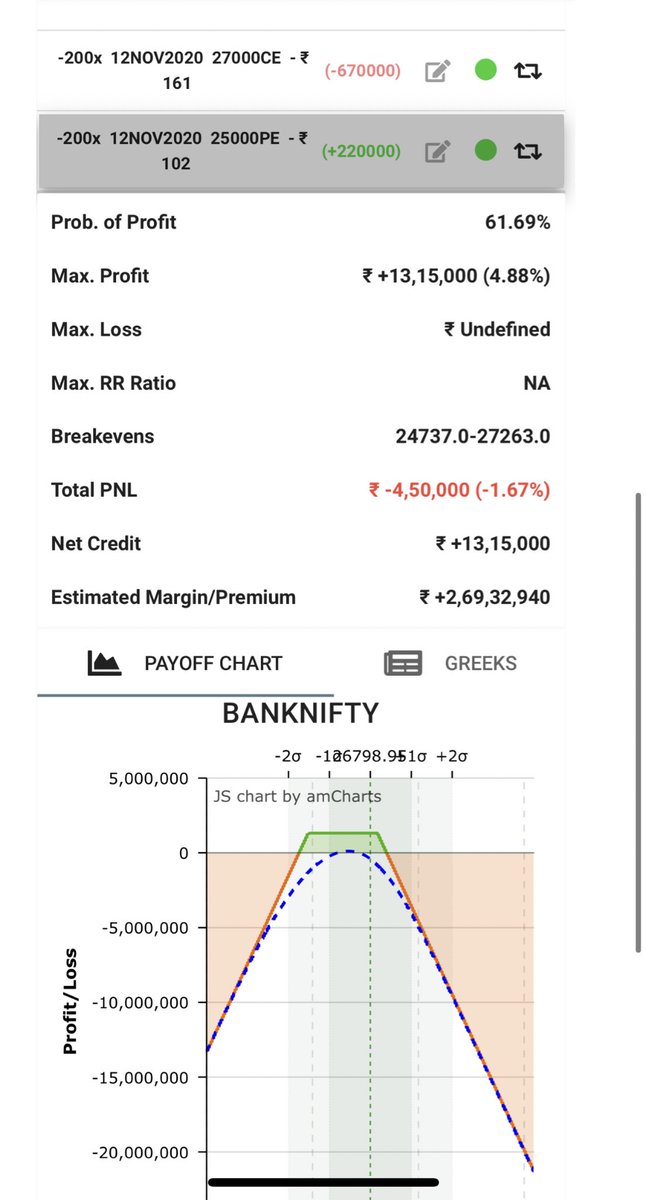

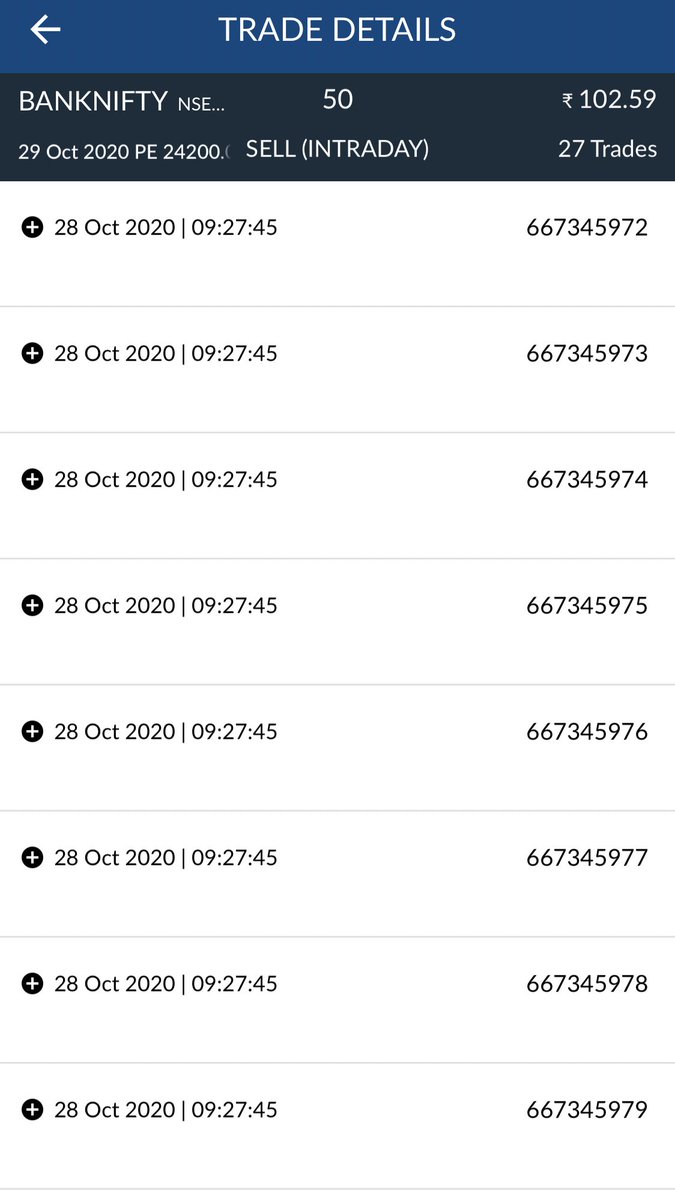

At 9:20 am created 29K PE and 30K CE at combined premium of 199.

Logic : Bnf was trading above yesterday high so created position with bullish delta.

The strangle closed around 110.

Key in non-directional trading is creating skewed delta positions as per view

#trading #data

Logic : Bnf was trading above yesterday high so created position with bullish delta.

The strangle closed around 110.

Key in non-directional trading is creating skewed delta positions as per view

#trading #data

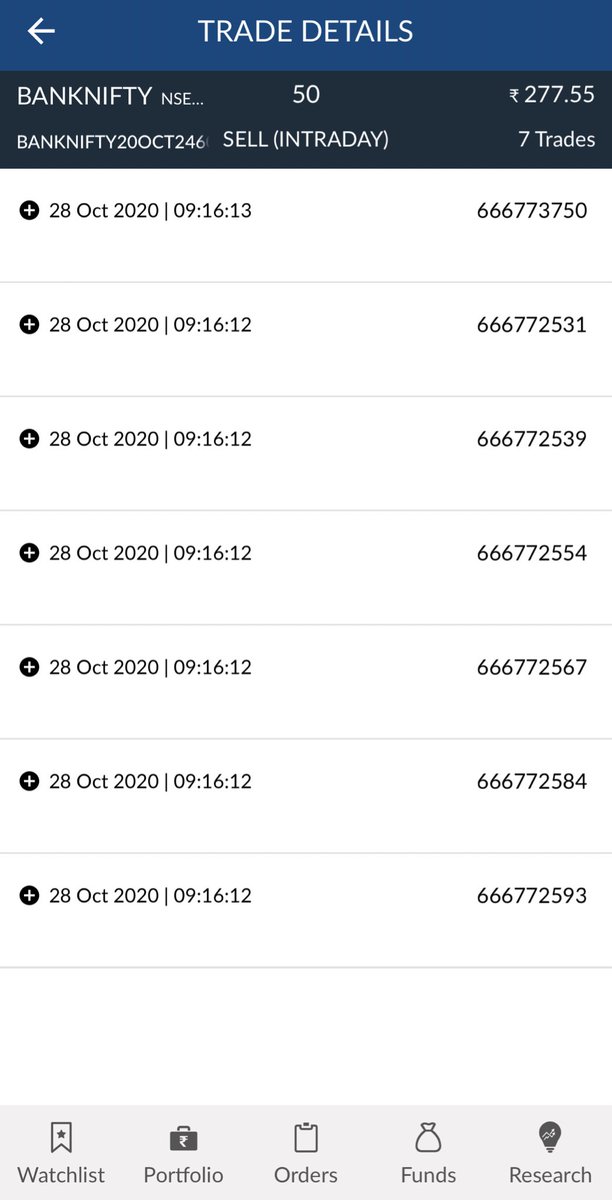

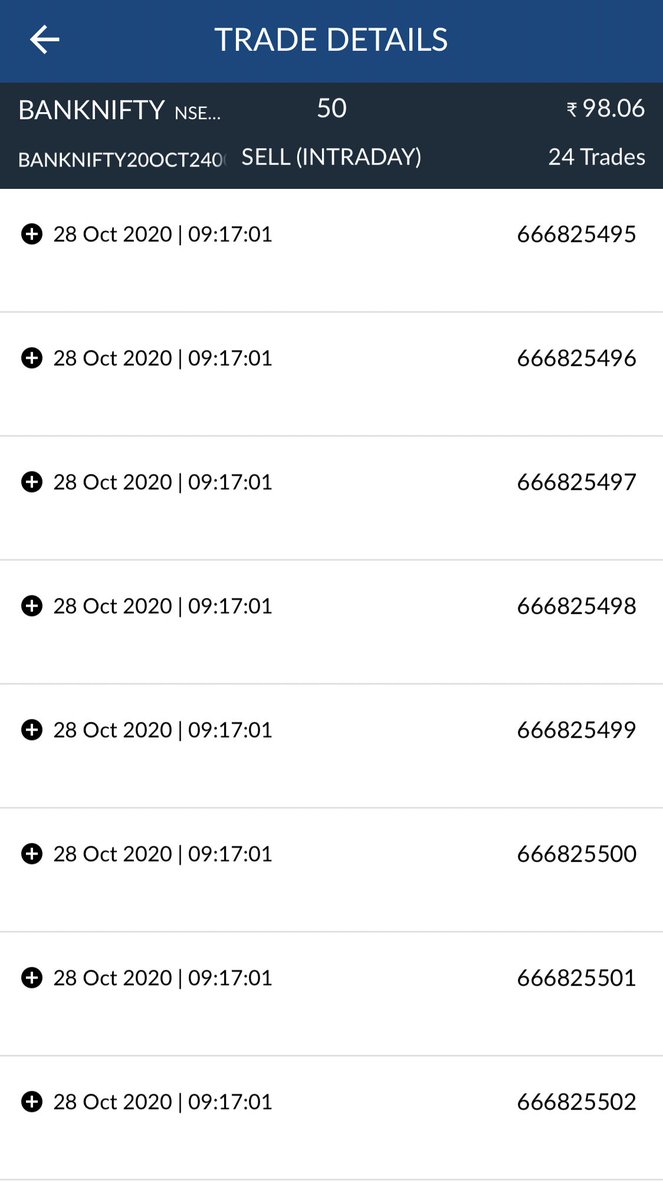

Initial buy SL was on 28700 PE above Vwap (95) and sl on 30300 CE around 30 (day high)

Put buy SL above vwap or day high(on otm strikes based on net credit recieved)

Make sure you have net credit even after buy sl is triggered

(2)

Put buy SL above vwap or day high(on otm strikes based on net credit recieved)

Make sure you have net credit even after buy sl is triggered

(2)

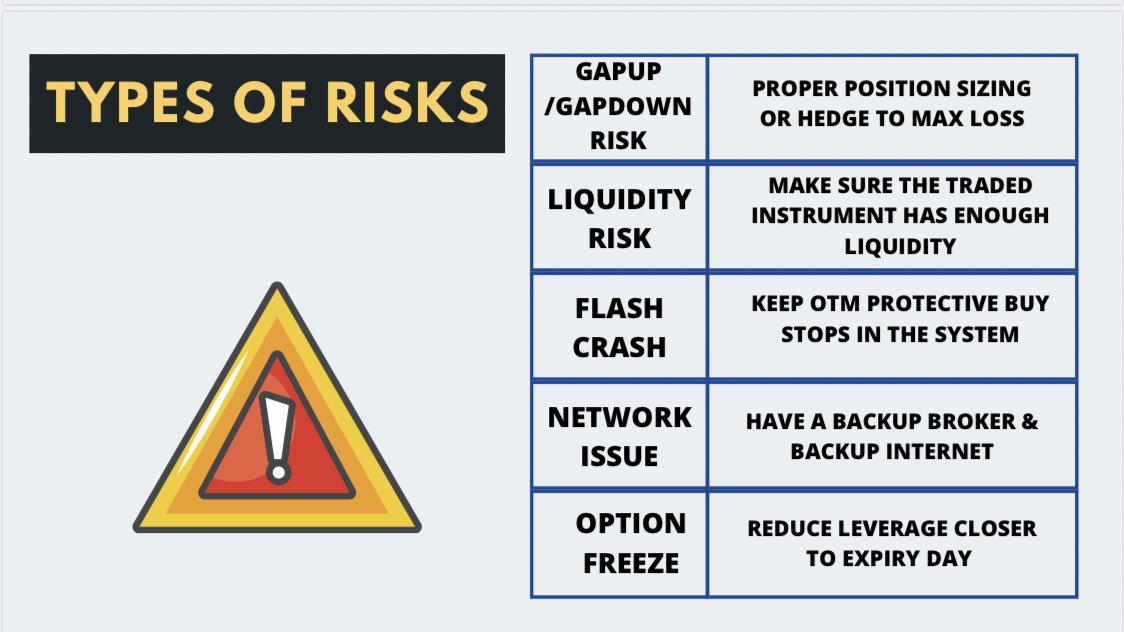

3) So in non-directional trading create positions as per view and always keep buy stops in otm wings to protect yourself from any big move.

Otm stops also helps in saving slippages.

Otm stops also helps in saving slippages.

4) That’s how I trade the index everyday.

-Create skewed positions as per view

-Keep buy otm stops to protect from any big moves

-Stay in the trade until sl is hit or mtm loss increase(>1% of capital)

Will keep sharing more insights on how to trade non-directional.

Goodluck !

-Create skewed positions as per view

-Keep buy otm stops to protect from any big moves

-Stay in the trade until sl is hit or mtm loss increase(>1% of capital)

Will keep sharing more insights on how to trade non-directional.

Goodluck !

• • •

Missing some Tweet in this thread? You can try to

force a refresh