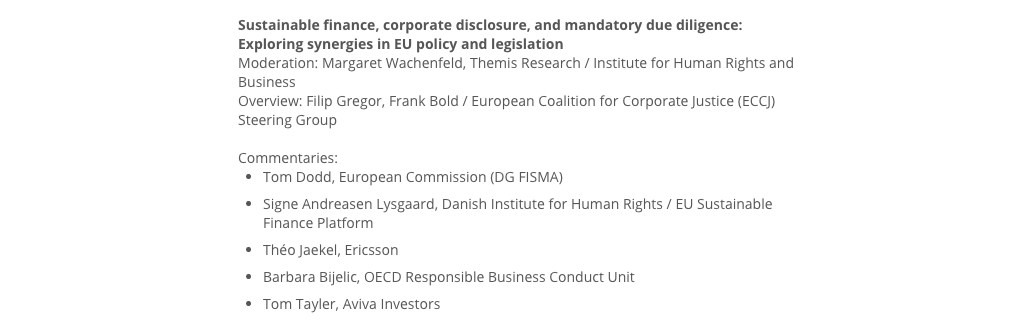

Filip Gregor will be providing an overview at a session co-organised by @ShareAction @BHRRC @Global_Witness @InvestforRights & @purposeofcorp

Looking forward to the commentaries of @EU_Finance, @Lysgaard_Signe @ericsson @barbara_bijelic & @thomasoftayler

#ERIN2020

Looking forward to the commentaries of @EU_Finance, @Lysgaard_Signe @ericsson @barbara_bijelic & @thomasoftayler

#ERIN2020

For those that are not able to follow the event live, a recording will be made available in ERIN's platform erin2020.pathable.co

#ERIN2020 @ShareAction

#ERIN2020 @ShareAction

“One ring that binds them all” - @MWachenfeld @ThemisResearch refering to the #sustainablefinance, corporate #sustainability disclosure, and mandatory #due diligence. Where are the gaps & synergies?

#ERIN2020

#ERIN2020

⬆️ Filip Gregor (@purposeofcorp @ECCJcorpjust & member of @EFRAG_Org reporting lab): All of the initiatives are framed by European #GreenDeal, incl. key EU objectives to reduce GHG #emissions, achieve #netzero carbon emissions by 2050 & ensure proper reallocation of capital

⬆️"Corporate disclosure (EU Non-Financial Reporting Directive) is meant to provide info to allow understanding on how companies implement #HRDD, and greatly influences how stakeholders (incl investors and affected people) are able to hold the company to account #ERIN2020

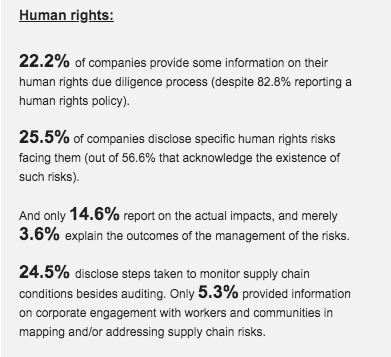

⬆️Filip highlights findings of our analysis on 1000 EU companies disclosures: "even if a majority of companies disclose a #humanrights policy, about 1 in 5 provide details of their HRDD process" bit.ly/2CPk18l

Event @BHRRC @Global_Witness @InvestforRights & @ShareAction

Event @BHRRC @Global_Witness @InvestforRights & @ShareAction

Thomas Dodd @EU_Finance announces at #ERIN2020 conference that the #EU Non-Financial Reporting reform proposal will be published in March 2021 with the renewed strategy on #sustainablefinance

@WWFEU @CDSBglobal @su_draeger @richardhowitt

@WWFEU @CDSBglobal @su_draeger @richardhowitt

Dodd refers to 3 key legislations that @EU_Finance is working to ensure alignment:

- Sustainability Taxonomy

- Disclosure Regulation (Financial Market participants)

- forthcoming proposals on sustainable #corporategovernance and #duediligence

- Sustainability Taxonomy

- Disclosure Regulation (Financial Market participants)

- forthcoming proposals on sustainable #corporategovernance and #duediligence

⬆️ T.Dodd "The alignment with Taxonomy and Disclosure Regulation will be relatively easy, they are out already. Alignment with sustainable #corpgov is challenging, because the proposal will come later - there is close cooperation with @EU_Justice"

@TJess1 @KateLLevick

@TJess1 @KateLLevick

Our key takeaways from @EU_Finance intervention at #ERIN2020

1⃣All disclosure/transparency requirements for sustainable corpgov should be concentrated in the NFR. There shouldn't be concurring reporting obligations

1⃣All disclosure/transparency requirements for sustainable corpgov should be concentrated in the NFR. There shouldn't be concurring reporting obligations

2⃣There is no doubt that mandatory EU reporting standards will be necessary. Pending agreement with co-legislators. We gave a mandate to @EFRAG_Org to start preparatory work.

3⃣@EFRAG_org taskforce is looking into how NFR reform can contribute to #duediligence (through NFR standards) and will make recommendations on this issue. They're also looking on how to operationalise #doublemateriality perspective

.@Lysgaard_Signe @humanrightsDK on #sustainablefinance legislation: Introducing both sticks and carrots. It's about mobilising the force of #finance to support good business practices

#ERIN2020

#ERIN2020

.@barbara_bijelic (@OECD) at #ERIN2020: Even before the EU started the #SustainableFinance strategy, investors were calling for similar measures. Now investors have their own expectations on #reporting. More alignment is needed in the words we're using in different regulations

Théo Jaekel from @ericsson at #ERIN2020 speaks about the companies problems → too many rating agencies, too many methodologies. There's a need for common standards.

• • •

Missing some Tweet in this thread? You can try to

force a refresh