Thread:

As 2021 begins, I would like to highlight the importance of perseverance & positive thinking.

The aim of this thread is to motivate people to stay committed to their goals.

Sharing few of accomplishments which I never thought would have been possible.

Dream BIG !

As 2021 begins, I would like to highlight the importance of perseverance & positive thinking.

The aim of this thread is to motivate people to stay committed to their goals.

Sharing few of accomplishments which I never thought would have been possible.

Dream BIG !

1)I did a 2 day quantitative trading seminar @iitbombay focussed on system driven trading and got a great response.

Being a introvert,I always shied speaking on the stage & this was my first public speaking apperance & learnt the importance of people’s skills.

Being a introvert,I always shied speaking on the stage & this was my first public speaking apperance & learnt the importance of people’s skills.

2) Seeing my IIT Bombay seminar post, I got approached by @JBIMS, a top MBA institute to share my insights on system driven and markets for their MBA students.

I realised the importance of brand building and self promotion.

I realised the importance of brand building and self promotion.

3) CEO of a multi-million dollar trading desk saw my post of IIT Bombay on Linkedin and asked if I could train his traders on how to build trading systems & be more system driven

That’s how I got introduced to training large proprietary trading desks.

That’s how I got introduced to training large proprietary trading desks.

4) Seeing my post of training Marwari Shares, I got approached by head trader of KIFS ( a large prop trading desk) to train their traders on the same.

It’s one of the best trading desk I have been to till date.

I personally learnt a lot & built a great network of traders

It’s one of the best trading desk I have been to till date.

I personally learnt a lot & built a great network of traders

5) All my posts were now being noticed by many & got approached by the secretary of Investment Fund Club from @iimb_official.

Loved the campus and my dream to get into IIM ( only for a day though) got fulfilled.

Loved the campus and my dream to get into IIM ( only for a day though) got fulfilled.

6) Earlier I was approaching colleges but now colleges had started to approach me :)

Got approached by @iitdelhi for a quantitative trading workshop.

The economics club head said that he has never such a positive feedback for any workshop held by them😬

Got approached by @iitdelhi for a quantitative trading workshop.

The economics club head said that he has never such a positive feedback for any workshop held by them😬

7) Got associated with Shri Ram College, one of the best commerce college in the country as a Knowledge partner for their economics summit

8) Then came the big breakthrough

E-Summit, hosted by the E-Cell, IIT Bombay,which is Asia’s largest Entrepreneurship promoting college body, approached me to be one of the speakers.

The speakers list included prominent personalities such as :

E-Summit, hosted by the E-Cell, IIT Bombay,which is Asia’s largest Entrepreneurship promoting college body, approached me to be one of the speakers.

The speakers list included prominent personalities such as :

9) Anurag Kashyap(Indian Filmmaker),@RishadPremji (Chariman Wipro Limited), @ashchanchlani (Popular Youtuber), @ashishchauhan (CEO BSEIndia), Manish Maheswari (MD Twitter India), Gunjan Samtani (Head Goldman Sachs India) etc

I was humbled to be one of the speakers🙏

I was humbled to be one of the speakers🙏

10)On Panel List for ‘Disruptive Innovation in the Financial World’

The panel had Lakshmi Iyer, CIO of Kotak AMC managing 11 billion $, Dr. Satvinder Madhok CTO of @Barclays and others.

The panel had Lakshmi Iyer, CIO of Kotak AMC managing 11 billion $, Dr. Satvinder Madhok CTO of @Barclays and others.

11) Got featured by @moneycontrolcom, top finance website.

You can read my trading journey & the interview below:

medium.com/@hello_74789/s…

You can read my trading journey & the interview below:

medium.com/@hello_74789/s…

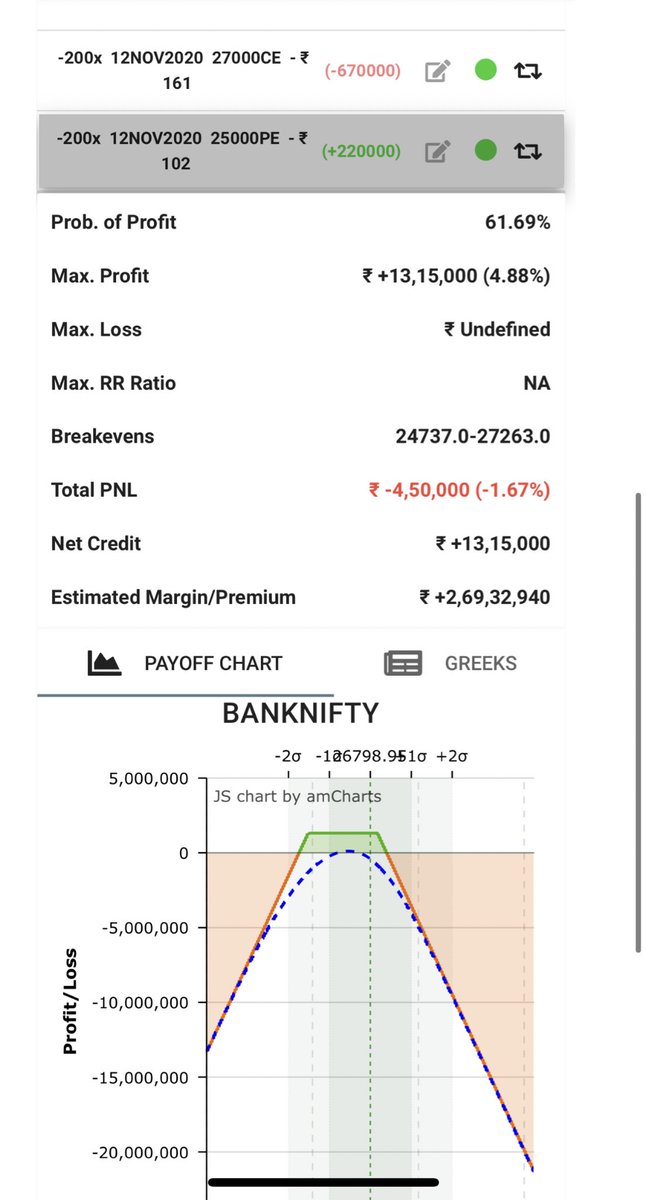

12) Invited by @BSEIndia to do a webinar on Advanced Derivatives.

Discussed about volatility and theta decay strategies.

Discussed about volatility and theta decay strategies.

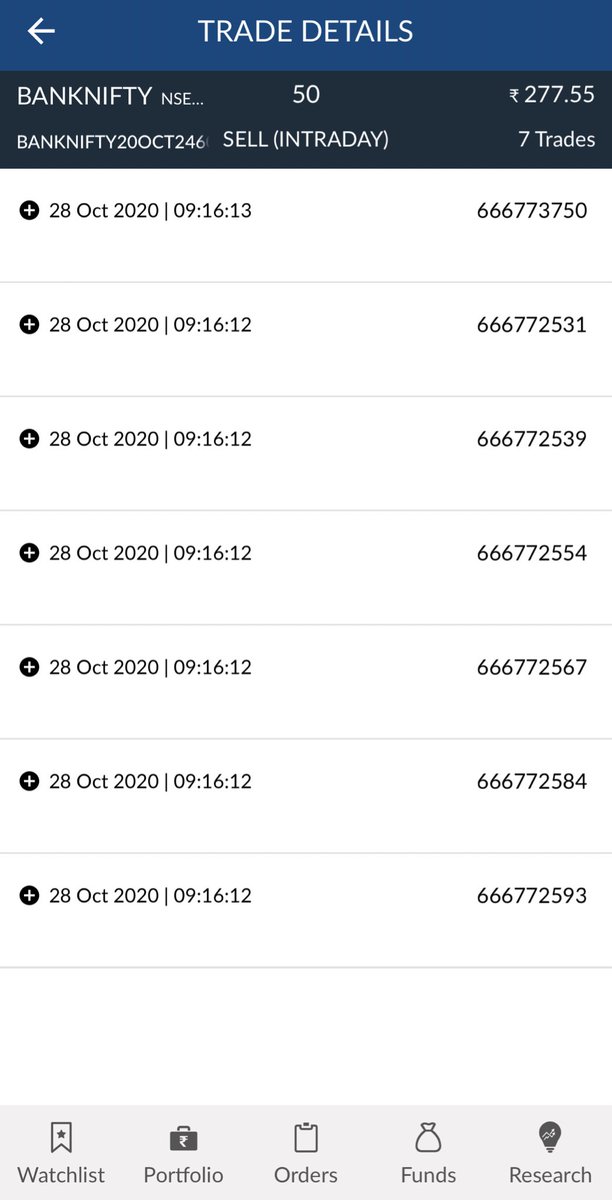

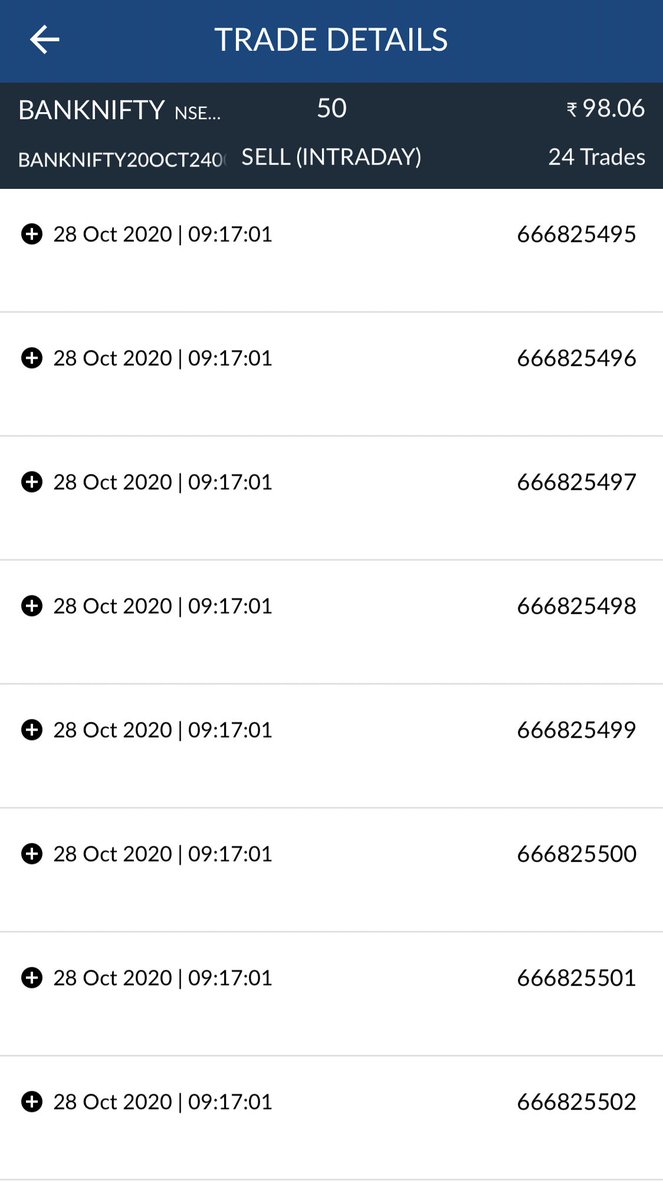

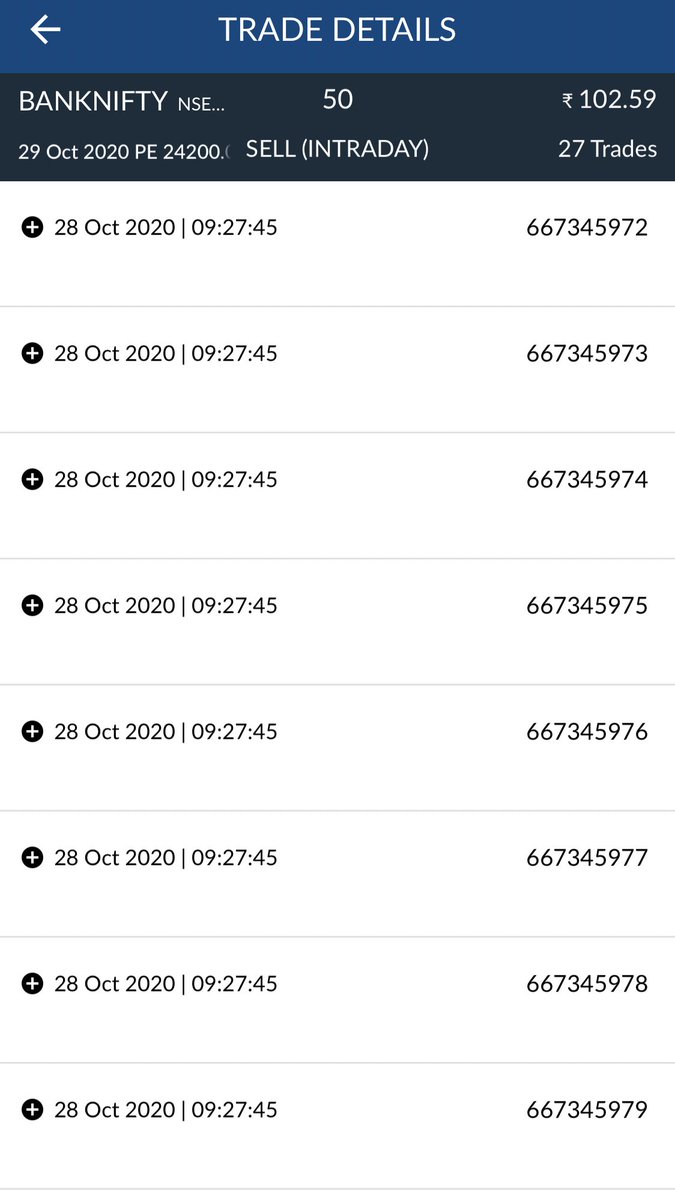

13) I taught a option trading strategy on how to capture intraday time decay & how to manage risk while trading options on @LearnApp_co

The platform has mentors like Ashish Chauhan (CEO, BSE), Ramdeo Agarwal (Chairman of Motilal Oswal), Nitin Kamath (CEO Zerodha)etc

The platform has mentors like Ashish Chauhan (CEO, BSE), Ramdeo Agarwal (Chairman of Motilal Oswal), Nitin Kamath (CEO Zerodha)etc

14) Did a session on Quant & Algo with for Futures First, one of the largest firm involved in the derivatives industry, trading 25 international exchanges across more than 150 product markets spread over 15 time zones.

Built some great connections with some top head traders.

Built some great connections with some top head traders.

15) One of the speakers @AlgoConvention.

I personally got lot of connects after this session :)

Thanks to @technovestor @SOVITCMT and @Deejaytweets for the opportunity

I personally got lot of connects after this session :)

Thanks to @technovestor @SOVITCMT and @Deejaytweets for the opportunity

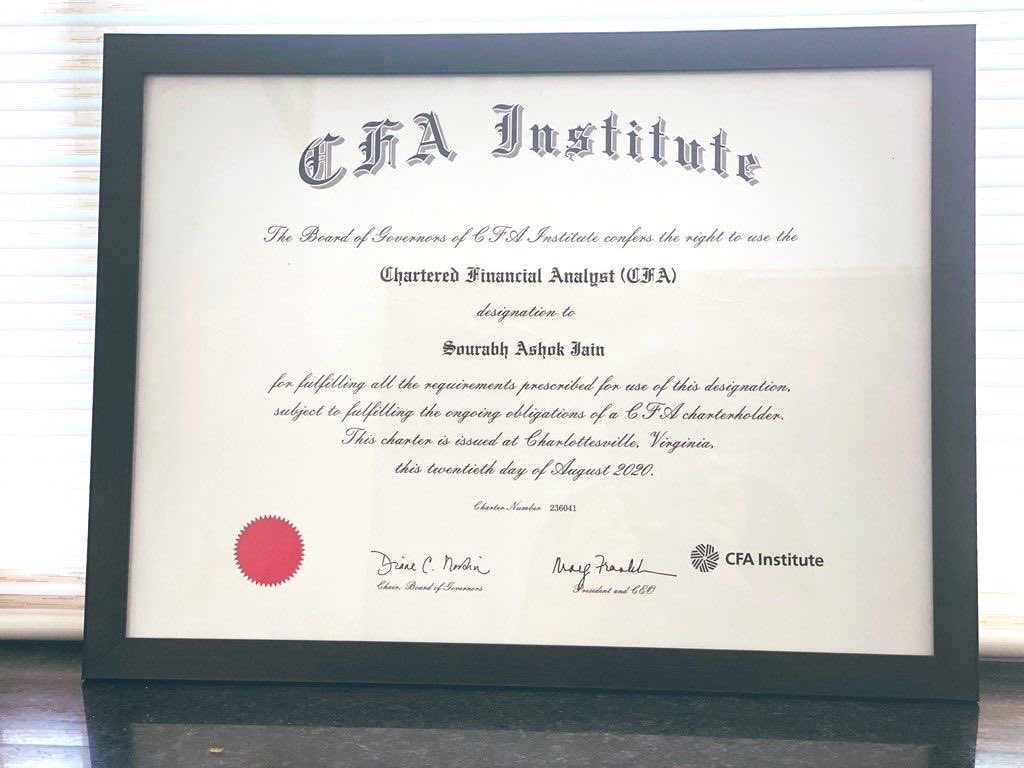

16) I recieved my CFA Charter, CFA charter is one of the most respected designations in finance and is widely considered to be the gold standard in the field of investment analysis

18) One of the speakers at Option Symposium by @quantsapp ,India’s largest option trading conference.

19) First time on a show on @CNBC_Awaaz and won it ;)

My mom literally called all my relatives to say that I am on TV😂

She thinks I am a celebrity😜

My mom literally called all my relatives to say that I am on TV😂

She thinks I am a celebrity😜

20) There’s much more to accomplish and I hope 2021 is even better.

Few of my goals for this year :

- To be featured in @ForbesUnder30 -Give a @TEDTalks

- Get silver button from youtube (1 lakh followers) for my channel youtube.com/c/SourabhSisod…

Few of my goals for this year :

- To be featured in @ForbesUnder30 -Give a @TEDTalks

- Get silver button from youtube (1 lakh followers) for my channel youtube.com/c/SourabhSisod…

21) I am a nobody & there are people who have accomplished much more than me.

All I want to say is that:

If you have not been able to get success yet, don’t lose hope & keep hustling.

You eventually get what you want😊

Hope you found some inspiration in the thread :)

All I want to say is that:

If you have not been able to get success yet, don’t lose hope & keep hustling.

You eventually get what you want😊

Hope you found some inspiration in the thread :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh