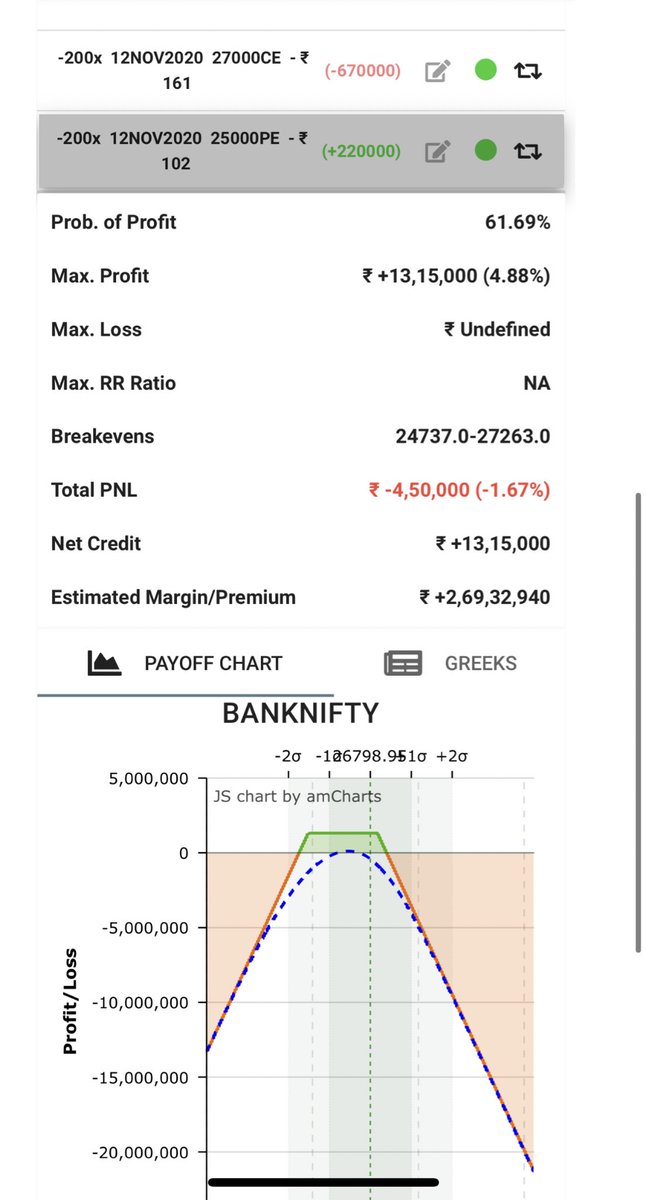

How to manage straddles :

