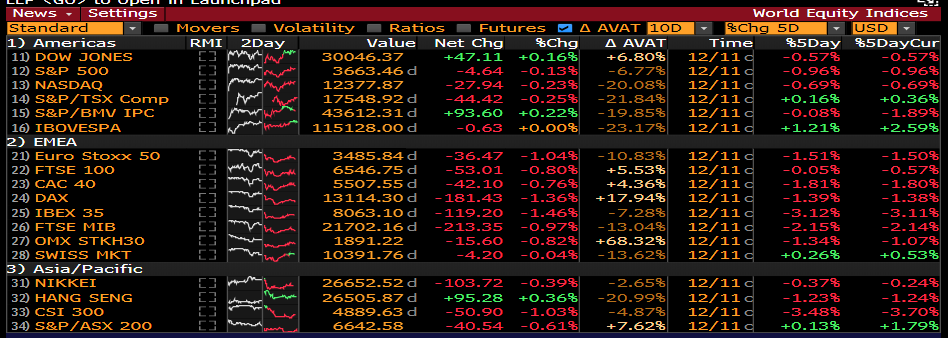

#stockmarket WE update - finally saw some nastiness on Fri w/ some fairly big moves in individual stks. could this be the start of something bigger? as discussed in last WE posts, we are set up for it but will it happen? #SPX held the 20day again. 3720/3660 next lvls to watch...

#stockmarket Demark propulsion up tgt still active w/ 3907 tgt but stuck on 10 count for the seq 13 sell since Jan 8th. still could post this wk as early as weds....

#StockMarket #nasdaq did record a Demark 13 sell & came w/in 20 points of the Propulsion up tgt (something I wrote about last WE as a possible sell trigger). the 13 sell that printed on 1/14 is now the swing high. currently on day 2 of a price flip...

#stockmarket #nasdaq is still above the 20day & above the Dec B/O lvl. Much below here & 12960 comes in play w/ 50 day a bit below. I see 12100 - 12200 as VIP lvls to hold if it gets there...

#stockmarket Demark Trendfactor lvls always to be considered & detailed here (next 4 lvls) for the #SPX and the #Nasdaq. Recall Tom Demarks work suggests that markets move in 5.56% increments w/ half lvls being relevant....

#stockmarket #Russell $RTY has been the strongest of the major indices since Nov, but ran into trouble on Fri. Notice that Demark 9 sells have relevance & another one printed on Fri. last 3 of 4 saw $RTY stall out or retrace...

#StockMarket Also notice the rising wedge into the upper bound of its ascending channel. We broke that on Friday but still managed to close above the 5day EMA. This could correct all the way down to 2030ish lower end of channel & 20day but still remain fairly bullish....

#stockmarket On balance volume for the #SPX is starting to lose some momentum as it has yet to make a new high w/ the indexes. We will put this in the cautious bucket. But #nasdaq looks much better....

#StockMarket #SPX MACD has been negatively diverging for most of Dec and now beginning to cross below the signal line. #nasdaq similar - not a great development...

#stockmarket New highs - New Lows index was showcased in last WE update as a reason to be NT cautious as it was the highest since '18. last week it turned down...

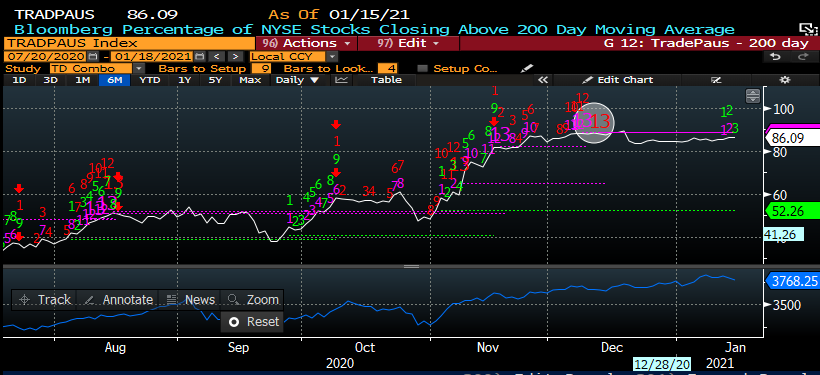

#stockmarket Stocks trading +200day w/ a pair of Demark 13 sells in early Dec, which has since traded sideways to down, despite indexes making ATH's. Not a deal breaker b/c its @ 86% but ATH indexes should be matched by strength in the underlying = a weakening trend & cautionary.

#stockmarket Put/Call is something i've illustrated multiple times & this chart shows when it turns up from such a low lvl we usu get some sort of retracement, some nasty, some mild, over the last yr. This tells me to remain cautious as we turned up from the lowest lvl on Fri...

#stockmarket Consumer discretionary vs staples ratio ( $XLY vs $XLP) overlaid w/ Demark signals is still stuck on the 11 count w/ seq 13 sell looming. Every 13 print over the last 1.5 yrs saw index retracements...

#stockmarket #SPX DMI is on the verge of crossing negative. Another non-confirming element w/ indexes near ATH & more evidence of a weakening trend...

#stockmarket But its not all bad, Smart Money Index is actually continuing to improve and just pierced the recent DTL resistance...

#stockmarket and the High yield market doesnt seem too worried. This is a chart of the CDX for HY spreads, which is at a very low lvl. Should this really start moving higher, than I would be more worried about something systemic unfolding under the surface...

#stockmarket CONCL: Lots of evidence that the current trend is weakening. We have some possible signals in place that could lead us to a more meaningfully correction than we've seen. But as always need to let price guide before being too aggressive - as of Fri seems contained...

#stockmarket So I will remain lighter than usual, hedged and continue to trade tactically. @threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh