1. #Bitcoin has just begun its new Four Year Cycle

Which means #BTC has confirmed further exponential growth in this #Crypto Bull Market

Here's what you need to know...

Which means #BTC has confirmed further exponential growth in this #Crypto Bull Market

Here's what you need to know...

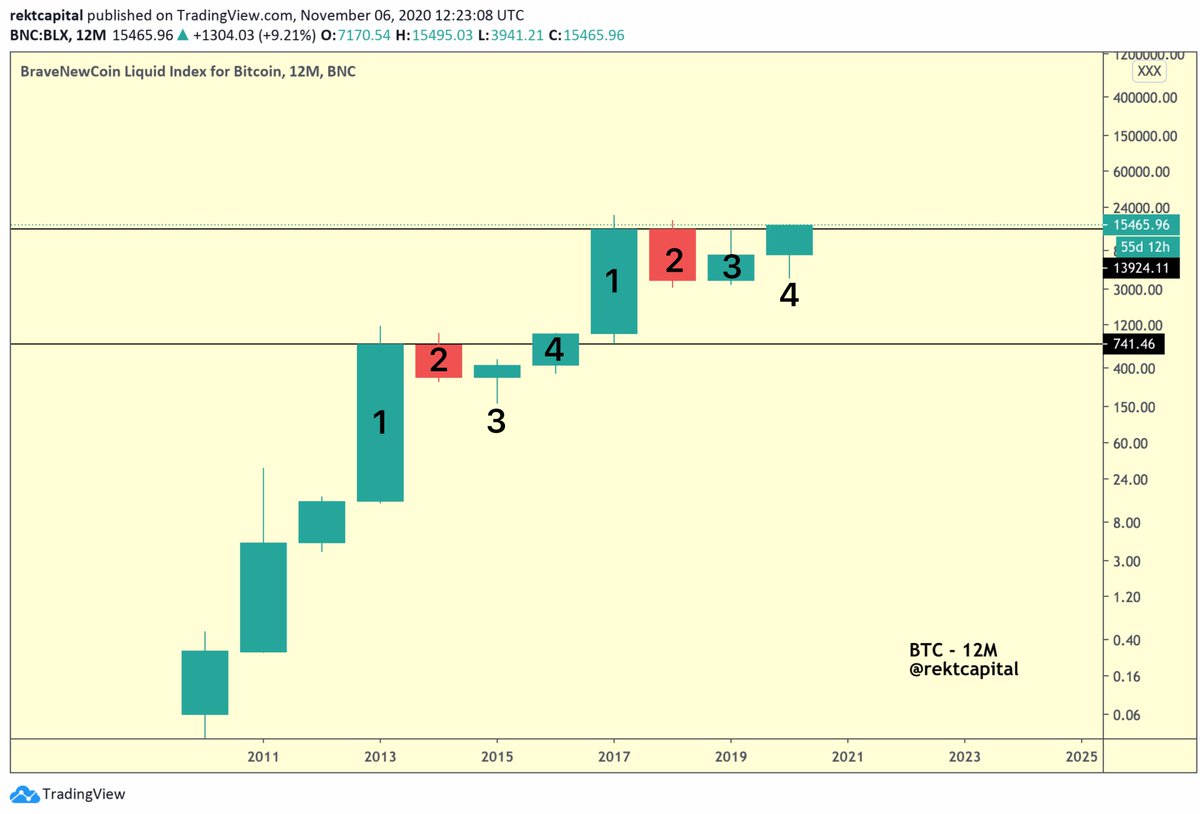

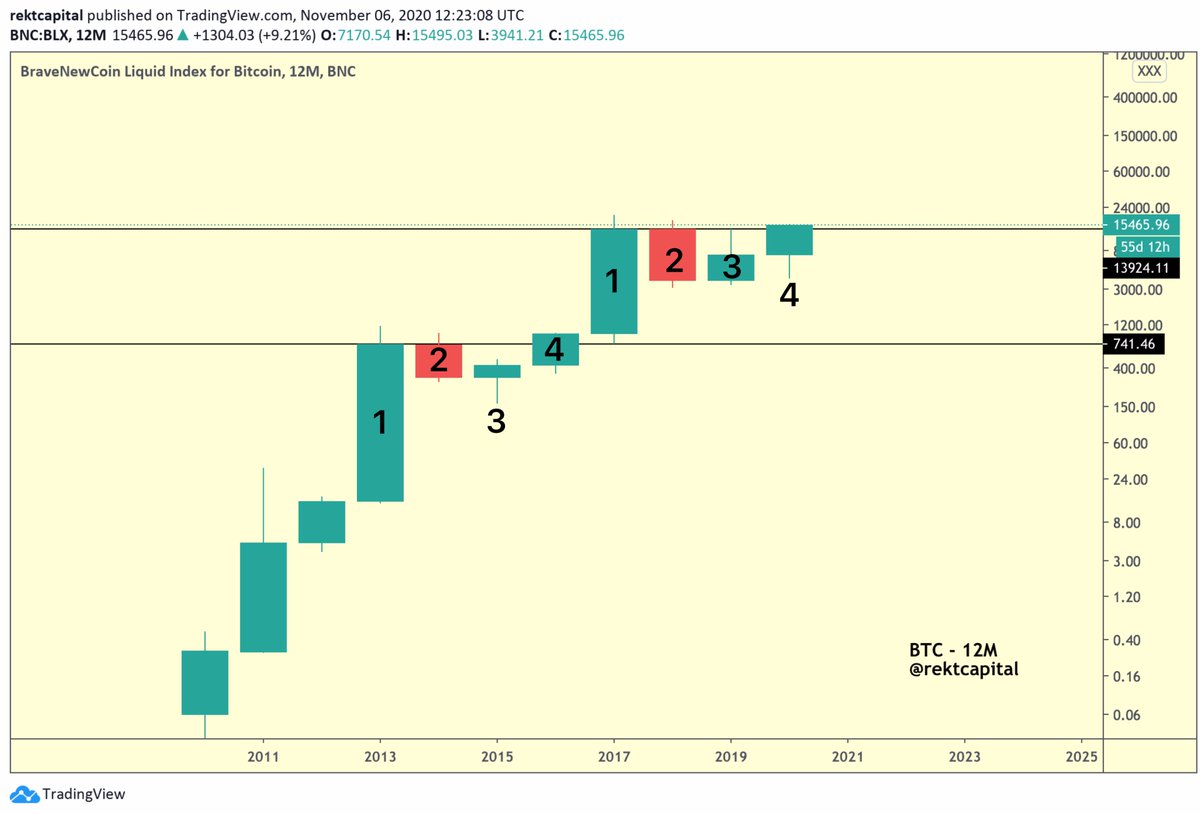

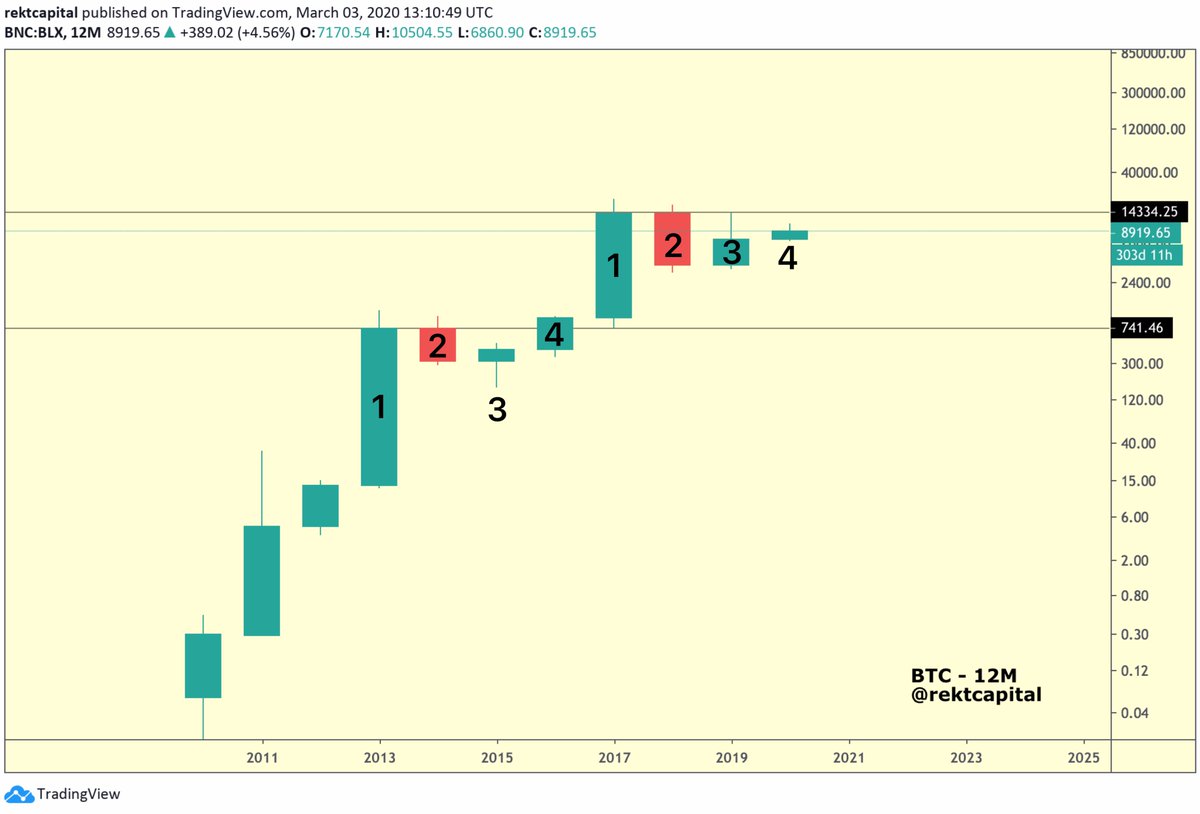

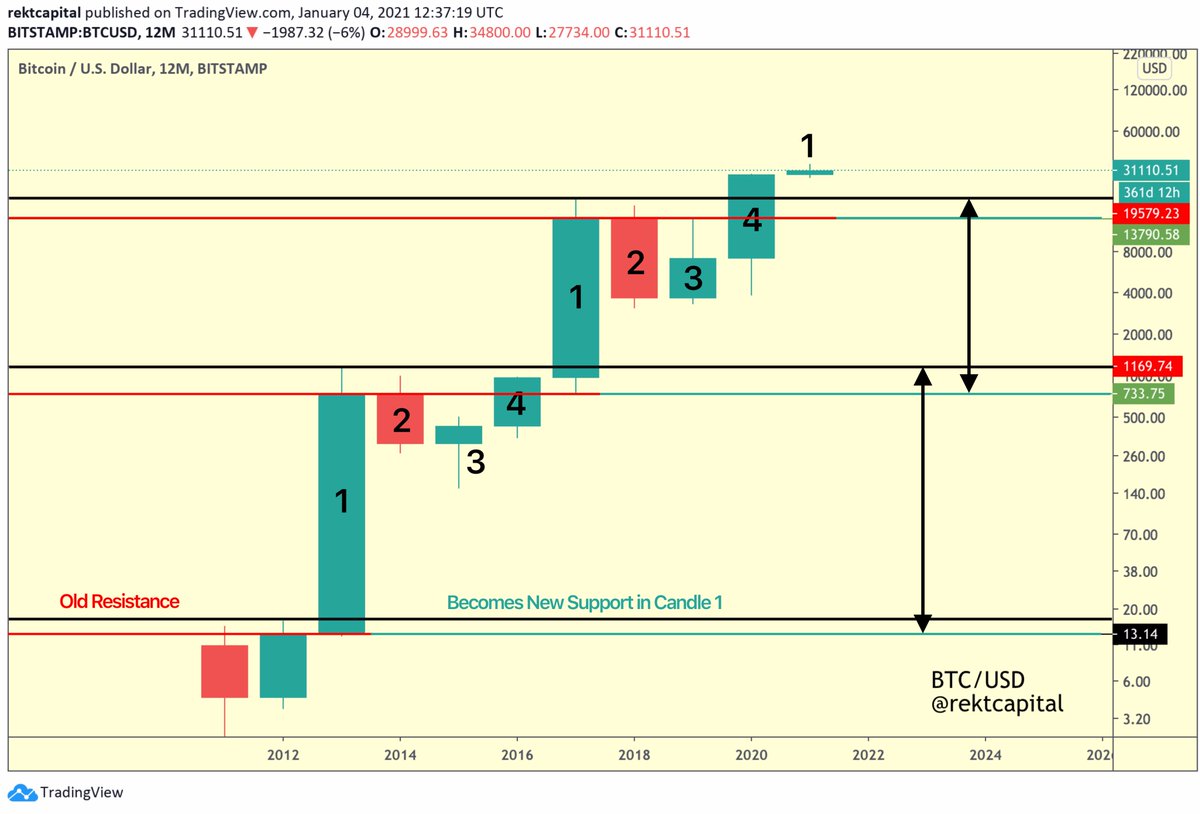

2. $BTC's price action behaves in Four Year Cycles

Each candle represents a year

Candle 1 ensures exponential growth where BTC breaks to a new ATH

Candle 2 is where BTC is in a Bear Market

Candle 3 is where BTC bottoms out

Candle 4 is where BTC recovers & begins a new trend

Each candle represents a year

Candle 1 ensures exponential growth where BTC breaks to a new ATH

Candle 2 is where BTC is in a Bear Market

Candle 3 is where BTC bottoms out

Candle 4 is where BTC recovers & begins a new trend

3. Candle 4 serves a crucial purpose in setting up the new Four Year Cycle

Its aim is to eclipse the previous resistance that prompted a bear market for #BTC 's price a few years earlier (i.e. “Candle 2”)

In the first cycle, that level was $741

In this cycle, it was ~$13900...

Its aim is to eclipse the previous resistance that prompted a bear market for #BTC 's price a few years earlier (i.e. “Candle 2”)

In the first cycle, that level was $741

In this cycle, it was ~$13900...

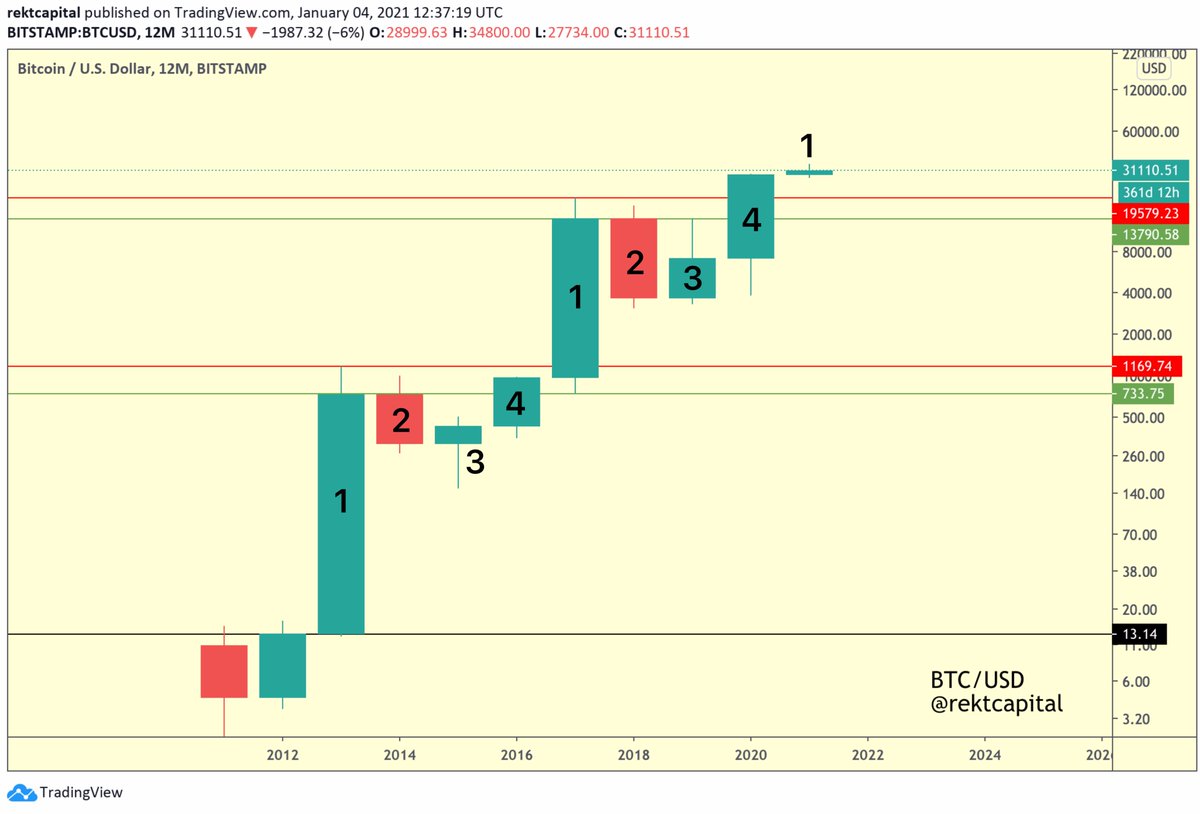

4. But Candle 4 did so much more than eclipse $13,900

Candle 4 broke the old All Time High of $20,000 and even ended the year at ~$29,000

This is a testament to how strong the buy-side interest for #BTC is, compared to the previous Candle 4 in the old Four Year Cycle

Candle 4 broke the old All Time High of $20,000 and even ended the year at ~$29,000

This is a testament to how strong the buy-side interest for #BTC is, compared to the previous Candle 4 in the old Four Year Cycle

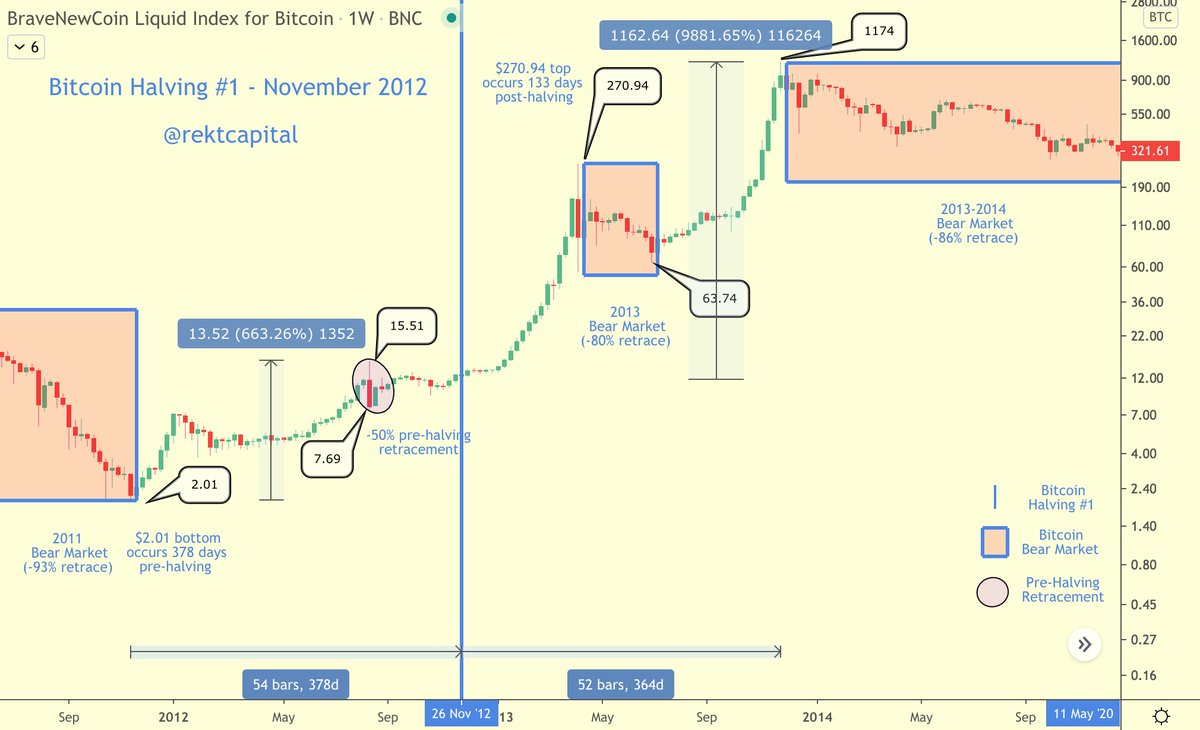

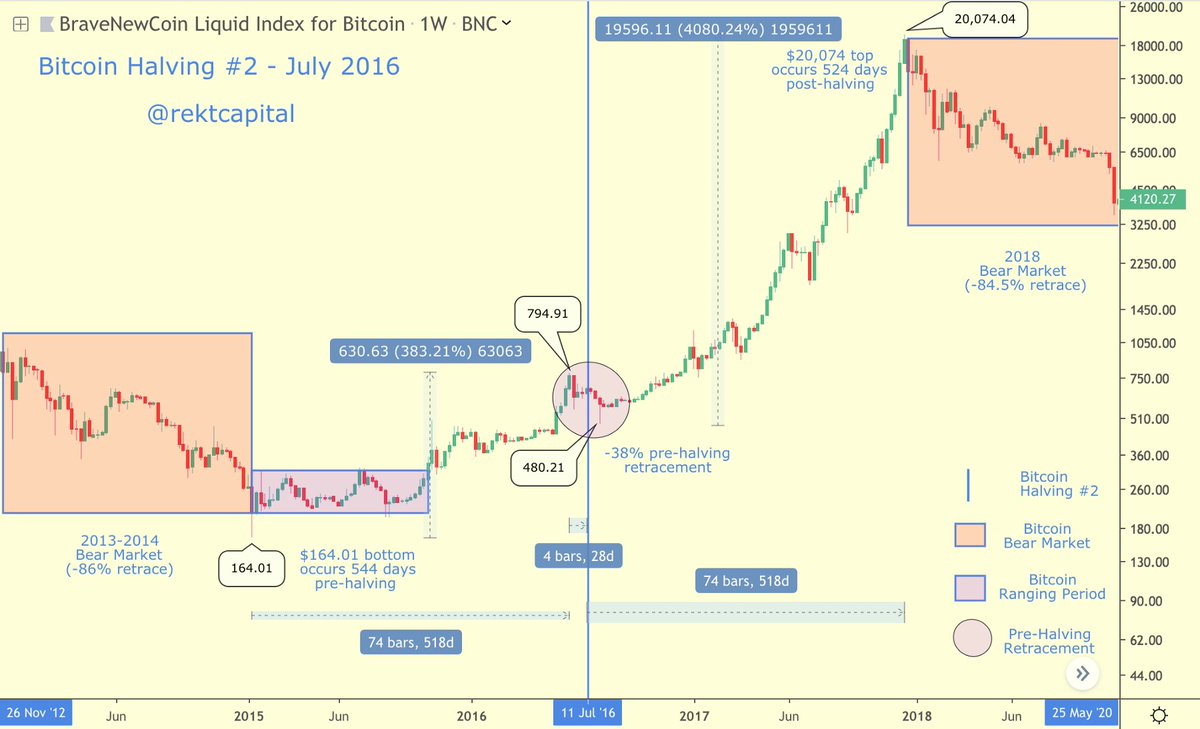

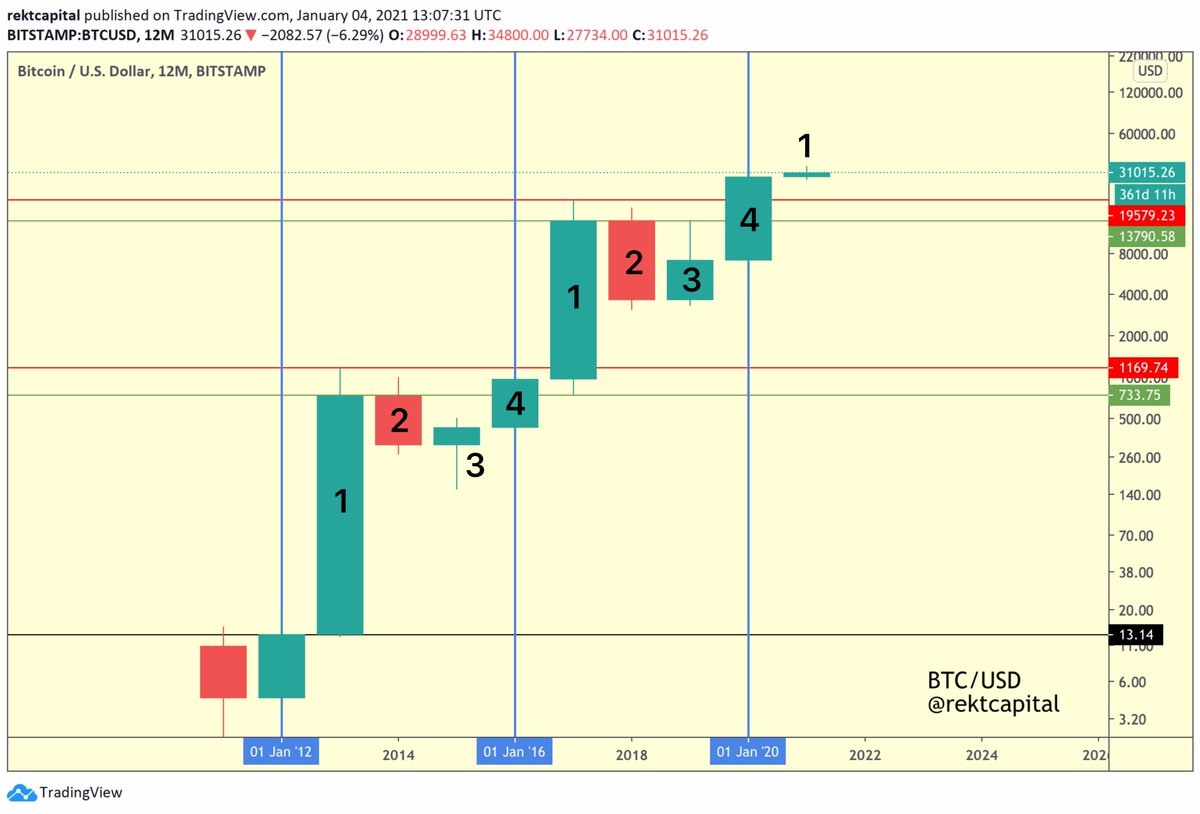

5. The #Bitcoin Halvings (blue) tend to play an important role in forming the Four Year Cycles

Bitcoin Halvings precede the exponential Candle 1 of a new Bitcoin Four Year Cycle

What this suggests is that Bitcoin will experience yet another exponential Candle 1 in 2021

Bitcoin Halvings precede the exponential Candle 1 of a new Bitcoin Four Year Cycle

What this suggests is that Bitcoin will experience yet another exponential Candle 1 in 2021

6. If you find the information in this thread valuable, you should check out my newsletter which is dedicated to unbiased cutting-edge #Crypto insights:

rektcapital.substack.com

rektcapital.substack.com

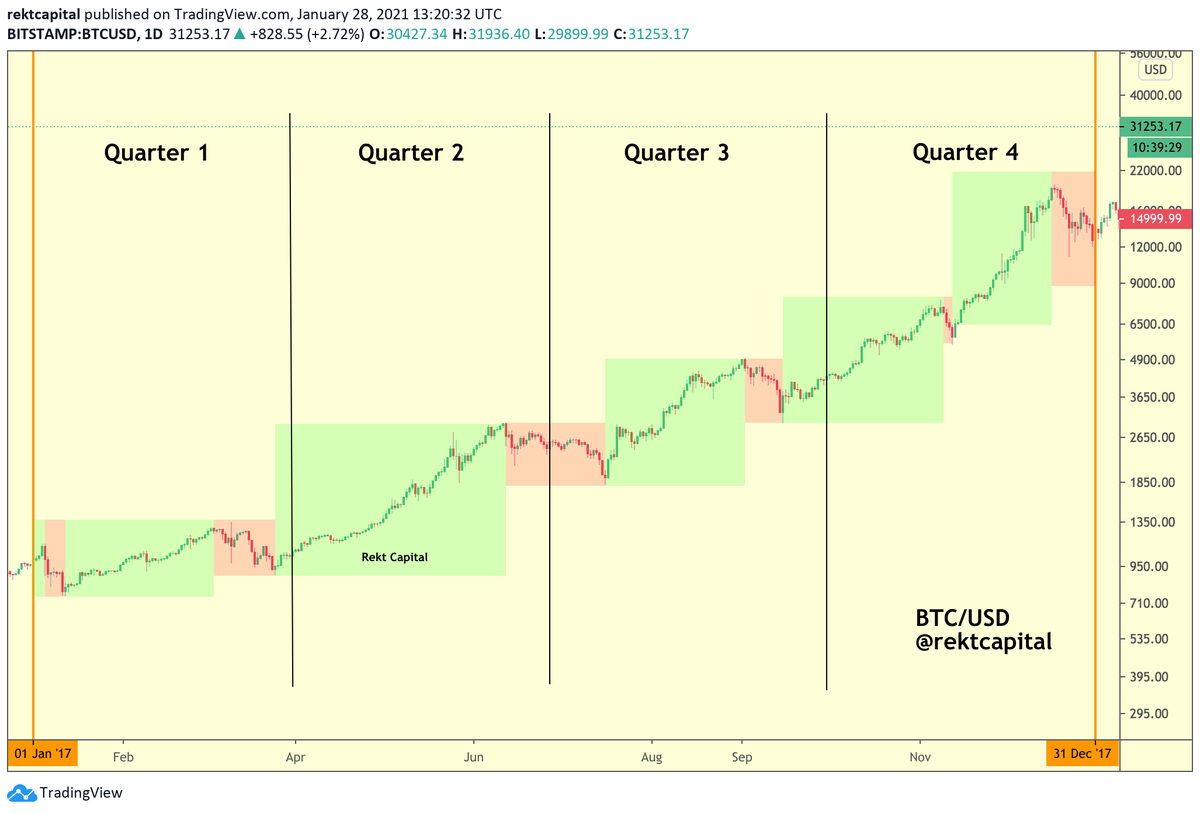

7. Retrace Possible in Q1, 2021?

Historically, a $BTC retrace tends to occur early in the new 4-Year Cycle where 🔴 resistance turns into 🟢 support

But recent Candle 4 was strong that a fall to $13,9K is unlikely

Overall, key 4-YC levels are:

• ~$29,000

• ~$20K

• $13,9K

Historically, a $BTC retrace tends to occur early in the new 4-Year Cycle where 🔴 resistance turns into 🟢 support

But recent Candle 4 was strong that a fall to $13,9K is unlikely

Overall, key 4-YC levels are:

• ~$29,000

• ~$20K

• $13,9K

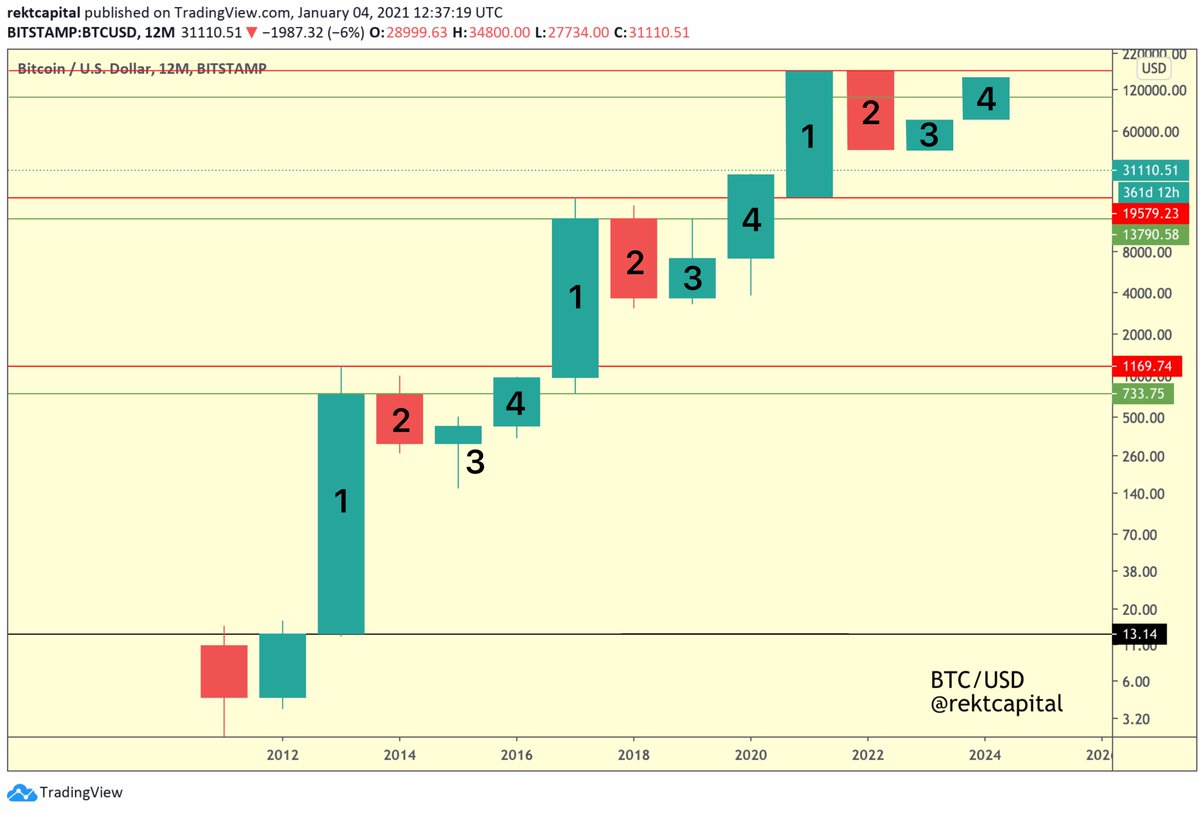

8. How Much Could #Bitcoin Rally In 2021?

Based on recurring price tendencies throughout #BTC history, here is an extrapolation of this new Four Year Cycle...

Based on recurring price tendencies throughout #BTC history, here is an extrapolation of this new Four Year Cycle...

9. #Bitcoin could rally to as far as $150,000-$170,000 in Candle 1

Candle 2 could experience a more than -80% Bear Market (2022)

Candle 3 is where #BTC would bottom (2023)

Candle 4 would signal a new trend & recovery (2024)

Yet another new Four Year Cycle would begin in 2025

Candle 2 could experience a more than -80% Bear Market (2022)

Candle 3 is where #BTC would bottom (2023)

Candle 4 would signal a new trend & recovery (2024)

Yet another new Four Year Cycle would begin in 2025

10. If you liked this thread, you'll really like my newsletter

Cutting-edge crypto market insights, straight to your inbox

Sign up:

rektcapital.substack.com/p/fouryearcycl…

Cutting-edge crypto market insights, straight to your inbox

Sign up:

rektcapital.substack.com/p/fouryearcycl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh