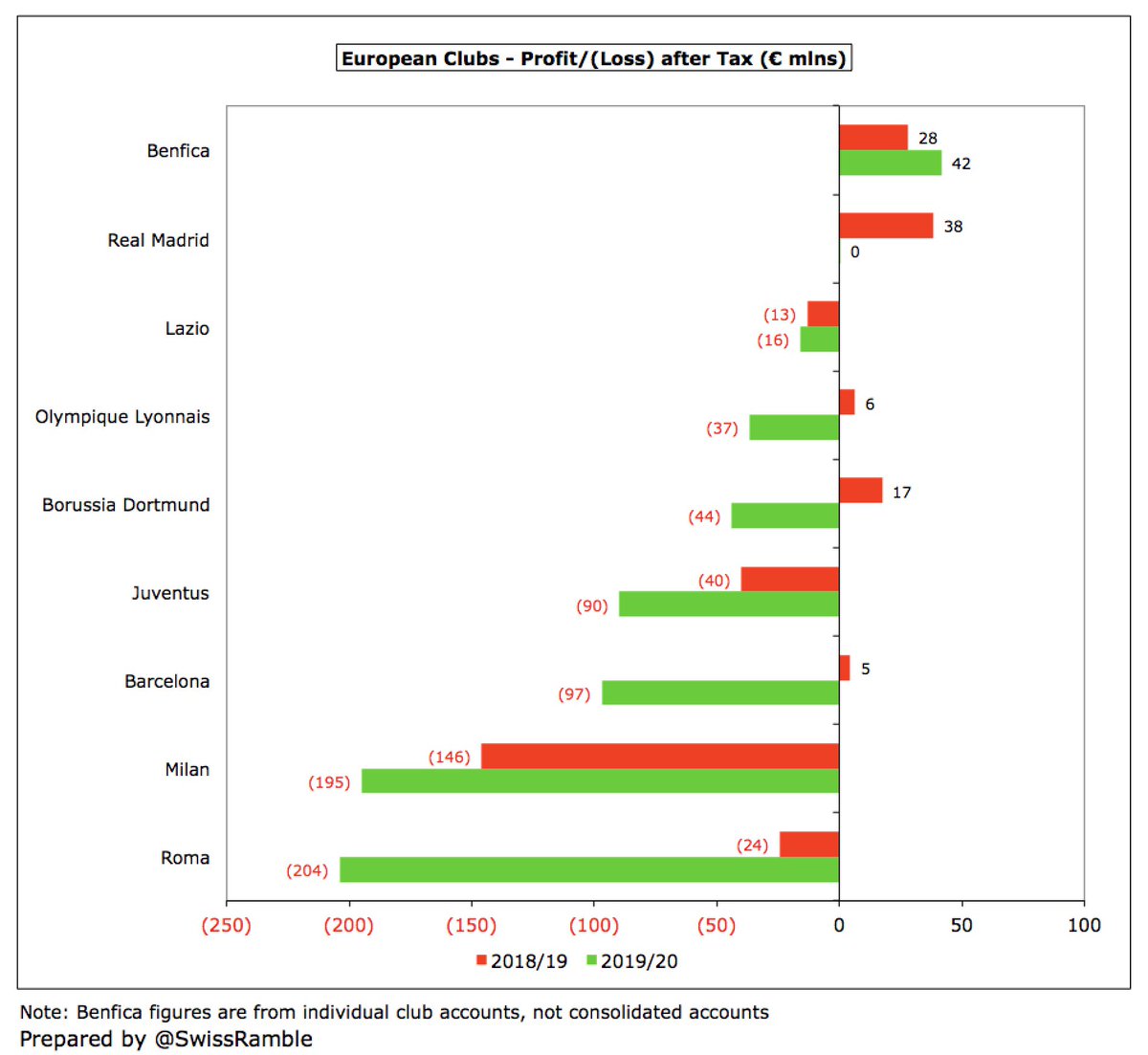

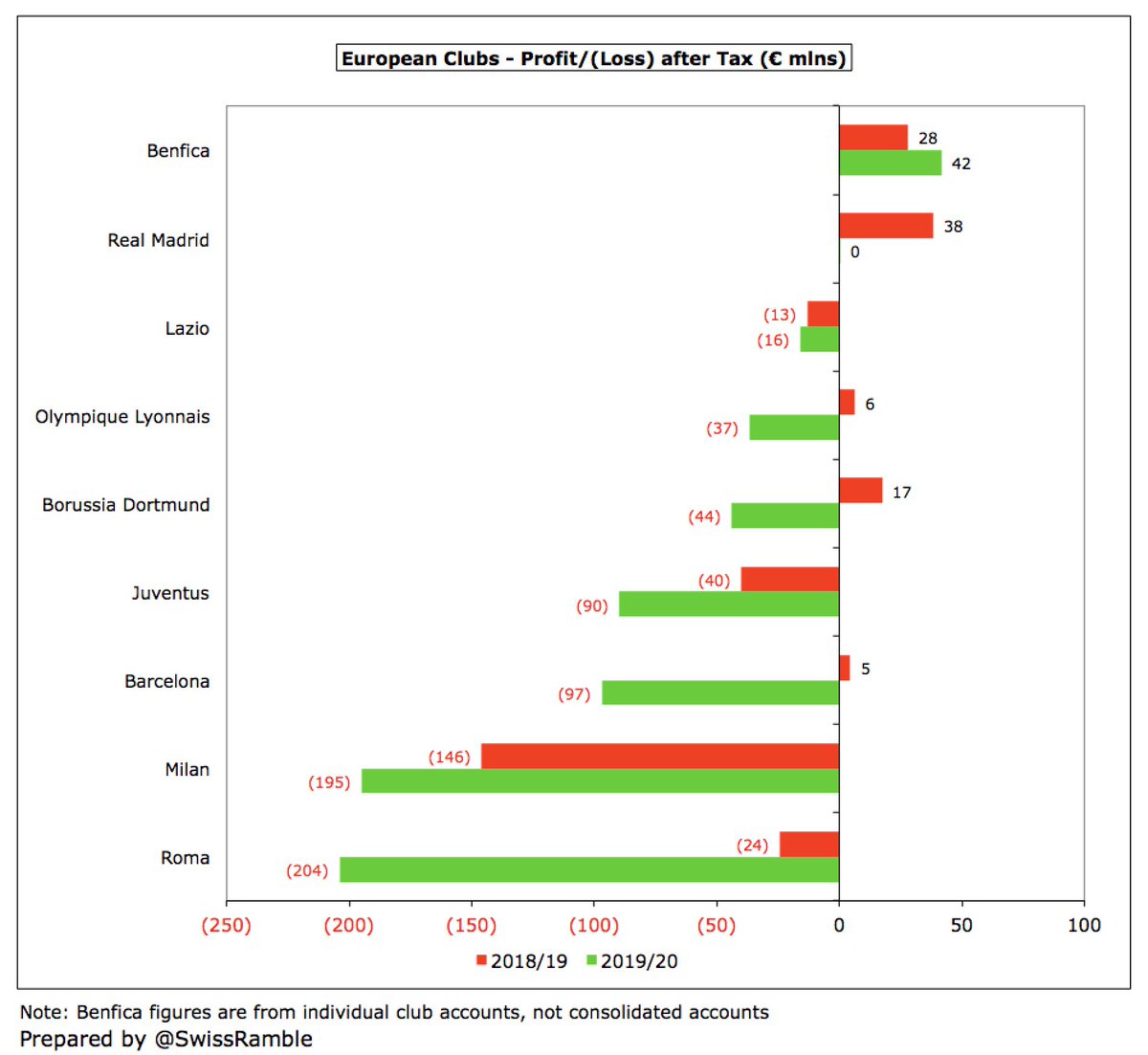

Although it’s early days in the reporting period for football club accounts from the extended 2019/20 season, we can already see the significant impact of the COVID-19 pandemic in a few selected announcements from some European clubs, which this thread will examine.

We have published accounts for #Juventus, #BVB, #TeamOL, #SSLazio and #Benfica, while #FCBarcelona have given an investor presentation and press releases have been issued by #RealMadrid, #Milan and #ASRoma (so we don’t have all figures from these 3 clubs).

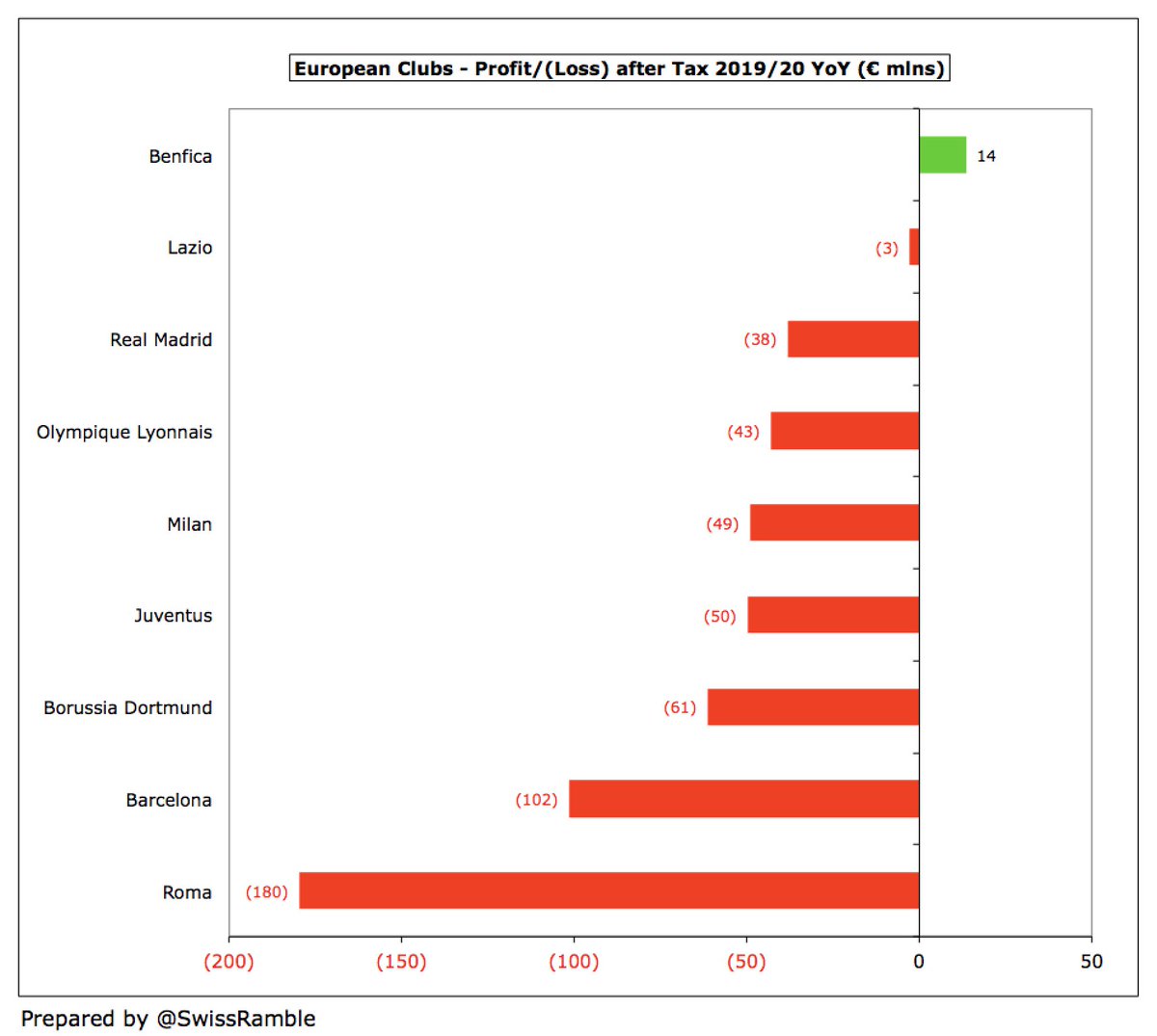

Although a large part of the 2019/20 season was completed before the lockdown, there has been a major adverse impact on these clubs’ accounts with massive losses being announced at #ASRoma €204m, #Milan €195m, #FCBarcelona €97m, #Juventus €90m, #BVB €44m and #TeamOL €37m.

#RealMadrid managed to still report a small €320k profit, but this was down from prior season’s €38m, while #SSLazio restricted their loss to “only” €16m (from €13m). #Benfica actually improved their profit from €28m to €42m, but only due to €126m profit from player sales.

Except #Benfica, all these clubs have suffered reductions in their bottom line, the largest being #ASRoma €180m, #FCBarcelona €102m and #BVB €61m. That said, some had already posted large losses pre-COVID, e.g. #Milan went from €146m to €195m #Juventus from €40m to €90m.

By my calculations, the #ASRoma €204m and #Milan €195m losses are the second and third highest losses ever in Italy, only surpassed by #Inter €207m in 2006/07. Not far behind largest ever loss of €219m by #MCFC in 2010/11.

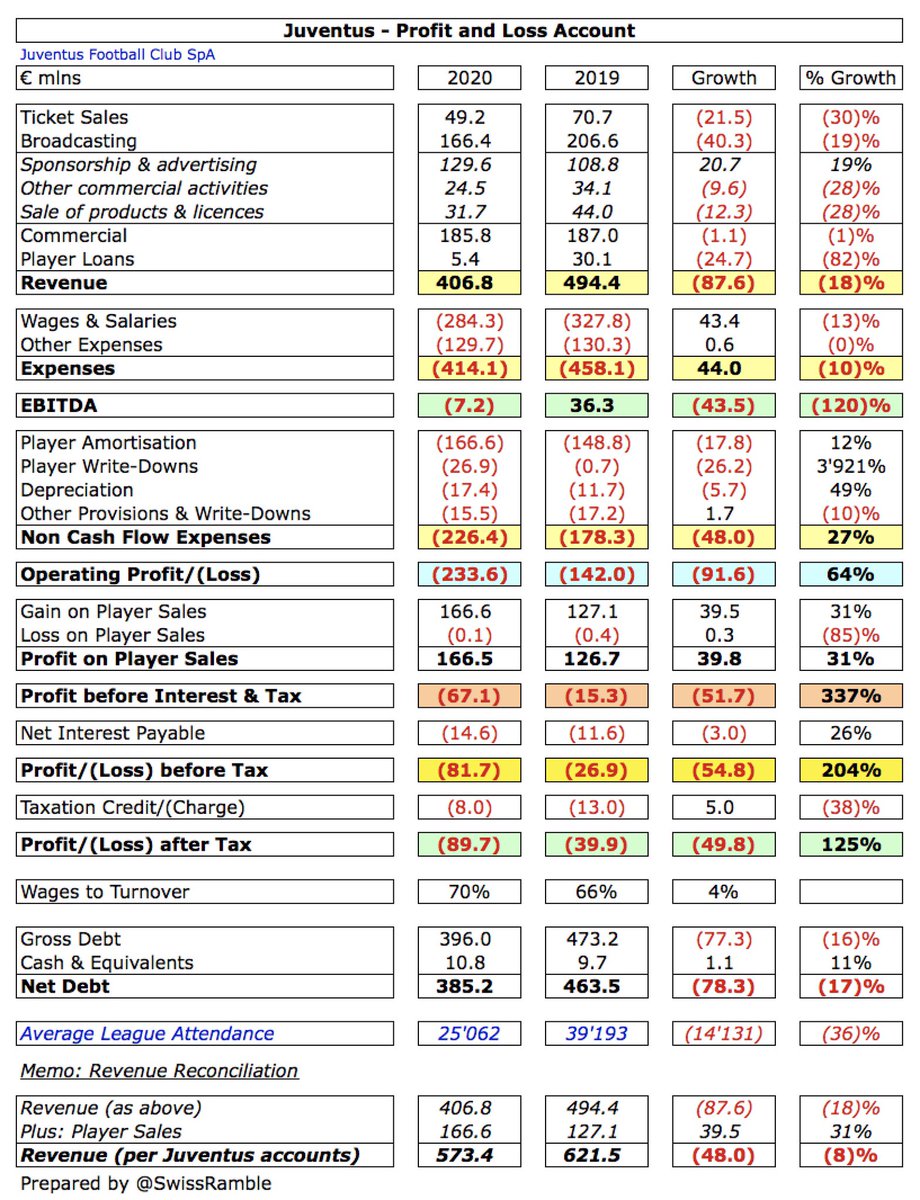

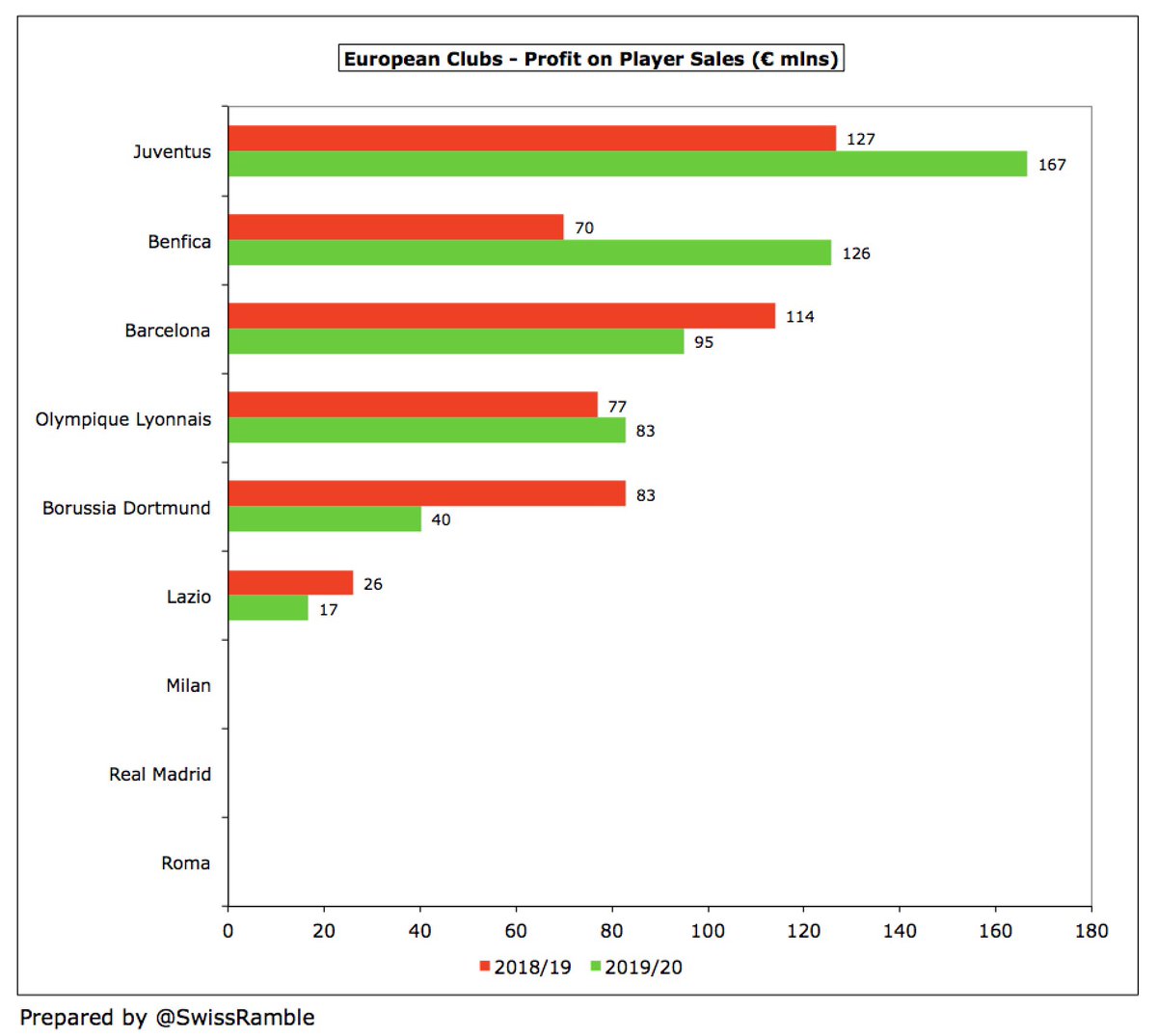

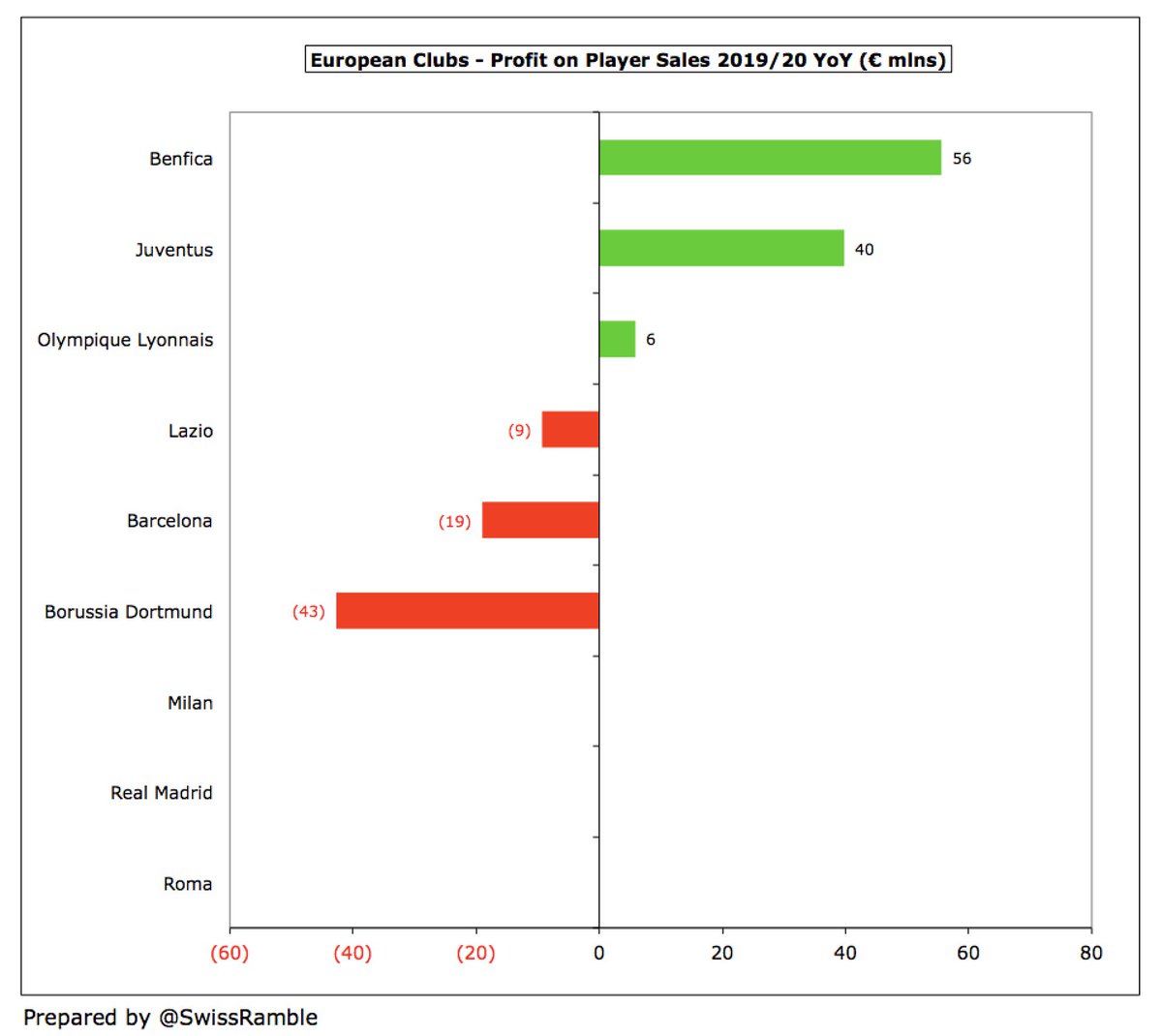

It is also worth noting that these terrible figures would have been even worse without some hefty profits on player sales, including #Juventus €167m (up from €127m), #Benfica €126m (up from €70m), #FCBarcelona €95m and #TeamOL €83m. However, #BVB fell from €83m to €40m.

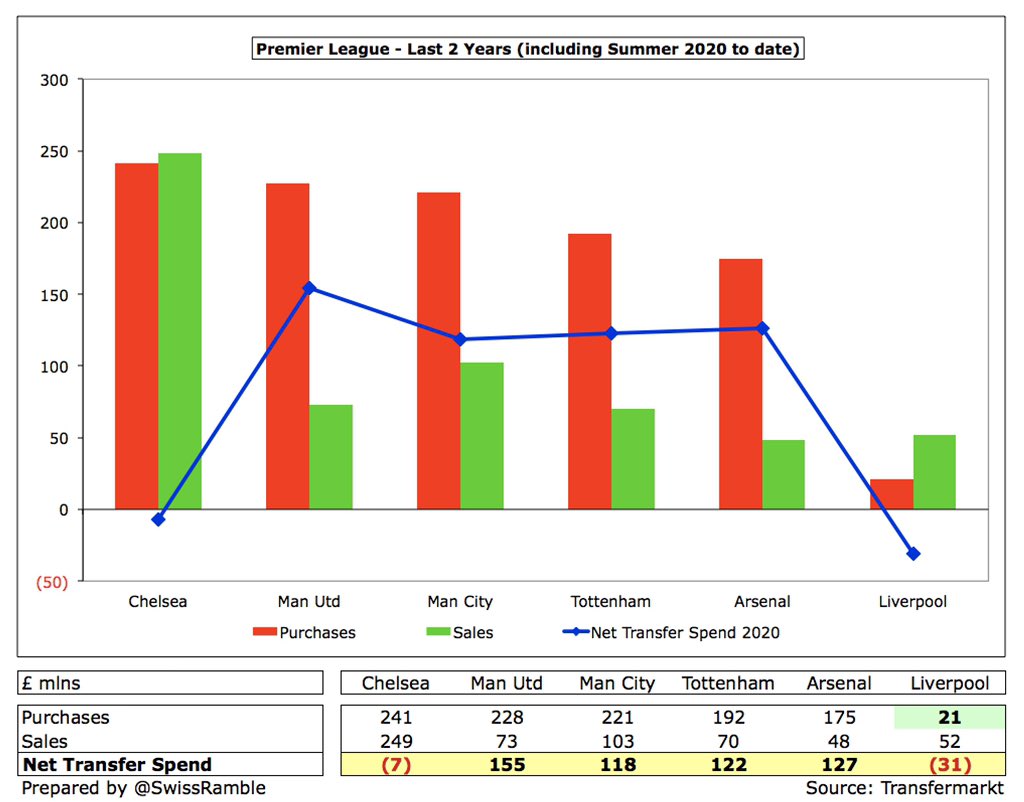

Most of these player sales were made before the pandemic struck, i.e. summer 2019 and January 2020. However, these profits are likely to be lower in the 2020/21 accounts, as the transfer market has been depressed this summer (with the exception of a few Premier League clubs).

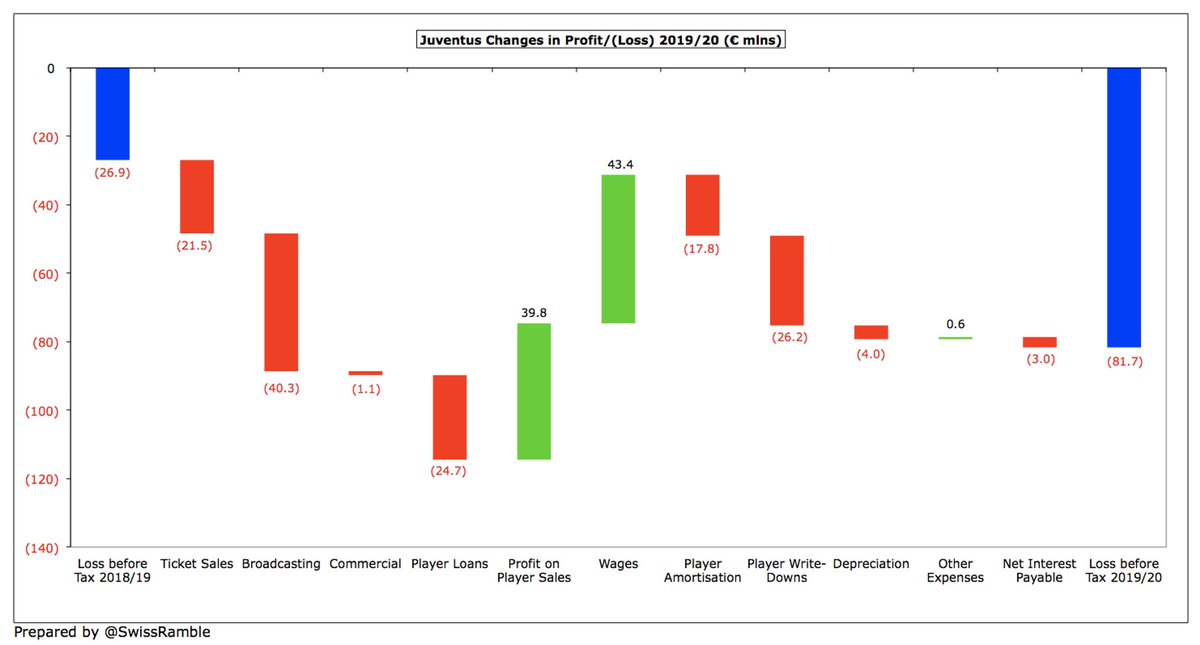

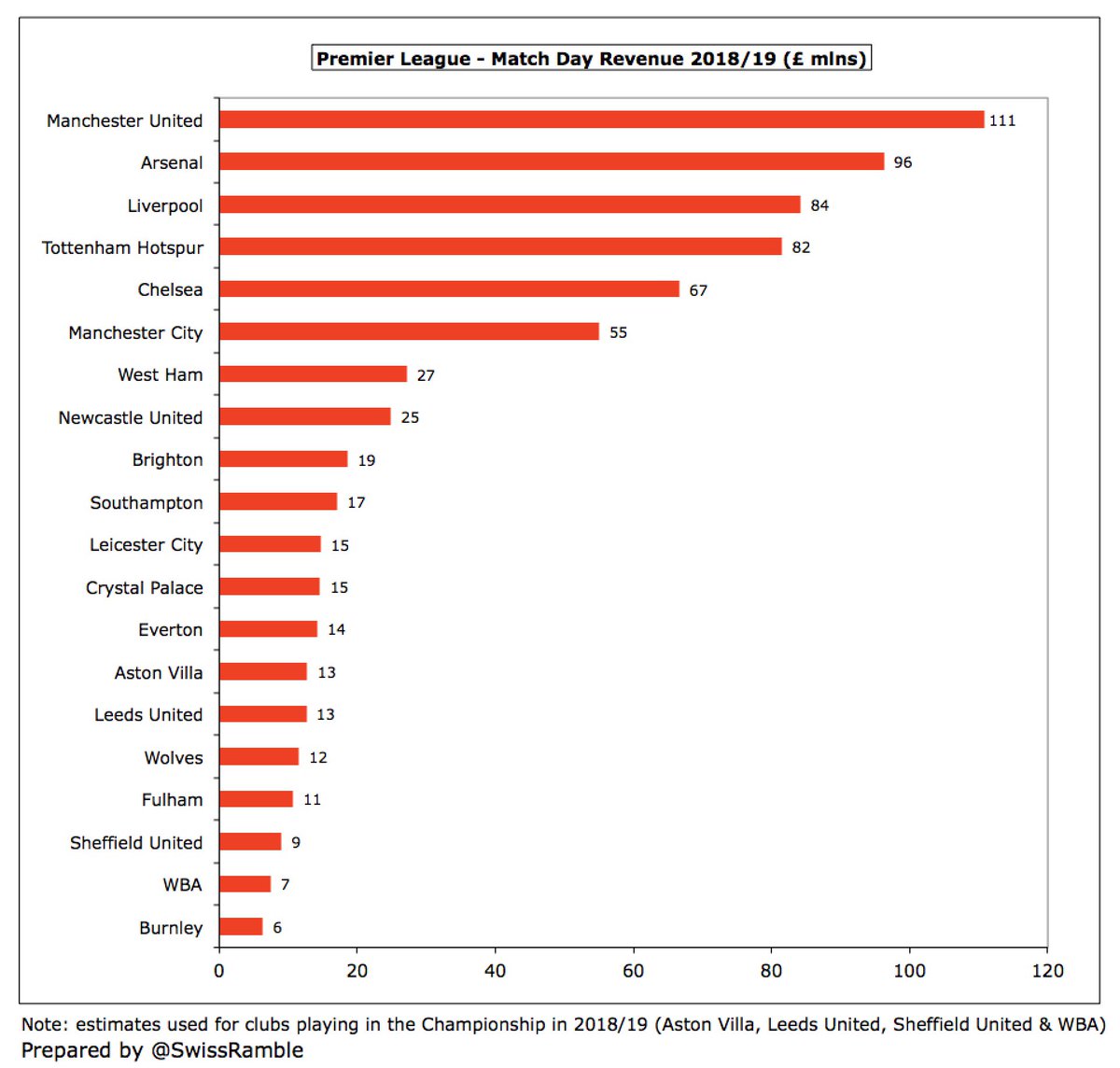

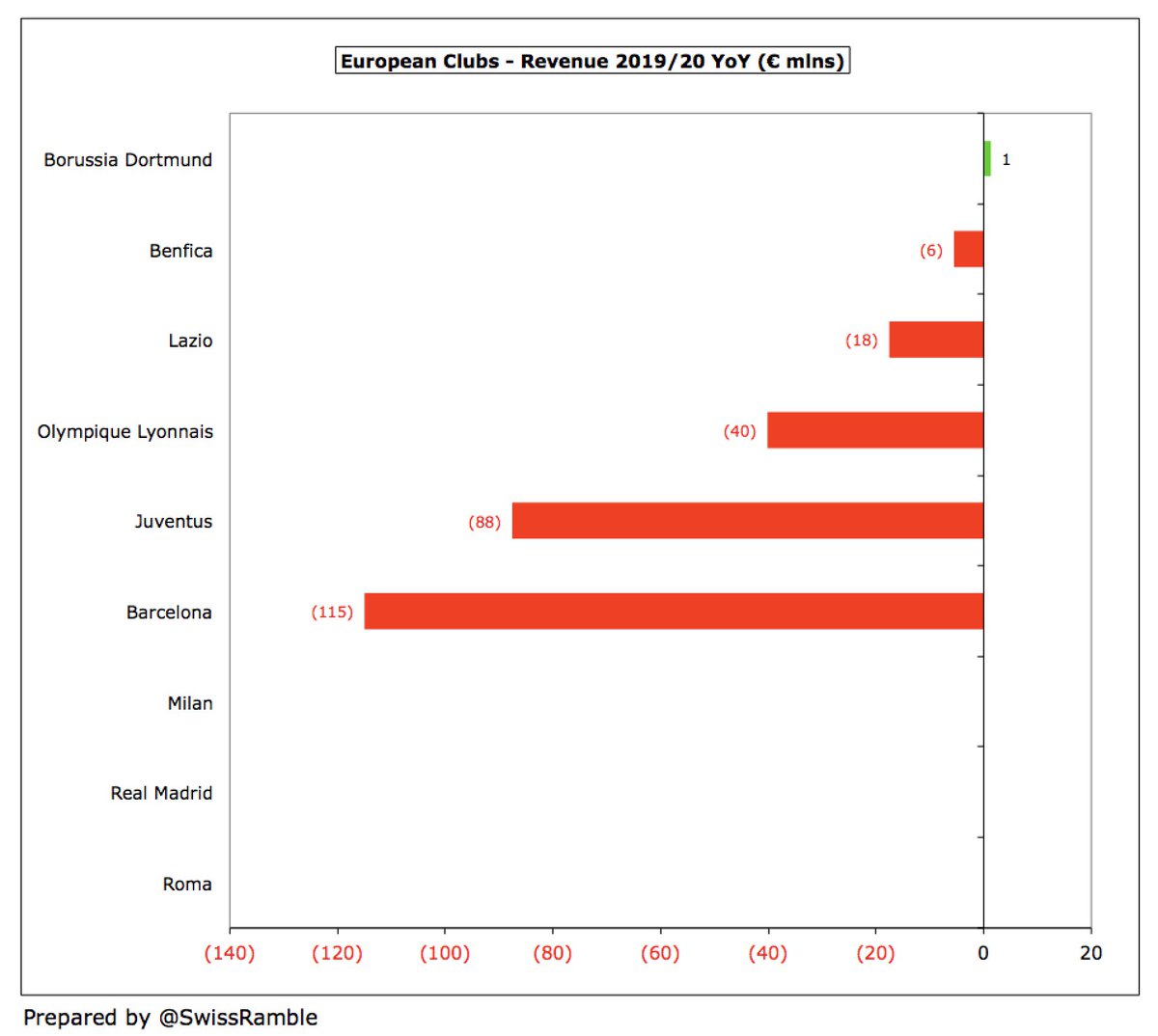

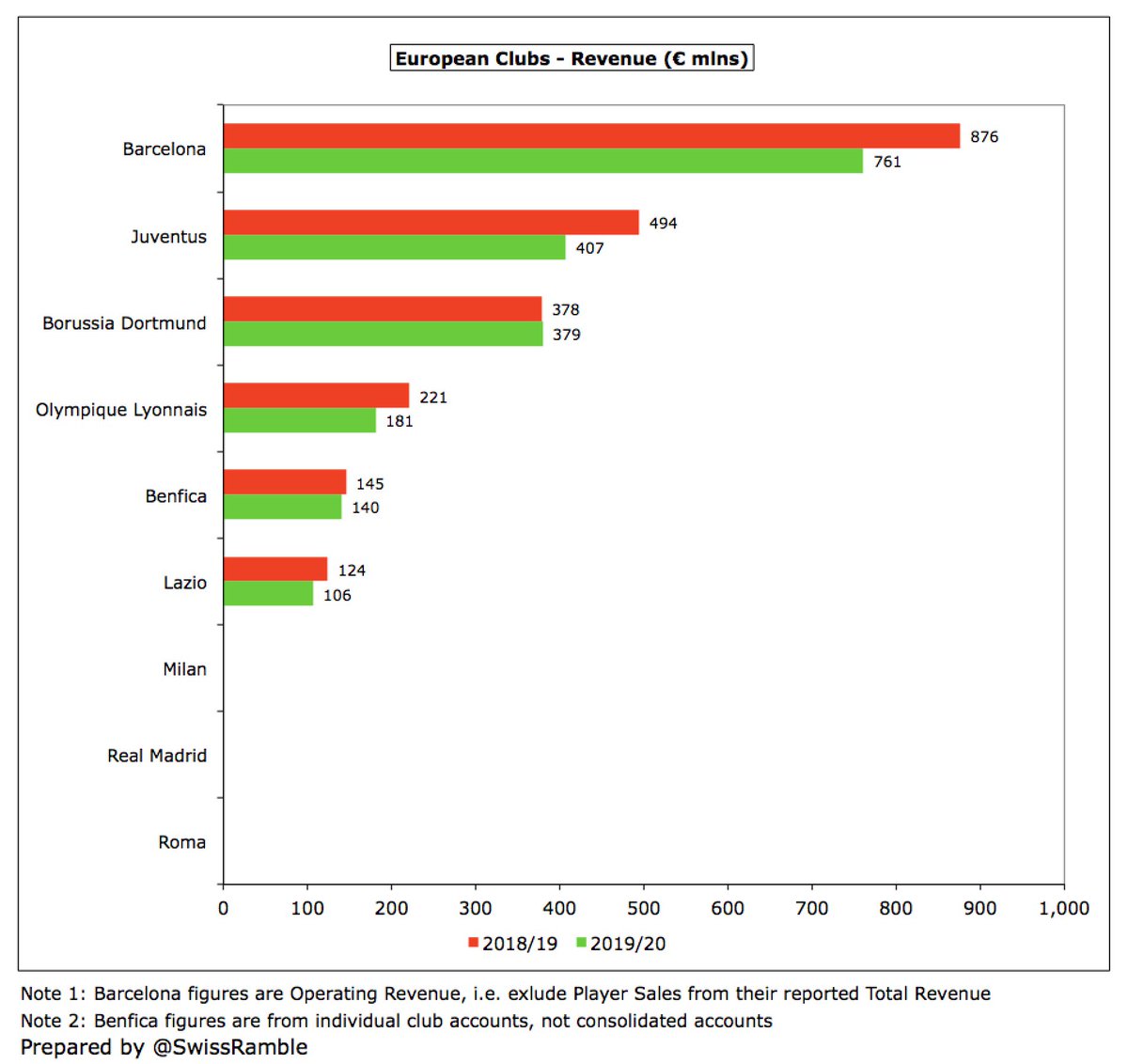

The pandemic has hit all revenue streams: match day (some games played behind closed doors), broadcasting (rebates to TV companies) and commercial (sponsorships and merchandising). Largest known revenue reductions were #FCBarcelona €115m, #Juventus €88m and #TeamOL €40m.

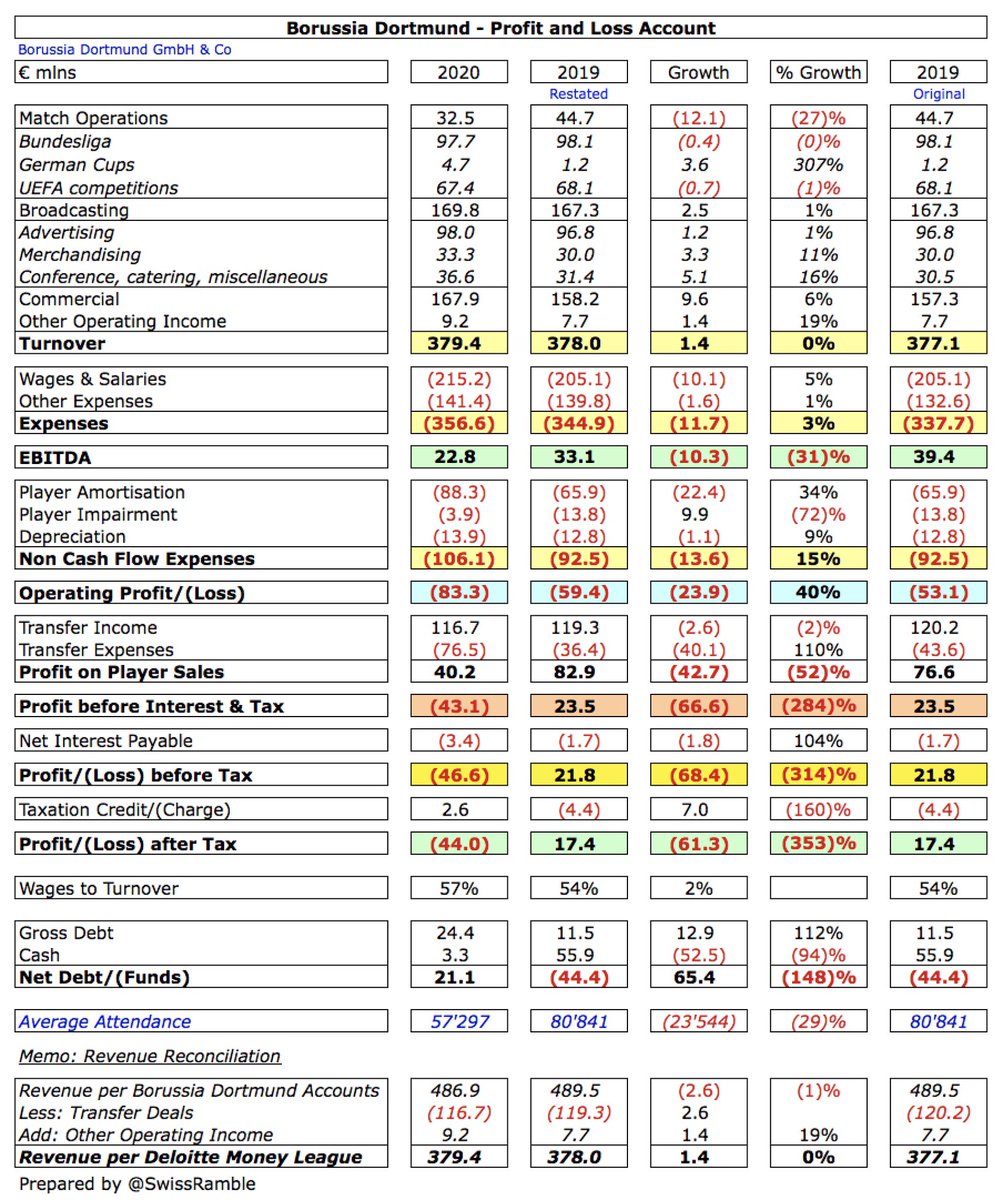

So #FCBarcelona revenue (excluding player sales) fell 13% from €876m to €761m, while #Juventus dropped 18% from €494m to €407m and #TeamOL 18% from €221m to €181m. #BVB revenue was flat at €379m, though growth was restricted by COVID.

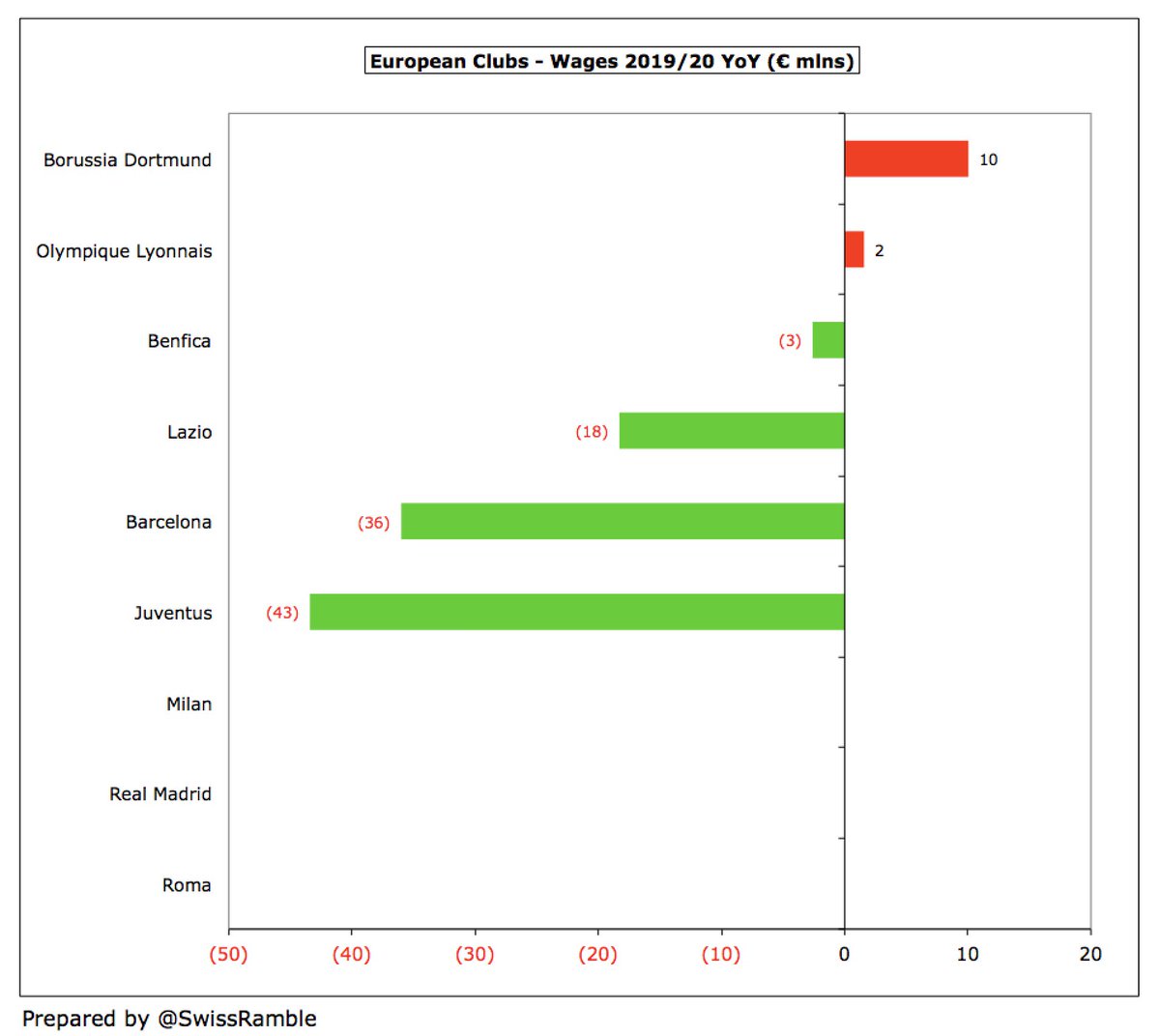

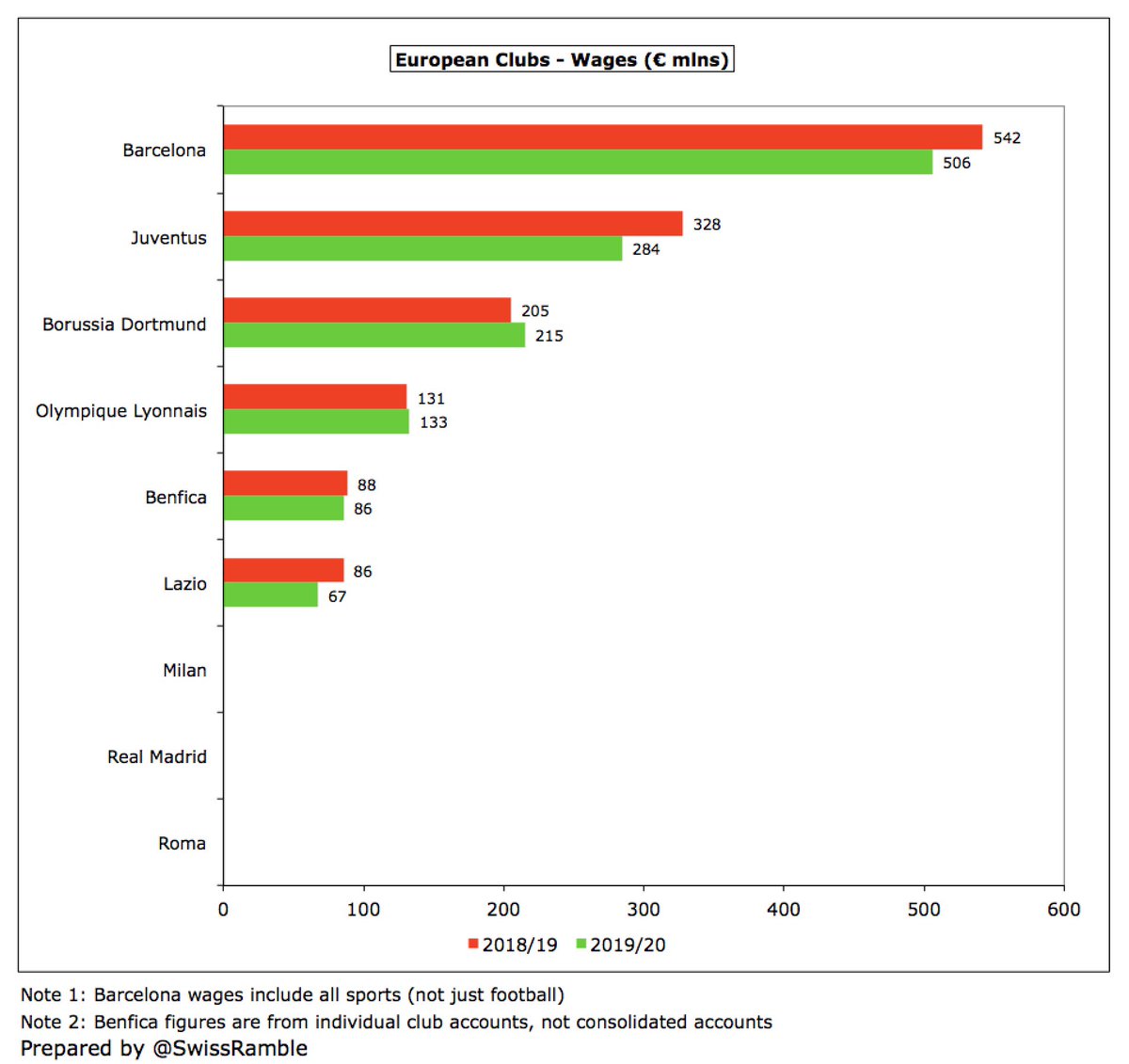

Some clubs have partially compensated for their revenue losses by reducing their wage bills, e.g. #Juventus €43m (four months salary not paid from May to June), #FCBarcelona €36m (70% cut during lockdown) and #SSLazio €18m (two months salary given up).

Of course, some of these wage bills are still very high, e.g. #FCBarcelona cut 7% from €542m to €506m (all sports, not just football), while #Juventus decreased 13% from €328m to €284m. #BVB and #TeamOL slightly rose, by 5% to €215m and 1% to €133m respectively.

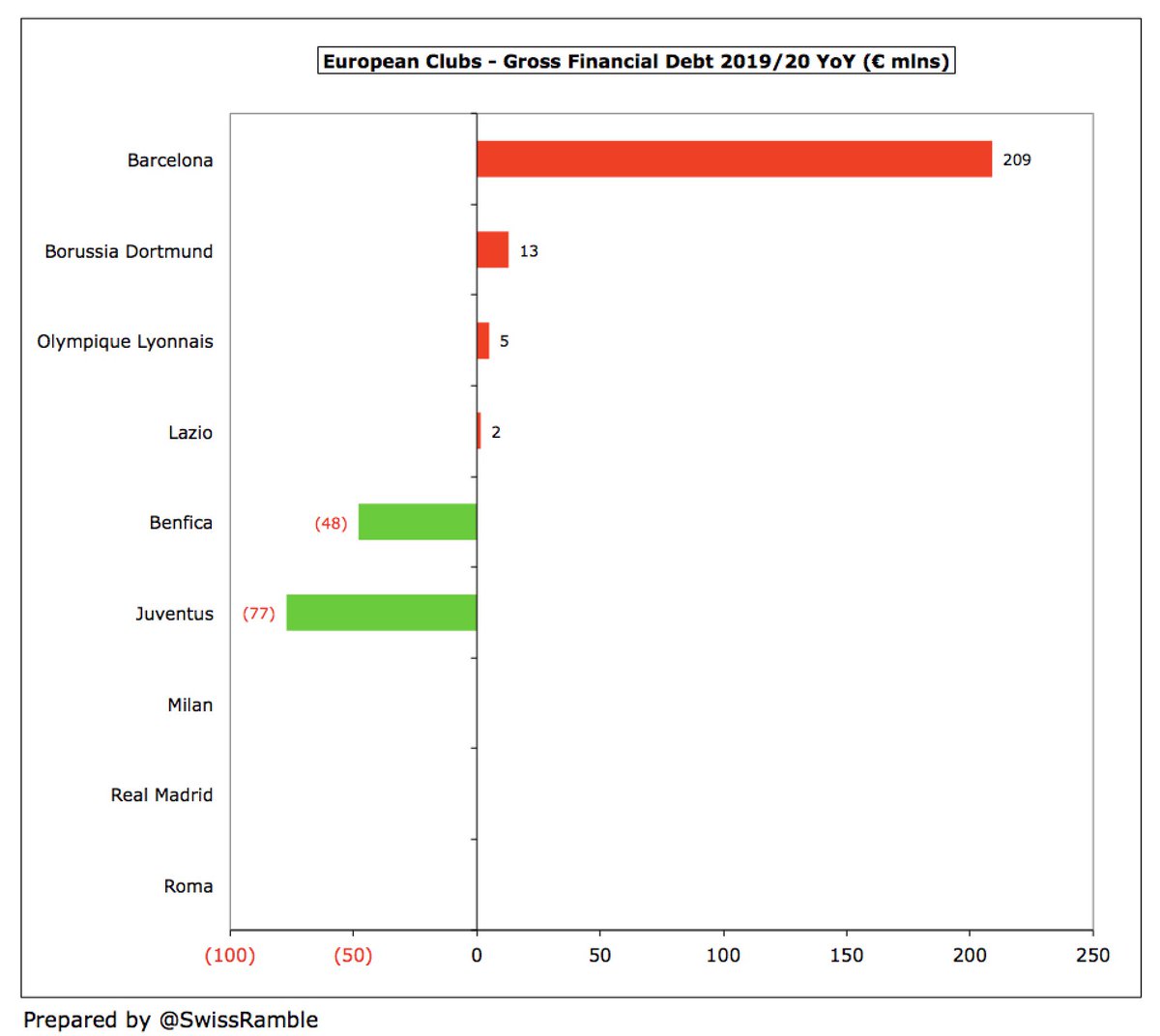

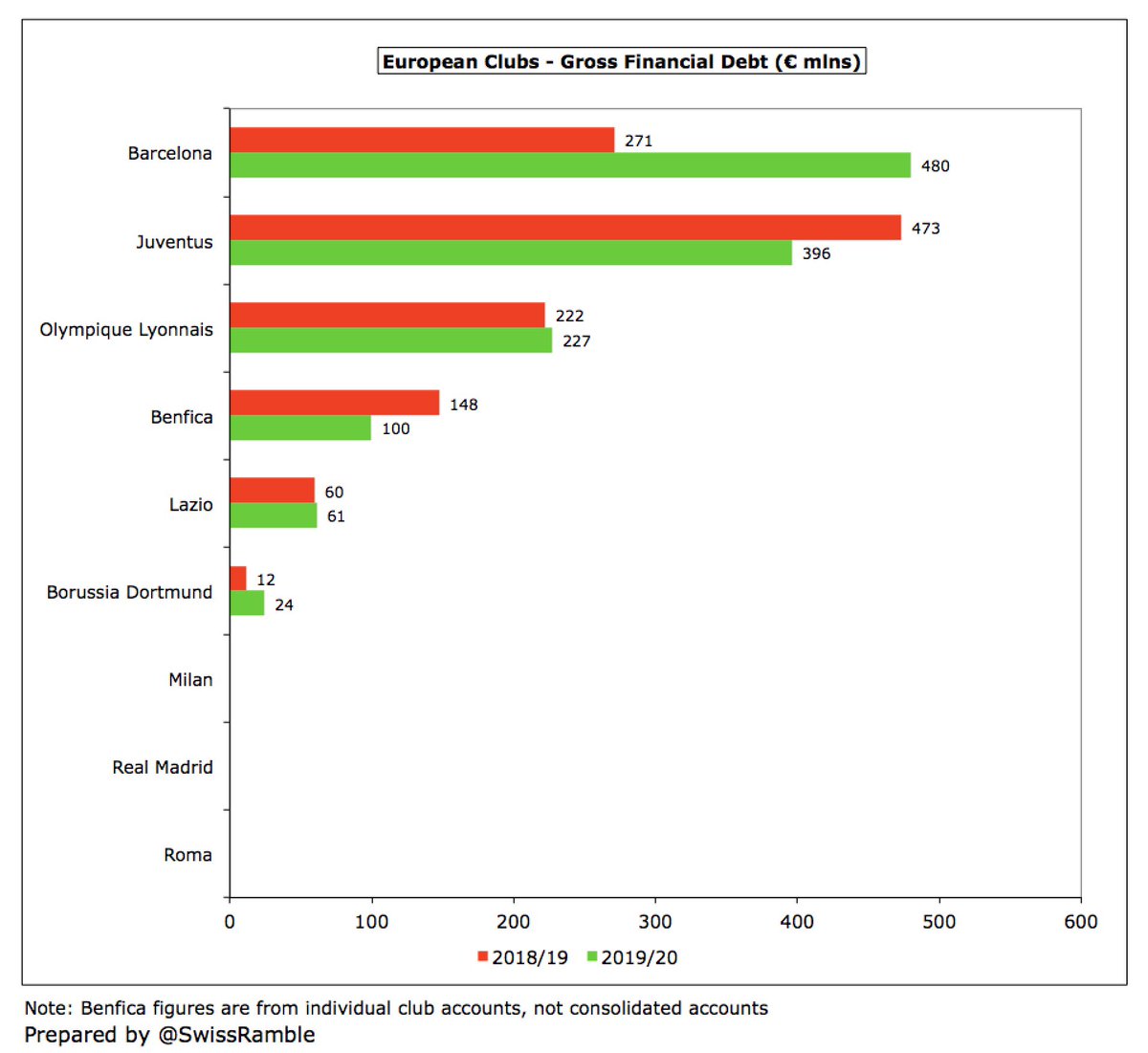

#FCBarcelona have had to increase their bank debt by €209m from €271m to €480m. #Juventus actually reduced their financial debt by €77m from €473m to €396m, but they did benefit from a massive €298m capital injection from their owners.

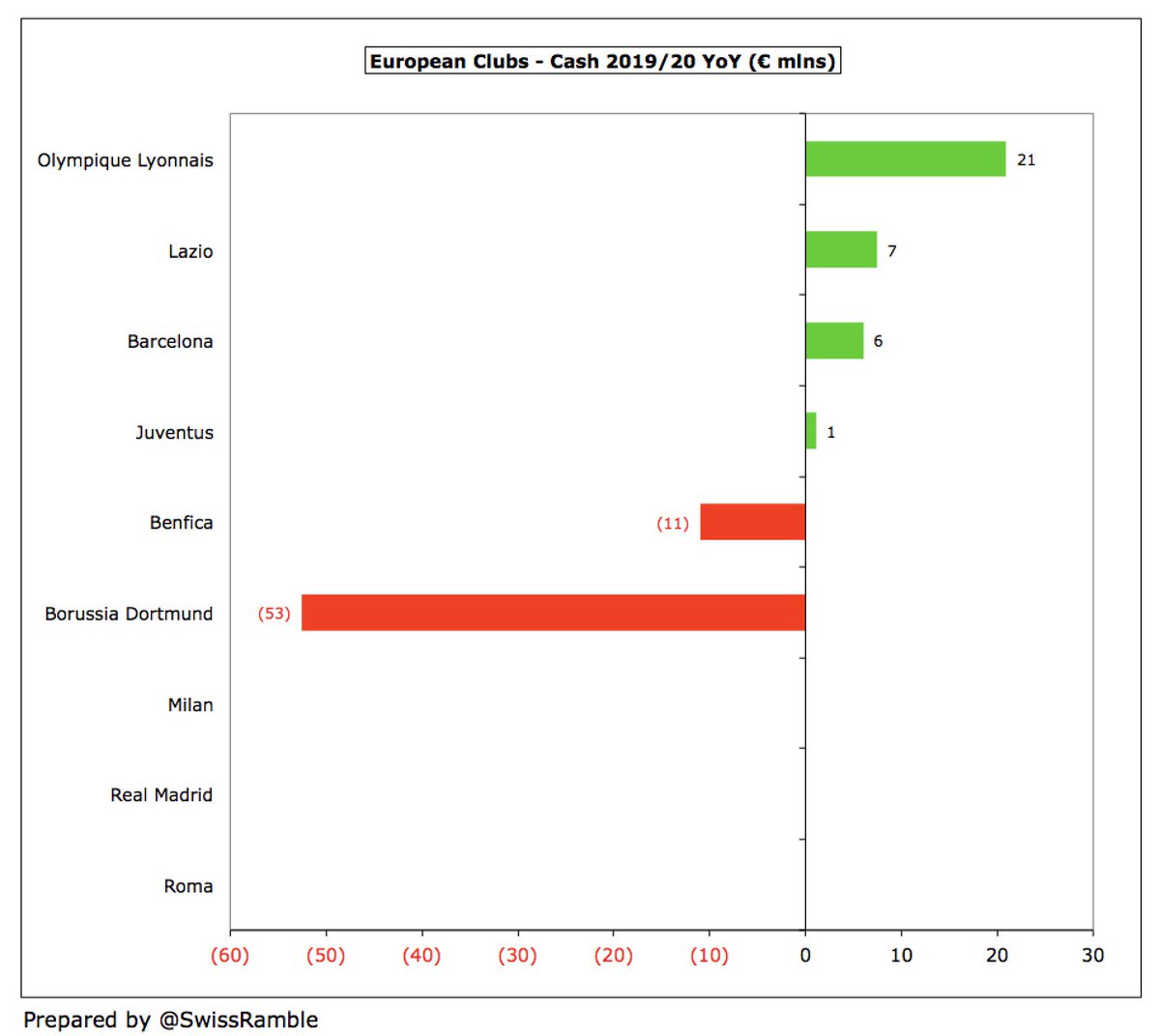

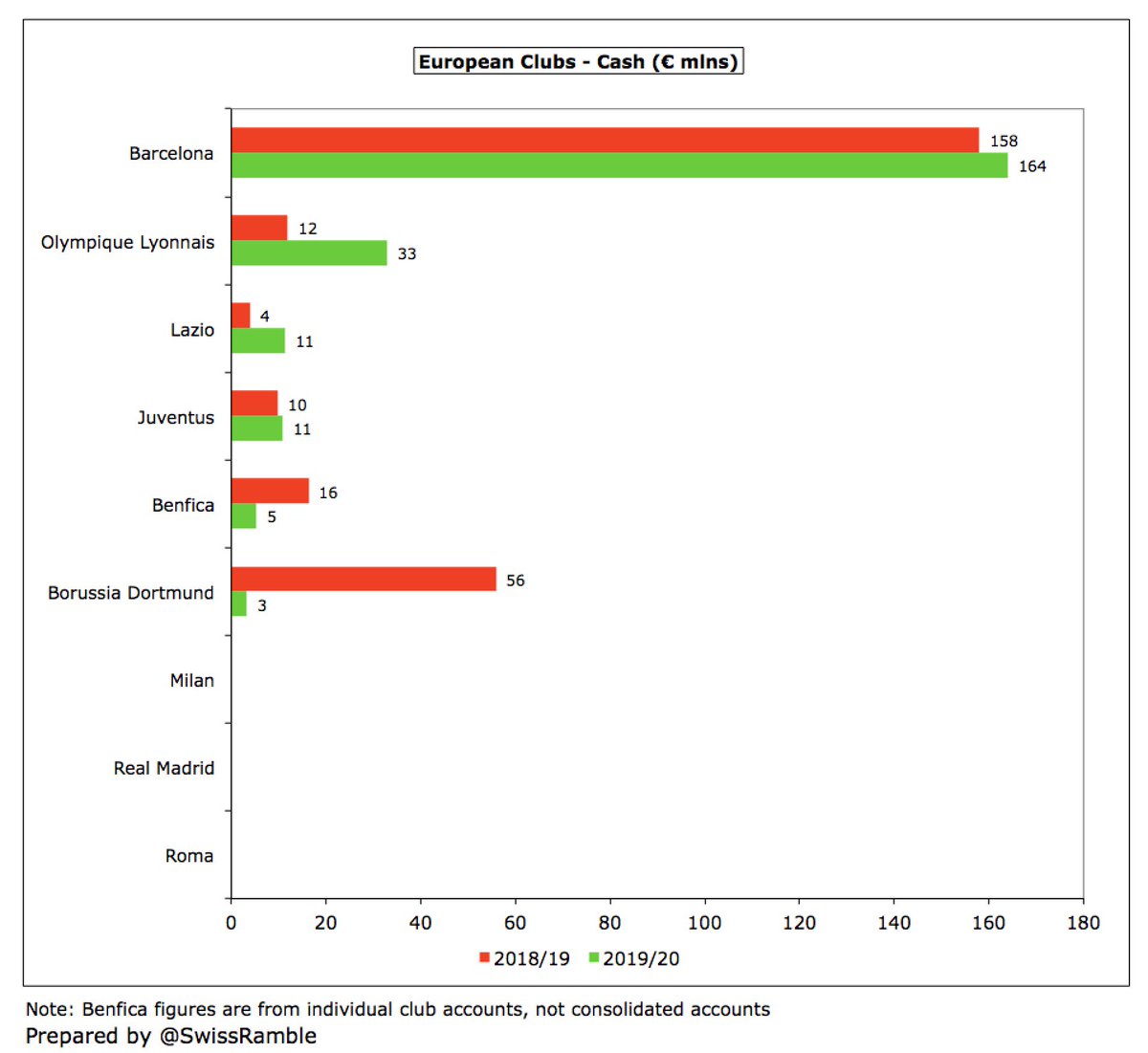

As at 30th June 2020, most clubs saw little impact on their cash balances, except #BVB who fell from €56m to €3m. However, with revenue so badly hit, many have had to address liquidity concerns since then, e.g. #TeamOL took out €93m government loan in July.

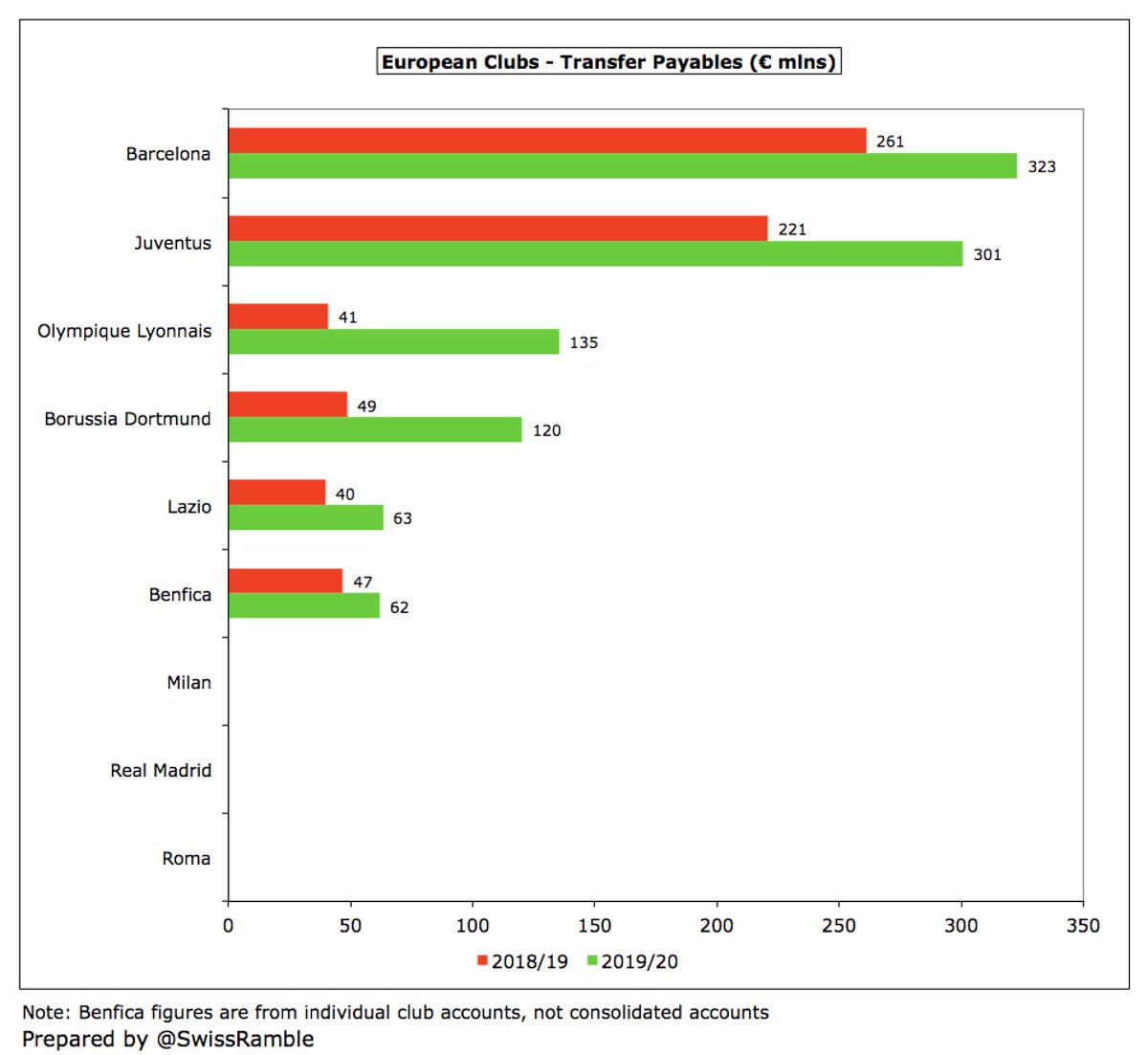

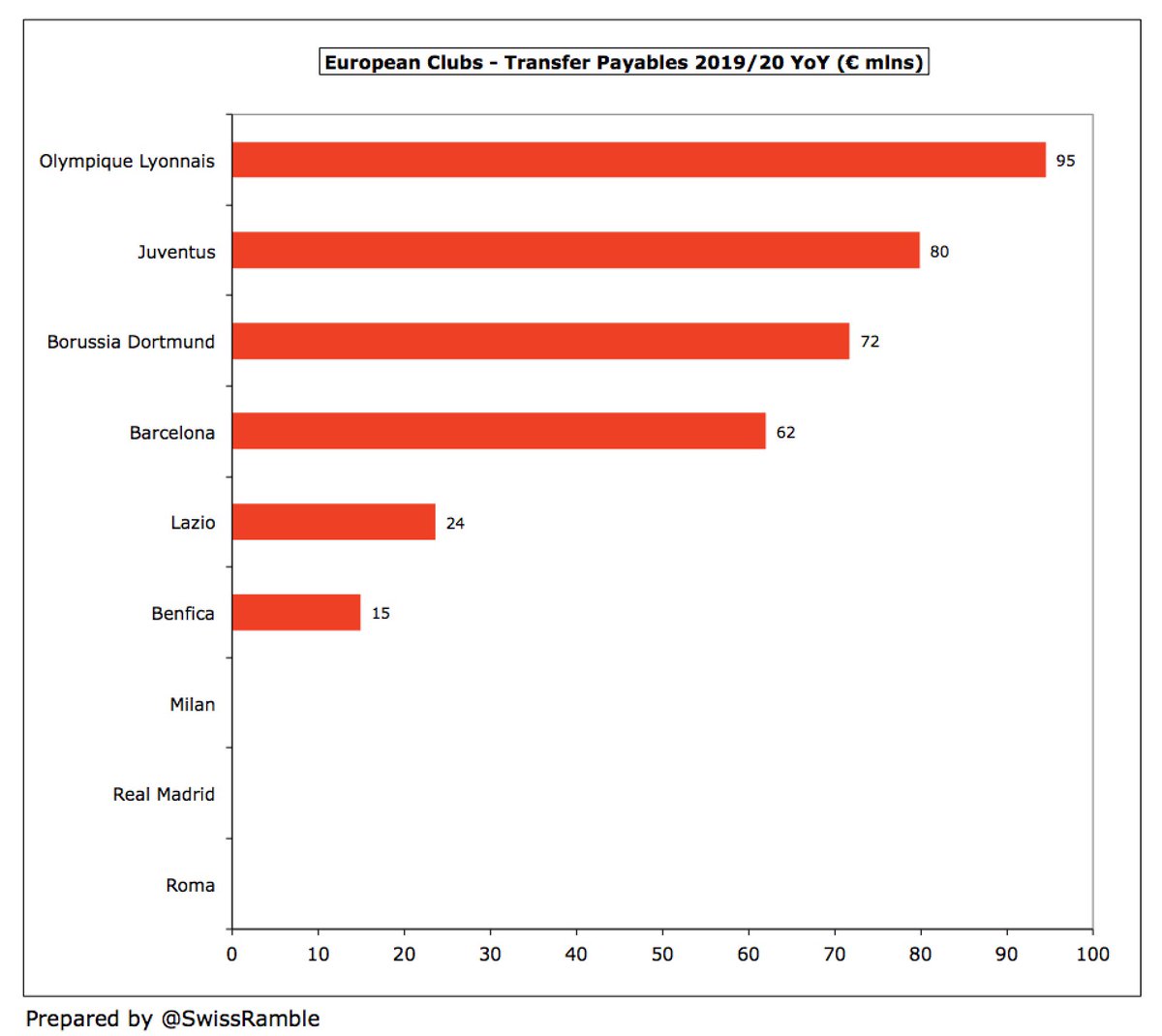

However, all clubs have increased their transfer debt, i.e. are making increasing use of paying transfers in instalments, especially #FCBarcelona up €62m to €323m, #Juventus up €80m to €301m, #TeamOL up €95m to €135m and #BVB up €72m to €120m.

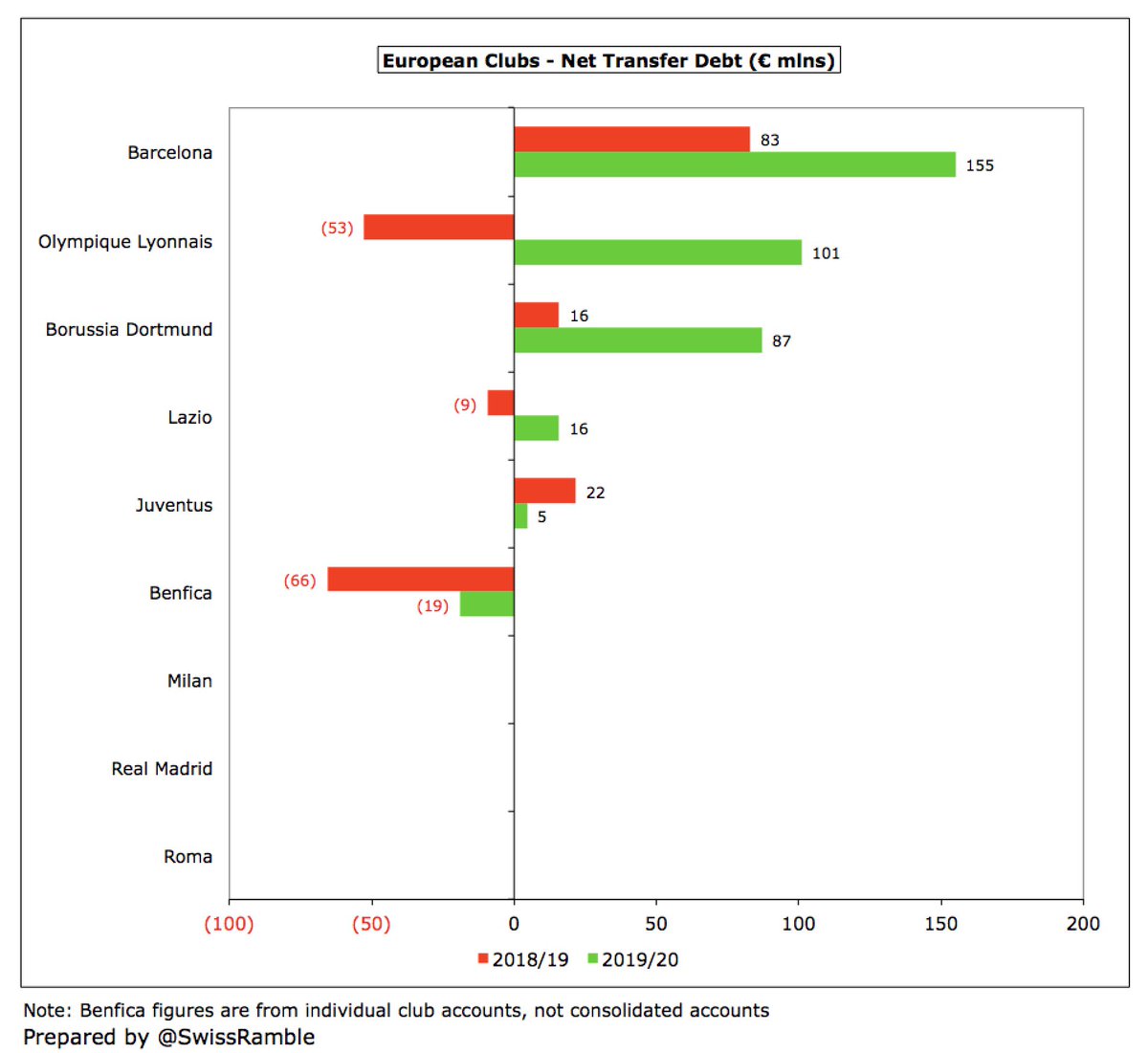

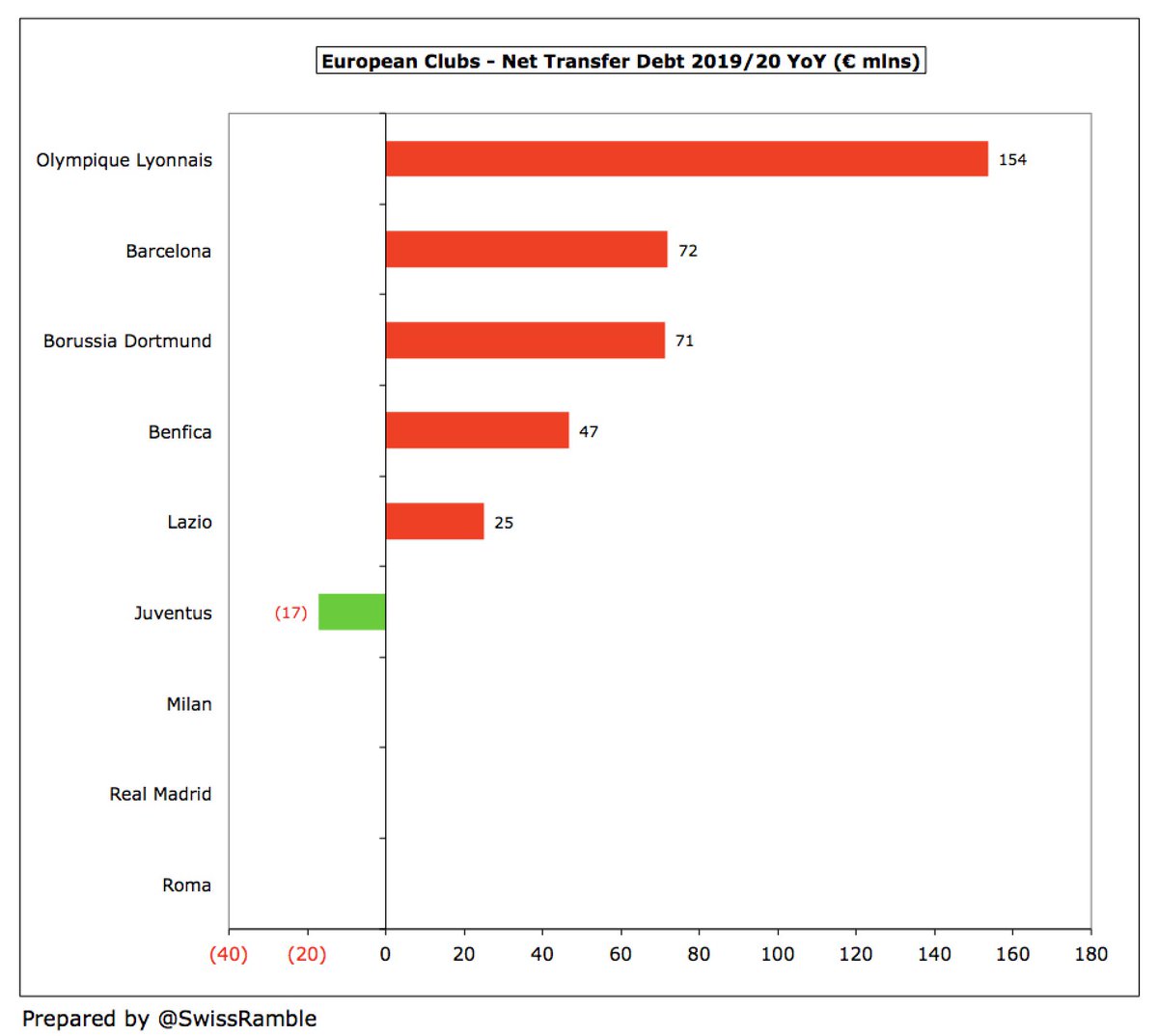

Of course, transfer dealings work both ways, so we should also look at net transfer debt, where largest amounts owed are #FCBarcelona €155m (up €72m), #TeamOL €101m (up €154m) and #BVB €87m (up €71m). #Juventus are owed €296m by others, so net debt down €17m to only €5m.

