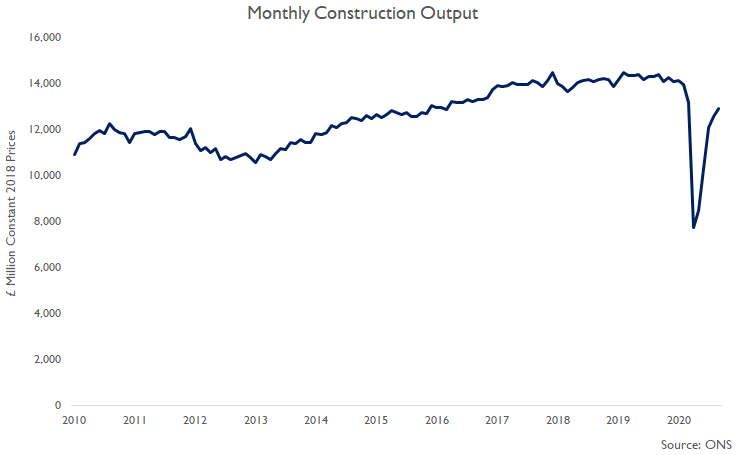

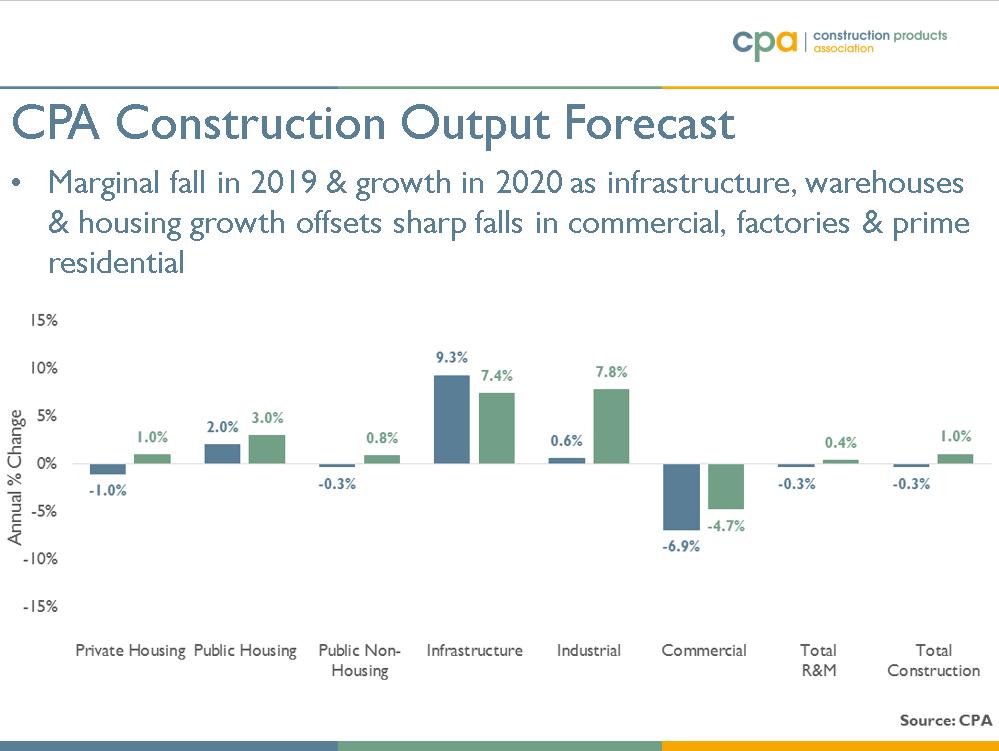

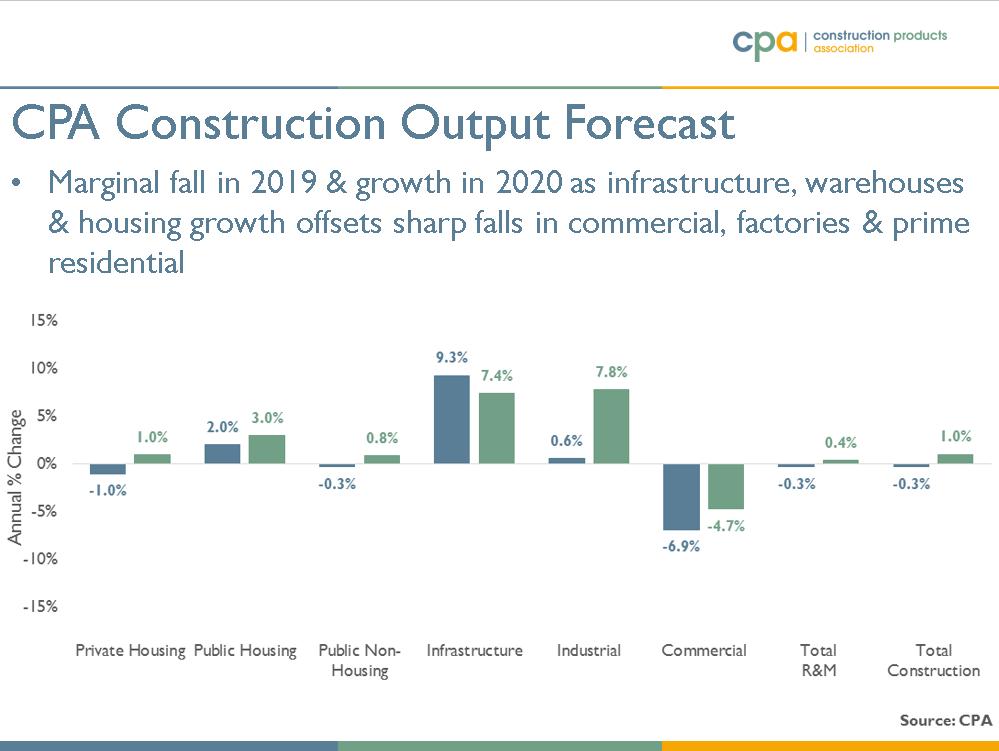

Construction output in October 2020 was 1.0% higher than in September but still remained 7.5% lower than a year ago. However, it is worth noting that there were considerable differences across the different construction sectors...

#ukconstruction

ons.gov.uk/businessindust…

#ukconstruction

ons.gov.uk/businessindust…

...& how construction firms have experienced recession & recovery depends on the sector(s) they work in. Looking at the key sectors, infrastructure was the least affected in the initial lockdown & activity is effectively back at pre-Covid-19 levels whilst...

#ukconstruction

#ukconstruction

... private housing new build & rm&i were the worst affected sectors in the initial lockdown but activity recovered from mid-May. Private housing rm&i activity was back at pre-Covid-19 levels in October & private housing new build output was 4.5% lower...

#ukconstruction

#ukconstruction

... but the key concerns are commercial & industrial. Output didn't fall as sharply as in housing but hasn't recovered as quickly. In October, commercial output was 16.1% lower than January 2020, pre-Covid-19, & industrial output was 25.3% lower than in January...

#ukconstruction

#ukconstruction

... Looking at the breakdown of the 1.0% growth in output in October 2020, the sharpest rises were in public non-housing (7.5%), which is education & health & public non-housing rm&i (cladding remediation) whilst there were falls in housing & commercial...

#ukconstruction

#ukconstruction

... but output in October 2020 was lower than a year ago in all sectors except infrastructure. Note firms in the construction supply chain report the ONS is underestimating private housing rm&i activity, which they state in October was higher than a year ago...

#ukconstruction

#ukconstruction

... Private housing output in October 2020 was 1.9% lower than in September & 4.6% lower than a year earlier. The indications from house builders are that all sites are open & demand remains high & demand is likely to remain high for 2021 Q1 & potentially Q2...

#ukconstruction

#ukconstruction

... although there was a temporary marginal slowdown in private housing activity in October due to persistent rain affecting on site activity & firms state there are issues of product supply & cost inflation (as demand exceeds supply)...

#ukconstruction

#ukconstruction

... on imported products such as timber, roofing materials & white goods, which are likely to be an issue into 2021 Q1 even with a deal with the EU & delays at ports will exacerbate this...

#ukconstruction

#ukconstruction

... Infrastructure output in October 2020 was 1.4% higher than in September & 3.0% higher than a year ago. Activity is strong due to public & regulated sector clients with certainty of finance & a strong pipeline of projects & frame works across...

#ukconstruction

#ukconstruction

... all areas of infrastructure (roads, rail, water & energy) except airports, which are retrenching on expansions & refurbishments, & councils' local infrastructure due to financial constraints & focus on social care rather than procuring construction work...

#ukconstruction

#ukconstruction

... The ONS reported that private housing repair, maintenance & improvement (rm&i) output in October 2020 was 1.2% higher than in September but still 8.1% lower than a year ago however firms in the supply chain report that this heavily underestimates activity...

#ukconstruction

#ukconstruction

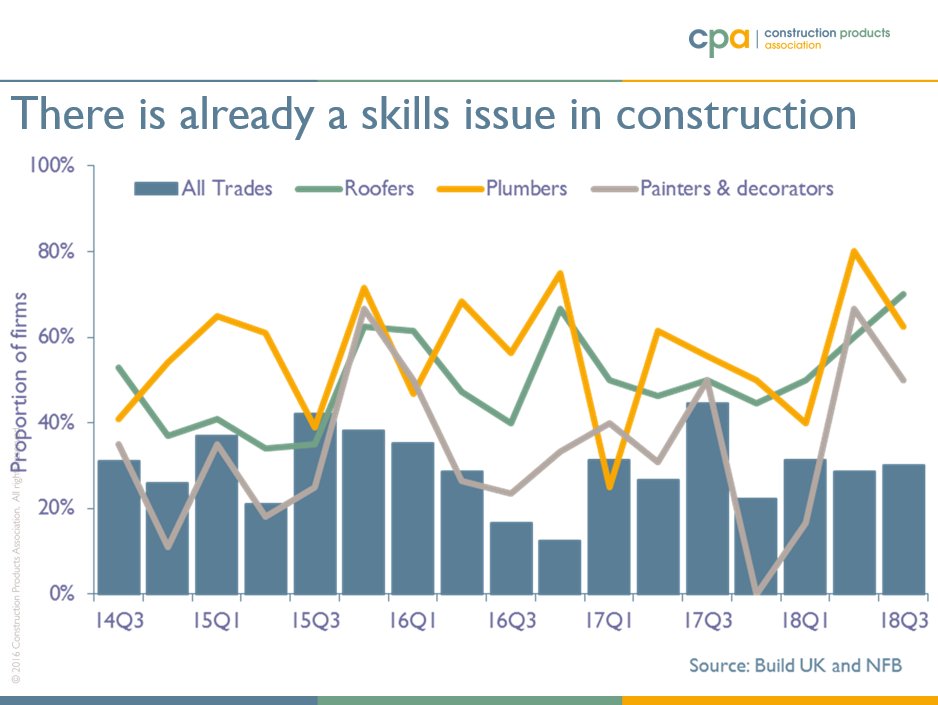

... as most firms in private housing rm&i are reporting activity is significantly higher than a year earlier & lead times are being pushed out. Key issues for SMEs working in the sector are availability & cost of products rather than a lack of demand...

#ukconstruction

#ukconstruction

... & SMEs report that rm&i demand will remain strong for the next 4-5 months whilst product supply issues are also likely to be an issue in Q1 whether there is a deal or not given ports issues...

#ukconstruction

#ukconstruction

... Commercial (offices, retail & leisure) output in October 2020 was 1.5% lower than in September & 18.9% lower than a year ago despite all sites (signed/started pre-Covid-19) having restarted as productivity on site is still 10-15% lower than pre-Covid-19...

#ukconstruction

#ukconstruction

... which slows on site activity, esp. on towers projects with different groups of trades working in small areas so towers expected pre-Covid-19 to finish in Summer 2020 are likely to finish in Q4 or 2021 H1. Note 1/3 of UK commercial construction is in London..

#ukconstruction

#ukconstruction

... Industrial output in October 2020 was 3.9% higher than in September but still 18.0% lower than a year ago. Although warehouses construction remains strong, factories construction is subdued with on site activity slower & projects due to finish this year...

#ukconstruction

#ukconstruction

... now expected to finish in 2020 H1 & as some smaller projects finished there were fewer projects in the pipeline to replace them given that factories is reliant on upfront investment for a long-term rate of return from manufacturing...

#ukconstruction

#ukconstruction

Overall, as a reference point for construction forecasts this year, if output continues at October's level for the rest of the year then overall in 2020 construction output would be 15.6% lower than in 2019 (note that our forecast for this year was -14.5%)...

#ukconstruction

#ukconstruction

... but note that firms in the construction supply chain state that private housing rm&i this year is likely to end up between -8 and -12.5% overall this year, contrasting sharply with the ONS data that implies a 20.1% fall in private housing rm&i output in 2020.

#ukconstruction

#ukconstruction

• • •

Missing some Tweet in this thread? You can try to

force a refresh