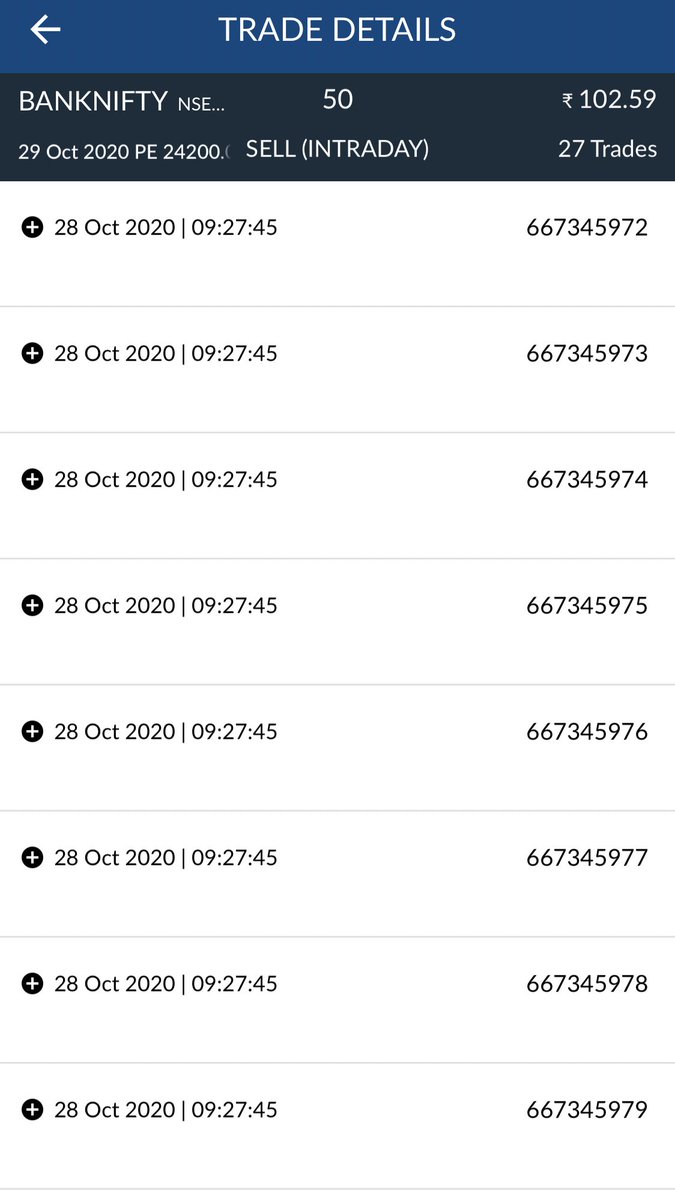

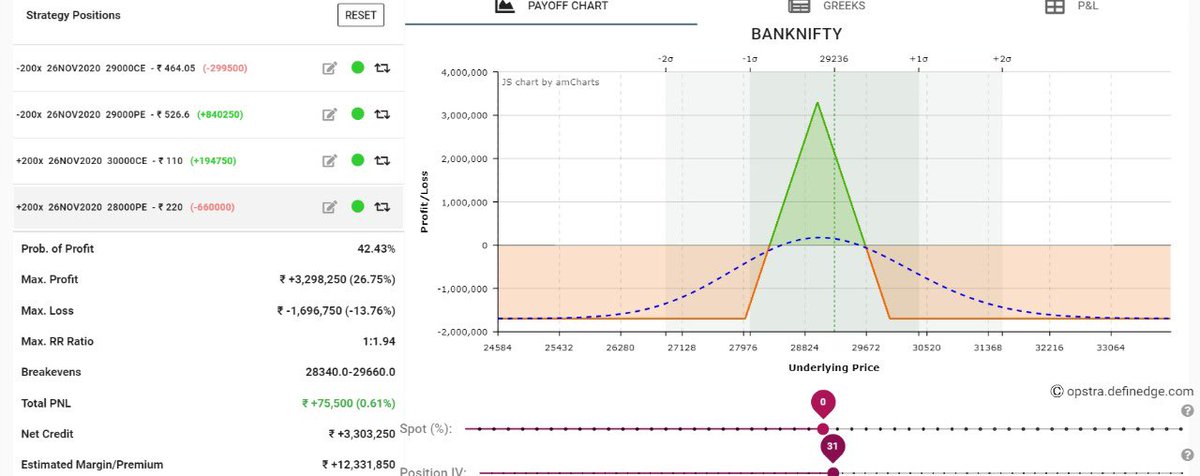

1) As bnf open was within yesterday range created a 29000 straddle at around 9:30 am

29000 PE sold at 528 and

29000 CE sold at 453

#trading #OptionsTrading

1) As bnf open was within yesterday range created a 29000 straddle at around 9:30 am

29000 PE sold at 528 and

29000 CE sold at 453

#trading #OptionsTrading

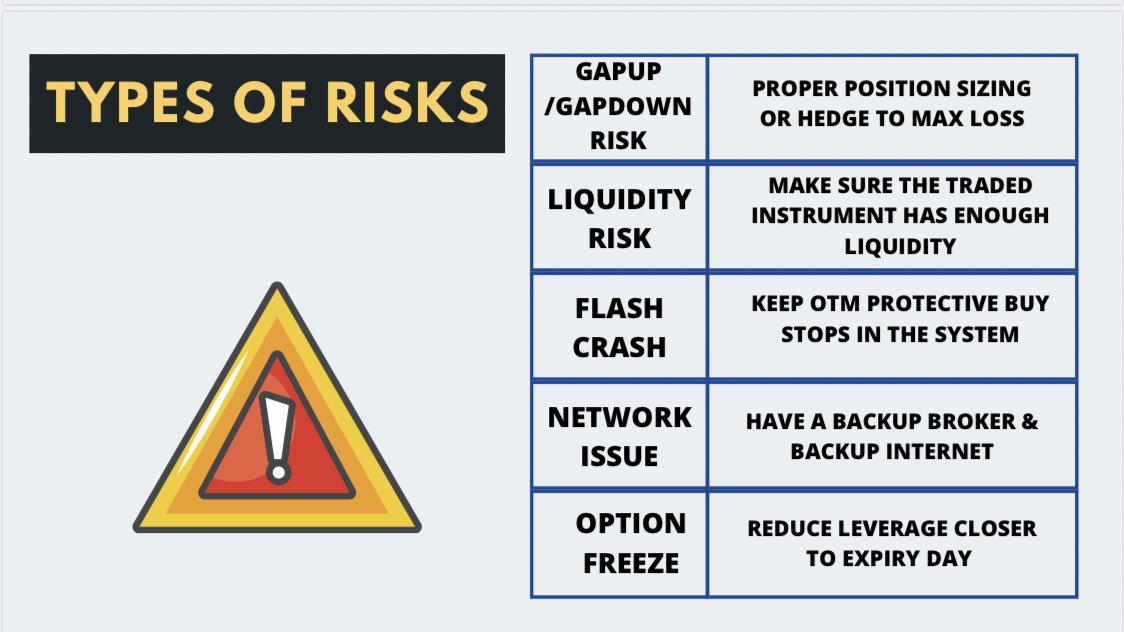

2) Instead of keeping SL on sold legs. I keep SL on otm options in the system

SL was on 28000 PE at 220 (day high)

SL was on 30000 CE at 165 (day high)

SL was on 28000 PE at 220 (day high)

SL was on 30000 CE at 165 (day high)

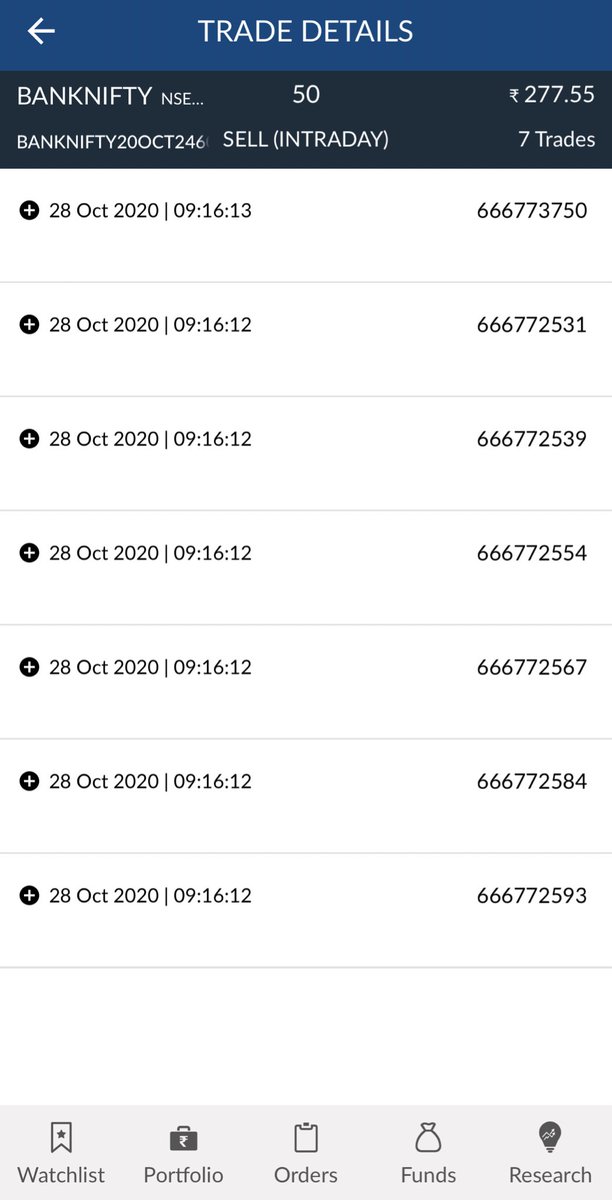

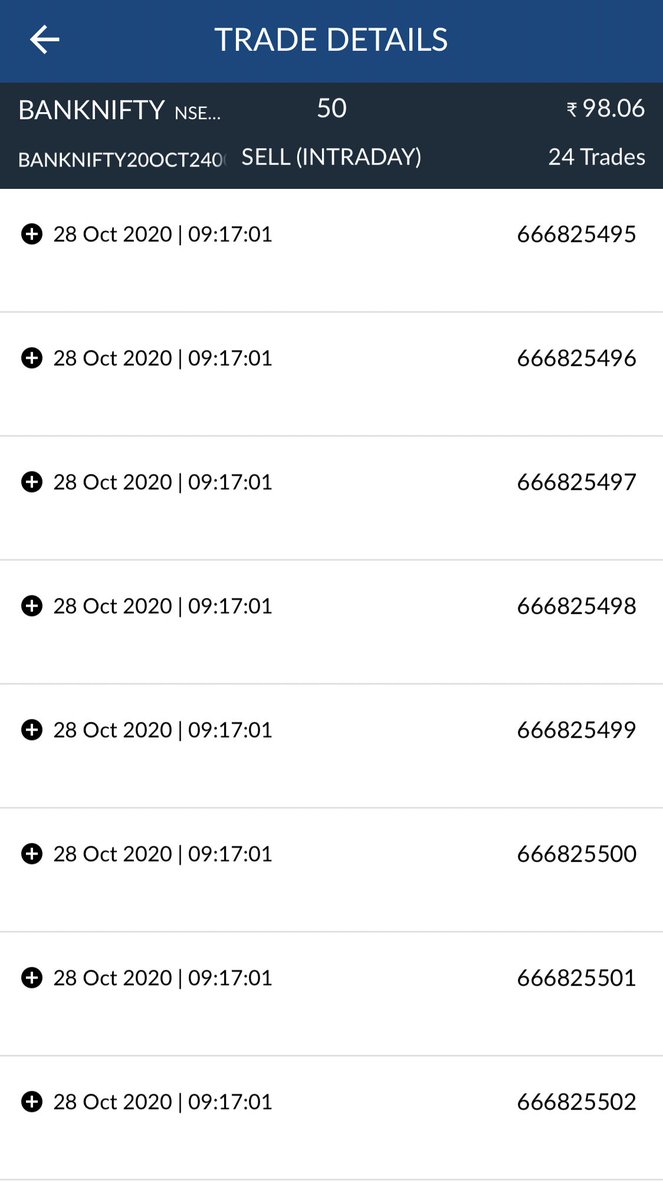

3) At 10:15 am, Bnf started to trend down and 28000 PE was bought at 220 and I immediately bought 30000 CE at 110

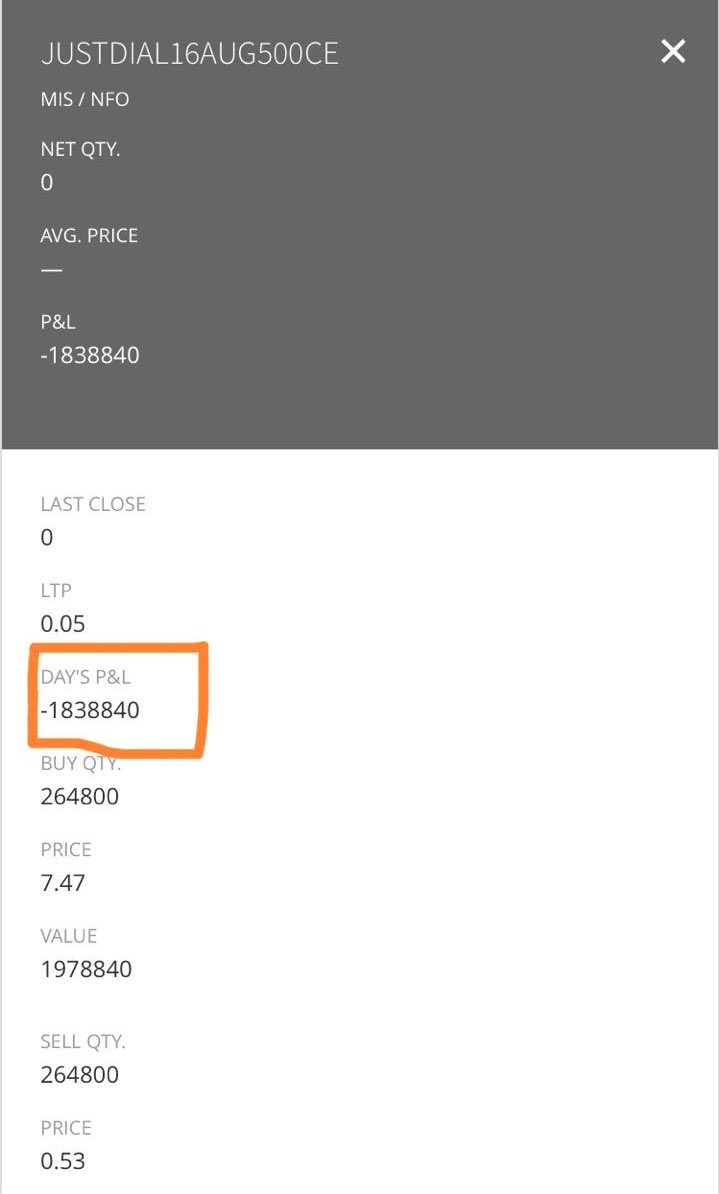

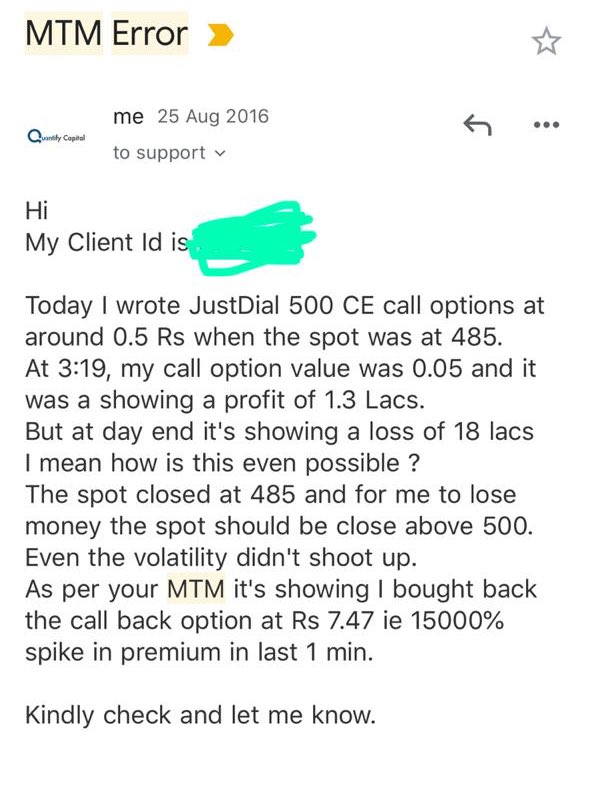

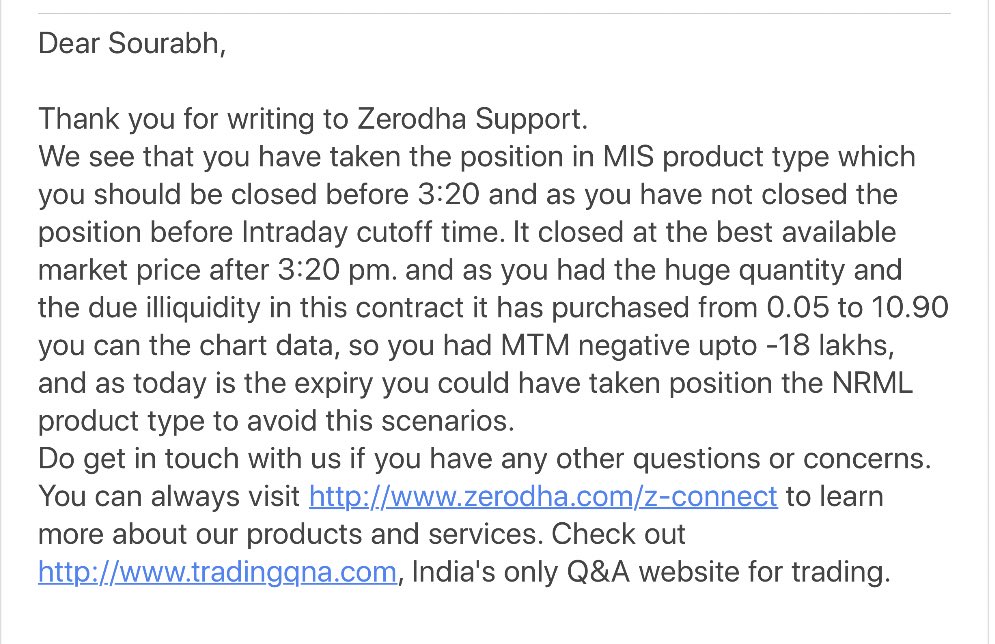

4) If you look at the straddle chart, there were lot of intraday spikes and your SL would have been hit if you had kept SL on atm sold legs

5) But after lot of intraday spikes the straddle from 980 closed at 880. A 100 point decay intraday.

But even if both your buy option got triggered you would have made around 15-20 points inspite of such violent moves on both sides.

But even if both your buy option got triggered you would have made around 15-20 points inspite of such violent moves on both sides.

6) So instead of keeping stops on sold legs ,keep stops on otm wings and once both wings are bought try to get credit extra credit on other side to reduce the breakeven. By this you will not be out during spikes and will save slippages too if trading huge qty.

7) So always remember

- Sell options as per view

- Keep protective buy stop on otm legs

- Once buy is triggered , stay clam and try to get extra credit by creating put spread or call spread as market movement

Goodluck !!

- Sell options as per view

- Keep protective buy stop on otm legs

- Once buy is triggered , stay clam and try to get extra credit by creating put spread or call spread as market movement

Goodluck !!

• • •

Missing some Tweet in this thread? You can try to

force a refresh