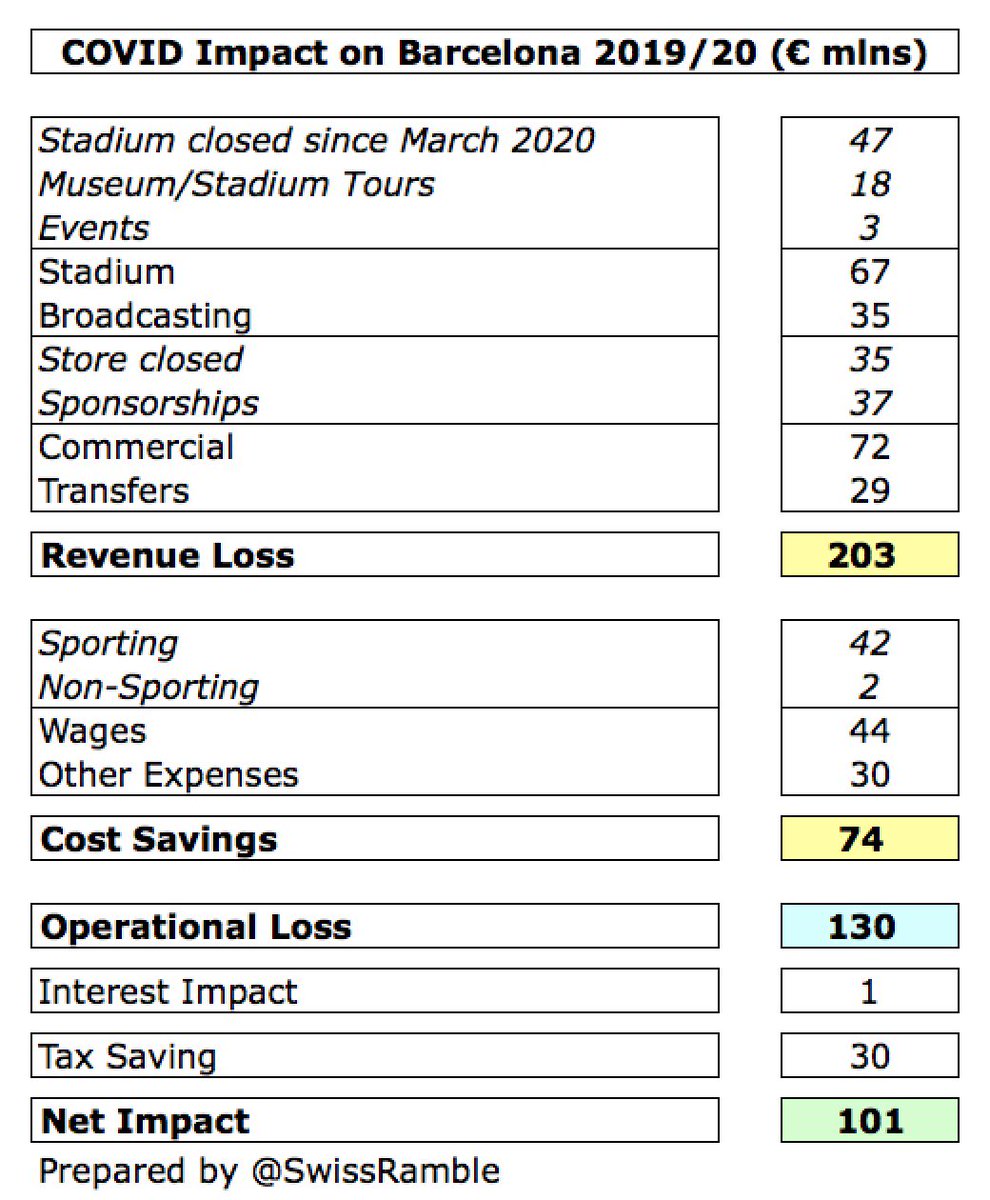

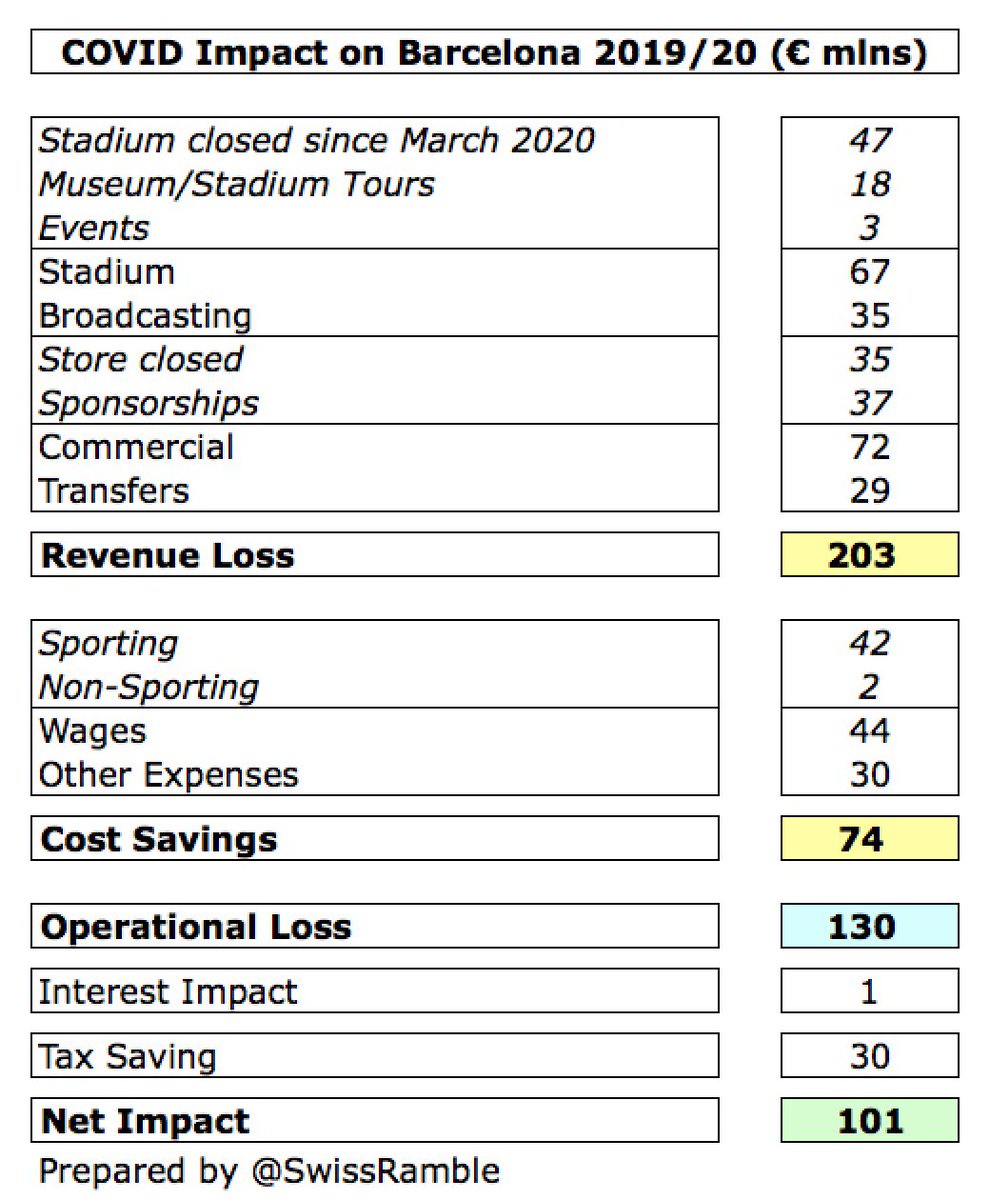

#FCBarcelona provided a detailed analysis of COVID impact, which has reduced net profit by €101m, comprising €203m revenue loss (stadium €67m, TV €35m, commercial €72m and transfers €29m), partially offset by €74m cost savings (wages €44m, other €30m) & €30m lower tax.

It’s obvious that clubs lose match day income when playing games behind closed doors, but what is perhaps more revealing is the substantial reduction in commercial revenue via reduced sponsorship and lower retail sales. If that’s the case at #FCBarcelona, what about others?

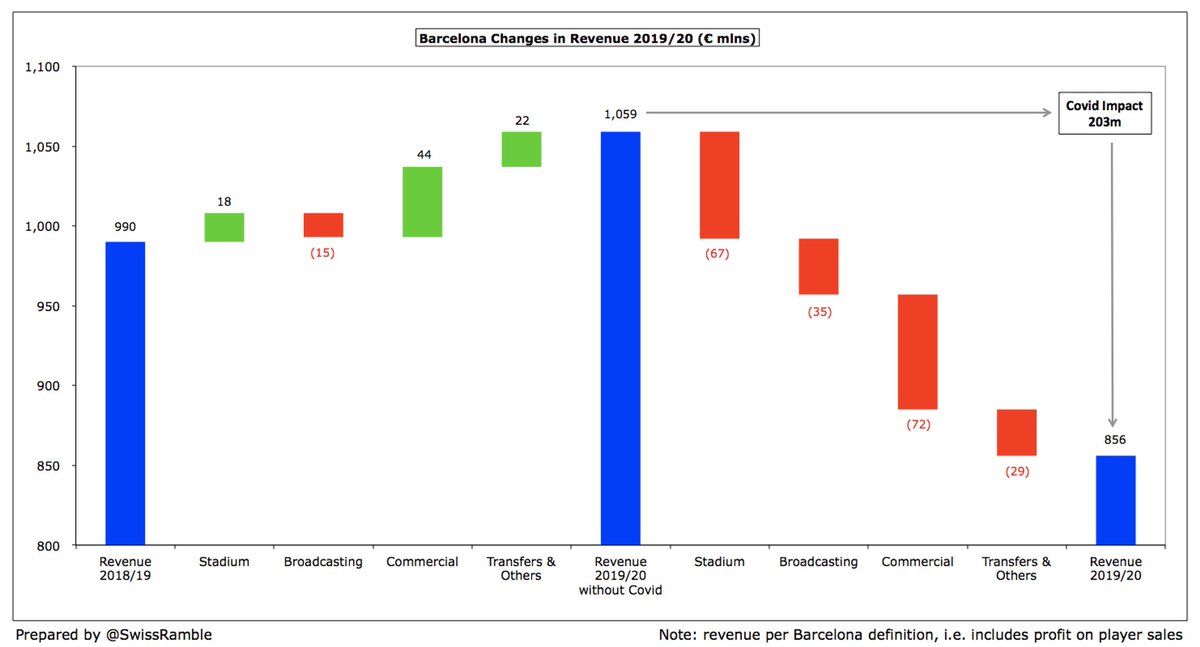

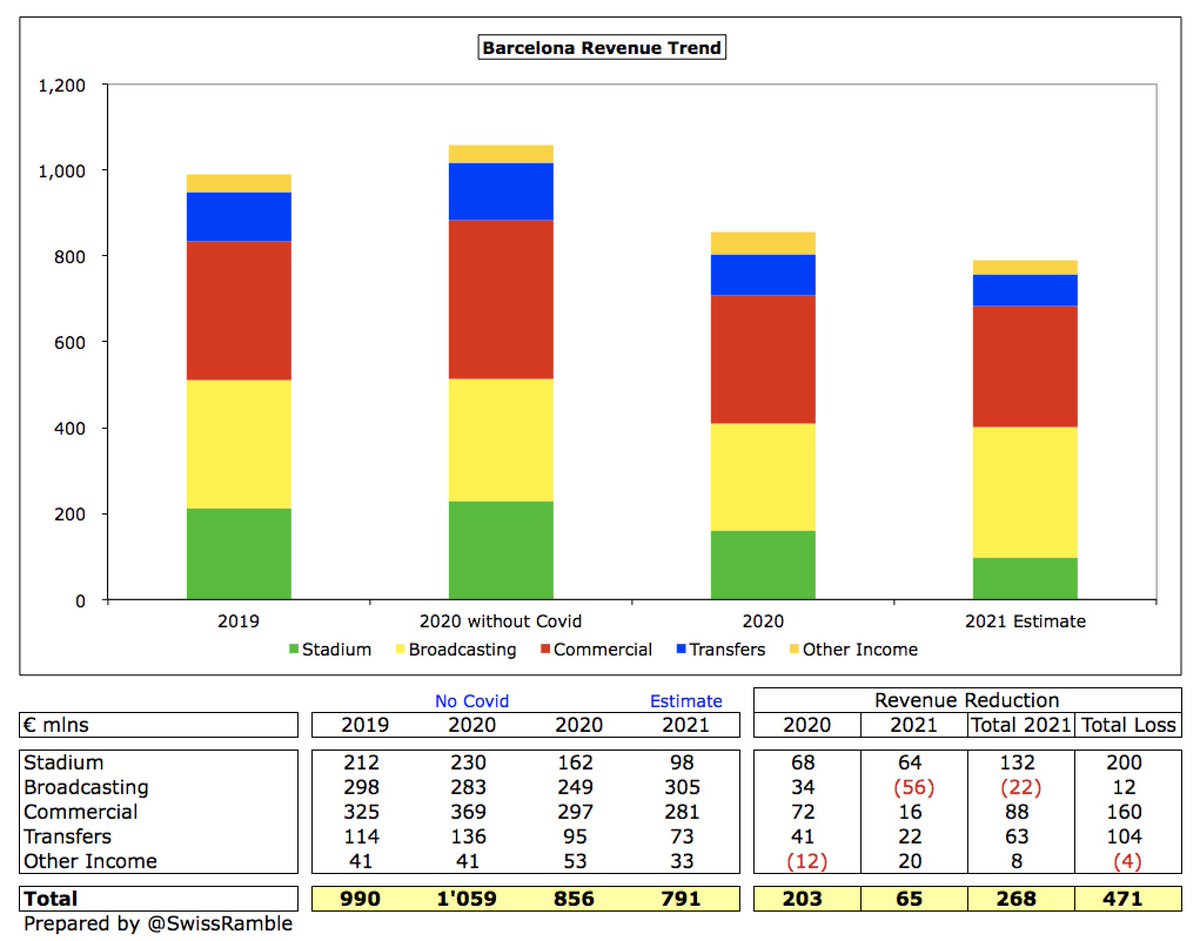

#FCBarcelona were keen to emphasise that without COVID they would have achieved their objective of reaching €1 bln revenue (including player sales) in 2019/20, i.e. growing €69m from €990m to €1,059m. However, the pandemic caused a €203m loss, reducing revenue to €856m.

#FCBarcelona have estimated a further €65m reduction in revenue in 2020/21 from €856m to €791m, partly mitigated by including TV money for 2019/20 competitions completed in July and August. That would mean a total revenue loss of nearly half a billion (€471m) over two years.

Clearly, football clubs are suffering from the impact of the pandemic. This is only a small sample, but it is a sign of things to come at every club, namely large revenue reductions, partly mitigated by cost savings, covered by taking on more debt or capital put in by owners.

• • •

Missing some Tweet in this thread? You can try to

force a refresh