1/17

IKIGAI : A reason for BEING .

I have structured the essential bits & pieces of the book in a flow for easy understanding + compiled some handwritten notes.

As always these are just MY TAKEAWAYS from the book :))

#ikigai

#BookReview

#BookRecommendation

IKIGAI : A reason for BEING .

I have structured the essential bits & pieces of the book in a flow for easy understanding + compiled some handwritten notes.

As always these are just MY TAKEAWAYS from the book :))

#ikigai

#BookReview

#BookRecommendation

2/

Firstly what is #IKIGAI ?

The Japanese call it - A REASON TO JUMP OUT OF BED EACH MORNING.

It's a convergence of 4 things .

*What you love

*What you are good at

*What you can get paid for

*What the world needs .

We need to find our Ikigai in life!

(Pic from the net)

Firstly what is #IKIGAI ?

The Japanese call it - A REASON TO JUMP OUT OF BED EACH MORNING.

It's a convergence of 4 things .

*What you love

*What you are good at

*What you can get paid for

*What the world needs .

We need to find our Ikigai in life!

(Pic from the net)

3/

Let's begin with DAILY HEALTH HABITS.

A SOUND MIND IN A SOUND BODY .

Both our MIND & BODY must be exercised well to avoid deterioration in latter years of life .

Have a mental workout routinely by stepping out of your COMFORT ZONE.

Expose yourself to CHANGE.

#RewireBrain

Let's begin with DAILY HEALTH HABITS.

A SOUND MIND IN A SOUND BODY .

Both our MIND & BODY must be exercised well to avoid deterioration in latter years of life .

Have a mental workout routinely by stepping out of your COMFORT ZONE.

Expose yourself to CHANGE.

#RewireBrain

4/

For a sound body there's no need to exercise relentlessly . Regular Yoga, Surya namaskar and Gardening is more than enough.

Don't be a couch potato! 🤷 Keep moving !

Our metabolism slows down just after 30 min of sitting sedentary.

#KeepMoving

For a sound body there's no need to exercise relentlessly . Regular Yoga, Surya namaskar and Gardening is more than enough.

Don't be a couch potato! 🤷 Keep moving !

Our metabolism slows down just after 30 min of sitting sedentary.

#KeepMoving

5/

#StressKills

Most health problems are STRESS INDUCED.

Hence TAKE TIME OFF every now & then .

SLOW DOWN !!

Life isn't a race .So stop running all the time.

Condition your mind to enjoy each moment by practising #Mindfulness.

Be Self aware & aware of your surroundings!

#StressKills

Most health problems are STRESS INDUCED.

Hence TAKE TIME OFF every now & then .

SLOW DOWN !!

Life isn't a race .So stop running all the time.

Condition your mind to enjoy each moment by practising #Mindfulness.

Be Self aware & aware of your surroundings!

6/

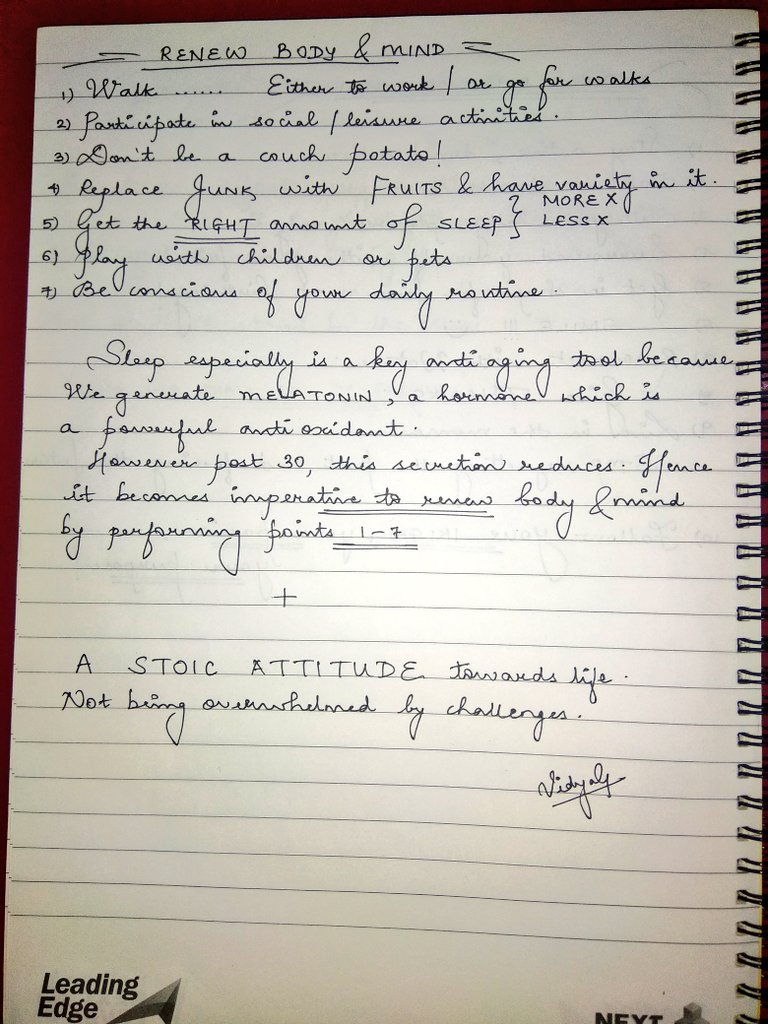

*SLOW DOWN THE AGEING PROCESS

2 dispositional traits found in people living a long and healthy life:

* A positive #ATTITUDE .

* A high degree of #EmotionalAwareness

A few pointers on How to Keep our Mind & Body from ageing overtly

👇

*SLOW DOWN THE AGEING PROCESS

2 dispositional traits found in people living a long and healthy life:

* A positive #ATTITUDE .

* A high degree of #EmotionalAwareness

A few pointers on How to Keep our Mind & Body from ageing overtly

👇

7/

Work hard but don't get overworked about it .

Enjoy the process & the learnings!!

Results shall follow.

Variety is the spice of life.

Learn to take price and thereby enjoy even mundane chores aka daily movements of #microflow

#EnjoyingEverydayLife

Work hard but don't get overworked about it .

Enjoy the process & the learnings!!

Results shall follow.

Variety is the spice of life.

Learn to take price and thereby enjoy even mundane chores aka daily movements of #microflow

#EnjoyingEverydayLife

8/

🙂🙃🙂🙃🙂🙃🙂🙃 !

Smile a lot and learn to celebrate the little things in life .

Someday you shall look back to realise those formed the biggest part of your life .

Practise Contentment & Gratitude.

Be Curious always!

#LittleThingsMatterTheMost

🙂🙃🙂🙃🙂🙃🙂🙃 !

Smile a lot and learn to celebrate the little things in life .

Someday you shall look back to realise those formed the biggest part of your life .

Practise Contentment & Gratitude.

Be Curious always!

#LittleThingsMatterTheMost

9/

Learn something new each day .

Laugh out loud . Never take yourself seriously !!

Humour is much needed to reduce anxiety.

Don't worry too much . Extra worrying shall not change anything!

Do something constructive for the community & create things of value.

#BeOfValue

Learn something new each day .

Laugh out loud . Never take yourself seriously !!

Humour is much needed to reduce anxiety.

Don't worry too much . Extra worrying shall not change anything!

Do something constructive for the community & create things of value.

#BeOfValue

10/

SOME INTERESTING CONCEPTS

*WABI SABI*

There lies such beauty in the imperfections , fleetings of nature all around us .

Choose to see beauty in the flaws, in the incompleteness of things and people.

Each one of us is unique!!

Embrace this uniqueness.

#BeUnique

SOME INTERESTING CONCEPTS

*WABI SABI*

There lies such beauty in the imperfections , fleetings of nature all around us .

Choose to see beauty in the flaws, in the incompleteness of things and people.

Each one of us is unique!!

Embrace this uniqueness.

#BeUnique

11/

* ICHI - GO ICHI - E *

This moment exists only NOW and won't come again .

Stay in the moment. ENJOY the present that life brings us.

Don't dwell in the past .

Don't predict the future .

* ICHI - GO ICHI - E *

This moment exists only NOW and won't come again .

Stay in the moment. ENJOY the present that life brings us.

Don't dwell in the past .

Don't predict the future .

12/

LOGO THERAPY.

Popularised by Victor Frankl who believed that everything can be taken from a human ,except THE WILL to live .

That becomes the reason to live.

We just need to DISCOVER it .

For he who has a WHY to live for, can bear with almost any HOW .😇

LOGO THERAPY.

Popularised by Victor Frankl who believed that everything can be taken from a human ,except THE WILL to live .

That becomes the reason to live.

We just need to DISCOVER it .

For he who has a WHY to live for, can bear with almost any HOW .😇

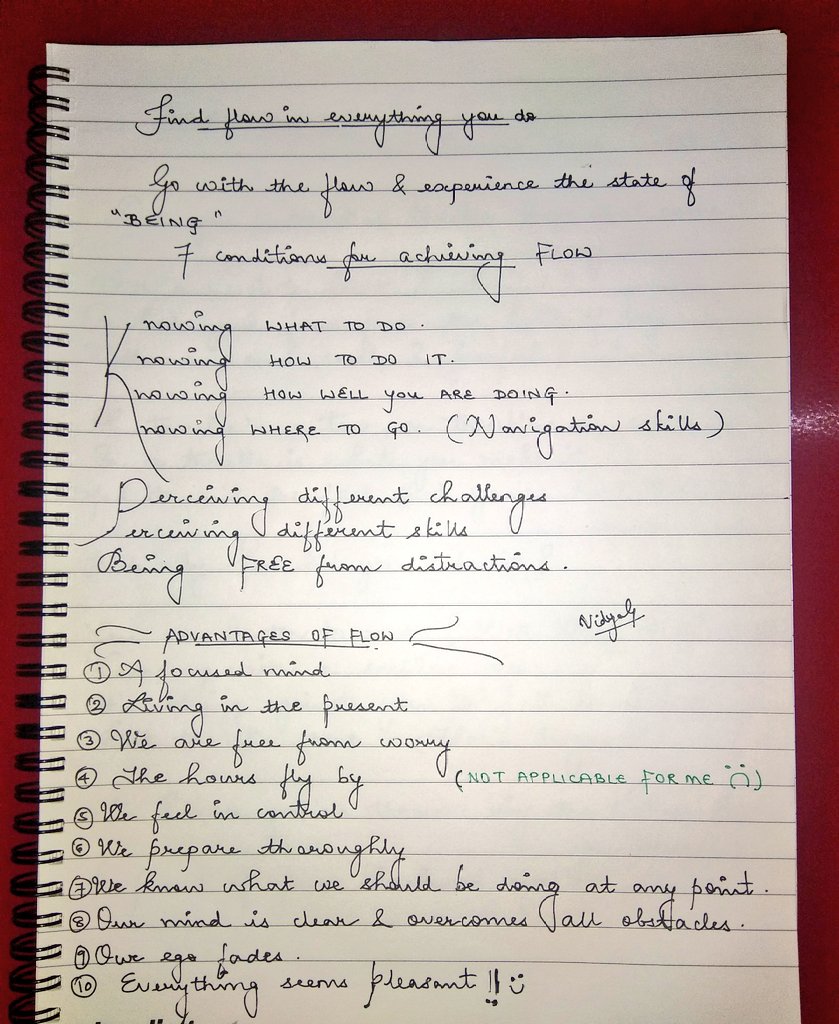

13/

GO WITH THE FLOW IN WHATEVER YOU DO .

Why is this necessary?

When we flow we are focused on the task at hand . NO DISTRACTIONS.

Helps keep mind in order & ensures quality output.

#GoWithTheFlow

Elaborated in these notes .

👇

GO WITH THE FLOW IN WHATEVER YOU DO .

Why is this necessary?

When we flow we are focused on the task at hand . NO DISTRACTIONS.

Helps keep mind in order & ensures quality output.

#GoWithTheFlow

Elaborated in these notes .

👇

14/

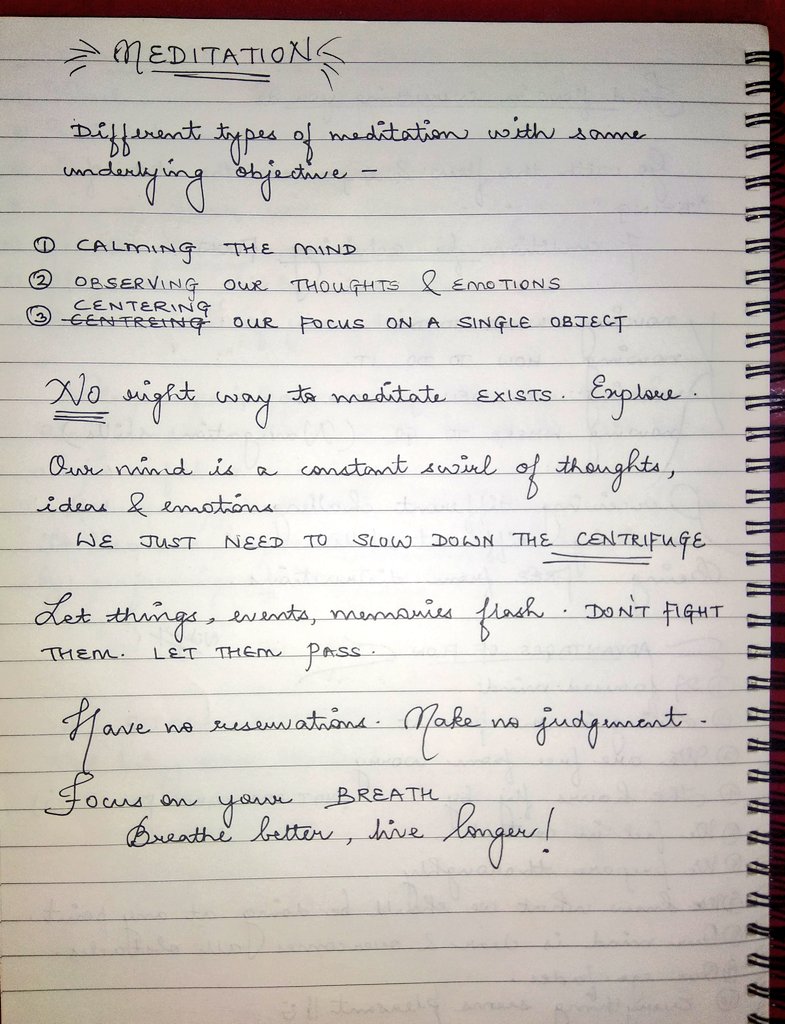

Meditation is recommended always for a calmer mind .

But we are often confused / clueless as to how to meditate !

Often we give up as we find our mind straying when we try to meditate . 🤷

The trick lies in "NOT TRYING " . :))

👇

#meditation

Meditation is recommended always for a calmer mind .

But we are often confused / clueless as to how to meditate !

Often we give up as we find our mind straying when we try to meditate . 🤷

The trick lies in "NOT TRYING " . :))

👇

#meditation

15/

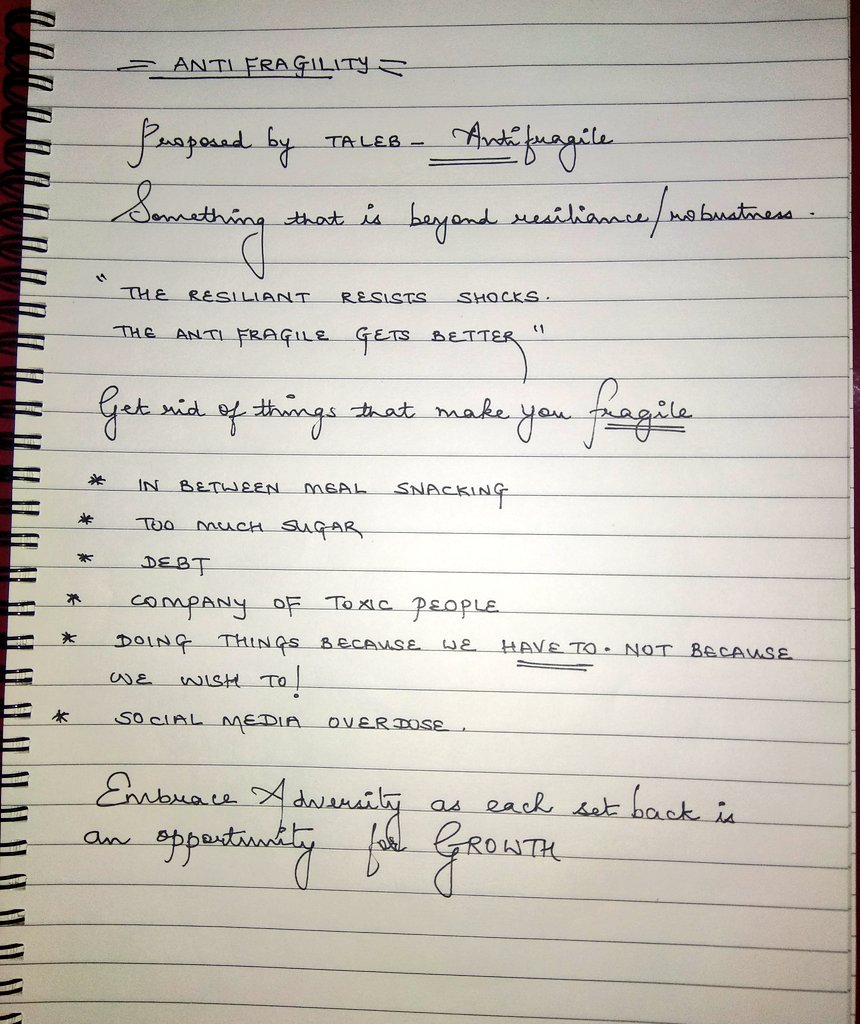

*ANTI FRAGILITY *

As Taleb says , we need randomness, mess , adventures. uncertainty , self discovery and trauma - All of it ; to make life worth living .

Let's become Anti fragile by

learning to get rid of things that make us Fragile .

HOW ?

👇

*ANTI FRAGILITY *

As Taleb says , we need randomness, mess , adventures. uncertainty , self discovery and trauma - All of it ; to make life worth living .

Let's become Anti fragile by

learning to get rid of things that make us Fragile .

HOW ?

👇

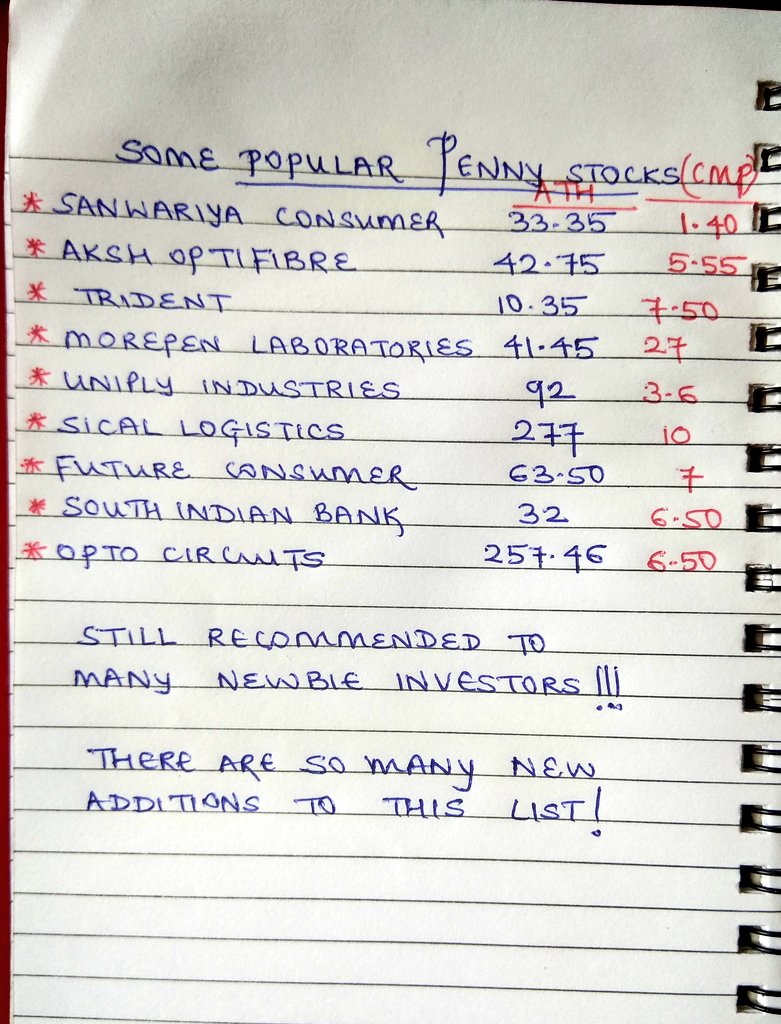

16/

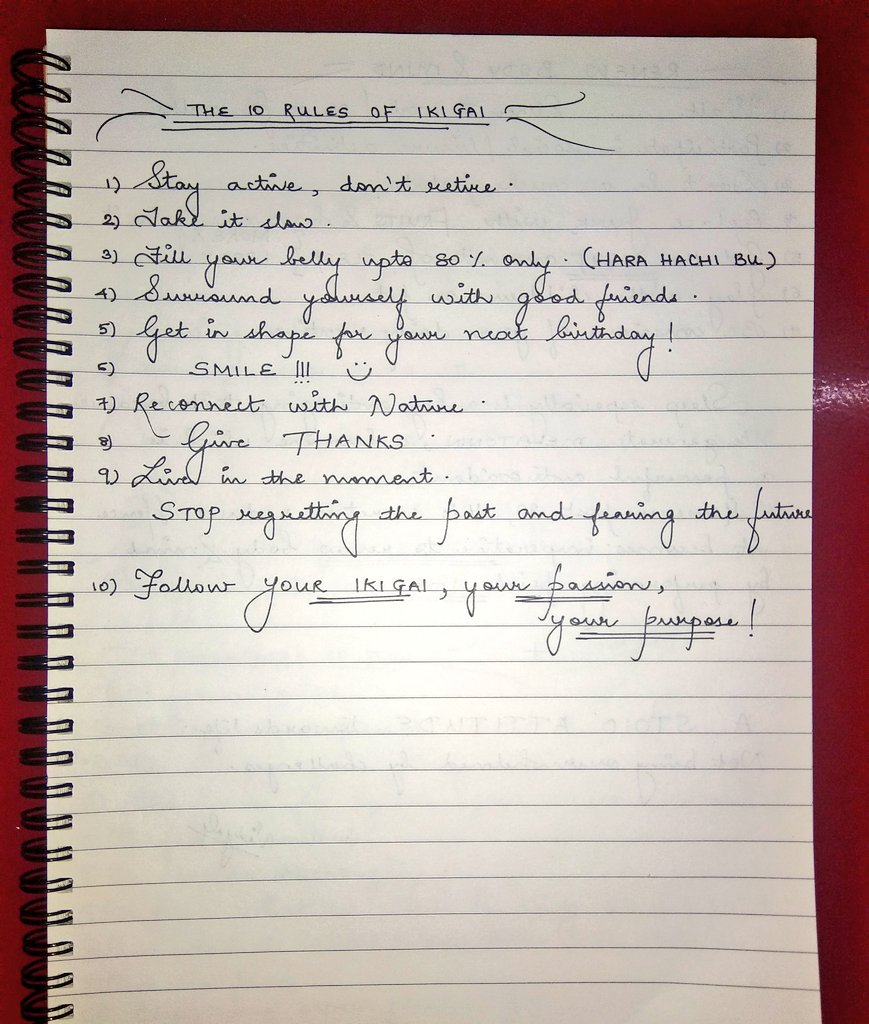

To sum it up ,

These are the 10 Rules of Ikigai.

ALL SEEMINGLY OBVIOUS.

But ultimately we need to delve deep within ourselves to find OUR IKIGAI - Our purpose .

The book just emphasises on certain aspects and approaches that help us on our self discovery journey.

To sum it up ,

These are the 10 Rules of Ikigai.

ALL SEEMINGLY OBVIOUS.

But ultimately we need to delve deep within ourselves to find OUR IKIGAI - Our purpose .

The book just emphasises on certain aspects and approaches that help us on our self discovery journey.

17/17

We all have the capacity to do noble or terrible things.

The side of the equation we end up on depends on OUR DECISIONS , NOT ON THE CONDITIONS in which we find ourselves.

That's IKIGAI for you . :))

* THE END *

#booklovers

#TwitterBookCommunity

We all have the capacity to do noble or terrible things.

The side of the equation we end up on depends on OUR DECISIONS , NOT ON THE CONDITIONS in which we find ourselves.

That's IKIGAI for you . :))

* THE END *

#booklovers

#TwitterBookCommunity

• • •

Missing some Tweet in this thread? You can try to

force a refresh