Thread :

We are regsitered as sub brokers with IIFL and Angel Broking & now planning to grow the sub broking business.

Looking to crowd source ideas/suggestions on the same from you guys

(1)

#trading #ideas #OptionsTrading

We are regsitered as sub brokers with IIFL and Angel Broking & now planning to grow the sub broking business.

Looking to crowd source ideas/suggestions on the same from you guys

(1)

#trading #ideas #OptionsTrading

2) Instead of sending recommendations(like traditional brokers) .. plan is to help traders learn & let them independently take trading decisions.

Ideas:

-Create a telegram channel and share ideas & explain trades with logic

Ideas:

-Create a telegram channel and share ideas & explain trades with logic

3) Plan is to help traders learn about

-options trading,

-long term investing

-intraday momentum trading

-event trading

-expiry trading and let them decide what suits them

Don’t charge any advisory fee but earn a share from their trades as brokerage

-options trading,

-long term investing

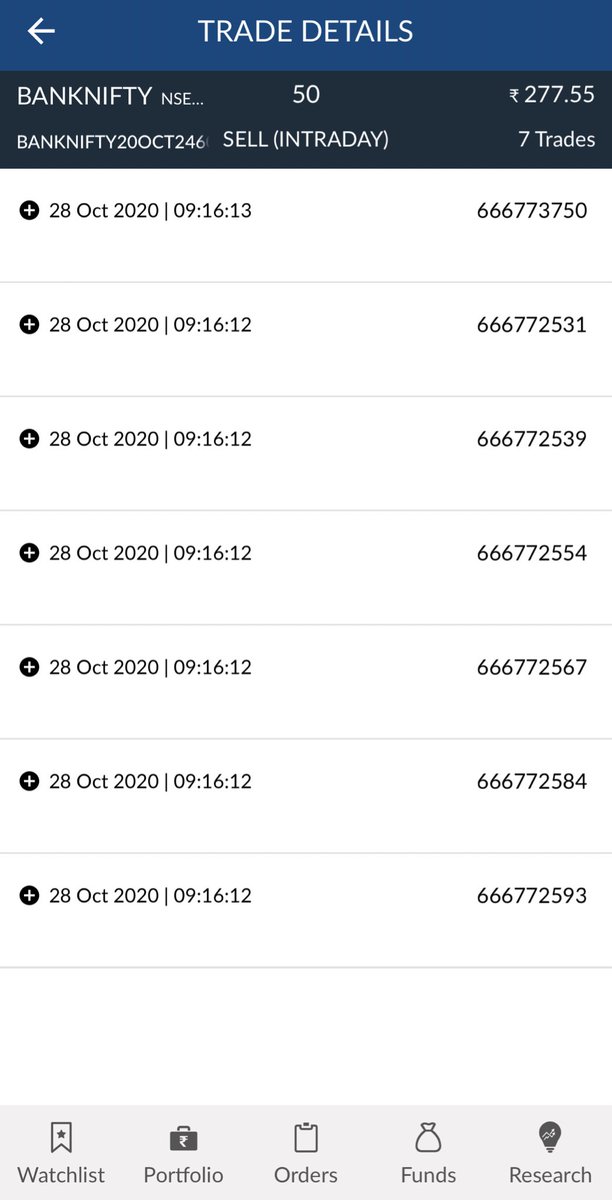

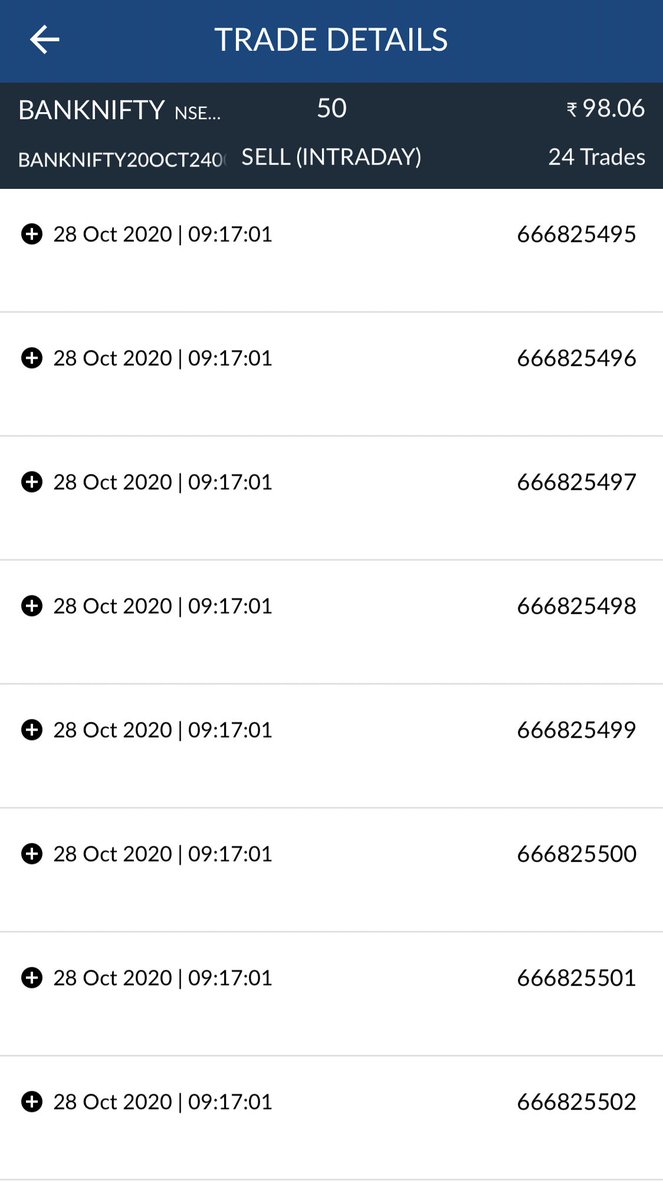

-intraday momentum trading

-event trading

-expiry trading and let them decide what suits them

Don’t charge any advisory fee but earn a share from their trades as brokerage

4) It’s a win- win for both.

Nothing changes for client as he doesn’t have to pay anything from his pocket and gets to learn in the process.

Meanwhile we also generate some share as brokerage from his trades.

That’s our plan for now. Any others ideas are welcome !

Thanks

Nothing changes for client as he doesn’t have to pay anything from his pocket and gets to learn in the process.

Meanwhile we also generate some share as brokerage from his trades.

That’s our plan for now. Any others ideas are welcome !

Thanks

• • •

Missing some Tweet in this thread? You can try to

force a refresh