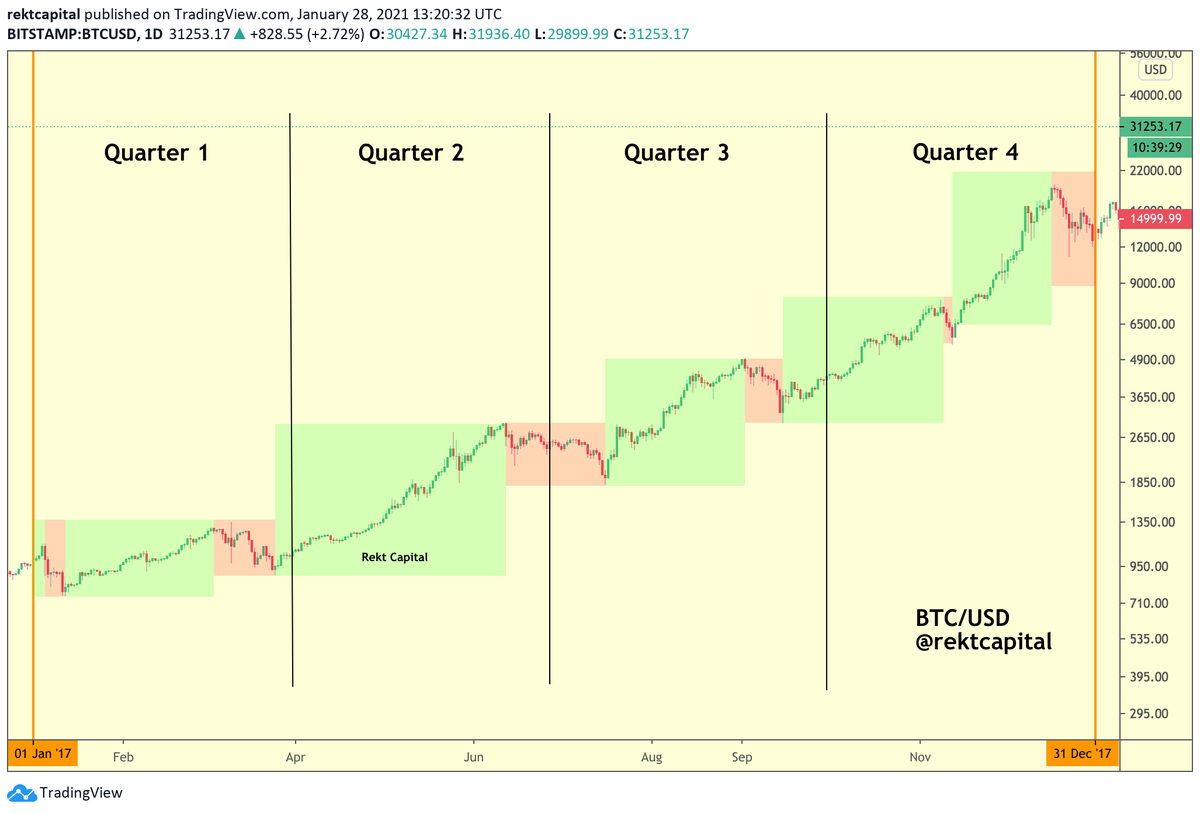

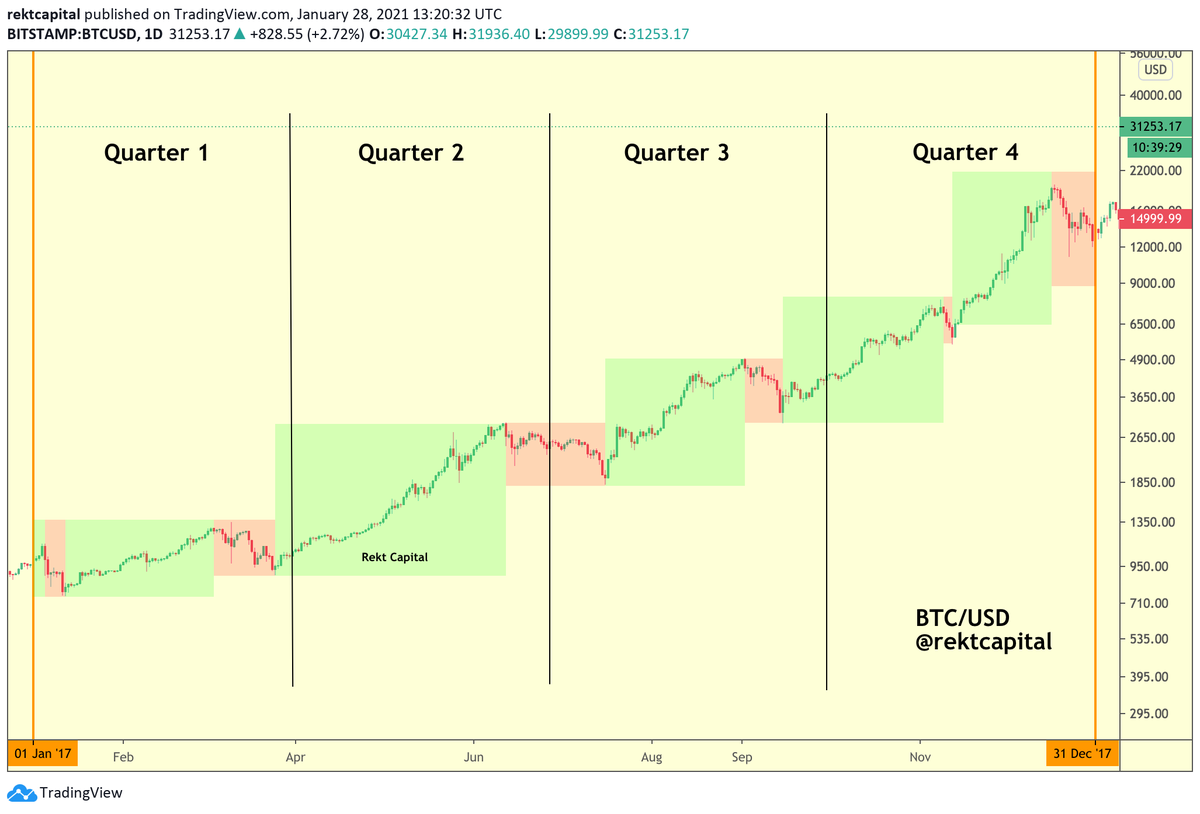

2. Let's divide the 2017 #Bitcoin Bull Market into Quarters

There are a few important things to note:

• Uptrends are longer than corrections

Throughout its Bull Market, #BTC spends most of its time in an uptrend (green) compared to time spent in

a correction (red)

There are a few important things to note:

• Uptrends are longer than corrections

Throughout its Bull Market, #BTC spends most of its time in an uptrend (green) compared to time spent in

a correction (red)

3. In fact, throughout the 2017 Bull Market, #Bitcoin spent 267 days in an uptrend and 98 days in a downtrend

That means that #BTC spent 73% of the entire year in an uptrend!

The average time BTC spent in an uptrend in 2017 was around 50 days

That means that #BTC spent 73% of the entire year in an uptrend!

The average time BTC spent in an uptrend in 2017 was around 50 days

4. Corrections are short

In 2017, #BTC experienced 5 major corrections

Shortest correction lasted only a few days

Longest lasted just over a month

First correction took 1 week

Second took 3 weeks

Third took ~5 weeks

Fourth took ~2 weeks

Fifth 3 days

(Sixth = Bear Market)

In 2017, #BTC experienced 5 major corrections

Shortest correction lasted only a few days

Longest lasted just over a month

First correction took 1 week

Second took 3 weeks

Third took ~5 weeks

Fourth took ~2 weeks

Fifth 3 days

(Sixth = Bear Market)

5. Corrections get shorter over time

Average time #BTC spent in a retrace was 16 days

Not only were retraces generally short in the 2017 BTC Bull Market...

But retraces got shorter as the Bull Market progressed

Corrections arguably become more brief later in the year/cycle

Average time #BTC spent in a retrace was 16 days

Not only were retraces generally short in the 2017 BTC Bull Market...

But retraces got shorter as the Bull Market progressed

Corrections arguably become more brief later in the year/cycle

6. If you like this thread...

You'll really like my newsletter

Cutting-edge cryptocurrency insights, straight to your inbox three times a week

Feel free to signup:

rektcapital.substack.com

You'll really like my newsletter

Cutting-edge cryptocurrency insights, straight to your inbox three times a week

Feel free to signup:

rektcapital.substack.com

7. Every Quarter sees at least one strong #Bitcoin correction

However, it's more common that two corrections occur during a Quarter (i.e. Q1, Q3, Q4)

The only Quarter that saw only one strong #BTC correction in 2017 was Q2

However, it's more common that two corrections occur during a Quarter (i.e. Q1, Q3, Q4)

The only Quarter that saw only one strong #BTC correction in 2017 was Q2

8. Corrections tend to occur at the end of a Quarter

While some #BTC corrections started at the beginning of a Quarter (e.g. Q1 & Q3)...

#Bitcoin corrected near the end of EVERY Quarter in 2017!

(The only time when BTC retraced mid-Quarter was in Q4, though it was very brief)

While some #BTC corrections started at the beginning of a Quarter (e.g. Q1 & Q3)...

#Bitcoin corrected near the end of EVERY Quarter in 2017!

(The only time when BTC retraced mid-Quarter was in Q4, though it was very brief)

9. Corrections tend to be -30% to -40% deep

Corrective periods are a natural, healthy part of any #BTC growth cycle

In fact, during the 2017 Bull Market, #Bitcoin experienced 5 major pullbacks which preceded new All Time Highs

The average Bull Market correction was about -35%

Corrective periods are a natural, healthy part of any #BTC growth cycle

In fact, during the 2017 Bull Market, #Bitcoin experienced 5 major pullbacks which preceded new All Time Highs

The average Bull Market correction was about -35%

10. At the moment, #Bitcoin is experiencing its first major pullback in this new Bull Market

The retrace at the moment is around -31% deep which is normal by standards of history

In fact, history suggests a retrace even deeper (e.g. ~$25000; -40%) would still be healthy

The retrace at the moment is around -31% deep which is normal by standards of history

In fact, history suggests a retrace even deeper (e.g. ~$25000; -40%) would still be healthy

11. If you liked this nutshell of insights, I guarantee you’ll love the newsletter where I feature more extensive, in-depth analysis

Early-bird offer ends February 1st

As a thank you to early-birds, you will always have access for only $5/month

Signup:

rektcapital.substack.com

Early-bird offer ends February 1st

As a thank you to early-birds, you will always have access for only $5/month

Signup:

rektcapital.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh