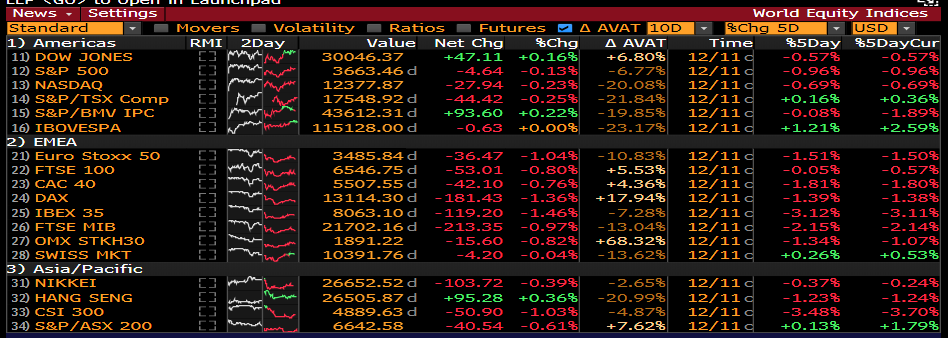

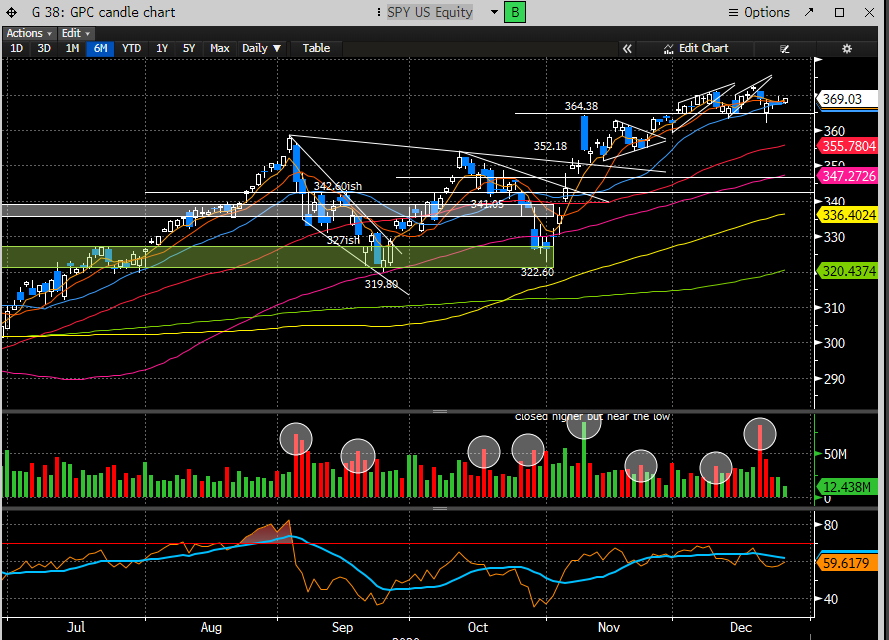

#stockmarket WE update - Holiday short version. $SPY shows 2 broken rising wedges but minimal damage. Nasty pierce of the 20day & support last wk but strong close & no follow thru. Resiliency matters & for now bulls in control. Currently 3 distribution days in Dec...

#stockmarket A close below $364ish would shake things up a bit I suspect but elusive at this point. $SPY weekly looks quite healthy to me....

#stockmarket #SPX recent Demark 13 seq sell did mark the recent swing high, now on day 3 of buy set up. Remember, 13's can signal pot'l trend change or sometimes just stall the trend - for now its stalled. Do we continue lower to complete the 9 buy or price flip back up & resume?

#stockmarket #NASDAQ will likely post a new 9 sell tomorrow w/ pot'l 13 combo sell looming (current 11 count) but would require strength. Propulsion up tgts still active for #SPX & #Nasdaq....

#StockMarket $RTY Russell has been chewing through Demark signals as of late, now above recent cluster of 13's after recycling the prior ones, & new 9 sell likely tmrw on the daily. Weekly 13's still active. Very steep rising wedge & very OB. retracement here likely in the NT....

#stockmarket $RTY ADX also quite elevated for the Russel and typically where trends start to stall or reverse. Factor exposure in this part of the cycle argues for overweighting small caps but that doesnt mean cant see a painful reversion....

#stockmarket Smart Money Index finally starting to show signs of life and very important to continue to improve if the rally is going to keep defying the skeptics IMO....

#stockmarket Arms Index or TRIN (measures intensity of downside volume) on Thursday was a bit baffling & recorded a relatively high number despite higher indexes. Could be a warning or could be nothing given it might just be end of the yr rebalance related...

#stockmarket Semis have been grossly underperforming Software as of late. Maybe that reverses into CES in Jan. Demark overlay of $SMH vs $IGV shows a new 9 buy recorded last wk. Track record w/ 9 signals marking swings is outstanding. time to buy semis? ....

#stockmarket Semi 4-pack i'll be watching next wk: $TSM pennant break over B/O zone. $MU Desc Triangle @ 20day support. $AMD falling wedge @ B/O zone. $MCHP falling wedge @ B/O zone & could record Demark 9 buy on Tues...

#stockmarket concl: As I mentioned last WE, I don't expect a bigger contraction until Jan. I think this wk will likely remain rangebound but certainly bulls have the edge w/ end of yr seasonality. I'll likely be trading less & spending more time w/ my family. Happy Holidays!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh