1. "Which Altcoin should I buy?"

"When should I buy it?"

Knowing when to buy one Altcoin is one thing

Knowing when to time your exposure to Altcoins as a whole is another

Here is a thread about how to use investor Money Flow behaviour to know which Altcoins to buy and when:

"When should I buy it?"

Knowing when to buy one Altcoin is one thing

Knowing when to time your exposure to Altcoins as a whole is another

Here is a thread about how to use investor Money Flow behaviour to know which Altcoins to buy and when:

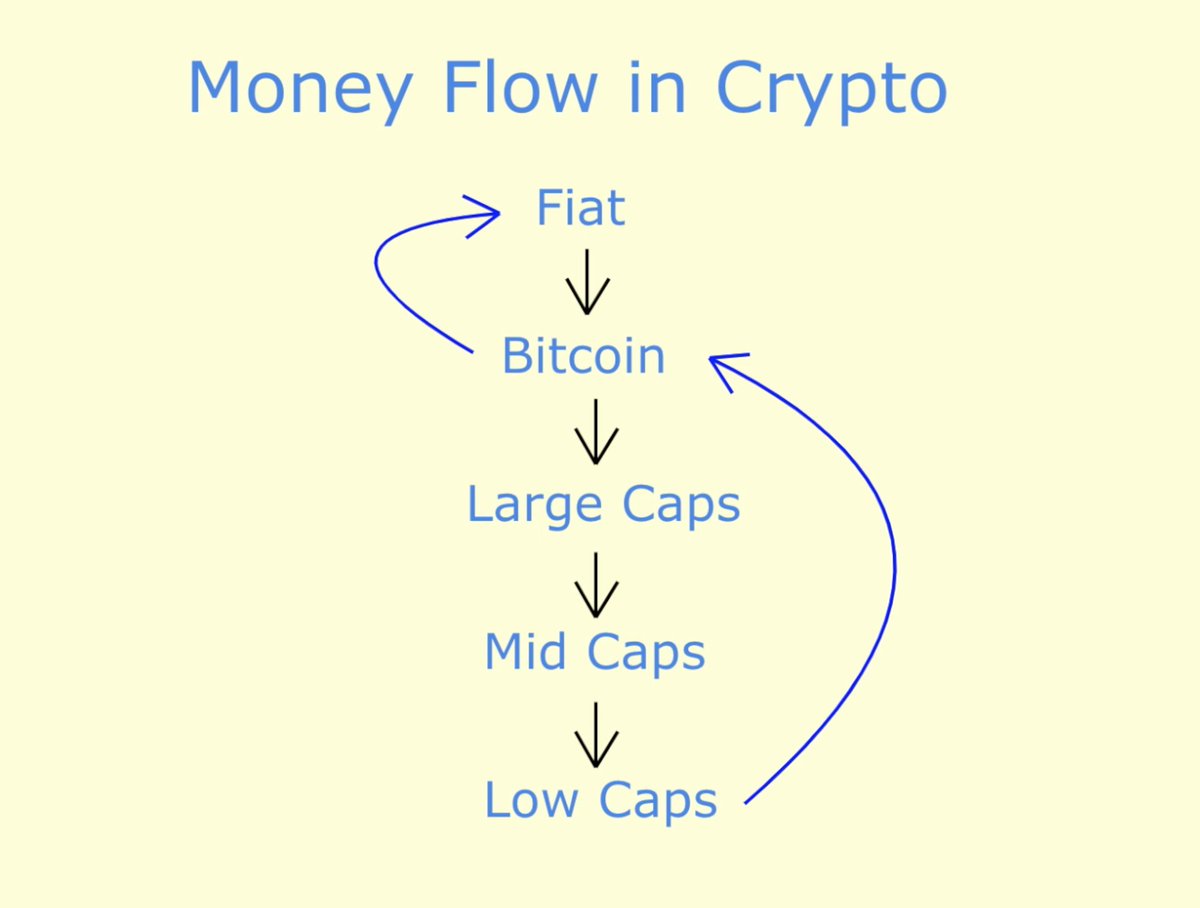

Here is how money flows in #Crypto:

1. Fiat (e.g. USD, EUR, GBP)

2. #Bitcoin

3. Large Cap Altcoins (e.g $ETH)

4. Mid Cap Altcoins

5. Low Cap Altcoins

6. #BTC again

7. Fiat

1. Fiat (e.g. USD, EUR, GBP)

2. #Bitcoin

3. Large Cap Altcoins (e.g $ETH)

4. Mid Cap Altcoins

5. Low Cap Altcoins

6. #BTC again

7. Fiat

3. Generally, when money is flowing towards $BTC, it is flowing away from Altcoins as a whole

It is during this time that BTC enjoys an uptrend & Altcoins experience downside

This is mostly due to investors panic-selling Altcoins in an effort to chase an exponential BTC uptrend

It is during this time that BTC enjoys an uptrend & Altcoins experience downside

This is mostly due to investors panic-selling Altcoins in an effort to chase an exponential BTC uptrend

4. But when the upside momentum for #BTC slows down, this is where money begins to trickle into Large Cap Altcoins, specifically $ETH

This is when $ETHUSD has a chance to follow BTC in its uptrend and attempt to catch up with a rally of its own

This is when $ETHUSD has a chance to follow BTC in its uptrend and attempt to catch up with a rally of its own

5. Generally, whenever Bitcoin rallies, ETH follows suit to an extent as well

However, throughout 2020 ETH's strongest rallies have arguably occurred after an exponential #Bitcoin price breakout

ETH has had a tendency of lagging behind Bitcoin rallies by approximately 7-14 days

However, throughout 2020 ETH's strongest rallies have arguably occurred after an exponential #Bitcoin price breakout

ETH has had a tendency of lagging behind Bitcoin rallies by approximately 7-14 days

6. If you like this thread, you'll really like my newsletter

Cutting-edge #cryptocurrency insights, straight to your inbox three times a week:

rektcapital.substack.com/p/crypto-money…

Cutting-edge #cryptocurrency insights, straight to your inbox three times a week:

rektcapital.substack.com/p/crypto-money…

7. The reason breakout rallies in #Ethereum precede price appreciation in other Altcoins is because ETH tends to be a leading indicator for Altcoins

When Ethereum rallies, it sets the stage for other, smaller Altcoins to outperform in the market

When Ethereum rallies, it sets the stage for other, smaller Altcoins to outperform in the market

8. Ethereum serves as fuel for Altcoin rallies

And so the more Bitcoin rallies, the more Ethereum rallies

And the more Ethereum rallies, the more Mid-Cap and Small-Cap Altcoins rally as well

But there's a unique psychology that underpins the money movement between these assets

And so the more Bitcoin rallies, the more Ethereum rallies

And the more Ethereum rallies, the more Mid-Cap and Small-Cap Altcoins rally as well

But there's a unique psychology that underpins the money movement between these assets

9. When #BTC rallies, at some point investors become more keen to circulate profits into other Cryptocurrencies

They become more comfortable with having a more diversified crypto portfolio

By the same token, they become more comfortable with risk

Their risk tolerance increases

They become more comfortable with having a more diversified crypto portfolio

By the same token, they become more comfortable with risk

Their risk tolerance increases

10. Which is why this money flow moves from Bitcoin, to Large Caps

And then later to smaller Altcoins, which offer a higher prospect of reward, but also carry higher risk

Over time, investors adopt an increasingly risk-seeking approach, fuelled by greed & lust for more profits

And then later to smaller Altcoins, which offer a higher prospect of reward, but also carry higher risk

Over time, investors adopt an increasingly risk-seeking approach, fuelled by greed & lust for more profits

11. The Crypto Money Flow Cycle outlines the movement of capital in the same way it emphasises a major shift in investor psychology, specifically:

An increase in appetite for risk & tolerance to risk, fundamentally fuelled by greed & excitement at the prospect of a higher ROI

An increase in appetite for risk & tolerance to risk, fundamentally fuelled by greed & excitement at the prospect of a higher ROI

12. If you found the information in this thread valuable...

You should checkout my newsletter which is dedicated to sharing cutting-edge Crypto insights that truly make a difference to you as an investor

Sign up:

rektcapital.substack.com

You should checkout my newsletter which is dedicated to sharing cutting-edge Crypto insights that truly make a difference to you as an investor

Sign up:

rektcapital.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh