHAPTER 6

#FAILURE IS NORMAL.

One CAN'T be right all the time.

An investor can be wrong HALF the time & still make a fortune (unlike a pilot wherein perfection is a pre requisite)

Tails drive everything ,whereby it's normal for lot of things to go wrong.

ACCEPT IT.

CHAPTER 6

#FAILURE IS NORMAL.

One CAN'T be right all the time.

An investor can be wrong HALF the time & still make a fortune (unlike a pilot wherein perfection is a pre requisite)

Tails drive everything ,whereby it's normal for lot of things to go wrong.

ACCEPT IT.

13/31

CHAPTER 7

The highest dividend that money can pay is the ability to give you CONTROL over YOUR time .

From retiring when YOU want to, to taking a FLEXIBLE job with LESSER hours..

Having money ensures we FREE UP our time to FOCUS on what we really desire .

CHAPTER 7

The highest dividend that money can pay is the ability to give you CONTROL over YOUR time .

From retiring when YOU want to, to taking a FLEXIBLE job with LESSER hours..

Having money ensures we FREE UP our time to FOCUS on what we really desire .

14/31

CHAPTER 8

We think we need luxurious cars / a flashy lifestyle to gain respect from others .

GET RID OF THAT FALLACY ASAP !

In reality respect is EARNED by being humane.

Humility , kindness & empathy shall bring in more respect than horsepower shall ever will .

CHAPTER 8

We think we need luxurious cars / a flashy lifestyle to gain respect from others .

GET RID OF THAT FALLACY ASAP !

In reality respect is EARNED by being humane.

Humility , kindness & empathy shall bring in more respect than horsepower shall ever will .

15/31

CHAPTER 9

There is a difference between having a high income & being wealthy.

Wealth is INCOME NOT SPENT.

It being hidden, makes it difficult for imitation. It's difficult to learn from what you can't see & hence wealth creation is achieved by a handful.

CHAPTER 9

There is a difference between having a high income & being wealthy.

Wealth is INCOME NOT SPENT.

It being hidden, makes it difficult for imitation. It's difficult to learn from what you can't see & hence wealth creation is achieved by a handful.

16/31

CHAPTER 10

A high savings rate is a must for wealth creation .

Yes, high earnings definitely help, but beyond a point high savings matter more .

Spend less .

Desire less .

Care less about others' opinion.

Intangible benefits of money are much under appreciated.

CHAPTER 10

A high savings rate is a must for wealth creation .

Yes, high earnings definitely help, but beyond a point high savings matter more .

Spend less .

Desire less .

Care less about others' opinion.

Intangible benefits of money are much under appreciated.

17/31

CHAPTER 11

Strategy that ensures peaceful sleep at night > Any mathematically optimal investment strategy.

For the math works on paper, being a rational strategy .

But it is often UNREASONABLE & hence impossible for humans to adhere to , given our emotions.

CHAPTER 11

Strategy that ensures peaceful sleep at night > Any mathematically optimal investment strategy.

For the math works on paper, being a rational strategy .

But it is often UNREASONABLE & hence impossible for humans to adhere to , given our emotions.

18/31

CHAPTER 12

The past isn't in any way the road map for the future. It does offer some guidance at best.

*One can never predict about what shall move the needle the most.

* CHANGE is the only constant . The world is evolving so rapidly that disruption is the new norm .

CHAPTER 12

The past isn't in any way the road map for the future. It does offer some guidance at best.

*One can never predict about what shall move the needle the most.

* CHANGE is the only constant . The world is evolving so rapidly that disruption is the new norm .

19/31

CHAPTER 13

Always plan keeping some room for error because there is a decent chance that you might be wrong .

Good ideas taken too far become indistinguishable from bad ones.

A MOS helps us navigate a world of uncertainties - viewing things as Grey helps .

CHAPTER 13

Always plan keeping some room for error because there is a decent chance that you might be wrong .

Good ideas taken too far become indistinguishable from bad ones.

A MOS helps us navigate a world of uncertainties - viewing things as Grey helps .

20/31

The biggest gains happen infrequently. To enjoy it one needs to HOLD the stock for long ,which only a person with room for error can .

Use it for estimating your future returns also .

Evaluate cost of upside vs downside always.

Avoid single points of failure .

The biggest gains happen infrequently. To enjoy it one needs to HOLD the stock for long ,which only a person with room for error can .

Use it for estimating your future returns also .

Evaluate cost of upside vs downside always.

Avoid single points of failure .

21/31

CHAPTER 14

Things change. Priorities change.

Thereby our goals & desires too change . We underestimate HOW MUCH this shall happen .

This makes long term planning a lot more difficult .

AVOID extreme ends of financial planning & ACCEPT the reality of our changing minds.

CHAPTER 14

Things change. Priorities change.

Thereby our goals & desires too change . We underestimate HOW MUCH this shall happen .

This makes long term planning a lot more difficult .

AVOID extreme ends of financial planning & ACCEPT the reality of our changing minds.

22/31

CHAPTER 15

Every job looks easy when we are not doing it as the underlying challenges are often invisible to us .

One must learn to take volatility as the fee ( not as a fine) we pay to earn our returns from the market .

Embrace it . Find the price and then pay it .

CHAPTER 15

Every job looks easy when we are not doing it as the underlying challenges are often invisible to us .

One must learn to take volatility as the fee ( not as a fine) we pay to earn our returns from the market .

Embrace it . Find the price and then pay it .

23/31

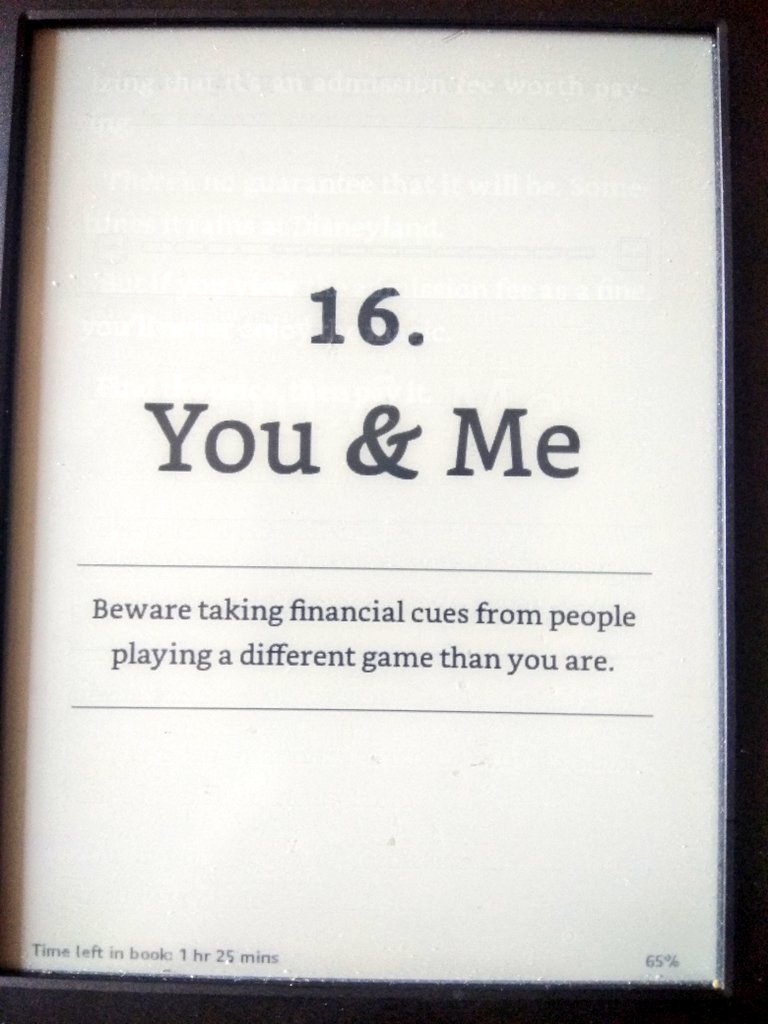

CHAPTER 16

Price of every asset class is subjective.

It all depends on the investors goal & time horizon on hand.Hence what price seems ridiculous to one makes sense to the other.

Profits are always chased no matter what the valuations are

CHAPTER 16

Price of every asset class is subjective.

It all depends on the investors goal & time horizon on hand.Hence what price seems ridiculous to one makes sense to the other.

Profits are always chased no matter what the valuations are

24/31

mostly because they are irrelevant to the game being played by the short term market participants.

The damage is done when LONG TERM INVESTORS TAKE CUES FROM SHORT TERM TRADERS.

Invest as per YOUR risk appetite,time frame, philosophy & goals and STAY THE COURSE.

mostly because they are irrelevant to the game being played by the short term market participants.

The damage is done when LONG TERM INVESTORS TAKE CUES FROM SHORT TERM TRADERS.

Invest as per YOUR risk appetite,time frame, philosophy & goals and STAY THE COURSE.

25/31

CHAPTER 17

Somehow we hold greater value for pessimism & get easily influenced by it ,for it sounds smarter & more plausible than optimism.

Optimists don't think that everything will be great but they know that the odds of good outcome will be in their favour in the L.T.

CHAPTER 17

Somehow we hold greater value for pessimism & get easily influenced by it ,for it sounds smarter & more plausible than optimism.

Optimists don't think that everything will be great but they know that the odds of good outcome will be in their favour in the L.T.

26/31

CHAPTER 18

The more you want something to be true, the more likely you are to believe a story that overestimates the odds of it being true.

Simply put : There are many things in life that we think are true BECAUSE we desperately WANT them to be true.

CHAPTER 18

The more you want something to be true, the more likely you are to believe a story that overestimates the odds of it being true.

Simply put : There are many things in life that we think are true BECAUSE we desperately WANT them to be true.

27/31

Everyone has an incomplete view of the world. But we form a complete narrative to fill in the gaps.

We focus on what we know & neglect what we don't know, which makes us overtly confident in our beliefs and funnily each one of us has our own mental model system.

Everyone has an incomplete view of the world. But we form a complete narrative to fill in the gaps.

We focus on what we know & neglect what we don't know, which makes us overtly confident in our beliefs and funnily each one of us has our own mental model system.

28/31

CHAPTER 19

To sum it all up

*Less ego.

* Adopt simple living ,high thinking .

*Be humble when right & forgive yourself when wrong.

*Sound sleep at night triumphs everything else.

*Hold for long term to reap benefits.

* Always Save . Expenses crop up unexpectedly.

CHAPTER 19

To sum it all up

*Less ego.

* Adopt simple living ,high thinking .

*Be humble when right & forgive yourself when wrong.

*Sound sleep at night triumphs everything else.

*Hold for long term to reap benefits.

* Always Save . Expenses crop up unexpectedly.

29/31

*Nothing worthwhile is free .Be ready to pay up.

*Avoid being at the extreme ends of Financial decisions.

*Accept risk but be paranoid of ruinous risk.

* There is no right way .No single right answer.Respect the varied opinions .Agree to disagree.

* Keep room for error.

*Nothing worthwhile is free .Be ready to pay up.

*Avoid being at the extreme ends of Financial decisions.

*Accept risk but be paranoid of ruinous risk.

* There is no right way .No single right answer.Respect the varied opinions .Agree to disagree.

* Keep room for error.

30/31

CHAPTER 20

*Find out what works for you . Stick to it .

*Keep one's expectations in check and live below one's means .

*Cash is also a position.

* Index funds work best if direct stock picking ain't your forte.

* No need to be brilliant or the best investor in town.

CHAPTER 20

*Find out what works for you . Stick to it .

*Keep one's expectations in check and live below one's means .

*Cash is also a position.

* Index funds work best if direct stock picking ain't your forte.

* No need to be brilliant or the best investor in town.

31/31

Just try not to be the worst or do anything stupid, for ultimately the goal of Financial Independence should not be at the cost of one's sleep .

* THE END *

@dmuthuk

@position_trader

@FI_InvestIndia

@RichifyMeClub

Just try not to be the worst or do anything stupid, for ultimately the goal of Financial Independence should not be at the cost of one's sleep .

* THE END *

@dmuthuk

@position_trader

@FI_InvestIndia

@RichifyMeClub

• • •

Missing some Tweet in this thread? You can try to

force a refresh