1/8

Dad told me about how his just retired friend's 25 year old insisted on liquidating F.D's worth a sizeable amt ( kept for EMERGENCY ) today as the son KNEW he could EARN SO MUCH MORE from markets in JUST a month ! 🤦

A thread on the same for NEWBIES.

Dad told me about how his just retired friend's 25 year old insisted on liquidating F.D's worth a sizeable amt ( kept for EMERGENCY ) today as the son KNEW he could EARN SO MUCH MORE from markets in JUST a month ! 🤦

A thread on the same for NEWBIES.

2/8

2020 was exceptional !!

A brutal crash followed by an unimaginable run due to liquidity.

NO. IT DOESN'T MAKE YOU TALENTED IF YOU HAVE MADE 50%+ RETURNS THIS YEAR.

Even a GROUNDED AIRLINE scrip is flying. That doesn't make you an expert.

IT JUST MAKES YOU LUCKY! 🤷

2020 was exceptional !!

A brutal crash followed by an unimaginable run due to liquidity.

NO. IT DOESN'T MAKE YOU TALENTED IF YOU HAVE MADE 50%+ RETURNS THIS YEAR.

Even a GROUNDED AIRLINE scrip is flying. That doesn't make you an expert.

IT JUST MAKES YOU LUCKY! 🤷

3/8

An experienced person with a modest risk appetite would be happy with 12-15% CAGR over a long term.

Most get caught at higher ends. ( Few accept it )

Only a HANDFUL enter at bottom ( Mostly Newbies).

You never know WHEN YOU too might get caught at the higher end!

An experienced person with a modest risk appetite would be happy with 12-15% CAGR over a long term.

Most get caught at higher ends. ( Few accept it )

Only a HANDFUL enter at bottom ( Mostly Newbies).

You never know WHEN YOU too might get caught at the higher end!

4/8

Don't get CARRIED AWAY by these Screenshots & Self proclaimed EXPERTS on Twitter who run paid subscription giving 5 FUNDAMENTALLY strong stock names EVERYDAY !

Yes they ARE making lot of money.

But NOT from markets .

They are MINTING money off you ! 🤦

Don't get CARRIED AWAY by these Screenshots & Self proclaimed EXPERTS on Twitter who run paid subscription giving 5 FUNDAMENTALLY strong stock names EVERYDAY !

Yes they ARE making lot of money.

But NOT from markets .

They are MINTING money off you ! 🤦

5/8

Leaving your JOB to pursue TRADING is mostly stupidity .

Stopping a A REGULAR source of income for a POSSIBLE windfall is TEXTBOOK DISASTER IN MAKING.

One can become Financially Independent by focusing on work, skillsets & investing sensibly . Weekend reading suffices.

Leaving your JOB to pursue TRADING is mostly stupidity .

Stopping a A REGULAR source of income for a POSSIBLE windfall is TEXTBOOK DISASTER IN MAKING.

One can become Financially Independent by focusing on work, skillsets & investing sensibly . Weekend reading suffices.

6/8

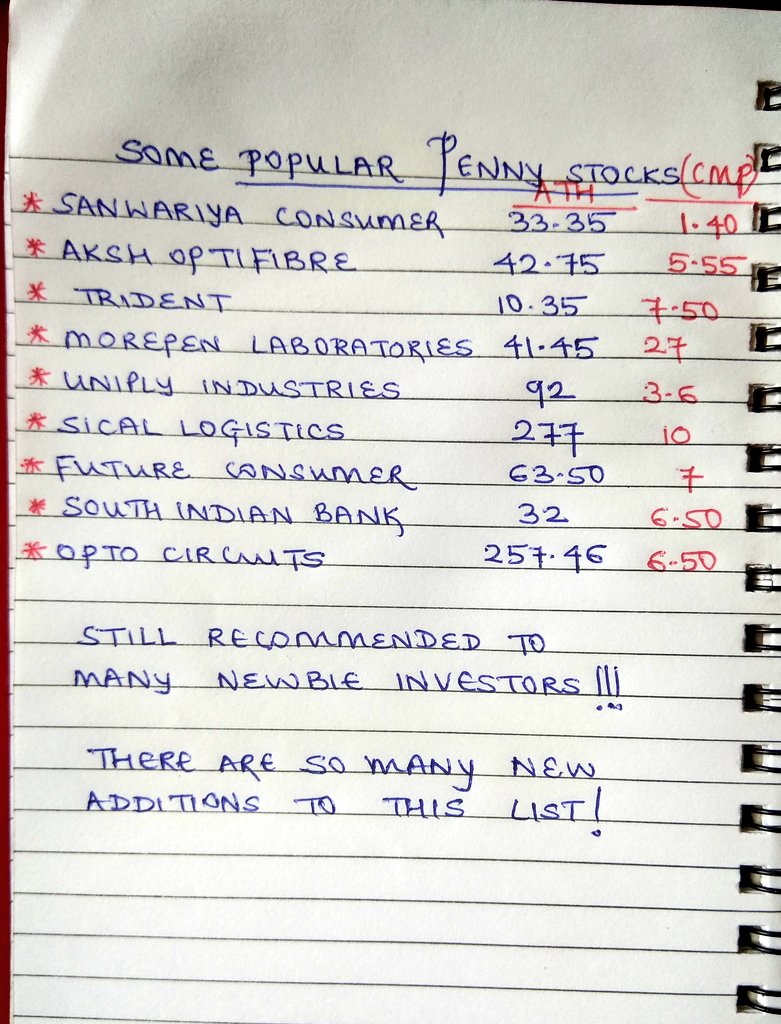

If you have made spectacular returns in Average/Penny stocks or Trading use that returns sensibly .

* Pay off existing loans .

Become DEBT FREE

* Ensure you have an Emergency fund worth a year's expenses

👇

* Open a PPF account

If you have made spectacular returns in Average/Penny stocks or Trading use that returns sensibly .

* Pay off existing loans .

Become DEBT FREE

* Ensure you have an Emergency fund worth a year's expenses

👇

https://twitter.com/VidyaG88/status/1345270444669210624?s=19

* Open a PPF account

7/8

* First ensure you have a Life Insurance , a Term Insurance , a good Medical Insurance - Not just from your Employer.

👇

* Read and improve Skillsets & start building a corpus - OF

YOUR OWN SAVINGS for investing.

STOP USING YOUR PARENTS' SAVINGS!

* First ensure you have a Life Insurance , a Term Insurance , a good Medical Insurance - Not just from your Employer.

👇

https://twitter.com/VidyaG88/status/1254279111763062784?s=19

* Read and improve Skillsets & start building a corpus - OF

YOUR OWN SAVINGS for investing.

STOP USING YOUR PARENTS' SAVINGS!

8/8

The markets may even see a Time Based correction in 2021.

NO ONE KNOWS what the future holds .

As Munger states,

All we need to do is try to be consistently not stupid , instead of trying to be very intelligent .

@dmuthuk

@Vivek_Investor

Tagging you for reach. 😇🙏

The markets may even see a Time Based correction in 2021.

NO ONE KNOWS what the future holds .

As Munger states,

All we need to do is try to be consistently not stupid , instead of trying to be very intelligent .

@dmuthuk

@Vivek_Investor

Tagging you for reach. 😇🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh